As the market had been forewarned, Christie’s dispensed of its evening sale of contemporary art in favor of a lower-value day sale today, “Post-War to Present,” combined with a selection works of even lower value from the Saatchi collection, “Handpicked: 50 Works Selected by the Saatchi Gallery.”

There might have been no sales at all, as happened last year when the house shocked the market by pulling out of the June contemporary sales altogether. But it decided on staging the day sale with the Saatchi lots instead.

Day sales are different not just because they are lower in value, but also because you don’t get the big hitters sitting in the saleroom. Christie’s kicked off with the Saatchi collection sale in a room that was three-quarters empty, but it was conducted by their head of post-war and contemporary art, Francis Outred, who has nurtured a special relationship with the Saatchi collection over the years.

This was a repeat of last year’s event, held at the now abandoned South Kensington saleroom, ostensibly to raise money to maintain the Saatchi Gallery’s free entrance policy.

The sale’s top lot was supposed to be a large and rather macabre painting by Dexter Dalwood of Rolling Stones guitarist Brian Jones’s swimming pool, where the musician tragically died. “It’s one of his best,” Outred enthused from the rostrum—and indeed it already holds the record £144,000 ($282,325) for the artist, set in 2007, when Dalwood was represented by Gagosian Gallery and was coasting toward a retrospective at the Tate. Saatchi didn’t buy it then, but he did seven years later, long after the artist parted company with Gagosian, dropping off the market’s hit list, and just as he was forming a relationship with Simon Lee Gallery.

The work’s price had precipitously dropped to £27,500 ($36,180). Maybe this history and its subject matter put people off because it didn’t sell with a £30,000-50,000 estimate—though I heard inquiries being made after the sale, so it has probably gone by now. Dalwood’s market is, in fact, stabilizing, and another painting of his, Camp David, which was previously in the Saatchi collection, sold from the mixed-owner sale at Christie’s today near the high estimate for £42,500 ($55,915).

Dexter Dalwood, Brian Jones’s Swimming Pool. Courtesy of Christie’s Images Ltd.

Such dramas have frequently swirled around artists in the Saatchi collection because he is constantly selling. But the question here was whether his provenance is what it was when he was the biggest contemporary art collector in town.

Pleasantly for Christie’s, the Dalwood work was one of only five lots that went unsold, and the total of £506,650 ($664,000) fell comfortably within the presale estimate. One of the bill toppers was a painting of a cat looking like Chairman Mao by Chinese artist Qiu Jie that was on the cover of Saatchi’s “New Art from China” exhibition catalogue in 2008. Saatchi had tried to sell it two years ago with a £10,000-15,000 estimate at Phillips, but failed. This time, with a lower estimate of £4,000-6,000, it attracted competition from the artist’s New York gallerist Irene Hochman and London and Stockholm gallerist Carl Kostyal, who was bidding through a Christie’s staffer and eventually carried it off for £31,250 or $40,875, just a shade below the record for the artist.

Qiu Jie, Portrait of Mao (2007). Courtesy of Christie’s Images Ltd.

Hochman then bought a painting on the low estimate for £10,000 ($13,156) by Brazilian artist Eduardo Berliner, which Saatchi had originally bought from her in 2009. Hochman also bought a painting below estimate for £2,000 ($2,636) by young artist Jeni Spota, which she also had originally sold to Saatchi and that might otherwise have gone unsold. It’s nice to see a gallerist support her artists.

Speaking of which, London gallerist Thomas Dane made an appearance to see one of his artists, Anthea Hamilton, sell on the low estimate for a record £5,000 ($6,591). One senses he was there just to make sure it sold. Later in the mixed-owner sale, Dane made a concerted effort to acquire a semi-pornographic painting by Dana Schutz, who he also represents in London, but was outgunned by a Japanese bidder after the price had exceeded its estimate, selling for £260,750 ($342,000).

