The Art Detective

Armory Week’s Lackluster Commerce Wasn’t Happy News for the Art Market. But the Real Test Is Yet to Come

Despite the New York fairs' effort to put on a brave face, quiet aisles and slow sales were notable across the city.

Despite the New York fairs' effort to put on a brave face, quiet aisles and slow sales were notable across the city.

Katya Kazakina

So how was business at Armory Week in New York, really?

As the art world rushes from event to event, driven by a mix of FOMO and transactional fervor, it can be hard to discern what’s actually happening on the ground in real time. The spin is thick. The stakes are high. And the next trade show is already on the horizon—not to mention the upcoming auction season, led (so far) by the $120 million Pablo Picasso from the late Emily Fisher Landau’s collection.

There’s no denying it: Things have changed. The pandemic art boom is over, even as the virus is back with a new strain.

The first-day reports of brisk sales—our own included—were somewhat inconclusive. In fact, the Armory Show exhibitors reported so few sales over the course of the week that Artnet News’s regular “Price Check!” roundup of fair transactions had to be shelved this time around. Was this because most of the savvy, publicity-generating mega-galleries—armed to the teeth with PR teams—opted not to participate in the fair, while the smaller galleries that did aren’t liable to telegraph their sales to the media?

The Armory Show, 2023. Photo: Vincent Tullo

This year’s fair came with a heavy load of competing events in New York and far away. The season-opening rush included openings on consecutive days of Frieze Seoul in Korea and the Armory Show in the Big Apple. Both brands are now owned by the Endeavor Group, which bought the Armory Show for $24.4 million, giving birth to a new hashtag: #Friezmory.

Further diluting attendance, Independent 20th Century—a boutique fair focused on overlooked artists—opened to the VIPs at exactly the same time as the Armory all the way on the other side of the island. Collectors and advisers had to juggle art events with their children’s back-to-school frenzies, not to mention post-vacation jetlag. The congested schedule translated into fairly unpopulated aisles—and, not surprisingly, slower sales.

This, at least, is the consensus of the market professionals the Art Detective spoke to for this column.

“It didn’t feel urgent,” said Alex Glauber, the recently elected president of the Association of Professional Art Advisors. “There wasn’t the velocity of sales. There weren’t that many compelling works you felt like you had to rush over and buy.”

To be sure there were bright spots. At the Armory, Victoria Miro sold all 11 paintings by Maria Berrio in its booth for as much as $200,000. Paintings by emerging artist Lydia Blakeley, priced at $2,000 to $20,000, were all snapped up too at Niru Ratnam of London.

Installation view of Lydia Blakeley’s work at the Armory Show, 2023. Courtesy of Niru Ratnam Gallery.

At Independent, Nahmad Contemporary sold out its booth of historic paintings by Marie Laurencin, with prices ranging from $50,000 to $250,000. Galerie Lelong sold three of its five paintings by Mildred Thompson, at $85,000 each.

Paintings by Winfred Rembert at James Barron Art drew rave reviews in the press, but just one sale was finalized by the fair’s end. Prices ranged from $225,000 to $400,000.

“More importantly, we have museums interested and that will take time, but we are in no rush,” Barron told me. “Given our goal of reaching an audience through museums so that Rembert’s life and art are shared, we are trying to match donors with the proper museums.”

