Auctions

Q4 Global Auction Report and Year in Review

artnet Analytics takes an in-depth look at the fourth quarter auction performance in 2013.

artnet Analytics takes an in-depth look at the fourth quarter auction performance in 2013.

Data aggregated from the artnet Price Database indicates that although the market has witnessed regional slowdowns tied to prevailing economic conditions this year, the overall Fine Art auction industry has remained healthy, and is showing steady and stable growth. In particular, positive trends were seen in the Post-War and Contemporary market, driven by extremely successful auction seasons in New York, as well as various other regional markets within the United States.

Global Overview

In 2013, the global Fine Art market increased 5% by value sold from the previous year, earning over US$14.4 billion. Although this year’s total sales value fell short of the post-recession peak reached in 2011 (US$16.2 billion), this figure was particularly promising considering the sluggish performance of the art market in China (-3%) and the United Kingdom this year (-4%). Both countries failed to reach 2012 levels by value and volume sold, although their Q4 results suggest a more promising outlook for 2014.

The overall growth of the art market for the fiscal year is directly tied to Q4 performances, when the overall market increased 20% by value from the same period last year. Q4 was marked by significant increases in value sold in the United States (+27%), China (+13%), the United Kingdom (+11%), and France (+8%). Of the top 10 works sold in 2013, seven were sold in the fourth quarter, led by the record-setting sale of Francis Bacon’s Three Studies of Lucian Freud (1969), selling for US$142.4 million at Christie’s Post-War and Contemporary auction in New York.

Of the lots offered in 2013, the number of high-value works (works sold for over US$1 million) increased almost 10% from 2012, with 113 works selling for over US$10 million, a new record in auction history. Collectively, these works accounted for over US$2.6 billion, and represented 18% of global Fine Art sold this year by value.

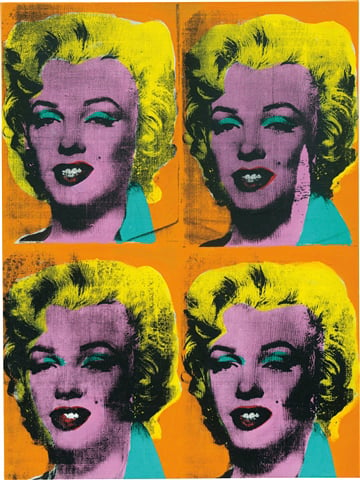

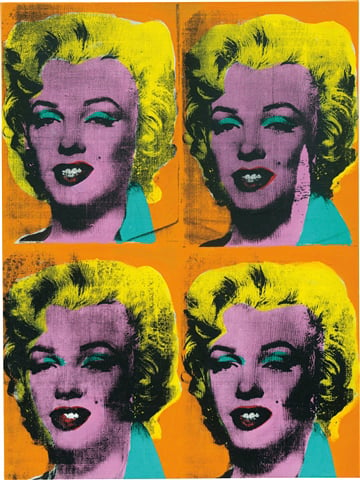

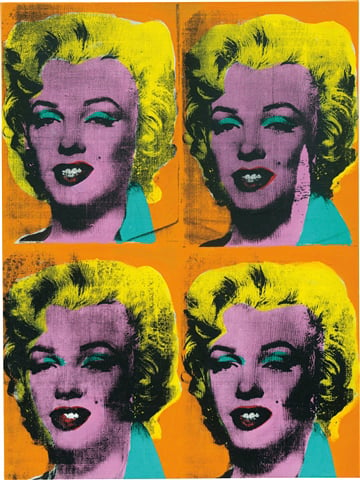

Andy Warhol, Four Marilyns, 1962, acrylic, silkscreen ink, pencil on linen, sold at Philips New York

The top 10 artists in 2013 by value sold at auction include: Andy Warhol (2013 sales: US$427.1 million), Pablo Picasso (US$422.8 million), Zhang Daqian (US$320.6 million), Jean-Michel Basquiat (US$286.8 million), Qi Baishi (US$265.6 million), Francis Bacon (US$219.8 million), Gerhard Richter (US$189 million), Roy Lichtenstein (US$160.9 million), Zao Wou-Ki (US$158.3 million), and Claude Monet (US$157.1 million).

Spotlight: United States

This year, the success of the art market in the United States was shaped by two primary factors: the booming Post-War and Contemporary market and the dominance of Christie’s. In 2013, sales at Christie’s New York represented roughly half (47.6%) of the value of art sold in the United States, grossing US$2.3 billion in sales in Fine Art alone, up 30% from value sold in 2012. Over 40% of the value sold at Christie’s this year was generated by the famed Post-War and Contemporary sales in May and November, both of which set subsequent new records for value sold during a single auction.

In May, Christie’s Post-War and Contemporary auctions collectively earned US$640 million, with the evening sale setting a new record high in auction history, selling US$495 million in a single auction session. During the course of the evening, over a dozen new auction records were set for Contemporary artists, among them, Jean-Michel Basquiat, Roy Lichtenstein, and Jackson Pollock. In the subsequent weeks, questions were raised about the stability and sustainability of the Contemporary art market growing at that pace. Q3 continued to look promising: auction sales of Fine Art in the United States were up 20% in the third quarter, led by extremely successful sales at Christie’s New York (+42% in Q3) and Bonhams New York (+18%). Other American cities were also able to capitalize on the traditionally slow summer months, with Heritage Auctions, Freeman’s Auctioneers, Leslie Hindman Auctioneers, and Neal Auction Company showing considerable growth in both volume and value sold in Q3. In November, the Post-War and Contemporary auctions at Christie’s New York topped the record set five months prior by selling over US$690 million during the evening auction, a sale which benefitted from strong demand (91% sell-through rate) on behalf of bidders from over 40 countries. During this sale, the record was set for the highest price ever paid for a work of art, as well as the highest price ever paid for a work by a living artist.

Of all Fine Art sold in the United States in 2013, the Post-War and Contemporary market held 44% of the market share by volume, followed by the Modern market (28%), and the Impressionist market (16%). Almost 50% of Fine Art sold in 2013 can be attributed to American artists. Leading American artists sold in the Unites States in 2013 include Andy Warhol, Jean-Michel Basquiat, Roy Lichtenstein, Willem de Kooning, Jackson Pollock, Jeff Koons, Norman Rockwell, Mark Rothko, Alexander Calder, and Cy Twombly. Among top-performing media categories in the United States, paintings and sculptures continued to perform well at auction, with paintings up 28% by value from 2012, followed by an 18% increase in value sold for sculptures.