Analysis

Oregon Museums Dangle Tax Breaks in Bid for Masterpieces

How art collectors can bring home the Bacon, without having to pay an arm and a leg.

How art collectors can bring home the Bacon, without having to pay an arm and a leg.

Pablo Picasso, Fillette Aux Nattes Et Au Chapeau Vert (1956)

Photo: Courtesy Jordan Schnitzer Museum of Art, private collection.

This past November, Francis Bacon’s triptych portrait Three Studies of Lucian Freud (1969) sold for $142.4 million at Christie’s, setting an artist’s record and becoming the most expensive work ever sold at auction. Less than a month later, the massive contemporary masterpiece turned up on loan, not at a modern-day art mecca like New York’s Museum of Modern Art (as Edvard Munch’s The Scream did), but on the opposite end of the US, at the Portland Art Museum in Oregon. The painting, which remained on view there through early April, was loaned by its new owner Elaine Wynn, ex-wife of casino mogul and top collector Steve Wynn. Mrs. Wynn, a resident of Nevada, was reportedly entitled to save more than $10 million in taxes by first parking the painting at the Portland Art Museum before bringing it to her home state.

That is because Oregon is one of only a handful of states—along with Alaska, Delaware, Montana, and New Hampshire—that does not have what is known as a “use” tax. Such taxes require that when a buyer acquires property out of state but then it ships it home for “use,” in this case, a painting that will likely hang on the walls of her private residence, she must pay the tax, which varies with the value of the object. In New York, for instance, this tax stands at 8.75 percent and there is no getting around it, whether a resident ships a painting there one, five, or 50 years after acquiring it. The New York use tax requirement applies regardless of when a work actually lands there.

Some lesser-known museums in Oregon are benefitting heavily from this collector-savvy strategy, enjoying a steady stream of loans of high-profile works from collectors who steer them there, sometimes fresh off the auction block, and presumably, in part, for a tax break. The Jordan Schnitzer Museum of Art at the University of Oregon, for instance, has established a program called “Masterworks on Loan,” which invites private collectors to share their art with museum visitors. According to the museum website: “Lenders are responsible for costs related to presenting their works. Some lenders may receive tax benefits for participating in our Masterworks on Loan program and should consult a tax advisor to learn more.”

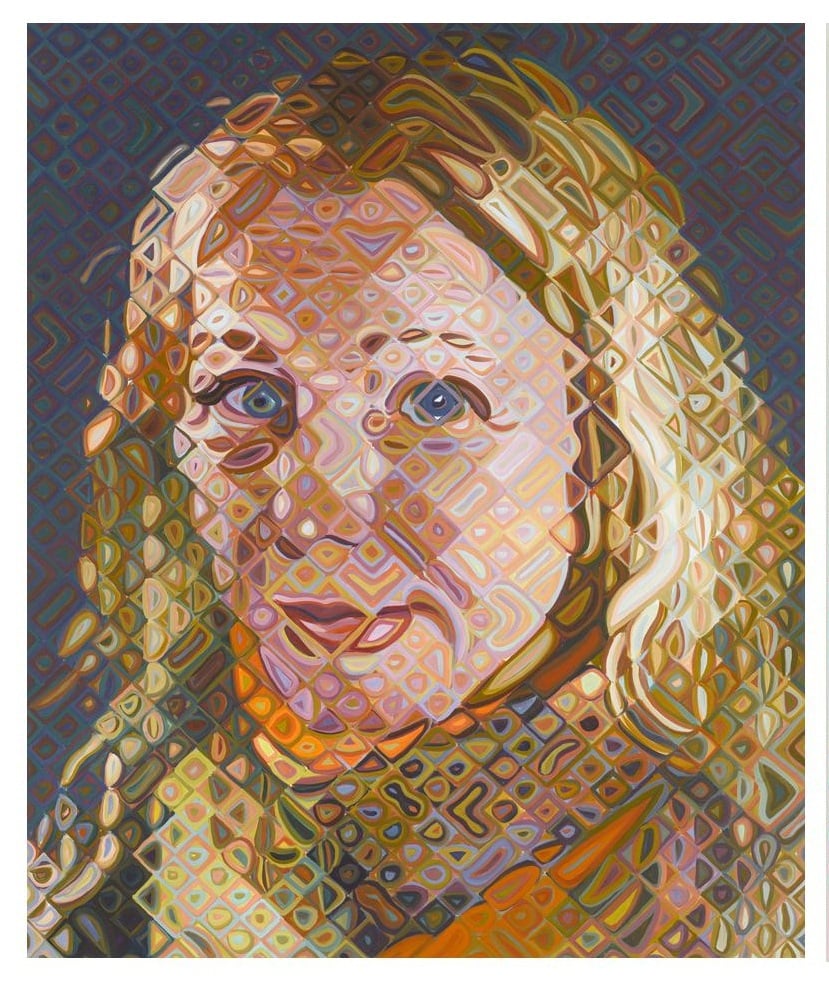

Chuck Close, Cindy (2012)

