I am urgently trying to scratch together enough fiat money—you know, old-fashion paper currency made legal tender by government decree—to buy my house, which is weighed down by an antediluvian hoard of physical art (in comparison to today’s digital culture), before my lease shortly expires. After explaining the predicament to my shrink, she replied: “Can’t you sell more NFTs?” No, she wasn’t a Richard Prince monochromatic joke painting incarnate (though she is nearly as expensive), but she did happen to read my recent Artnet News articles on the subject. In today’s column, the third in what I suppose has become a series, I will address the fervidly fierce critics of NFTs, while allowing you to skip the vitriol of some of the schoolyard-level personal attacks leveled against me on Instagram. (I wish I could.) Twitter, in contrast, the platform of choice for tech proselytizers, is generally a much safer space.

The NFT antichrist—no, not fellow columnist Nate Freeman, who referred to NFTs as a “gimmick” in his last column, but rather David Gerard—authored a scathingly critical exposé on digital currency entitled “Attack of the 50 Foot Blockchain: Bitcoin, Blockchain, Ethereum & Smart Contracts” (self-published). Sue Halpern, in a January 2018 article in the New York Review of Books, called Gerard’s publication: “A sober riposte to all the upbeat forecasts about cryptocurrency.” And he didn’t stop there—Gerard picked up the assault in a recent blog post: “NFTs: crypto grifters try to scam artists, again.” Ouch.

To quote the blockchain butcher himself: “NFTs are worthless, fraudulent magic beans, with massive CO2 generation per transaction, this is because NFTs only exist to further the crypto grift. Tell artists there’s a gusher of free money! They need to buy into crypto to get the gusher of free money. They become crypto advocates, and make excuses for proof-of-work and so on. A few artists really are making life-changing money from this! You probably won’t be one of them. You can tell that crypto art is definitely art, because so many proponents of it are insufferable manifesto bros. Just the manifestos could cause runaway global warming from the sheer volume of hot air. Note that it’s only the token that’s non-fungible—the art it points to is on a website, under centralized control, and easily changeable. An NFT doesn’t convey copyright, usage rights, moral rights, or any other rights, unless there’s an explicit license saying so.” Umm, I hate to break the news to Mr. Gerard, but neither does buying a Picasso!

I don’t dress too appropriately IRL, and in Decentraland I didn’t fare very well either. Courtesy of Kenny Schachter.

Gerard’s cohort in decrying the tendency of market players to dump their crypto profits into NFTs, thereby creating the hype that sucks artists in to buy more crypto (making the merry-go-round spin—and spinning more profits for the miners) is Amy Castor, another blogger and journalist who penned an even more venomous NFT rebuke in her piece “WTF is an NFT,” where she boils down the entire sector into a ruse to convert hard cash into digital currency: “If initial coin offerings were the crypto grift of 2017 and decentralized finance (aka “DeFi”) was the grift of 2020, then “nifties” are the grift of 2021, and they do just what crypto grifters need them to do: lure more dumb money into crypto.” These curmudgeons, who together make Hilton Kramer and Robert Hughes look like Little Red Riding Hood, equate NFTs to the short-lived Beanie Babies craze of the ’80s—but, then again, that was the same criticism leveled against PayPal at its inception.

Help! Let me out! I need to buy some NFTs! B.F. Skinner founded token theory in behavioral science. Courtesy of Kenny Schachter.

According to the website Decrypt, “Tokenomics” is the study of how cryptocurrencies work within a broader ecosystem, including digital token distribution, and how they can be used to incentivize behavior in the network, perpetuating adaptation and practical functionality—i.e., giving crypto bros something to spend their funny money on (according to the skeptics). Funnily enough, this terminology was originated in 1972 by B.F. Skinner, most famous for bringing up his daughter in a box he devised to reinforce certain actions by imposing consequences. Skinner believed an economic model based on tokens could control animal (and human) activity by incentivizing positive behavior. More recently, in a similar vein, the artist Kevin Abosch devised an NFT project that surreptitiously rewards collectors who keep hold of their tokens rather than instantly flipping them back into the marketplace in a nanosecond—only neglecting to forewarn the buyers beforehand in an act of subterfuge he sees as key to the conceptual conceit of the work.

