Auctions

Who Says the Lower End of the Art Market Is Suffering?

Colin Gleadell finds much activity at London’s recent low-value auctions.

Colin Gleadell finds much activity at London’s recent low-value auctions.

Colin Gleadell

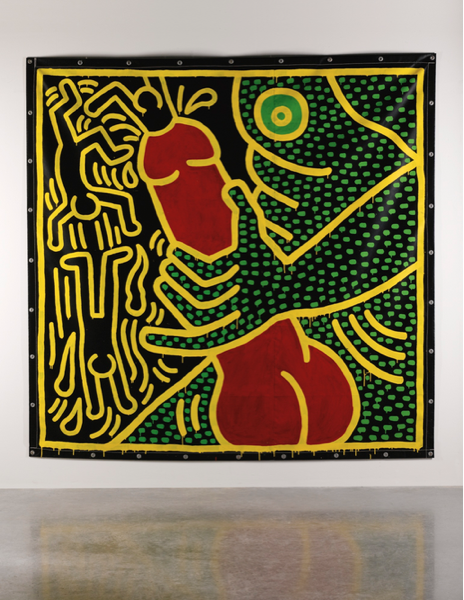

Keith Haring, Untitled, (1984)

Courtesy Sotheby’s

It’s been a low-value sales season for modern and contemporary art in London this month, but not without its highlights and stupendous sell-through rates.

Sotheby’s “Bear Witness” contemporary art evening sale on March 10—on the eve of TEFAF and just after Armory Week ended—was outed as the collection of Italian luxury boat manufacturer, Guido Orsi. The title of the sale reflected the amount of bear sculptures populating the saleroom, which was bedecked like a circus tent with trapeze artists and animated bears carousing at the pre-sale party.

But there weren’t that many bidders in the saleroom, where a large number of Sotheby’s Institute students filled several rows of seats. One bidder was dealer Ezra Nahmad who bagged a black Fontana painting, Concetto Spaziale, Attesa (1965) for £1.8 million or $2.8 million (estimate: £1-1.5 million/$1.5-2.23 million). Another was Simon de Pury who battled, mobile phone pressed to his ear, before winning Gerhard Richter’s figurative Kleine Tur (1967), for £1 million or $1.5 million (est: £600-800,000/$895-1,193,000) (see Simon de Pury on Why TEFAF Really Matters and the Future of the Art World).

The happiest face of the evening was Micky Tiroche’s as he put in a cheeky half-estimate bid for a massive tarpaulin piece of Keith Haring erotica and won it at £420,000 ($626,000) (est: £700-900,000/$1,043,000-1,341,000) (see artnet Asks: London Gallerist Omer Tiroche). Considering the timing, the sell-through rate was impressive at 88 percent of lots, and the total £36 million ($53 million) was almost precisely on the pre-sale high estimate.

Pablo Picasso, Nature Morte, 1953

Courtesy Sotheby’s

On March 18, Sotheby’s was back in action with yet another Picasso ceramics sale, for which demand continues unabated. 95 percent of the 146 lots were sold for £1.7 million ($2.3 million), with seven of the top 10 lots breaking records for their editions (see Buy, Sell, Hold: Picasso Ceramics).

Christie’s’ March 19 sale of playwright Noël Coward’s collection (see Noël Coward’s Art Collection and Paintings Hit the Block at Christie’s), passed down through a relative since his death in the 1970s, was equally successful, with all but three of 74 lots selling for £1.3 million, three times the pre-sale low estimate.

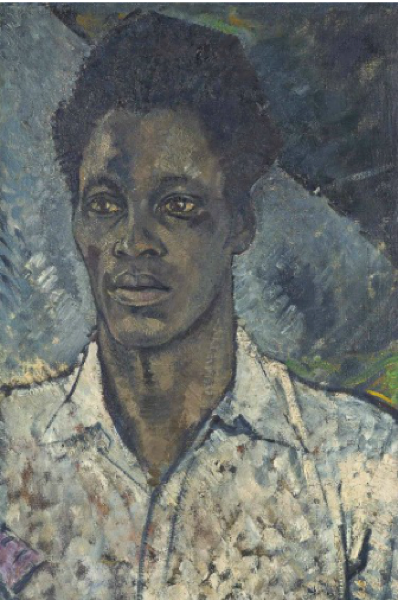

The big surprise was the estimate of just £15-20,000 ($22,322-29,763) on a stylish late work of 1937 by society portrait painter, Glyn Warren Philpot. Head of a Negro is a portrait of his manservant, Henry Thomas, and similar in quality and appeal to the artist’s portrait of the entertainer Tom Whiskey, that sold to dealer Richard Osborne for £192,500 ($286,464) four years earlier. Still, the £302,500 ($450,158) given by a private European collector new to Christie’s was a lot more than most imagined it would make.