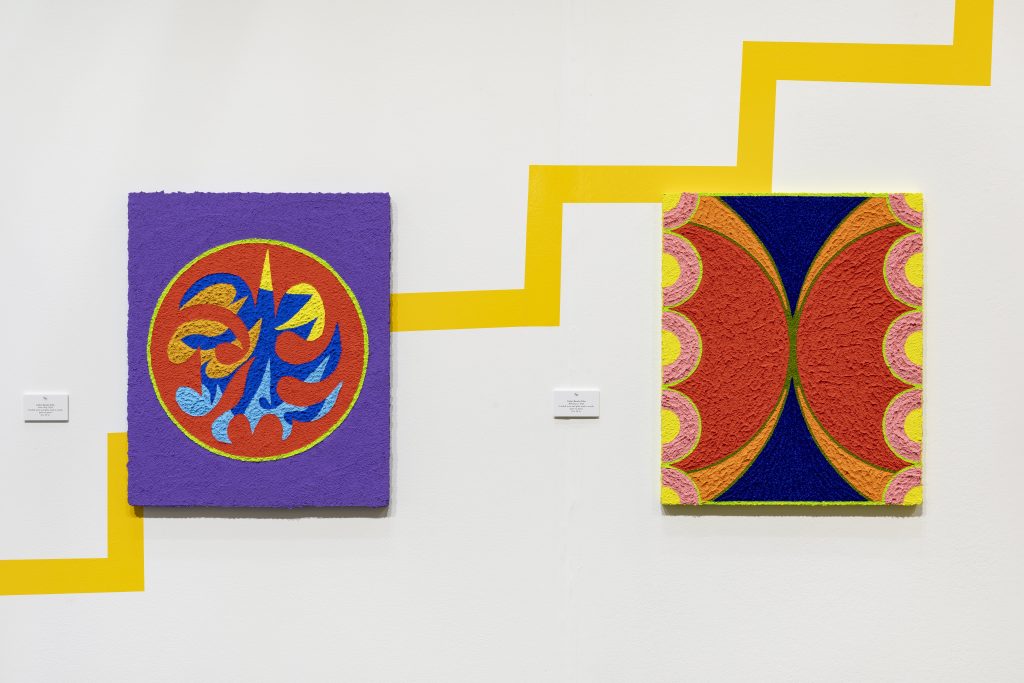

Meanwhile at the Armory Show, art dealer Allegra LaViola mounted a striking solo presentation by El Paso, Texas-born Carlos Rosales-Silva, who just completed a large commission for the San Antonio Museum of Art.

“In the first 20 minutes I was like: ‘Why isn’t everything sold?’” LaViola told me this week.

Sargent’s Daughters presentation of Carlos Rosales-Silva at the Armory Show. Courtesy of the artist and Sargent’s Daughters. Photo: Nicholas Knight.

It was a joke about her own impatience, but also a reflection on the change of pace in the market.

“We got a little spoiled by the pandemic environment, where random people would email you and buy random works sight unseen,” LaViola said. “It wasn’t normal—at least not for me. Now we returned to the playing field where people want a sure thing. They want what they know, what’s been vetted, or what they’ve been waiting for. There’s less desire to take a chance—even if the works are very inexpensive.”

The 12 works on view were priced between $5,000 and $10,000, a comfortable range for most VIP collectors to say yes to. LaViola sold seven works, and is optimistic about placing the remaining five.

“The main goal was to have a lot of eyeballs on his work,” she said about the fair.

LaViola wasn’t alone in noting that “things were moving, but not flying.” Other dealers stressed having “good conversations”— the ultimate code word for making lemonade out of art-fair lemons—instead of frenzied sales.

Todd Levin, a veteran art adviser, said the slower pace of transactions during Armory Week represented the market’s return to normalcy after several seasons of being “out of whack” due to rampant speculation. Back then, investors flocked to the market from around the world on the hunt for inexpensive works by emerging artists in hope of reselling them a year or even months later.

Winfred Rembert, Watermelon, Saturday Evening (2003). Presented by James Barron Art at Independent 20th Century.

“Untested artists selling at auction for $400,000, $600,000, $800,000, $1.2 million—they don’t deserve those numbers,” he said.

Now, with interest rates still rising and money much more expensive than a year ago, let alone at the peak of the pandemic, many speculators are out of the market.

“I wasn’t shocked when dealers said the fair was OK but not gangbusters, or when collectors said, ‘Yeah, I went but didn’t buy anything,'” Levin said.

On the primary market, we’ll have to get more data points next month when blue-chip galleries will converge at Frieze London and, afterwards, at the keenly anticipated Paris+ par Art Basel.

Then November will be the big test of the secondary market, with many exceptionally high-quality works coming to auction—a panoply of masterworks that could either act as a defibrillator on the softening market or further flatline it.

Sotheby’s won many of them so far. The Emily Fisher Landau collection—highlighted by that high-value 1932 Picasso, Femme à la montre (“Woman With a Watch”)—is the most stunning trove going under the hammer so far. Art dealer John Cheim is parting with a significant painting by Joan Mitchell, estimated at $20 million. And the Long Museum’s founders hope to get more than $45 million for their Modigliani in Hong Kong next month.

Advisers believe that wealthy collectors are still willing to splurge on the best of the best—if not the rest.

“If that Picasso doesn’t bring at least $100 million at auction, I’ll hang my hat,” Levin said.