Op-Ed

The Surging Demand for Digital Collectibles Could Offer a Lifeline for Cash-Strapped Museums—Here’s How

Museums facing a financial shortfall may find a lifeline in selling limited-edition digital versions of the art in their collections.

Museums facing a financial shortfall may find a lifeline in selling limited-edition digital versions of the art in their collections.

Museums are in the midst of reckoning with two major shifts: the undeniable evolution in how people interact, value, and consume digital media, and the urgency to cultivate new, sustainable revenue streams. In an effort to recover from pandemic-induced budget shortfalls, museums have leveraged social media, virtual tours, and livestreams to attract visitors and recover lost earnings.

But there is another avenue they may not have considered: the digital collectibles market. In recent months, demand for these assets has skyrocketed and new online marketplaces are making it easier than ever to participate in the market. Already, hundreds of millions of dollars have been transferred in exchange for digital collectibles.

With the advent of blockchain, it is now possible to attach a level of authenticity and ownership to digital objects in a way that was not previously feasible. Museums looking to monetize their vast troves of digital assets now have the means to enter a thriving market where their collections might take on a new life and value of their own—all without having to sell any flesh-and-blood works from their collections at auction.

This new frontier may offer a way to bridge the gap between traditional modes of operating and the evolving virtual world. And it could have a big impact on museums’ bottom lines.

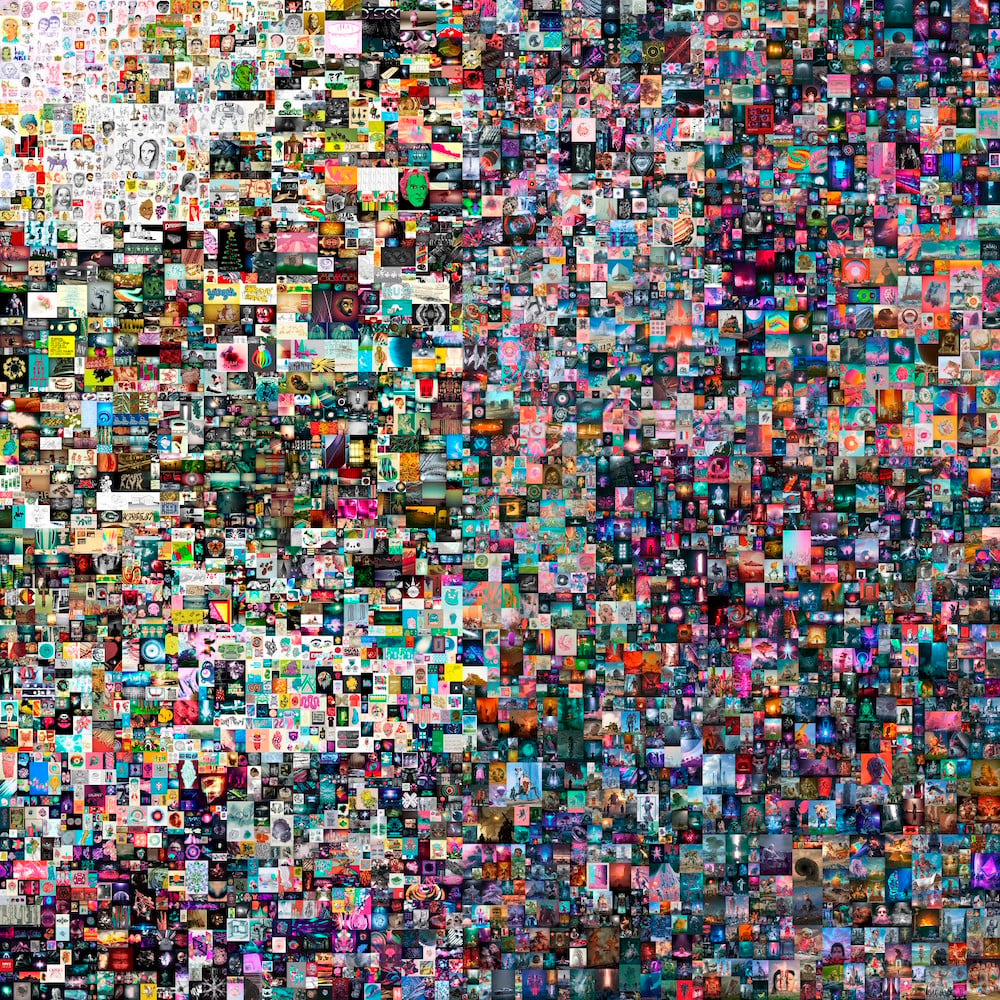

Beeple, Everydays – The First 5000 Days NFT, 21,069 pixels x 21,069 pixels (316,939,910 bytes). Image courtesy the artist and Christie’s.

The digital art and collectibles market was valued at close to $5 billion in 2020, and it’s been growing rapidly ever since. In December, a relatively obscure digital artist named Beeple made the largest digital art sale in history, bringing in a total of $3.5 million. His work is now the subject of a highly anticipated (and groundbreaking) sale at Christie’s.

Blockchain has made it possible to create a never-before-seen scarcity in digital media and, in the process, generate an entirely new market. One of the more recent phenomena to enter this arena is non-fungible tokens (NFT), which Coindesk describes as “digital assets that represent a wide range of unique tangible and intangible items, from collectible sports cards to virtual real estate and even digital sneakers.”

