Market

Art Funds: Moguls, Magicians, Money, and Monet

An examination of the parallels between art funds and hedge funds.

An examination of the parallels between art funds and hedge funds.

Katherine Markley

In a recent article in Businessweek, “Hedge Funds are for Suckers,” hedge fund managers are compared to failing magicians, whose days of pulling billion-dollar white rabbits out of hats are long gone. Once viewed as the fast track to obscene wealth—think Steve Cohen buying Picasso’s Le Rêve for a reported $155 million from the casino mogul Stephen Wynn—these funds have come under scrutiny. Over the last year, they have struggled to match the seemingly impossible returns formerly achieved, and the entire industry has been shrouded in headline news scandals involving brilliant, and seemingly untouchable investors. The correlations between this industry and the blue-chip art of our time run high. The failures of hedge funds and speculative financial investments in general have proven to be cautionary tales for art funds, and many ultra-high net worth individuals who have scored big in their financial investments have been behind some of the largest art-world transactions of the past decade. After watching hedge funds struggle and, in some cases, prove to be colossal failures, many people have taken a more skeptical look at art funds to assess whether they are at risk of sharing a similar fate.

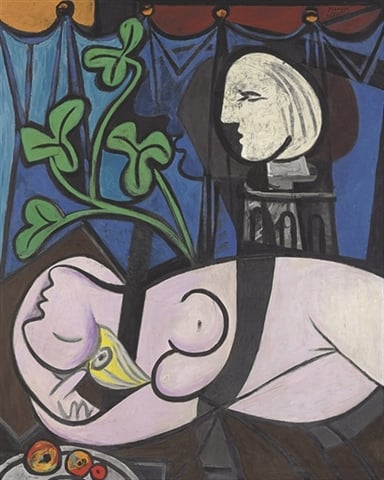

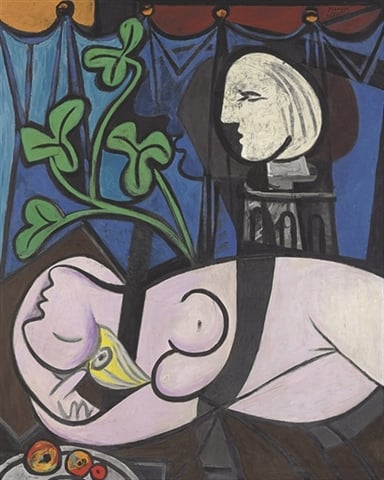

Pablo Picasso, Nude, Green Leaves, and Bust, 1932, sold for US$106,482,500 at Christie’s New York

Over the past five years, art funds have grown in popularity as investors look outside of traditional markets to diversify their portfolios and tap into a relatively unregulated market. The idea of an art fund in itself is not at all new; the more contemporary structure of an art fund has been around for decades, and the idea itself is even older. In recent years however, art funds have gained traction as they have received more attention in the press, and have joined forces through regulatory associations like the Art Fund Association. Potential investors from outside the art market are comfortable with the structure of art funds: They function similarly to traditional funds in their overall strategy and management fee breakdown, perform proper due diligence, and allow investors unfamiliar with the art market to avoid venues like auction houses or galleries that could otherwise overwhelm someone with no knowledge of art-world jargon. The potential for returns through art funds can be promising, even with relatively high transaction costs and fees associated with buying and selling art. The allure of big-name artists like Andy Warhol (American, 1928–1987), Gerhard Richter (German, b.1932), and Pablo Picasso (Spanish, 1888–1973) add a certain cultural cachet to the overall investment opportunity, which would appeal to someone with a portfolio invested entirely in stocks, bonds, and commodities.

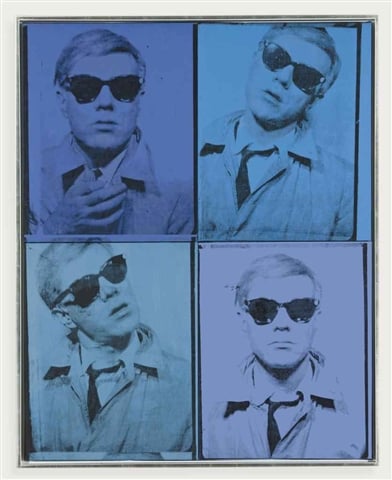

Andy Warhol, Self-portrait (in 4 parts), 1963–1964, sold for US$38,442,500 at Christie’s New York

The number of art funds that have emerged in the last decade has increased, but not all of these funds were able to stay afloat after the financial crisis. One of the best examples of a fund that did survive the crisis is the Fine Art Fund launched by Philip Hoffman, a former Board Member at Christie’s. According to the Fund’s website, over $150 million in assets is under management today, and the majority of works have produced profits even amidst minor losses.1 As hedge funds have been compelled to submit more information on their investments to financial oversight committees according to the Dodd-Frank Act, art funds will also be impacted as they are, by law, required to comply with new regulations. While fund managers display mixed feelings regarding these new regulations, investors should see this as a sign that precautions are being taken—regardless of who has initiated them—to ensure that fund managers are held to a higher standard of accountability and that their investments will be subject to increased oversight and transparency. Even with these added regulations, many art market professionals view art funds as promising investment vehicles that should still be approached with caution and due diligence on behalf of the investor.

Gerhard Richter, Domplatz, Mailand (Cathedral Square, Milan), 1968, sold for US$37,125,000 at Sotheby’s New York

Fortunately for investors, information on the market performance of artists is easy to come by these days. In the past few years, there has been an influx of art market information readily available to potential investors, providing new levels of transparency across the secondary market. To the extent that a client may feel uncomfortable performing their own research, art advisory services can step in as needed, relying on their own expertise, as well as new data analysis available for the art market. All of these tools will help investors perform due diligence on funds, and determine whether these funds are offering the right type of investment potential for their specific needs. In this light, the last line of the Businessweek piece on art funds seems especially apropos: “No matter how many $100 million Picasso paintings they purchase, hedge fund moguls are not magicians. The sooner investors realize that, the better off they will be.”2 This rule of thumb holds true for art funds as well: due diligence is still the safest way to hedge your bets on earning returns on any investment.

2 Sheelah Kolhatkar, “Hedge Funds are for Suckers,” Businessweek, July 11, 2013, http://www.businessweek.com.

For more information about the methodology of artnet Indices, please see the artnet Analytics White Paper.

Need additional analysis? artnet Analytics can work with you to create even more customized reports based on the specific needs of your auction house.