Dana Schutz, Shaving (2010). Courtesy of Christie’s Images Ltd.

Several other records were set in the Saatchi event, as might be expected in a sale comprised of artists who’ve rarely been tested at auction. A 2009 painting by American artist Elizabeth Neel, for instance, leapfrogged a £2,000-3,000 estimate to sell for £25,000 ($32,700), which is not surprising considering that her more recent works sell for slightly more. Or a mixed-media figure on a table by Francis Upritchard that sold for a record £15,000 ($19,774) might be considered a bargain, but more recent work was selling at Art Basel for twice that.

So the issues of Saatchi sales remain, though they aren’t considered as damaging as they once were (remember unloading Sandro Chia?), or as impactful. With the waning of the YBAs, what place in history does Saatchi currently occupy other than as a popular entertainer and entrepreneur? There is, however, always enough work in storage for Christie’s to do the same again next summer… and the next…

In the mixed-owner sale that followed, Christie’s added in a few high-value lots to its average day-sale fare to reap a £12.8 million total ($16.7 million) against a pre-sale estimate of £8.8-12.7 million with only 10 of the 132 lots unsold. (Sale prices include the buyer’s premium; estimates do not.)

Pierre Soulages, Peinture 195 x 130 cm, 3 février 1957 (1957). Courtesy of Christie’s Images Ltd.

It may have felt out of place, but the only guaranteed lot in the sale was the top lot, a 1957 abstract work by Pierre Soulages that sold without competition, presumably to the guarantor, for £2.9 million ($3.8 million). The price in euros, €3.3 million, still compares very favorably for the vendor who bought it in Paris in 2013 for €1.5 million.

There was then a big drop to the next group of works by Lucio Fontana, Martin Kippenberger, Georg Baselitz, and others selling in the £300,000-£500,000 range—or what is known as the middle market. The real buzz came for currently hot artists like Stanley Whitney, George Condo, and Shara Hughes, which Christie’s did well to open with, as they sold for three or four times over estimate (though not for records).

The first record came for a drawing by Swiss painter Nicolas Party that quadrupled estimates to sell for £12,500—more like the Saatchi sale level. Bids for three drawings by Party came over the internet from France and California, as well as several phone lines.

Nicolas Party, Still Life No 102 (2012). Courtesy of Christie’s Images Ltd.

