Three decades after founding his gallery at the age of 21, Emmanuel Perrotin sits atop an international gallery juggernaut of 145 people spread across six locations, four of them in Asia: Hong Kong, Seoul, Shanghai, and Tokyo. Getting there was not so easy—and for younger dealers who complain about how difficult it is to break into the business today, he reminds them that it was even harder when he was starting out.

So how did Perrotin do it? By finding talented artists far outside the mainstream art-world consensus and nurturing them for years until they became stars; by hiring and empowering an opinionated, expert staff; and by constantly growing, building bigger spaces, finding new markets, striking more ambitious partnerships, and moving restlessly forward like the proverbial shark. Partly this is due to his boundlessly energetic nature; partly it is because he suspects that if he pauses, even for a moment, he’ll be finished.

In his push for scale, Perrotin is greatly aided by the fact that several of his superstar artists—Murakami, KAWS, JR, and, increasingly, Daniel Arsham—have managed to break out of the art world’s confines to engage far larger global audiences. In KAWS’s case, in fact, his challenge remains to break into the art establishment, which to date has been more comfortable marveling at his astronomical auction results than giving him museum shows. Of course, given the pressures on museums to appeal to the same mass audience as Perrotin’s gallery does, you can expect that to change quickly in coming years. His first major New York exhibition, planned to take place at the Brooklyn Museum in 2021, will likely open the institutional floodgates—just as Murakami’s famous show there in 2008, with its standalone Louis Vuitton gift shop, did for him.

How big can Perrotin’s gallery—and, by extension, the art market generally—get? Here, in the conclusion of a two-part interview, artnet News editor-in-chief Andrew Goldstein speaks to the dealer about his ambitions in Asia, why Africa is bound to become the next giant market, and why he is so eager to merge his gallery with another organization.

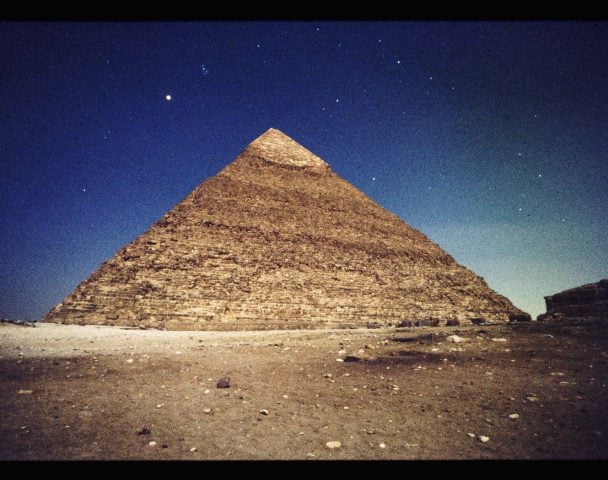

JR’s installation at the Louvre in 2019 on the occasion of the pyramid’s 30th anniversary. Photo courtesy of JR-art.net / Perrotin Gallery.

The 2008 financial crisis must have been a real whiplash moment for you, considering that you just came out of a period of making a lot of money during the art boom.

Well, I never made a lot of money. I invested a lot of money. You make a lot of money when you don’t develop your gallery, when you don’t try to buy up the real estate of your gallery in Paris and expand to the space next door, when you don’t open a gallery in Miami and then in Hong Kong. Many businessmen don’t put all of their money into developing their business—they put it aside for their family, for their children. These days, if you think I’ve become a bit more boring, maybe it’s because I’ve started to have something to lose. But I will do everything I can to not be boring. I will try to make things even bigger.

I’ve heard you’re very generous in investing in your artists, in production for their shows, and you don’t always do this with an eye to ensuring a profit for your gallery.

When it works, people say, “Oh that’s logical, they’re doing it because it’s profitable.” They don’t know that we’ve been doing it since the beginning, when it was not so logical. I could only sell [Murakami’s] Hiropon sculptures at $10,000, and the production cost $8,000. So, you know, Takashi got $1,000, I got $1,000, but my $1,000 was to pay the shipping. And now the production cost for works like that might be $250,000, and just for one edition. For some artists, the production costs can be more than what we can sell it for.

Murakami, though, was a supernova—there are few artists who have gotten that famous, and that expensive, that quickly.