Okay, I appreciate how this all sounds like a decentralized, distributed scam. The elephant in the room is taxes, and as sure as shit governments will cotton onto the gross expenditures well broadcasted in the worldwide media of late and try and carve out a (significant) piece of the ever-expanding digital pie. NFTs present not so much tax evasion as a collective act of sidestepping taxes altogether. Like 1031 real estate exchanges, the now-outlawed tax-code lingo that permitted investors to avoid capital gains by reinvesting proceeds in like-kind property deals, spending your Bitcoin or Ethereum riches on NFTs does not give rise to a taxable transaction. For now anyway. There is also a burgeoning crypto intelligence network, akin to forensic scientists, who use blockchain analytics to chase breadcrumb trails (crypto money flow, for those who haven’t read my glossary) in the same way journalists used the Panama Papers to expose rogue offshore-finance shenanigans. Fun!

Would you rather have yet another T-shirt or an NFT? I know what I want—more art, digital or otherwise. Courtesy of Kenny Schachter.

Is the largely unknowable, seemingly shady (under)world of cryptocurrency genuine? Do Bitcoins and ETHs have any real underlying value? By the same token (ha!), you can pose an identical question about the present state of the US dollar. I know a billionaire who just received his second government-issued stimulus check. Could hyperinflation return to the unprecedented levels last seen in Weimar Republic Germany, when wheelbarrows full of cash were necessary to buy a loaf of bread? Yes, the digital currency players frequently employ FUD (Fear, Uncertainty and Doubt), a term coined—sorry, couldn’t resist—to describe the strong-arm tactics of Microsoft’s sales propaganda practices in the 1990s and coopted for use as scare tactics in the Wild West of crypto-land. However, I am cynically idealistic that this field will grow well beyond the video game and screensaver sensibility of much of the art now flooding NFT platforms (which are reproducing quicker than hydra) to blossom into history-making art treasures.

This beer-loving CryptoWiener is the protagonist of a famous Austrian TV-show from the ’70s that split the Austrian nation because of its portrayal of the working class. Today his famous quote „Mei Bier is ned deppat“ (which translates to “My beer is not stupid!“) is considered premier pop culture. Courtesy of Kenny Schachter.

Great NFT art can already be found, as covetable as canvas. Interesting NFT galleries have already sprung up that have a lot more to offer, quality-wise, than most of the crypto art on view in the mainstream platforms, including: www.left.gallery; www.hicetnunc.xyz; www.folia.app; www.feralfile.com/exhibitions; www.cryptowiener.com. (I must admit I’m a sucker for CryptoWieners.) Some of the above sites utilize technologies that reduce the disproportionately high carbon footprint so widely reported regarding blockchain business, as does Untangible (soon to launch online), which will use a private blockchain where you can purchase, move, and interact with works safely within the system without incurring fees or killing trees. Artists such as Rhea Meyers, Sarah Friend (who worked for years on a universal basic-income internet company), Robert Alice, pioneer Anna Ridler, Darren Bader, and the aforementioned Kevin Abosch are producing significant works that I will expand upon in my next column. (Yes, I am afraid there will be another.)

Want to see a magic trick? How do you make $69 million disappear in the blink of an eye? Take the time to actually look at the crap Beeple crap art. Courtesy of Kenny Schachter.

