South Dakota may not be known as a buzzing art hub, but a recent Supreme Court decision about how the home of Mount Rushmore handles taxes could have serious implications for the art world.

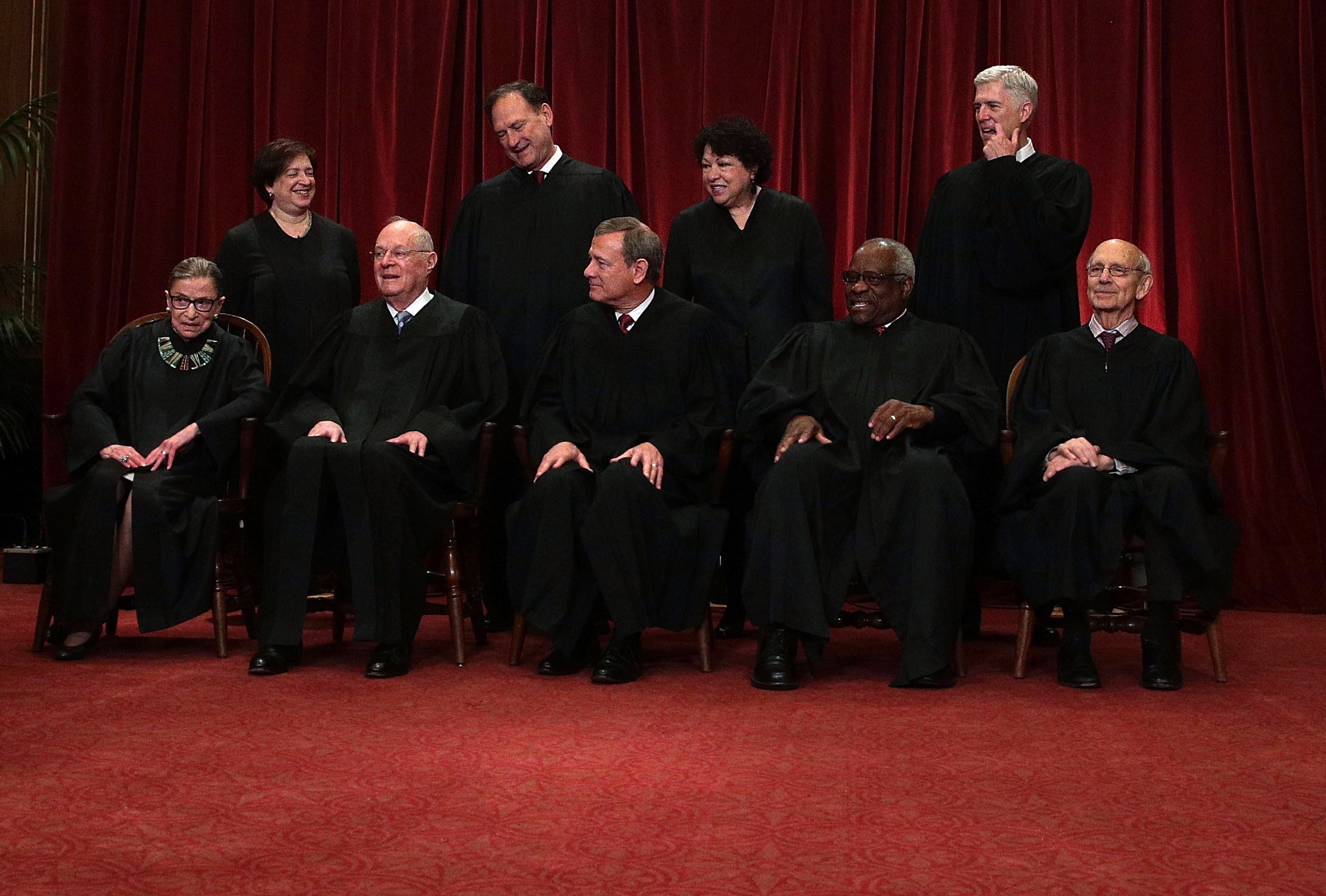

The case, known as South Dakota v. Wayfair, pitted the state government against the home goods e-commerce site known for selling affordable lamps and rugs. The June 21 ruling, penned by outgoing Supreme Court Justice Anthony Kennedy, concluded that retailers are responsible for collecting sales tax on objects shipped out of state under certain circumstances, even if the seller doesn’t have an office or any other physical presence in that state.

