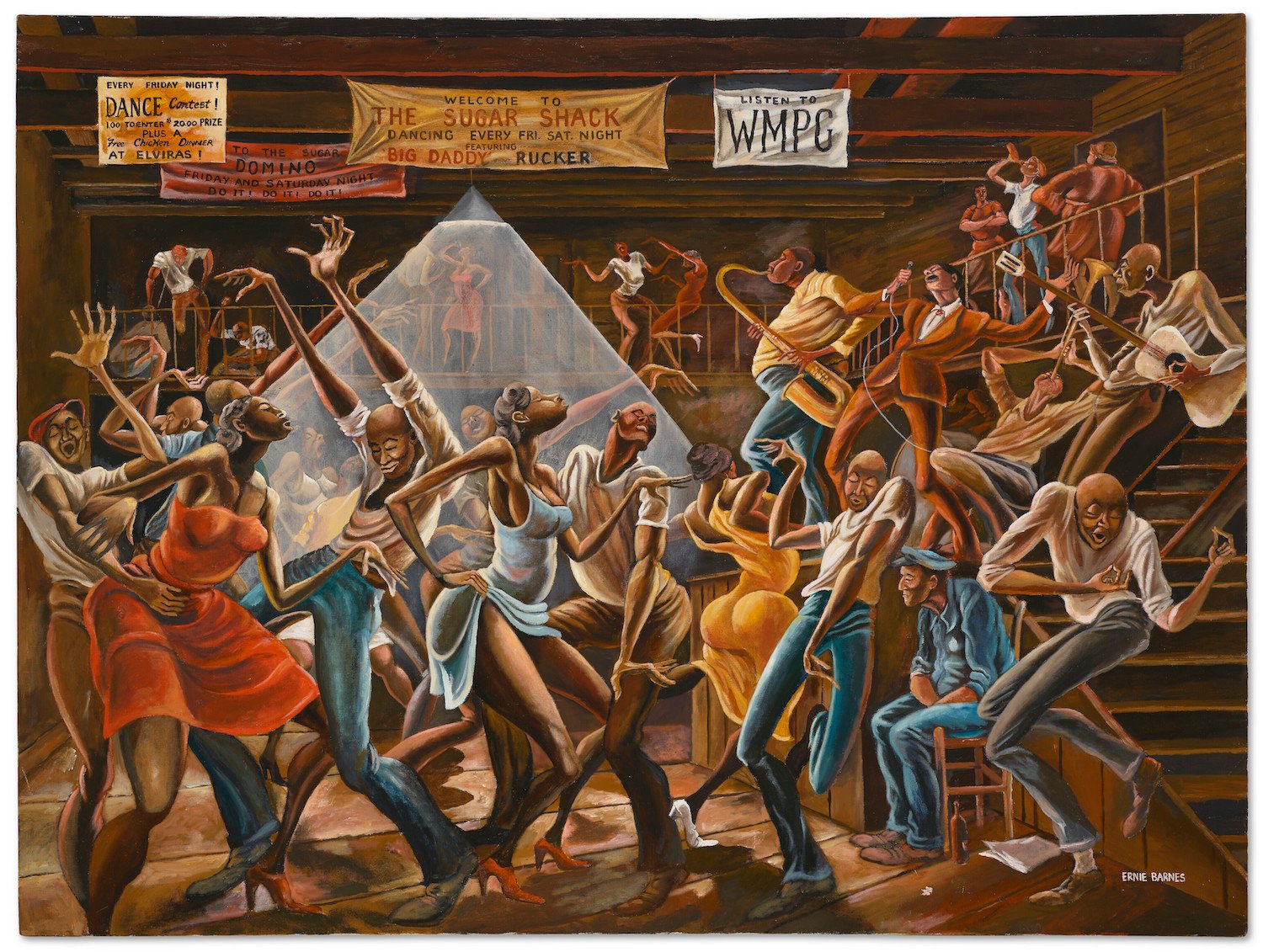

A painting by artist and former NFL player Ernie Barnes stole the show at Christie’s 20th century evening sale last week. Fierce competition for the 1976 work, The Sugar Shack, drove the price up to 76 times its high estimate, an astonishing $15.3 million. The painting, which appeared on the cover of Marvin Gaye’s 1976 album I Want You and in the 1970s television show Good Times, depicts a joyful crowd dancing to live music.

