Law & Politics

Congress’s $2 Trillion Stimulus Package Offers Many Benefits for Artists and Freelancers. Here’s a Step-by-Step Primer on How to Claim Yours

Self-employed artists, freelancers, and gig-workers can now apply for unemployment benefits.

Self-employed artists, freelancers, and gig-workers can now apply for unemployment benefits.

Taylor Dafoe

Americans will soon be receiving $1,200 checks from the government as part of the Coronavirus Aid, Relief, and Economic Security Act (the CARES Act). But many still don’t understand everything that the bill, which passed unanimously in the Senate on March 25, might mean for them—particularly those who have non-traditional means of income, such as artists.

Unlike unemployment benefits in the past, the act now makes it possible for freelancers, gig workers, and the self-employed to apply for assistance, even though they don’t have an employer who paid unemployment taxes on their behalf. It also allows those whose work was directly impacted by COVID-19 to apply for an additional form of emergency assistance.

The bill is unprecedented in terms of the scope of the benefits it provides to those impacted by the pandemic, says Joseph Tedeschi, an attorney on the board of the nonprofit organization Volunteer Lawyers for the Arts. “It’s a universal response to a universal impact,” says Tedeschi, who has been working to educate artists on how to navigate the “very complicated” CARES Act.

“There is help out there, but you have to act and you have to seek the help,” he says. “You have to submit applications, you have to be prepared, and you have to be patient.”

Indeed, the coronavirus pandemic has yielded an unprecedented number of unemployment claims. Within the last three weeks alone, the US Department of Labor has reported that 17 million Americans have filed jobless claims, and that number might be a conservative estimate as overwhelmed state offices are still sorting through the backlog of applications.

For those who are considering applying, there are several steps to keep in mind beforehand that might help make the process smoother. We spoke with Tabeschi to bring applicants this primer on who qualifies for the CARES Act, what benefits they should expect, and other frequently asked questions along the way.

US President Donald Trump signs the CARES act, a $2 trillion rescue package to provide economic relief amid the coronavirus outbreak, at the White House on March 27, 2020. Photo by Jim Watson/AFP via Getty Images.

Which type of assistance should I apply for?

The first thing you should know is what you’re applying for. In addition to extending the reach of unemployment insurance, the CARES Act also created new temporary programs to aid those impacted by COVID-19.

Who is eligible for these benefits?

If you are a full-time or part-time worker who has recently lost your job, or if you are a self-employed or freelance laborer who has recently lost work, you will be eligible for either unemployment insurance or pandemic unemployment assistance.

To qualify for the third type, pandemic unemployment compensation, you have to have lost your job (either full time or gig work) and have been directly impacted by COVID-19. The applicable scenarios are quite broad. For example, if you or a family member contracted the disease, or if quarantine has prevented you from reaching your place of work, you are eligible for the $600-a-week payment.

How much can I expect to receive in assistance?

Both traditional unemployment checks and pandemic unemployment assistance are determined by the state after looking at your 2019 tax return and the other benefits you may be receiving (for instance, if you’re currently receiving sick leave or severance payments from an employer, it will impact how much money you’re eligible for).

