The Back Room

The Back Room: A Year That Went Boom

This week: art-market acceleration hits a new gear, Sotheby's outsells itself, European gavels get loud too, and much more.

This week: art-market acceleration hits a new gear, Sotheby's outsells itself, European gavels get loud too, and much more.

Every Friday, Artnet News Pro members get exclusive access to the Back Room, our lively recap funneling only the week’s must-know intel into a nimble read you’ll actually enjoy.

This week in the Back Room: art-market acceleration hits a new gear, Sotheby’s outsells itself, European gavels get loud too, and much more—all in a 7-minute read (1,942 words).

__________________________________________________________________________

Programming Note: The Back Room will be on hiatus Christmas Eve and New Year’s Eve, returning the first Friday of 2022.

Emily Mae Smith, Broom Life.(2014) Image courtesy Phillips and Poly Auction.

For nearly two years, many analysts have been declaring that COVID dramatically accelerated changes in business and culture that were already underway. While I think the full story is more complex, the markets of several in-demand contemporary artists have furiously sped up this year—to a velocity that appears unprecedented even in the speculation-driven 21st century.

In the first half of the 2010s, favored artists in the Zombie Formalist movement generally shot out of the gate with jetpacks, quickly reaching prices near the half-million-dollar mark, before either crashing back to earth (see: Smith, Lucien) or else managing to roughly maintain their initial altitude up to the present day (see: Murillo, Oscar).

What we’ve seen happen with some of the most in-demand talent in 2021 is much more extreme, I argued this Wednesday. In multiple instances, artists in their mid-30s to early 40s high-jumped from well-established auction prices at or above the richest results of the Zombie Formalists to lofty new territory multiple times higher seemingly overnight.

Consider capsule studies of the following three artists (who aren’t even a part of the most speculated-upon group of the past few years: figurative artists of color depicting subjects of color)…

Loie Hollowell

Avery Singer

Emily Mae Smith

Several factors have enabled these rapid accelerations since the onset of the pandemic. Young money, particularly in East Asia, charged into the art market with new confidence, vigor, and international taste. Many high-net-worth individuals bought new homes with bare walls in places like Aspen, the Hamptons, and Palm Beach. Income normally spent on lavish vacations and nights out was reallocated elsewhere. Art sellers finally embraced online and hybrid selling en masse.

But the explanations are less important to me than the implications about what comes next, especially in light of the cross-fair spending spree we saw at Miami Art Week 2021. With the stampede breaching multiple tiers of the primary market, not just the auction sector, there’s no telling how much faster things could move from here.

__________________________________________________________________________

There have never been this many people in this many places ready and willing to spend this much money this confidently in the art market before. That’s great news for the sell side of the trade, but it is warping the expectations and incentives on the buy side to new extremes.

With the careers of coveted living artists already hurtling further past the speedometer’s red line than any of their predecessors, the question becomes who in the business can keep control of the wheel once this unprecedented straightaway leads into the next hairpin turn.

____________________________________________________________________________

A booth at TEFAF Maastricht in 2019. Photo by Loraine Bodewes, TEFAF Maastricht.

The last Wet Paint of 2021 will be up later today, but here’s what else has made a mark around the industry since last Friday morning…

Art Fairs

Auction Houses

Galleries

Institutions

NFTs and More

____________________________________________________________________________

© Artnet News 2021.