Barnes is known for his vibrant paintings of African American life in his signature “neo-mannerist” style, depicting elegant, long, fluid figures with almost balletic limbs.

Off the back of the sale, it was announced that Barnes’s estate would be represented by New York galleries Ortuzar Projects and Andrew Kreps, which co-organized an exhibition of the artist’s work last year. Artnet News’s Katya Kazakina also revealed that Ortuzar Projects owner Ales Ortuzar was actually the consignor of The Sugar Shack, suggesting that the market moment for Barnes might have been more carefully orchestrated than it appeared.

We took the opportunity to appraise Barnes’s sparse market history from the Artnet price database. Here’s what we found.

The Context

Auction Record: $15.3 million, achieved at Christie’s in May 2022

Barnes’s Performance in 2021

Lots sold: 15

Bought in: 2

Sell-through rate: 88.2 percent

Average sale price: $139,494

Mean estimate: $38,467

Total sales: $2 million

Top painting price: $550,000

Lowest painting price: $14,000

Lowest overall price: $14,000, for the painting Race Day.

© 2022 Artnet Worldwide Corporation.

The Appraisal

- Loyal following. During his lifetime, various figures in the sports and entertainment worlds collected Barnes. His work was popular among athletes in the ‘70s and ‘80s and actors including Eddie Murphy, who owns the sister painting to The Sugar Shack. Many buyers, such as Los Angeles collector Jim Epstein (who sold a group of works to Ortuzar six months ago), purchased works straight from the artist and have held onto them for decades. Today, the Lucas Museum of Narrative Art owns more than 10 paintings by Barnes, and the next largest institutional holding is at the California African American Museum.

- Representation matters. Before 2008, Barnes’s work had only come to auction four times. Then, in 2019, UTA Fine Arts started representing his estate, and things started to change. A major Barnes exhibition at UTA Artist Space in 2020, which Barnes curated before his death, introduced his work to new collectors.

- Payoff. 2021 was a landmark year for Barnes’s market where the fruits of the promotion began to pay off. His work finally cracked the $100,000 mark at auction and even set a new auction record with the $550,000 sale of Ballroom Soul (1978), at Christie’s New York in November. Eighteen of his top 20 sales have all happened in the past two years, and last week was a huge moment for Barnes’s estate. Aside from The Sugar Shack, Christie’s also sold Storm Dance (1977) at its postwar and contemporary day sale for $2.3 million (against a high estimate of $150,000), and Heritage sold Pool Hall (ca. 1970) for $131,250.

- Balletic Bodies. Barnes’s most sought-after works are paintings not dissimilar to The Sugar Shack, with popular common themes being group scenes featuring complex compositions of many figures, and the balletic bodies that feature in his “Basketball” and “Football” series.

- Market Playbook. The Barnes estate is thought to hold hundreds of paintings, and, natch, hot off the auction success last week came the announcement that Barnes’s estate is now repped by New York galleries Andrew Kreps and Ortuzar Projects. The galleries are already adjusting the primary market prices to reflect the demand at auction, and Kreps sold a 1987 work, Study for the Assist, at Frieze New York for $75,000, telling Katya Kazakina that, a couple of weeks ago, it would have cost half that amount.

Ernie Barnes, Cool Quarterback (1991). Courtesy the Estate of Ernie Barnes, Andrew Kreps, New York, and Ortuzar Projects, New York.

Bottom Line

The steep incline of Barnes’s market over the past three years can be attributed to the perfect storm of factors: securing gallery representation and players vested in developing a coherent market strategy, met with wider trends of reappraising overlooked artists from the past century; and increased interest in narrative and figurative art.

There will no doubt be a flood of Barnes works coming to auction from other collectors wanting to cash in, and it remains to be seen whether the market could survive a shake out.

Several lots worth watching will hit the block on Thursday, May 26, including a 1971 work titled The Maestro, which will probably blow past its high estimate of $35,000 when it comes up at Bonhams New York. Meanwhile, Christie’s Hong Kong will offer Listen Up (1980) with an estimate of HKD$800,000–HKD$1,200,000 ($101,912–$152,868), and there’s no telling what will happen when the rising market meets the competition from Asian bidders. The sales will no doubt create extra marketing power for the joint exhibition Kreps and Ortuzar are planning for 2023, and UTA Artist Space has also announced an exhibition in Februrary 2023.