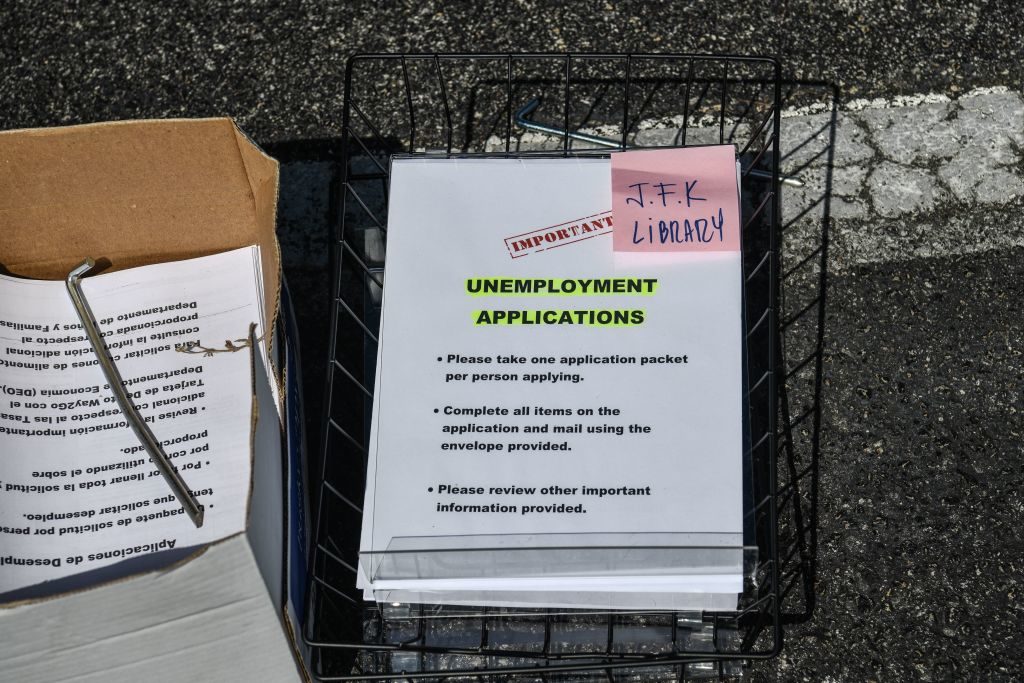

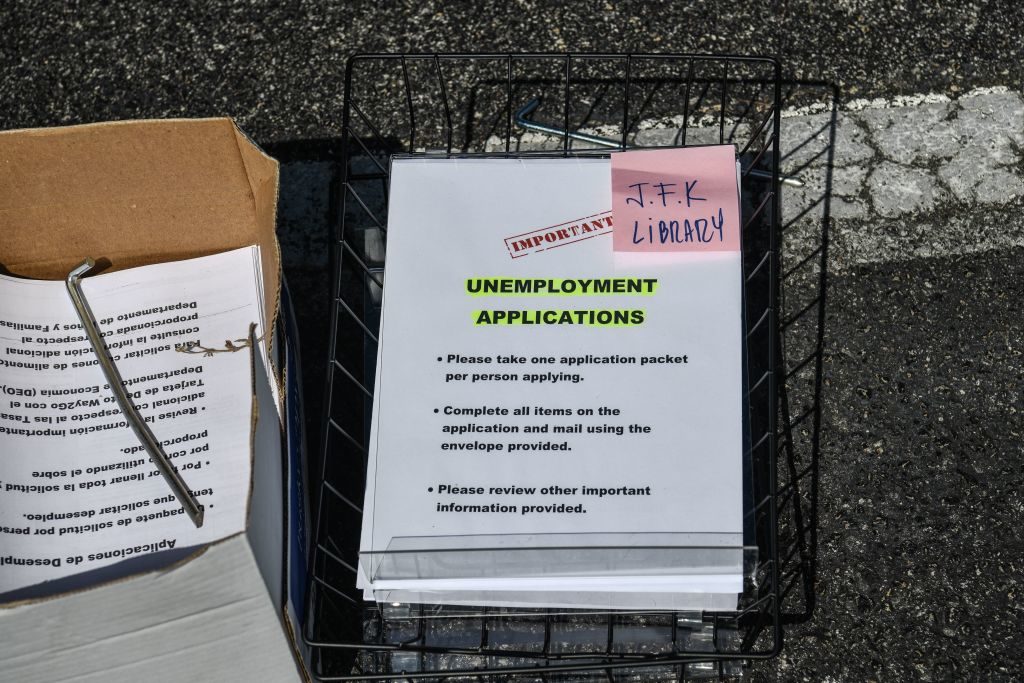

A view of new York State Department of labor office in Queens on April 12, 2020. Photo: John Nacion/NurPhoto via Getty Images.

Can you apply for unemployment insurance or pandemic unemployment assistance because of future work that has been canceled?

Yes.

I live in one state, but work in another. Where do I apply?

You should apply in the state in which you worked, via that state’s department of labor website.

How long will these programs last?

Pandemic unemployment assistance and the 13-week extension to regular unemployment assistance will last through the end of December, 2020. Pandemic unemployment compensation will last through the end of July 2020.

If you have a temporary work visa, can you apply?

Yes, if you had work authorization during the relevant period.

What do I need to apply?

First, you should create a personal pin number through your state’s department of labor website. After that, make sure you have at hand your social security number, driver’s license or motor vehicle ID number, mailing address, and (if you have a green card) your alien registration card number.