It was not so quick! When you looked at the numbers he looked like a big success, but that’s superficial, because the difference between primary-market prices and secondary-market prices always distorts the perception. Now, after having the gallery for 30 years, 10 years looks reasonable. But, trust me, at that time it seemed super long.

Emmanuel Perrotin and Takashi Murakami at Perrotin Paris, 2016. ©Say Who/Jean Picon

What were the lessons you learned from Murakami’s success?

So many things. Organization. He’s a master of organization—he can make PDFs that describe every aspect of a project in a very visual way that allow him to answer every question without losing too much time. Now we use his technique in every aspect of our business.

We learned how important it is to respect the idea of an engagement. For Western people, if you decide to change a date, it’s not a big deal. In Japan, you have to do it for a very good reason.

Now, you’re experiencing something that’s almost a re-do of that giant cultural moments with KAWS, who oddly enough you also first showed in Miami in 2008. How did you meet him? You first met Pharrell Williams, and he introduced you to KAWS?

I met Pharrell when I had my gallery in Miami, and he became a good friend and invited me to his home. It’s funny, Pharrell showed me his KAWS collection, and I was like, “OK, it’s fine.” It was the ones with “The Kimpsons” and “The Kurfs.” At the time I was intrigued but not convinced. But Pharrell and Sarah Adelman from Collette both talked about him a lot, and they set up a lunch between us and Brian [Donnelly, also known as KAWS] during the Art Basel fair in Miami. He showed me more recent works, and it was incredible.

Pharrell Williams and Emmanuel Perrotin at a Collette dinner hosted by Pharrell at Asia de Cuba in New York City in 2008. (Photo by NICK HUNT /Patrick McMullan via Getty Imagess)

Trust me, famous people introduce me to artists every month and say, “You have to show him.” Pharrell showed me many artists, and KAWS is the only one I am showing so far. When you meet Brian, you understood his energy much more, and his goals, and the way he sees everything. I was able to feel it was a kind of new revolution, the way he was leading with his merchandising—before being famous in the art world, he was famous for what he built by himself, for his toy shop in Japan, in a parallel world to the art world.

It seems strange now, but it was a risk to show him. The art world used to be more closed to specific practices. I can’t understand why in the music industry it’s evident that you can love opera music, jazz music, and, at the same time, dance music! Nobody thinks that makes you strange. What at the time can seem like superficial music can become very important music 50 years later!

Yes, 2008 was a huge change in the art world, but also because we started to think, “Maybe some artists’ success was exaggerated.” So, people started to look at French artists again—it gave a real chance to French artists. I was using the network I had built with my international artists to provide access for my French artists.

Let me tell you, Jean-Michel Othoniel, Laurent Grasso, Bernard Frize—they are not just “French artists” like we would say before 2008. They are a big part of my income. And I show Pierre Soulages, Hans Hartung, Georges Mathieu—many of these artists are being reconsidered in a very strong way.

Collector NIGO with his KAWS painting THE KAWS ALBUM, which sold for $14.8 million at Sotheby’s Hong Kong. Photo by Thomas Thompson, courtesy of Sotheby’s.

Now you’re seeing KAWS have tremendous sales at auction, with a $14.8 million record at Sotheby’s in Hong Kong this April, and I’m sure you’ve seen these videos of the riots over his Uniqlo t-shirts in China.

In fact, it was like that two seasons before—you can find it on my Instagram: people were already fighting to buy his t-shirts in Korea. But people only started talking about it after the $14.8 million price.

You can’t build a phenomenon like this artificially—it’s done step-by-step over years and years. His numbers at auction were ridiculous, we all agree. When he was doing $2 million, that’s OK, but when he does $14.8 million? That’s a little bit over the top. For many artists, their record prices start to be a problem, you know? I’ve seen it happen before when artists get too expensive, too fast. We didn’t know it would happen, but it’s the same that happened for Murakami, for that one sculpture. It was just one sale, and you can’t blame him for that.

These days, everyone in the art world is debating, “What does it mean?” What does it mean that somebody like KAWS, from this parallel art world, could achieve these prices?

You have some people who have been collecting this work for a very long time, and you only need two of them to make a crazy price.

The KAWS show “Imaginary Friends” at Perrotin in Paris in 2012. Courtesy of Perrotin Gallery.

People say the buyer was Justin Bieber.