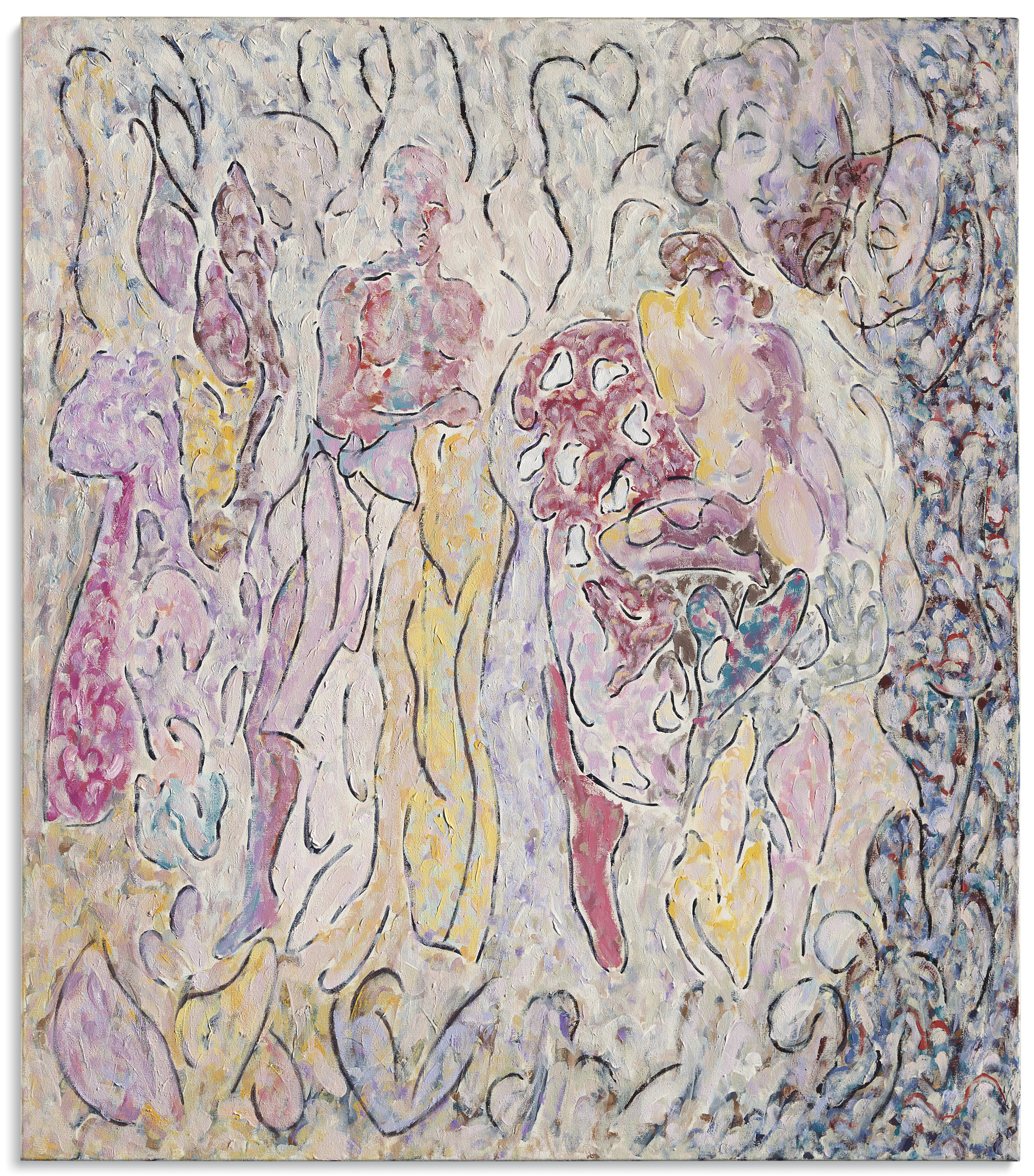

One lot later, a record tumbled for 70-year-old Marc Camille Chaimowicz, whose work rarely surfaces at auction. In 2016 he was a nominee for the Turner Prize for his exhibition at the Serpentine Gallery and his influence on younger artists. His 4-foot Untitled painting of 1991, of colorful, sinuously interlocking forms was estimated at £7,000-10,000 as nothing by the artist had ever sold for more than £10,000 at auction. I was told by a friend of the vendor that a dealer had offered them £20,000 to withdraw the painting and sell it to them, but they were advised by Christie’s that it might do better than that. And indeed it did, soaring to a very satisfactory £75,000 ($98,871).

“This is the kind of thing the mid-season sales are all about,” said Francis Outred afterward, discussing the pros and cons of staging contemporary art evening sales in June. “Our June sale totals had been diminishing and our October sales increasing,” he said. “So it seemed a logical progression to build up October when there are more contemporary art collectors in London. Ideally, we want to stage the best quality evening sales possible,” he said, “to raise our level by compiling masterpiece sales, and I don’t think that it is feasible to maintain that aspiration three times a year in London.”

Last October and March he mounted the two biggest sales ever for contemporary art in Europe. The sales today, he said, were more to do with encouraging young buyers. “But our calendar change is not fixed in stone,” he added. “We will see how we have done at the end of the year. We have already taken great things in for October. For us, it’s not a matter of who does better in which month, but on a year-by-year basis are we best serving our sellers and buyers, and that is what we will be looking at before we decide on our sales program for 2019.”

This article was updated with additional quotes on June 29.