Auctions

Will Dan Loeb Take Sotheby’s Private? Stock Rises 9 Percent on Departure of William Ruprecht

Change is coming to the world's second biggest auction house.

Change is coming to the world's second biggest auction house.

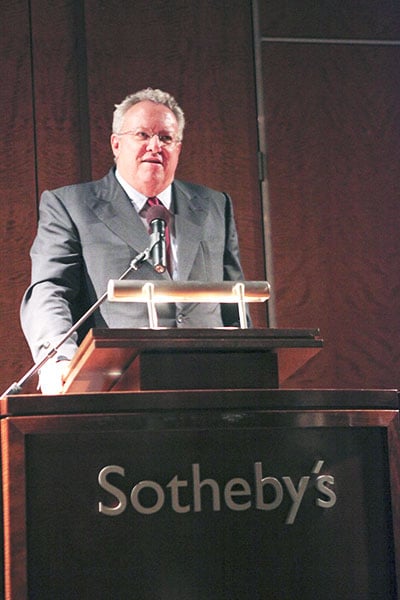

Bill Ruprecht, former CEO of Sotheby’s / Shaun Mader/patrickmcmullan.com

When hedge fund managers began amassing big stakes in Sotheby’s in 2013 and pressing for control of the auctioneer, William Ruprecht, chief executive since 2000, privately belittled them. In an e-mail to a colleague, he needed just one word to describe hedge fund manager Daniel Loeb, who acquired 10 percent of the stock: “scum.”

Apparently the antipathy was mutual.

Yesterday, Sotheby’s said Ruprecht will step down “by mutual agreement with the Board,” which Loeb and two allies joined in May after a successful proxy fight.

Loeb made his intentions known a year ago. Citing poor strategy, poor leadership, and poor expense control, he called on the board to replace Ruprecht, who joined Sotheby’s as a typist in the rug department in 1980.

“A day of reckoning” was inevitable for Ruprecht, said art adviser Todd Levin of the Levin Art Group and a former Sotheby’s staffer. “Bill comes out of the culture of Sotheby’s, which at times felt like a gentleman’s club,” Levin said. “Dan comes out of the culture of hedge funds, and his primary concern is making money for his investors.”

The exit portends a fresh start for the publicly traded company, which saw its profit and stock price peak in 2007, before the financial crisis. Sotheby’s said it hired Spencer Stuart, an executive search firm, to help choose a successor for the 58-year-old Ruprecht. A new chief executive could transform the 270-year-old company, such as overseeing a buyout.

“The possibility of taking Sotheby’s private is always a consideration,” said Jeff Rabin, who worked in financial services at Christie’s and cofounded Artvest, which provides investment advice about art. “The resignation of Ruprecht, or more importantly, the yet to be determined new CEO, will likely play a large role in that decision.”

As a private company, Sotheby’s wouldn’t have to disclose the level of guarantees or margins on private sales or auctions, giving it more flexibility to compete for business. Said Rabin: “As the two firms go head to head on almost every large consignment, there is only so far that Sotheby’s can go, whereas Christie’s is in a position to win business that they feel is strategically important, even if it is not financially profitable in the short run.”

Hedge fund manager Daniel Loeb who won a proxy battle with Sotheby’s.

The topic of going private arose when Loeb quizzed Sotheby’s executives at an August 2013 meeting about the differences between their shop and Christie’s. According to his notes, his questions included: “What would you do different if Sotheby’s was a private company? Do you think that would change the industry competitive dynamic?” (Loeb and Ruprecht’s private notes and e-mails were made public as part of a lawsuit Loeb’s Third Point LLC filed against Sotheby’s in Delaware.) An internal document of Third Point proposed to “push mgmt. to explore strategic alternatives and let an art loving billionaire [i.e. Loeb]…take [Sotheby’s] private.”

And Olivier Reza, a jewelry executive and now Sotheby’s director, “on more than one occasion suggested that Loeb consider taking Sotheby’s private,” Donald Parsons, a vice chancellor of Delaware Chancery Court, wrote in a May 2014 filing. Parsons added that it’s unclear how receptive Loeb was to the company going private.

A Third Point spokeswoman declined to comment for this story.

Ruprecht was not made available for an interview. A Sotheby’s press release said he will remain as chairman, CEO and president until a successor is named. In the release, both Ruprecht and Domenico De Sole, Sotheby’s lead independent director, promised a “smooth transition.”

Being a Sotheby’s lifer perhaps wasn’t ideal preparation for initiating the bold action Loeb said he sought. And it left Ruprecht vulnerable to what Loeb privately referred to as his “holy jihad”—led by a 1,636-word letter he filed with the Securities and Exchange Commission that was intended to “shock and awe” the company and “undermine the credibility” of the CEO.

Ruprecht was an oriental carpet specialist, director of marketing, and eventually among the executives considered for the top job when a price-fixing scandal laid the company low from 2000 to 2002. “It’s like they were asking for volunteers and everybody else stepped back, and I didn’t hear the question,” he said in a 2006 interview with Fortune about his ascension.

Ruprecht was “an able steward” both then and during the 2008–09 financial crisis, Loeb acknowledged in the letter. But growth in recent years has been elusive; expenses rose almost as fast as revenue and sweeteners to consignors ate into auction commissions. Private sales also struggled of late. Loeb said Ruprecht lacked an effective strategy for selling over the Internet or wresting contemporary art sales from Christie’s.

Sotheby’s and Loeb did announce a settlement adding the board seats, but lasting peace was impossible after such an acrimonious battle. “Sotheby’s has an incredible brand,” Rabin said. “It’s a terrific business if it’s led by the right people.”

This morning the stock rose as much as 9 percent.