Auctions

Auction Market Leading up to November 2013 Sales

New York City auction houses prepare for November sales.

New York City auction houses prepare for November sales.

Katherine Markley

With November sales just a few weeks away, the spotlight will be on the Post-War and Contemporary auctions in New York. The question on many minds is whether the market can come close to hitting the US$640 million Post-War and Contemporary sale record set in May at Christie’s.

The outlook seems promising: in the first three quarters of 2013, the United States’ art market increased 8% by value and 1.5% by volume sold over the same period in 2012. While this increase was in part due to highly successful May sales, the market didn’t lose any traction in the summer months. Auction sales of Fine Art in the United States were up 20% in the third quarter of 2013, led by extremely successful sales at Christie’s New York (+42% in Q3) and Bonhams New York (+18%). Increased performance leading up to November sales has also been seen in the United States in other American cities, with Heritage Auctions, Freeman’s, Leslie Hindman Auctioneers, and Neal Auction Company showing considerable growth in both volume and value sold in Q3.

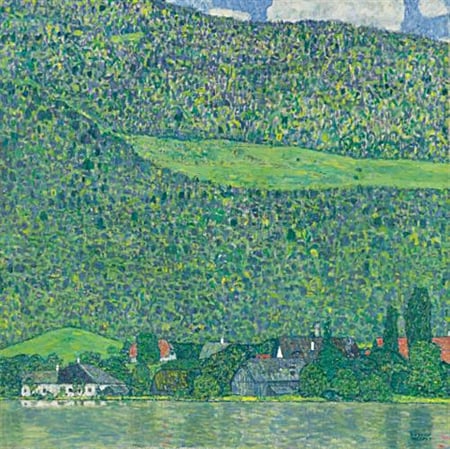

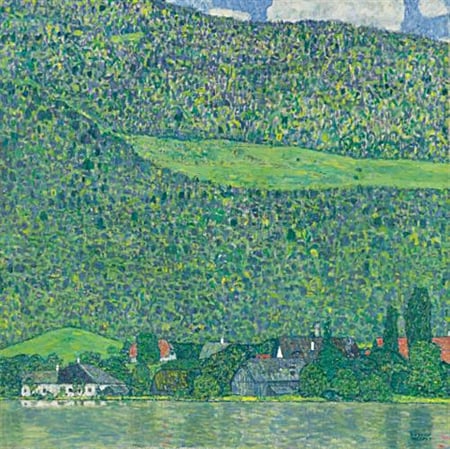

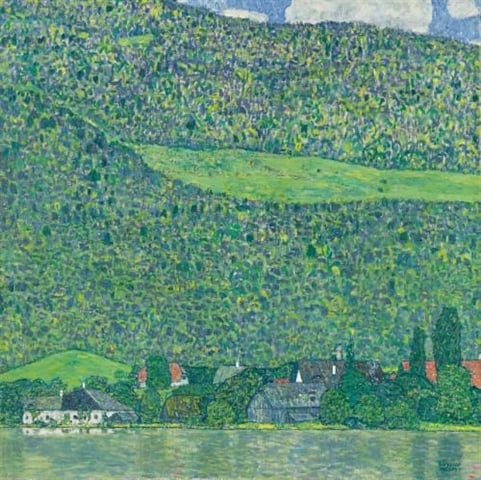

In years past, November sales have been a time for auction houses to outshine each other, both in consignments offered and value sold. In 2011, Sotheby’s Post-War and Contemporary sales stole the show, bringing in US$370 million, with 62 of 73 lots selling in their evening sale. Of the main lots offered, four Clyfford Still (American, 1904–1980) consignments were on the block, with proceeds going toward funding the opening of the Clyfford Still Museum in Denver. Still’s 1949-A-No 1 made headlines, selling for a record-setting US$61.7 million. Sotheby’s also bested Christie’s in the Impressionist and Modern category, selling almost US$200 million in their evening sale, led by the sale of Gustav Klimt’s landscape Litzlberg am Attersee, for US$40.4 million. Christie’s struggled to match Sotheby’s consignments, only bringing in US$140 million during their evening sale. Of the top 10 lots sold in November of 2011, Christie’s only sold one lot, compared to Sotheby’s eight. To place the 2011 November sales in greater economic context, the United States was still in the throes of the post-financial crisis, with implications extending across the art and luxury goods markets. Collectors walking into the Sotheby’s evening auction had to bypass a throng of Occupy Wall Street demonstrators in order to enter the building. By the end of 2011, the Chinese auction market had successfully surpassed the United States as the largest auction market by volume, ending decades of American dominance.

Gustav Klimt, Litzlberg am Attersee, c.1914–1915, oil on canvas, sold at Sotheby’s New York

The following year, the entire global art market was notably altered: the United States market had recovered significant market share, while the Chinese market had come to a standstill. By November, the New York auction market was abuzz with speculation about whether this positive trend could continue. Perhaps most notably, the first installment of the The Andy Warhol Foundation’s single-owner sale was offered at Christie’s on November 12, 2012. This sale signaled a shift in the relationship between Sotheby’s and Christie’s, suggesting that Christie’s had the consignments to pull ahead in November. The sale was enormously successful, with a 91% sell-through rate. This set the tone for the remaining week of sales at Christie’s, with the Post-War and Contemporary auctions bringing in over US$508 million, with a sell-through rate of 90% in the evening sale. Both auction houses boosted successful November sales, with Sotheby’s selling Mark Rothko’s No. 1 (Royal Red and Blue) for US$75 million at the Contemporary Art Evening Auction, and Christie’s topping its Impressionist and Modern Evening Sale with Claude Monet’s Nymphéas for US$43.7 million. Both auction houses greatly surpassed value sold in Post-War and Contemporary auctions the year before, and boasted strong sales in their Impressionist and Modern auctions.

This year’s November sales could mark an even more pivotal rift between the auction houses as Sotheby’s navigates a critical period for their management team. In early October, activist investor and major Sotheby’s shareholder Daniel S. Loeb, of the hedge fund Third Point, announced that he planned to seek a board seat and increase his shares in the company. Loeb called for the resignation of the company’s chairman and chief executive due to a crisis of management. Much of Mr. Loeb’s criticism came from Sotheby’s weakened market share against their primary competitor, Christie’s, an issue that will come into play throughout the November auction season. Regardless of how this internal dispute plays out, both auction houses are touting impressive lineups heading into November.

Sotheby’s will be featuring Andy Warhol’s Silver Car Crash (Double Disaster) in their Contemporary Art Evening Auction, accompanied by other works by Roy Lichtenstein (American, 1923–1997), Willem de Kooning (American/Dutch, 1904–1997), and Clyfford Still. Works by Cy Twombly (American, 1928–2011), Barnett Newman (American, 1905–1970), and John Chamberlain (American, 1927–2011) from the famed Dia Art Foundation will be offered throughout this sale. The evening before, Christie’s will be featuring the iconic Three Studies of Lucian Freud by Francis Bacon (Irish, 1909–1992), as well as Gerhard Richter’s Abstraktes Bild (809-1) from the collection of Eric Clapton. Both houses have stepped up brand-name consignments from major collectors and institutions throughout their suite of November sales. The scene is set and market confidence in the United States is at an all-time high. The question remains: can the market sustain this pace?