Historical issues that have long plagued the media market, like digital piracy and illegal reproduction, can be now all but forgotten. By creating a permanent, publicly transparent stamp of ownership, NFTs and blockchain present what some technologists are calling the biggest technological innovation since the iPhone.

The Metropolitan Museum of Art in New York. Photo by Spencer Platt/Getty Images.

I’ve been following blockchain since its earliest days, when Bitcoin’s value was still in the single dollar range. I’ve also researched and speculated about the ways I think cryptocurrency could impact museums. I’m intrigued and inspired by the growing momentum and innovation in the world of digital collectibles.

As museums rethink their revenue streams for an increasingly digital world, they might consider looking towards the nascent digital collectibles market. Although not without its obstacles, the NFT paradigm may be breaking the mold for how digital objects are bought and sold.

An unlikely but promising model for museums to consider is the NBA’s new marketplace and community called Top Shot, which recently surpassed $200 million in transactions. Eight out of 10 of the best performing Top Shots feature plays made by LeBron James, with the most valuable currently trading at over $200,000. While sports may have more mass appeal than fine art, the activity on Top Shot illustrates that if a digital asset is certified and officially licensed, the price tag can skyrocket. Top Shot has exploded in popularity among those looking to trade memorable plays, just as their parents traded basketball cards.

In the nonprofit world, NFTs could be a compelling way to take works by historical artists and turn those static, high-resolution JPGs into unique digital collectibles. Museums invest significant resources in digitizing their collections for the world to access. These institutions are sitting on thousands, if not millions, of unique assets of cultural and historical significance. Now could be the time to monetize them by selling licensed, limited-edition, digital collectable versions.

Is an NBA-licensed digital collectible of LeBron James throwing down a one-handed slam dunk equivalent to a Met-licensed NFT of an Impressionist masterpiece or a MoMA-licensed digital collectible of a work by Warhol? We just might find out.

Could NFTs lead to real money for museums? (Photo by Yuriko Nakao/Getty Images)

There are countless marketplaces on which museums could share their content with limited effort or overhead. Museums are constantly looking for new audiences and avenues to boost attendance and buzz. This could enable them to do so while printing revenue from that which is otherwise free.

This prospect could seem at odds with recent Open Access initiatives and far outside of the core mission of museums (which is to promote education rather than turning a profit). But it could be worth exploring what can be done digitally before resorting to the painful and unpopular act of deaccessioning artworks. After all, museums also have gift shops, cafes, and are involved in other revenue-seeking activities that aren’t tied to their educational mandates.

Forward-thinking artists and cultural organizations are already recognizing the potential in these technologies. The New Museum’s NEW INC and partner Rhizome have been early to explore the potentials of blockchain in the art and cultural sector. In recent years, museums like the Broad have partnered with startups like Sedition to monetize limited-edition digital art by the likes of Jenny Holzer and Tracey Emin.

Plus, if museums aren’t going to move quickly, others might do so on their behalf. There are already accounts popping up on markets like OpenSea selling NFTs of public-domain artworks from the collections of the Art Institute of Chicago, the Cleveland Museum of Art, and the Rijksmuseum.

Institutions with more traditional patrons could also consider taking a page from Beeple, who, as a companion to the digital files he sold for $3.5 million in December, offered a small, titanium-backed glass screen that displayed each object and a QR code linked to the blockchain file’s information, yoking a tangible and intriguing art object to the digital sale. In an age when galas, exclusive art-fair walkthroughs, and travel programs have become unfeasible, such a physical manifestation might offer a new type of currency to excite patrons.

The Kunstforum Palais Populaire, run by the Deutsche Bank. Photo: Jörg Carstensen/dpa/picture alliance via Getty Images.

Some people think that blockchain is the answer to all of our problems. I’m not one of them.

Crypto art and collectibles are still in their early days. Like any new technology, there are challenges and bugs to be worked out. The biggest problem from the supply side is the steep transaction fees creators or issuers must pay to sell digital works. These fees, commonly referred to as “gas,” have historically ranged from a few dollars to as much as $50 and are tied to every transaction. The overhead could quickly add up when dealing with a museum’s entire collection—but on the bright side, these fees are starting to drop.

Despite its recent popularity, NFT technology is also only now hitting the mainstream, which raises skepticism. According to Duncan Cock Foster, co-founder of the NFT platform Nifty Gateway, digital art’s adoption will follow a path parallel to that of Bitcoin, which “started as an asset collected by nerds” and is now within the purview of hedge funds and insurance companies. He continued: “You’ll see art institutions collect NFTs as people get more familiar with the concept.”

NFTs and digital collectibles could present a paradigm shift, or they could be a passing fad—but either way, they highlight an evolving discourse about what constitutes art. With more and more people willing to pay hundreds, even millions, of dollars to own unique digital artworks and the rise of sophisticated technology to authenticate these assets, new questions emerge about the future of digital collectibles.

With the new reality of digital scarcity, museums are sitting on large, potentially monetizable digital repositories of photographs, prints, and archival materials. While we’re just beginning to explore what this means for the cultural sector, digital assets may very well help recast the future of museums.

Brendan Ciecko is the founder and CEO of Cuseum, a platform that helps museums and cultural organizations engage their visitors, members, and patrons.