It’s an option. It would be funny if he had made a mistake about the currency. [Laughs] To be honest, it was an anomaly, this sale. The ones around $2 million are more logical. Will it stay like that for many years? Maybe, because many people want to get access to his older works—and you’ll see, many of his records were done with very old works—to complete their collection. And why not? There are many people who are waiting for his older works to come to market. It’s not surprising to me.

We are very far away from the phenomenon of, I won’t name names, but, let’s say, some abstract painters doing $14 million at auction and selling for “only” $4 million to $6 million in the primary market. And then the dealers pretend, “Oh, we don’t have anything to do with the very big prices at auction.” Sorry, my dear, but $4 million or $6 million for an abstract painter who was not doing too many museum shows before looks to be a lot of money.

This was not the case with Brian. I will be surprised if Brian comes back with works for $1 million or $2 million at auction. The problem in the primary market is that you can sell sculptures for a lot, but the production costs are very, very expensive. For a KAWS sculpture that’s 30 feet high, it costs a fortune.

That said, it’s a big deal for me, because after something like that it’s quite difficult to decide who you sell the works to. There’s a huge risk [of the buyer flipping the work at auction].

But considering the number of works my gallery sold originally, very few of them actually went to auction. I am very proud of the work that my team did for KAWS over these 11 years of our collaboration. Unfortunately, that might be not enough to be able to keep him in my roster, considering all the pressure. I doubt he will continue with us for long. In any case, I will be satisfied if his career continues to develop in a good way.

We’re seeing an interesting shift now, where popularity is becoming the chief indicator of value, much more than the traditional metrics of critical acclaim or institutional acceptance.

For sure. But one of my favorite artists in my gallery is someone who sells very few things and is absolutely not popular except among critics and curators in France, and I see him as one of the most important artists in my gallery.

And who is that?

Claude Rutault. Maybe you’ve never heard of him, but he is the perfect example of an artist who makes us feel a little sad as a gallery, that we are not able to share him with the rest of the world. That’s why we need to work hard, because the fact that we are not able to make Claude Rutault more successful internationally—because he’s quite successful in France—is a huge failure.

KAWS, Daniel Arsham, Emmanuel Perrotin, Ivan Argote, JR. Photo courtesy of Perrotin Gallery.

You have an older, critically acclaimed generation of artists working in your gallery, and then at the other end of the spectrum you have these younger artists like JR, Daniel Arsham, and KAWS, who are much more comfortable working in this new twilight zone of the art world between the commercial market and the art market. It seems that this approach is resonating very strongly in Asia, and—it’s almost funny—you happen to be one of the largest galleries in Asia. How did that happen?

I’ve had a fantastic team in Asia, and for years they’ve made my galleries there very successful. In Asia, more than anywhere, if you don’t have the right team, you can’t do it. Every gallery tries to poach my team, and I’m always afraid that they’re going to leave. But in Asia there’s also the opportunity to differentiate the way that I work from Paris or New York.

You opened your first Asian outpost in Hong Kong 2012 and then followed that with galleries in Seoul in 2016, Tokyo in 2017, and then Shanghai in 2018. What led you to ramp up your presence in Asia so quickly?

I have to follow the strategy that we come up with as a team. For example, I had some people working for me in Hong Kong who had special access in Korea, so I became interested in opening there. And later, many were telling me, “We absolutely have to open in Shanghai. If we don’t open in Shanghai now, it will be too late.” You think I was going so fast—they felt we were going too slow.

A fifth of your artists are Asian. What percentage of your sales comes from Asia?

Our two top territories every year are Asia and North America, and after that, Europe. Sometimes North America is number one, sometimes it’s Asia—it can change quickly. I don’t know exactly what it is now, but usually it’s a little bit more than one-third North American and a little bit more than one-third Asia.

The “Happy Birthday Galerie Perrotin: 25 Years” show at the Tripostal in Lille, France, in 2013. Photo: Claire Dorn / Courtesy Perrotin

According to the Boston Consulting Group, Chinese consumers currently constitute 32 percent of the global luxury market, and that number is predicted to rise to 40 percent by 2024. How do you envision Asia impacting your gallery’s business 10 years from now?

The American market is by far the most mature market in the world. But it’s growing very quickly in Asia, and it’s very unfair to compare North America with all of Asia. [Laughs] There are many more people there. And then consider the number of new rich people in Asia, and that they do everything very quickly. It’s the same as America used to be compared to Europe, you know? Americans’ fortunes were growing much faster compared to Europeans after World War II, and they built much bigger collections much faster. So we can imagine that Asia will be a very strong market center over the next 10 years, if only for reasons of demography.