Photo: Courtesy the Jordan Schnitzer Museum of Art, private collection

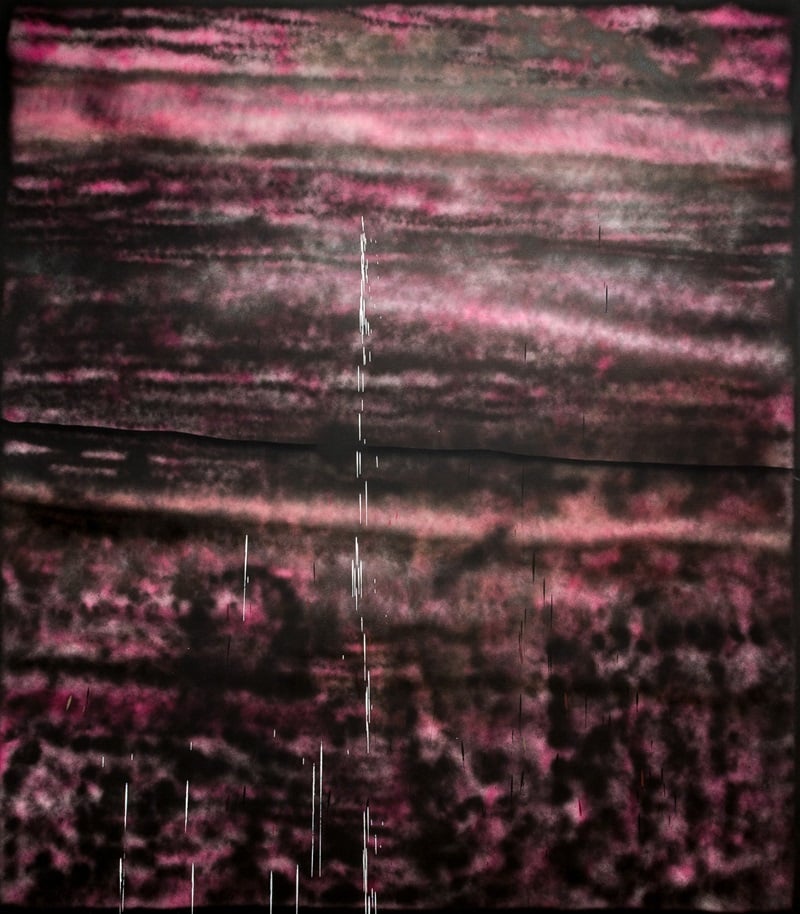

Among the works listed as past or current loans are Chuck Close’s 2012 oil on canvas painting of artist Cindy Sherman (Cindy), and Jean-Michel Basquiat’s Ribs Ribs (1982), an oilstick on paper. According to auction records, the latter work was bought at Christie’s New York in May 2013, for $5 million (estimate: $3 million to $5 million). George Condo’s oil on linen Reclining Blue Form (2011) was also part of this loan program. Other works shown under the program include recently executed and acquired works by art market darlings, such as Nate Lowman as represented by Orange Proxima (2005), a silkscreen on canvas, and Wade Guyton’s untitled (2007) Epson Ultra Chrome inkjet print. Sterling Ruby, whose work was featured prominently in the recent Whitney Biennial as well as taking over Hauser and Wirth’s massive Chelsea space this month has had two works on view there, including SP 136 (2010), a spray paint on canvas. Among works currently on view are Ruby’s 2013 BC (4642), of fabric, glue, paint, and bleached canvas on panel, and Mark Grotjahn’s Untitled (Orange Eye Leopard Tree Fallen and Hiding Pussy Face) (2013). Another work with a recent auction track record is an untitled 1989 Rudolf Stingel painting, oil and enamel on canvas. It appears to be the same work that sold at Phillips New York evening sale in May 2013 for $509,000 (estimate: $400–$600,000).

“It’s a wonderful program for us because we can share these masterworks with our students, who are the primary audience because we’re on a campus” says Jill Hartz, executive director of the Jordan Schnitzer Museum. “The students are really interested in the art of their time and how artists respond to the same thing they’re seeing. Having contemporary art is fabulous for that purpose. We have a really large studio program, so for them to see firsthand what artists are doing is great.”

Sterling Ruby SP136 (2010)

Photo: Courtesy the Jordan Schnitzer Museum of Art, private collection.

The Schnitzer Museum also has its fair share of older blue chip masterpieces under the Masterworks on Loan program, several of which recently changed hands at auction according to the artnet Price Database. These include Picasso’s Fillette Aux Nattes Et Au Chapeau Vert (1956), which auction records show sold for $5.9 million at Sotheby’s New York in May 2011; and Rembrandt Bugatti’s bronze Grand Girafe tete basse (c. 1910–34), which sold for $1.4 million at Sotheby’s New York in May 2010. Paul Signac’s scenic boat painting Les Tours Vertes, La Rochelle (1913) sold at Sotheby’s London in June 2011 for $4.2 million (GBP 2.6 million). Gauguin’s Mona, Mona, Savoureux (1901), an oil on canvas, sold at Sotheby’s New York in November 2010, for $3 million.

The bottom line? The business of buying and selling art comes with a multitude of tax implications: capital gains taxes, sales taxes, and the perhaps lesser known use tax. Amid all the hype about booming prices and profits, it’s important for collectors to know what and how much these extra taxes are, where they apply, and perhaps most important, where they don’t.

Gone are the days, say the experts, when dealers, with a wink and a nod, would ship an “artwork”—an empty crate—to a use-tax–free state. The former Tyco executive Dennis Kozlowski did this on several occasions. The tax evasion case brought against Kozlowski not only resulted in his having to pay $3 million in back taxes and penalties worth $14 million, it also meant jail time.

The tax setup in Oregon makes for a win-win situation for both the collector and the viewer. Collectors can take advantage of a tax break that can save them thousands, and, in some cases, millions of dollars. Students and other viewers get to enjoy works they might otherwise never see, often before they disappear for good into a private collection.