The Art Detective is a weekly column by Katya Kazakina for Artnet News Pro that lifts the curtain on what’s really going on in the art market.

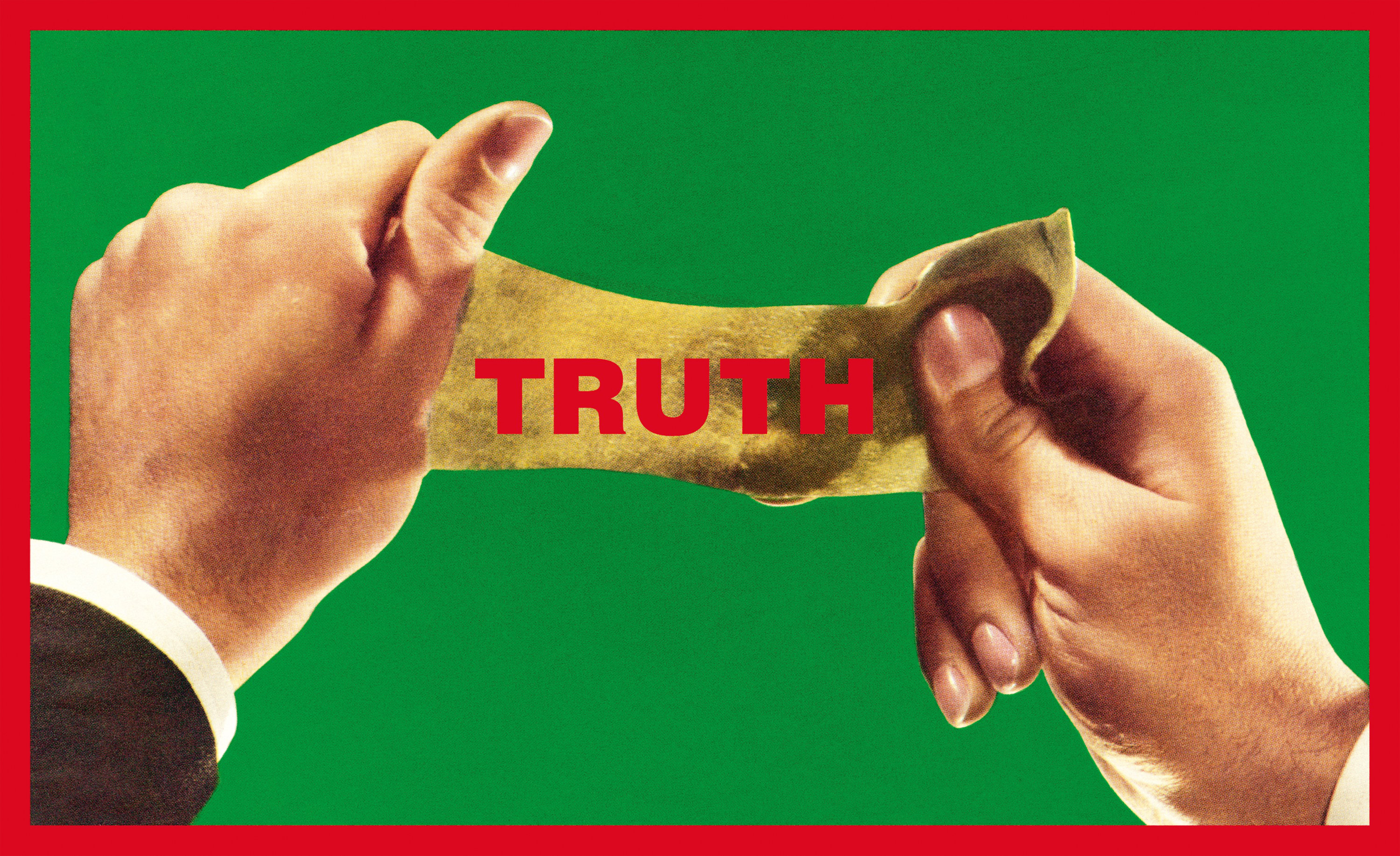

Why do art dealers lie?

The question inevitably makes people laugh. As in: Are you serious? Or: Is this even a question? And: Welcome to the art world!

There are lies of omission (withholding stuff) and lies of commission (misrepresenting stuff). Both types can be supremely useful to the liar—and not so much to those on the receiving end.