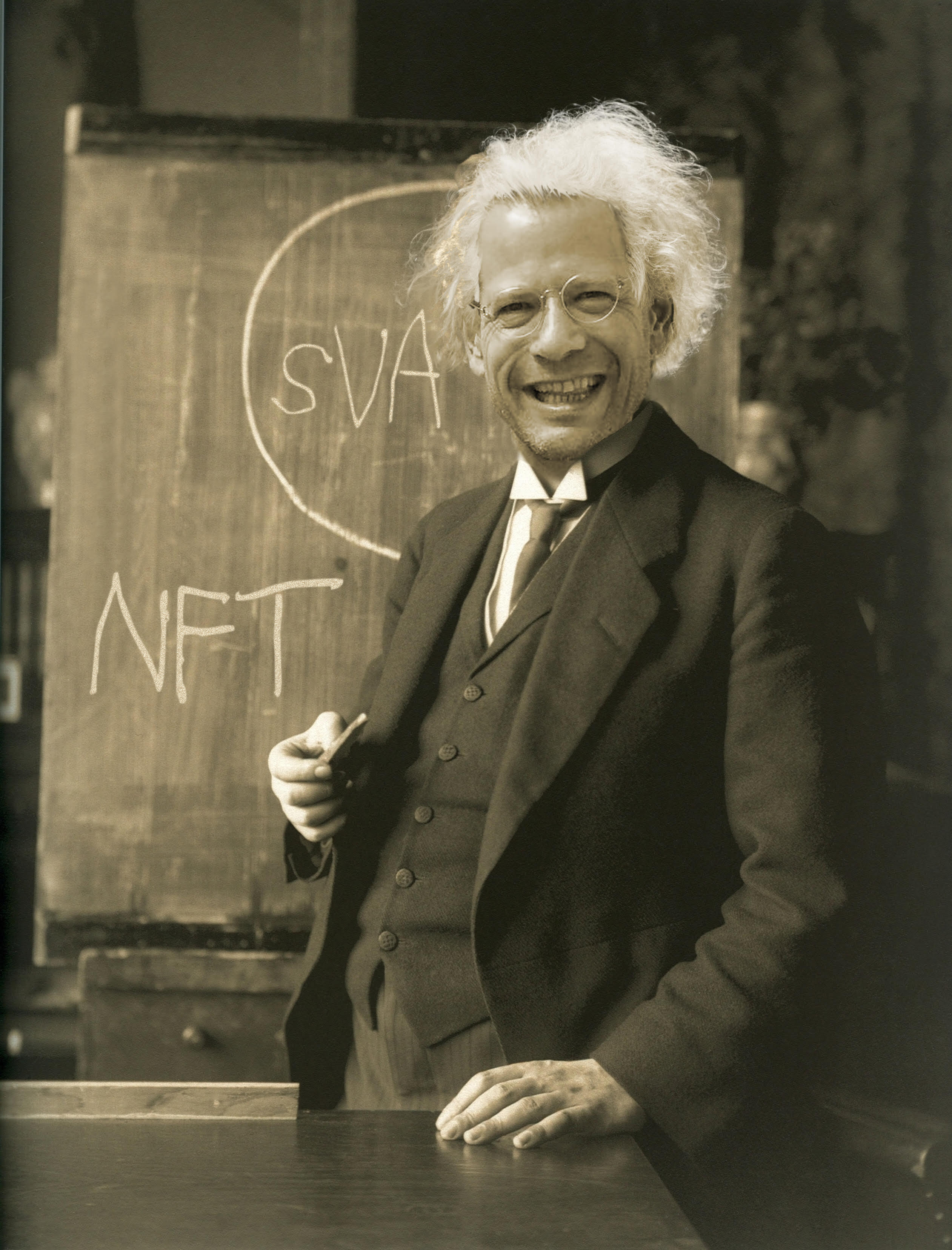

We indisputably live in a different age from when I was a growing up, where every teenager yearned for a car that symbolized mobility and freedom (largely from your family)—whereas now ride-sharing apps like Uber or Lyft will suffice, kids today have no interest in owning a car, and many don’t drive altogether. Likewise, with art, these days a digital good(ie) will more often than not do the trick and satisfy the dopamine impulse that landed me with three warehouses full of art. But the crypto digerati need to learn about yesterday’s art world if they really want to flourish in tomorrow’s, and vice versa. In that regard, I have a crypto mentor: a longtime Google employee and insatiable early NFT collector extraordinaire based in Singapore who I met on Instagram. He teaches me tech and, in turn, I tutor him on the old (art) world. To push myself even more, I’ve pitched and (to my surprise) been accepted to teach an NFT senior-thesis workshop at the School of Visual Arts this semester—the first of its kind, I’d venture to assume—and will give an open-to-the-public lecture Monday, March 28th, at 6 pm EST. (Reserve a spot here.)

C’mon, NFTs can’t be all that bad! Someone bought Lindsay Lohan’s and trashed it. Courtesy of Kenny Schachter.

People would do well to take the current NFT frenzy in stride and spend some time to digest this groundbreaking period of change in art. NFTs are only a means of dissemination of digital art into the stream of commerce, and will only continue to flourish. Watch. There is no love in fear, which accounts in much of the brouhaha surrounding the vicious critics. At the beginning of the 20th century, Cubism was considered a search for the fourth dimension—are NFTs a window onto the fifth?