In the same way, there’s now a huge potential in Africa. It’s like in the 1970s, when people were asking when China would wake up and others said, “Oh, come on—give me a break.” Look at where it is now. What took China 30 years might now take Africa 10 years. Now in Africa it’s complicated because you don’t have a hub that exists there like Hong Kong in Asia, so it’s hard to know where to go if you want to do something. But certainly you will have a lot of collectors coming from Africa.

Speaking of market growth, there’s a wide gap in the art world between the smaller galleries and the biggest galleries. In the past, you’ve talked about the idea of gathering together galleries to create larger corporate structures like you see in the luxury industry, like the LVMHs and the Kerings. Why hasn’t that happened yet?

I’m surprised that we are still operating like a 19th-century—or maybe today a 20th-century—business. We will have big revolutions in the art world in the next few years. And, for sure, it won’t only be the provenance of the clients, it’s also going to be the organization of the gallery. If you are a small gallery, if you are a medium gallery, and you are doing it for pleasure, to be part of the community? It’s not the fault of the big galleries if it’s difficult. It’s not that it’s more difficult today, it’s just that this is a very difficult business. And it’s very difficult to share the success equally, and it wouldn’t make any sense in any case.

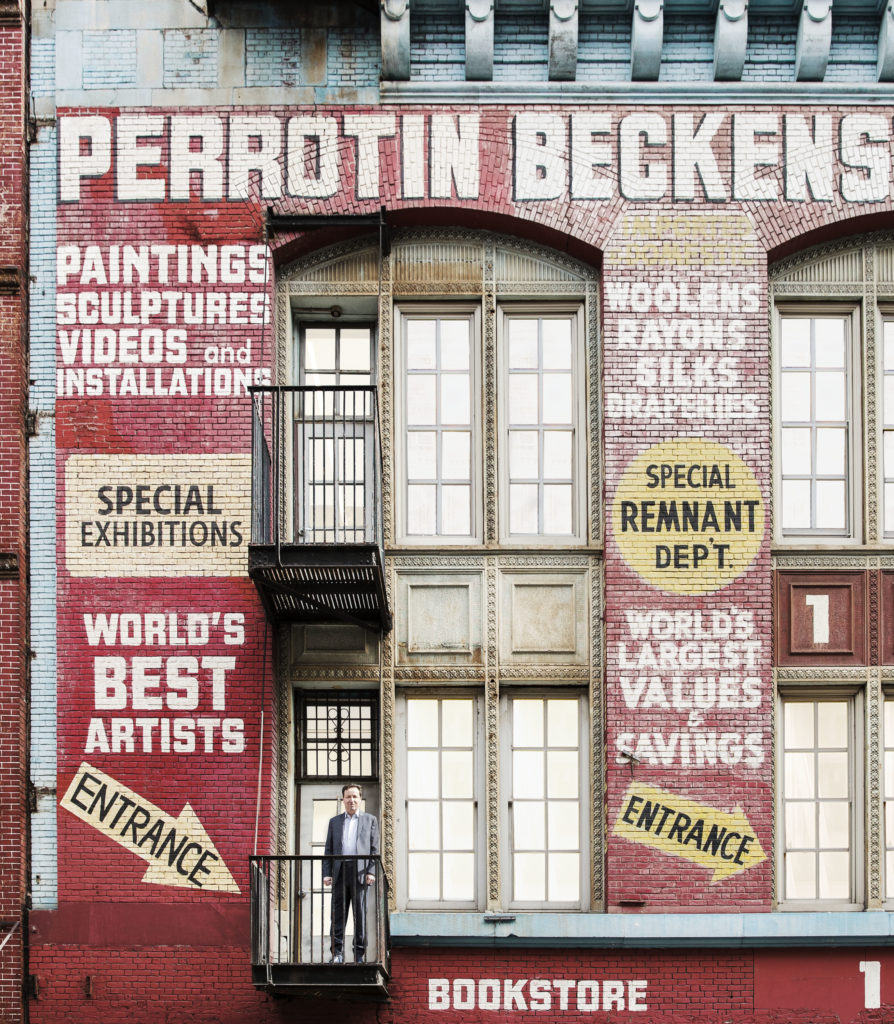

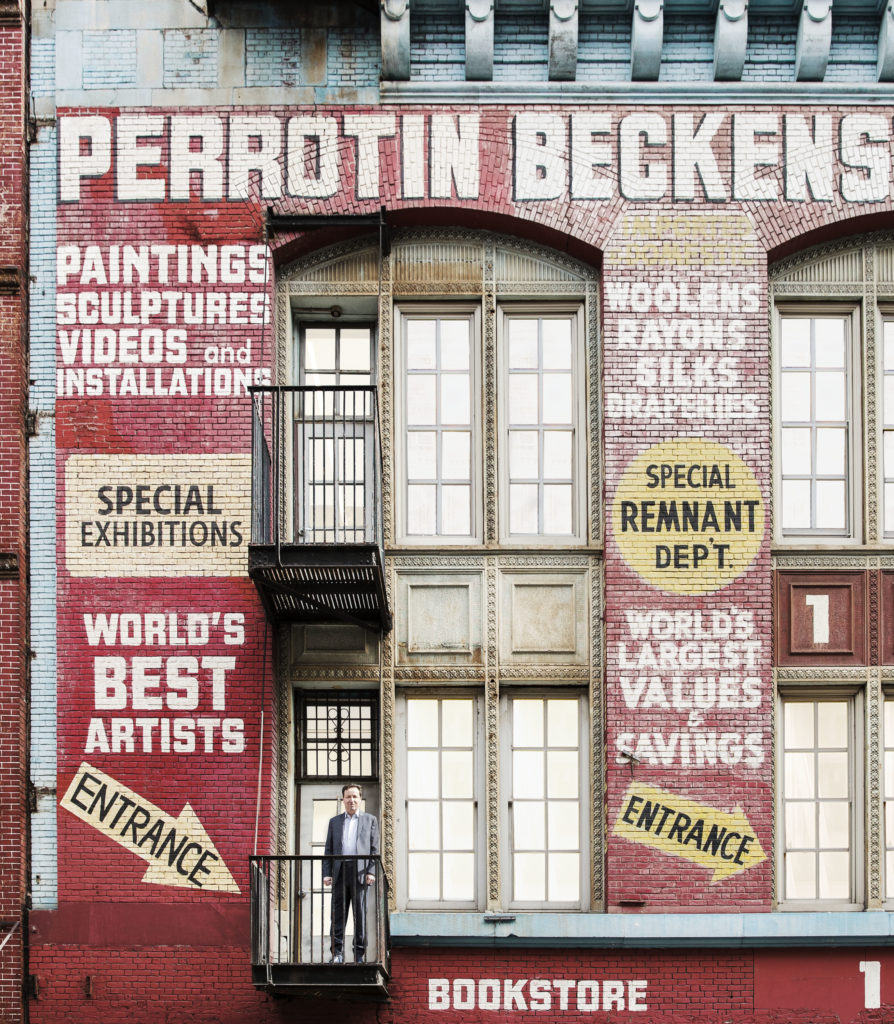