This might sound technical—and it is. But it is likely to perk up the ears of anyone who has bought or sold art in the United States.

Here’s why: When a buyer lives in a separate state than the one(s) where the seller is based, the seller does not charge sales tax on the transaction. The reason is that buyers are supposed to report every out-of-state purchase, then pay their home state the same amount of tax they would have paid if they had bought the item locally. This is called “use tax.” (Americans of all income levels encounter it every April on their state tax returns, when they’re asked to back-pay for every small purchase they’ve made online or while traveling in the past year.)

Employees of the Musee Marmottan Monet transport a crate. Photo Patrick Kovarik/AFP/Getty Images.

However, it’s not unusual for buyers to forget (or “forget”) to report some of these purchases, starving their home state of tax money. As a result of both honest mistakes and intentional mischief, states—including art-market hubs like New York and California—miss out on billions of dollars in revenue.

In the case of the art market, there are even instances in which collectors with multiple homes might skirt the law with a shipping shell game. For example, a New York collector might acquire work from a New York dealer and arrange a discreet local delivery—while simultaneously directing the dealer to send a dummy shipment to, say, their vacation home in Florida.

The dealer can file away shipping documentation that says the box contained the artwork, putting the tax burden on the buyer. The buyer can conveniently forget to report the purchase in Florida. And the actual work can stay on their wall in New York tax-free forevermore (until, or unless, the authorities catch wind, as they sometimes do).

What It Means

The Wayfair case overturns a 1992 decision that effectively allowed e-commerce sites to operate tax-free in the United States. It clears the way for South Dakota to collect taxes from retailers like Wayfair or Overstock that ship hundreds of items to the state, but do not have a physical location there. The ruling applies to items that cost $100,000 or more as well as any business that ships more than 200 individual objects to South Dakota.

Now, some tax experts believe other revenue-hungry states will seek to replicate South Dakota’s measure. And that could have a big impact on galleries, dealers, and auction houses.

“The Wayfair decision looks like a sales tax game-changer for many New York galleries,” attorney and art law expert Thomas C. Danziger told artnet News. “Until now, most New York dealers who delivered works of art to out-of-state buyers didn’t even have to think about sales tax, much less go through the exercise of computing and collecting tax from the buyer based on the delivery location.“

Art handlers at the Smithsonian. Image courtesy of Flickr.

Say you are an honest, law-abiding New York-based Impressionist art dealer with no physical presence in any other state. A collector based in Hot Springs, South Dakota, walks into your gallery and buys a Picasso painting for $1 million. (Hey, a dealer can dream.) Before the Wayfair decision, you would only have needed to worry about safely shipping the work to your buyer and collecting your $1 million.

After Wayfair, you are potentially responsible for collecting applicable South Dakota sales and use tax—now at 4.5 percent—and remitting it to the state’s taxation department. That may not sound so onerous, but what if you had to replicate that process for every single artwork or object valued over $100,000 that you ship out of state?

What Comes Next

To date, a number of states appear poised to follow South Dakota’s lead. The Supreme Court decision notes that 41 states, two territories, and the District of Columbia have asked the court to do away with the requirement that a business must have a physical presence in a state in order to collect sales and use tax.

The law firm Withers Bergman raised a red flag about the new development in a recent newsletter, telling clients: “In light of this decision, art businesses must re-evaluate whether they have a sales tax collection responsibility to any state in which they deliver art, and art collectors should also follow any subsequent changes in state legislation that may affect individual sellers.”

Amanda Rottermund, an associate at Withers Worldwide based in New York, told artnet News that the decision as it stands now would affect any dealer who conducts a sale with a buyer in South Dakota. “On a really straightforward reading of the South Dakota statute, you could be pulled into South Dakota’s sales tax registration requirements just because you ship one $100,000-plus piece into that state. And you might have no other connections to South Dakota,” she said.

The case will now head back to the South Dakota Supreme Court, which is expected to issue an opinion to clarify the finer points of the ruling in August. “[W]e will all have to tune back to see if there are any additional clarifications that the state court makes in light of the Supreme Court’s ruling,” Rottermund said.