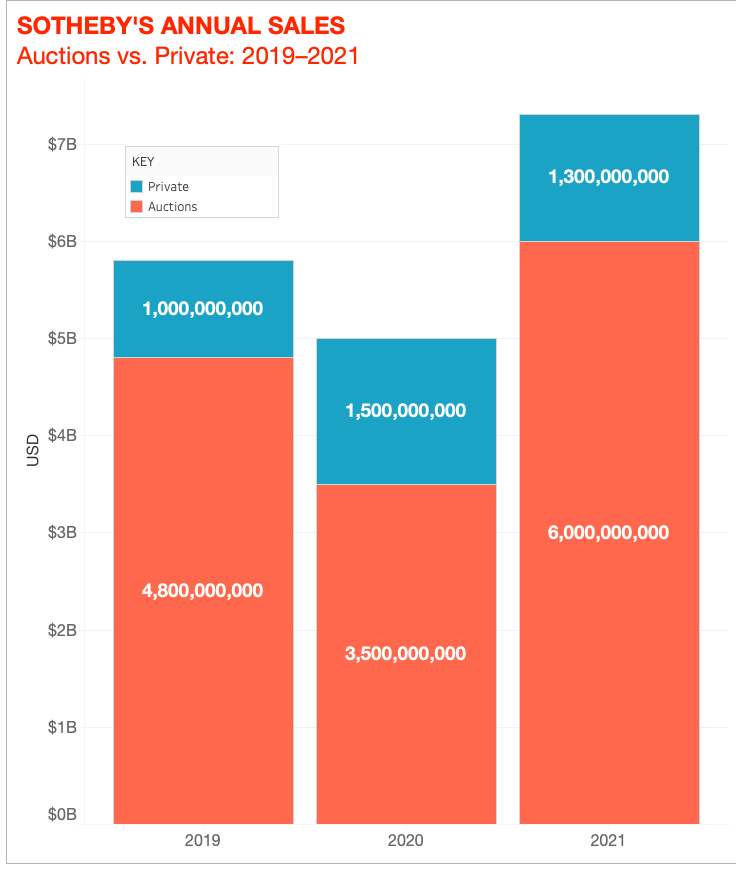

Sotheby’s sold $7.3 billion worth of art and collectibles in 2021, a record in the auction house’s 277-year-history. While private sales declined roughly 13 percent year-over-year, to $1.3 billion, live and online auctions contributed an all-time-high $6 billion.

Lots that fetched more than $10 million appeared in a wide range of categories, including Asian art, contemporary, Modern, Latin American, Old Masters, watches, jewels, books and manuscripts, and NFTs (with the last category amassing $100 million in sales).

The robust results arrive amid rumors that the house could be taken public once again, according to Bloomberg News. Sotheby’s owner Patrick Drahi has reportedly held preliminary private discussions with potential advisors about a U.S. listing as soon as next year. (A Sotheby’s spokesperson declined to comment “on rumors or speculation.”)

____________________________________________________________________________

“Honoring the Sackler name on the walls of the Met erodes the Met’s relationship with artists and the public. Given the federal crimes committed by Purdue Pharma and the staggering national death toll, this is a situation of force majeure.”

—Partial text of a letter to Metropolitan Museum of Art leadership from an international group of A-list artists pushing to strip all references to the Sackler family from the museum, which Met officials finally obliged late last week. Along with Sackler PAIN founder Nan Goldin, the 77 signatories included Ai Weiwei, Jenny Holzer, Arthur Jafa, Anish Kapoor, Ed Ruscha, Richard Serra, Cindy Sherman, and Kara Walker. (The New Yorker)

____________________________________________________________________________

Albert Oehlen, Untitled (Triptych) (1988). Courtesy of Ketterer Kunst.

____________________________________________________________________________

Estimate: €1.5 million ($1.7 million)

Sale Price: €3.6 million ($4.2 million)

Sold at: Ketterer Kunst, Munich

European auction houses are enjoying the plump fruits of the latest art-market surge just like their larger international competitors, my colleague Kate Brown wrote this week. Whether for individual works or year-end totals, newsworthy numbers have been reported by regional players including Germany’s Ketterer Kunst and Grisebach, Vienna’s Dorotheum, and Polswiss Art in Warsaw, Poland.

Robert Ketterer, owner of Ketterer Kunst, credited “Brexit and low interest rates” as added factors that helped make 2021 the highest-selling year in the company’s history. The house tallied €88 million ($99.3 million) in combined online and offline sales, including 15 lots moved for more than €1 million.

The richest and most recent of those seven-figure sellers was Albert Oehlen’s Untitled (Triptych) from 1988. Ketterer Kunst director Sebastian Neusser said of the painting that “a work of this quality has never been sold on the European auction market before.” He called it a “key” piece in the artist’s oeuvre, marking “the beginning of his turn towards abstraction.”

On December 9 in the house’s Munich salesroom, a private collection from the Benelux Union beat out competitors from Germany and Switzerland to win the triptych for €3.6 million ($4.2 million), more than double its low estimate. The result marked the first time Ketterer Kunst has sold a work for more than €3 million, and it set a new record price for Oehlen in his native country.

It’s also a vital year-end reminder that historic bidding wars aren’t the sole birthright of hot young artists and massive global auction houses.

____________________________________________________________________________

Additional reporting and writing by Naomi Rea.