Emmanuel Perrotin outside his Orchard Street gallery in New York in 2018. Courtesy or Perrotin Gallery.

The most obvious opportunities, in fact, seem to be at the very top, for the apex galleries. Would you ever consider merging with one of the biggest blue-chip galleries, like Gagosian or David Zwirner?

I would love it! I was offered to merge with a gallery, but I have my favorite gallery that I would dream to merge with. I can dream, you know?

Which gallery is that?

Aha, now that’s difficult to say. It’s not a necessity anymore. But it would help to make a revolution. We would love to make some kind of revolution. If I want to find pleasure in this job for the next 50 years, I have to find creative ways to do it.

If my artists are more and more successful and I don’t change anything, they would desert me. And I should not be surprised. More and more, I face the risk of losing artists. The more you attract attention, the more you risk.

With the assets you have in your gallery, from your incredible roster of very popular, commercial artists—who have almost become a genre unto themselves—to your extensive presence in Asia, it would seem you would be able to easily join forces with one of the biggest galleries to forge the beginnings of an LVMH equivalent for the art world. Wouldn’t that be the best way to scale?

Yes, but I don’t think it will happen with the older generation, or the biggest galleries. If I were to merge with somebody it would be to develop something much bigger than what either of us are individually. And the gallery I’m thinking about isn’t any of the ones you might guess.