“It’s always greed,” an art advisor opined. “These dealers lie because of greed. That they’ll make more money because they change the circumstances.”

There are famous cases of lies getting dealers into legal trouble. The Los Angeles gallerist Douglas Chrismas was just ordered to pay creditors more than $14 million after a forensic accountant found that he hid a small fortune in shell accounts before filing for bankruptcy. Selling the same artworks to multiple investors landed dealers like Larry Salander and Inigo Philbrick in jail.

But these are extreme cases. The lies most dealers tell aren’t illegal—or even close to illegal. They are simply part of doing business in an opaque industry where information is the most valuable currency. While often whispered about, they are usually impossible to dispute.

But in at least one case of a quotidian—and, it should be said, not illegal—misrepresentation, we have receipts. (More on that later.)

***

Sometimes hype can be a pretense for lying. Dealers lie about selling out shows and art-fair booths, about waiting lists and institutional interest. There are the subterfuges lurking around every corner of the art world. You may think that your work is being purchased by a museum trustee only to discover later that it has been flipped by an art fund. Or that a painting by an artist you covet is being offered to others despite the gallery’s assurances that nothing is available. A gallery director may ask you to buy “into the program” to improve your status as a collector—promising that at some unspecified point, which never seems to arrive, the desired work may be finally yours!

“Dealers lie when they say business is great because nothing succeeds like success,” said Walter Robinson, an artist and writer. “And dealers lie when they say business is slow for sympathy and to avoid paying raises or bills.”

In an attempt to make things appear more exclusive, dealers will sometimes tell you that they are finally able to release a work that has been on hold for a museum. “They often do it with works of terrible quality,” said Amsterdam-based collector Freddy Insinger.

There is, of course, a spectrum between outright, deliberate lies and statements that can be subject to misinterpretation. Dealers frequently disclose sales with asking prices attached, failing to mention that the actual prices reflect a discount. They might say a work sold on the first day of an art fair when it was, in fact, sold via PDF in advance.

Most of the time, we’ll never know for sure what the gap is between what a gallery says and the truth. But here is one story in which we do.

***

Last May, the art world began emerging from the pandemic and some galleries flocked to Art Basel Hong Kong. The first IRL Art Basel in almost 18 months, it would send an important signal about the state of the art market.

So it was a big deal when Lévy Gorvy gallery announced during the fair’s VIP opening that it had sold a painting by Joan Mitchell with an asking price of around $19.5 million. Titled 12 Hawks at 3 O’Clock, the 1962 abstract canvas was a beehive of brushstrokes, muscular and willowy, in various shades of green and red. It was a beauty.

Joan Mitchell, 12 Hawks at 3 O’Clock (1960). © Estate of Joan Mitchell.

I first saw the painting in 2018 at Christie’s in New York, when it was offered as part of storied collector Barney Ebsworth’s estate sale. It was big—almost 10 feet tall and 6.5 feet wide—but evoked human proportions. The provenance was impressive: It was first owned by painter Sam Francis, who kept it until his death in 1994. Then it joined Ebsworth’s collection alongside masterpieces by Jackson Pollock, Willem de Kooning, and Edward Hopper.

Estimated at $12 million to $16 million, the painting fetched $14 million, including fees. It became the second most expensive Mitchell sold at auction.

Lévy Gorvy’s announcement of its successful resale three years later was significant—the asking price, $19.5 million, represented the highest known price for Mitchell, whose auction sales had declined 21 percent from their peak in 2018.

“There’s a strong interest in Mitchell in Asia,” Brett Gorvy told ARTnews at the time. “It is a territory where you’ve got incredibly hungry avid collectors, who have been collecting in other fields and now who have been moving very quickly into major Western art.”

The gallery declined to name the buyer or specify their location, ARTnews pointed out, adding that “the sale signals the Asian art market’s enduring strength, even as the pandemic rages on.”

The optics were great for Lévy Gorvy and the broader blue-chip art market. Demand from Asia has been one of the biggest stories of the past two years.

There’s just one problem: 12 Hawks at 3 O’Clock had been sold a month earlier—and not in Asia, nor for a price in the region of $19.5 million.

***

Dealers routinely fudge the asking prices to shape public perception while often giving discounts to collectors and institutions, but this seemed like a particularly extreme example. Here’s what happened—and the explanation from the gallerists, who suggest that the statement was accurate and maintain they had no intention of deceiving anyone.