The other notable price of the sale was the £218,500 ($325,289) (est: £70-100,000/$104,221-148,903) given by dealer Richard Green for a colorful view of St Ives painted by Christopher Wood in 1925, when he was staying in the West of England with Ben and Winifred Nicholson. This period of British art history, when the three artists discovered the primitive work of retired fisherman Alfred Wallis, and just preceding Wood’s sad death falling under a railway train at 29 years-old, holds a special fascination for collectors.

Glyn Warren Philpot, Head of a Negro, 1937

Courtesy Christie’s

The very high sell through rate continued with a low value sale, “Made in Britain” at Sotheby’s on March 25, which realized a top estimate £2.3 million with only 11% of the 354 lots not selling. Who says the lower end of the market is suffering? Here, 8 auction records were set including a 1935 still life by the underappreciated Jacob Bornfriend which sold for 20 times its estimate for £21,250 ($31,666).

A pre-pop, 1960 sand and oil painting by Joe Tilson sold for 15 times its high estimate at £45,000 ($67,031). In the evening, Sotheby’s sold 100% of the contents of the fashionable Ivy restaurant led by a vibrant 1998 abstract by Bridget Riley, The Ivy Painting, which sold for £413,000 ($614,824) (est: £120-180,000/$178,635-267,949) and a record for a work on paper by Howard Hodgkin was set when his unique colored intaglio print, Ivy, sold for £106,250 ($158,158) (est £6-8,000/$8,934-11,912).

Bridget Riley, Ivy Painting, 1998

Courtesy Sotheby’s

Christie’s rounded off the month with a “First Open” sale on March 26 at entry level prices for new collectors. Although 80% of lots were sold for a within estimate £2.4 million, there was not a huge buzz about the bidding.

Collector Charles Saatchi had a dozen works on the block culled from recent shows of German and British art at his gallery. Best performer was a 2004, 3-meter tall painting of a semi-clad female, Black Camisole, by Chantal Joffe which sold above the estimate for £27,500 ($41,000), but other results from his group of young hopefuls were lackluster, three not selling. Demand was also thin for one of the stars of Art Basel last year, Christian Rosa, in spite of a newly opened exhibition at White Cube. Rosa’s characteristic 2-meter square Untitled (2014) was estimated at £30-50,000 ($44,676-74,461) and sold to a bid of just £15,000 ($22,338).

The strongest area of the sale was for a small group of Zero group artists including Otto Piene and the lesser known Hermann Goepfert, whose Untitled aluminum relief of 1965, last sold in 1994 for £2,300 ($3,425), now fetched a quadruple estimate and record £37,500 ($55,854).

Jacob Bornfriend, Still Life, 1935

Courtesy Sotheby’s

Internet bidding was heavy and noticeably nationalistic, with bidders from Poland buying Polish artists, from Greece, Greek artists, and from Oslo, Norwegian artists. The downside of that was that the sale was incredibly long. Where there were no reserves and only Internet bidding, one lot could take 6 or 7 minutes just to realize £5,000 ($7,445).

A couple of personnel changes over the month are worth noting. Thaddaeus Ropac has headhunted Polly Robinson Gaer from Pace London to look after artists’ projects in the UK where he doesn’t have a gallery. Robinson Gaer’s long prior experience with Anthony d’Offay and relationships with established collectors and artists should go some way to filling the gap left by the departure of Jill Silverman van Coenegrachts from Ropac two years ago.

Hugues Joffre, Christie’s rainmaker and business getter in the post-war market, has left the company. Joffre led Sotheby’s contemporary art department through the late 1980s-early 90s boom, and switched to Christie’s in 1992 (at the same time, incidentally that Tobias Meyer left Christie’s for Sotheby’s). In 2001, Joffre left Christie’s to work as an independent advisor, but returned with an apparently free reign to source and sell, in 2010. Apart from a masterful knowledge of the post-war European market, he has a personal interest in British pop art and was instrumental in mounting the British pop art show at Christie’s private sales gallery last year.