On April 23, 2021—a month before the fair—12 Hawks at 3 O’Clock was sold by High Fashion Concepts LLC, an entity controlled by the Mugrabi family of collectors and traders, to Masterworks, a fractional art ownership company, for $14.2 million, according to regulatory filings obtained by the Art Detective. The price represented a tiny 1.4 percent increase in value over 2.5 years—not the $5.5 million hike that Lévy Gorvy’s published price suggested.

But how exactly did the same painting end up being widely reported as having been sold at Art Basel Hong Kong for $19.5 million? As it turns out, Lévy Gorvy was a co-owner of the work, having jointly bought it with the Mugrabis at Christie’s in 2018.

Joan Mitchell’s 12 Hawks at 3 O’Clock (1960) at Lévy Gorvy’s booth in Art Basel Hong Kong. Courtesy of the Gallery.

Masterworks purchased the painting as part of a massive spree of acquisitions worth more than $300 million in 2021, according to its filings with the Securities and Exchange Commission. A growing power player in the market, Masterworks creates an LLC for each work, adds an 11 percent fee, and then offers it to investors like an IPO. Individual shares start at $20. In the case of 12 Hawks at 3 O’Clock, the minimum buy-in was $15,000, filings show.

On July 6, 2021, Masterworks filed an offering circular, a brochure issued when a new security is listed in the private markets, for 12 Hawks at 3 O’Clock, with $15.8 million as the “maximum offering amount.”

The purchase agreement and the SEC offering circular, both reviewed by the Art Detective, show that Masterworks retained ownership before and after Art Basel Hong Kong. The purchase agreement states that the painting went to the fair “for the purposes of exhibition.”

A screen shot of Masterworks’s purchase agreement for the Mitchell painting.

Representatives for Masterworks and High Fashion Concepts didn’t respond to emails and calls seeking comment. Brett Gorvy and Dominique Lévy, the gallery founders who have since formed a new dealership called LGDR, provided the following statement in response to a list of questions:

“Lévy Gorvy and HFC [High Fashion Concepts] jointly purchased Joan Mitchell’s 1962 painting 12 Hawks at 3 O’Clock at auction. Subsequently, due to the consequences of the Covid pandemic and the delay of the Joan Mitchell museum retrospective, the joint owners reluctantly decided to deaccession the painting sooner than originally planned. Lévy Gorvy believed the best route was to present the work at Art Basel Hong Kong—the only ‘in-person’ art fair taking place at that point in the pandemic—as the centerpiece of its stand at the fair. Simultaneously, conversations had begun with Masterwork [sic] about possible acquisition of the painting. News of this exceptional canvas appearing at Art Basel Hong Kong accelerated interest and triggered its sale.

Lévy Gorvy considers that sale to have been a direct result of the fair, and the gallery consequently reported that the work was sold. As a policy and at the request of its clients, Lévy Gorvy very rarely discusses the transaction price of works in its sales reports, instead disclosing the offering price.”

***

A representative for Art Basel said the art fair wasn’t aware of the incident. Asked about the transaction—which was shared with the press on the VIP opening day by a Lévy Gorvy representative as well as by the fair’s publicity team—the spokesperson said: “Art Basel is not involved in private transactions between galleries and buyers at our shows. We are also not aware of this incident and cannot speak for the gallery on this subject.” She added that “when reporting sales that take place on our platform, Art Basel relies on galleries to provide sales made on a voluntary basis.”

Presumably, 12 Hawks at 3 O’Clock is now sitting in a Delaware freeport, where Masterworks usually ships its loot.

An interior hallway of the ARCIS freeport in Harlem. Image courtesy of ARCIS ©2018.

It’s unclear who could be hurt by this type of misrepresentation, especially if the transaction was done between a willing buyer and a willing seller, lawyers said. It’s easy to imagine that the owners of other, similar Mitchells might even be encouraged by such a report. But it also sows uncertainty—and perpetuates the art market’s reputation for lack of transparency.

One dealer, who wasn’t involved in the transaction, told me that it’s all about marketing. “You can impress people by selling works like this and possibly attract similar consignments,” the person said.

There’s no doubt the packaging of the sale is good for business. With a price of $19.5 million now publicly associated with Mitchell’s work, it might no longer seem unreasonable to ask for (or pay) $20 million down the line. Too bad that price wasn’t real.