Market

How the Y2K-Era Art Boom in China Began a Remapping of the Global Art Market

The explosion of China's art market and contemporary art scene in the 2000s was a once-in-a lifetime golden era.

It’s been nearly 17 years since Claudia Albertini was among the art world’s movers and shakers who attended the highly anticipated grand opening weekend of Ullens Center for Contemporary Art (now called UCCA Center for Contemporary Art) in Beijing in 2007, but the vivid memories of those landmark events still linger today.

Opening amid the exciting prospect of the following year’s Beijing Olympics, the UCCA transformed the factory buildings in a former munitions complex (better known as 798 Art District) into one of China’s biggest contemporary art spaces at the time. Scenes of the lavish series of events hosted by the center’s founders, Belgian collectors Guy and Myriam Ullens, who were among the biggest buyers of Chinese contemporary art at the time, made news headlines. Curator Hans-Ulrich Obrist, Victoria Miro director Glenn Scott, mega collector Uli Sigg, as well as artists Rebecca Horn and Sarah Sze were among the international art crowd, and reportedly 250 VIPs flew in for the occasion.

“It was amazing. It was really, really big,” Albertini said via the phone from Hong Kong, recalling those unforgettable times in Beijing. Currently based in Hong Kong where she is senior director for Massimo de Carlo, Albertini began her venture in Asia’s art world back in 2005 in the Chinese capital, working as a gallerist for the Italy’s Primo Marella Gallery; it was one of the handful of western galleries that opened in the mid-2000s in Beijing.

The façade of UCCA. Image courtesy UCCA.

Opening events ranged from a private viewing of the center’s inaugural exhibition “85 New Wave: The Birth of Chinese Contemporary Art,” to a flamboyant party that included a performance by Spanish art troupe La Fura del Baus. There, two dozen performers dangled in the air amid a music and light show. A flamboyant dinner at a neighboring factory space decorated with fur, velvet, and bling, sat some 700 guests. There was also a very exclusive, VIP dinner inside the Forbidden City.

As Albertini remembers it, the opening of UCCA marked a new era. Not only did it elevate the status of 798, which became a not-to-be-missed cultural destination in China, it also brought optimism about the future of Chinese contemporary art, both on the global stage and locally amid the explosion of the Chinese art market.

“There was a lot of anticipation, a crazy boom from the mid-2000s leading up to the [2008] Beijing Olympics. There was this great energy and momentum,” said Albertini. “A crescendo of the audience, with more than just visitors coming from abroad. You could also feel that even the local public was getting more interested.” Meanwhile, many western galleries also opened shops in China during this period (ShangART opened in Shanghai in 1996). On the heels of Primo Marella Gallery, Galleria Continua and Pace Gallery, opened in Beijing in 2005 and 2008, respectively.

“At the time, you could sell anything when a gallery did a show. It was a crazy period,” Albertini recalled. In parallel, the secondary market for Chinese contemporary art grew exponentially, with auction records set in mainland and international sales one after another.

It was credited as a decisive era when the Chinese art world began taking on an active role in engaging an international dialogue in an open manner, and coincided with an economic boom that looked like a miracle to the West. China’s first taste of economic prosperity in the post-war era was a result of major economic reforms that followed the aftermath of the 1989 Tiananmen crackdown; in 2001, the country joined the World Trade Organization, cementing a decade that saw a global effort to promote the story of China as a rising star.

The story of art in the 2000s in China is by now one of legend; it was like a party that everyone hoped to last forever. A critical look back in hindsight, given the recent developments in the country’s economy and political circumstances, the decade was a once-in-a-life-time golden period that would make one wish to be able to turn the clock back.

Guy and Myriam Ullens. Photo Luc Castel, courtesy Ullens Center for Contemporary Art, Beijing.

The “Internationalization” of China’s Art Scene

The Chinese contemporary art boom in the 2000s has often been associated with the secondary market, where works by Chinese contemporary artists reached record prices. Artworks that went previously unnoticed were being snapped up by a new group of affluent Chinese collectors who accumulated wealth during the economic expansion, which saw double-digit annual GDP growth rates. Notable collectors emerged during this period, including Zhang Lan, entrepreneur and owner of restaurant chain Southern Beauty, and Chen Dongshen, CEO of Taikang Life Insurance, who reportedly bought artist Chen Yifei’s Ode to the Huanghe River (1972) for $5.8 million in 2007.

But what was more significant was the beginning of the “internationalization” of China’s art scene at the turn of the century. Although the 1990s saw Chinese contemporary artists appearing on the international stage (the Venice Biennale, thanks to Hong Kong gallerist and curator Johnson Chang and curator Harald Szeemann, featured many Chinese artists in the 1999 show and western collectors such as Uli Sigg who were already collecting Chinese contemporary artworks extensively), it was the third Shanghai Art Biennale that opened at the Shanghai Art Museum in November 2000 that marked a major shift.

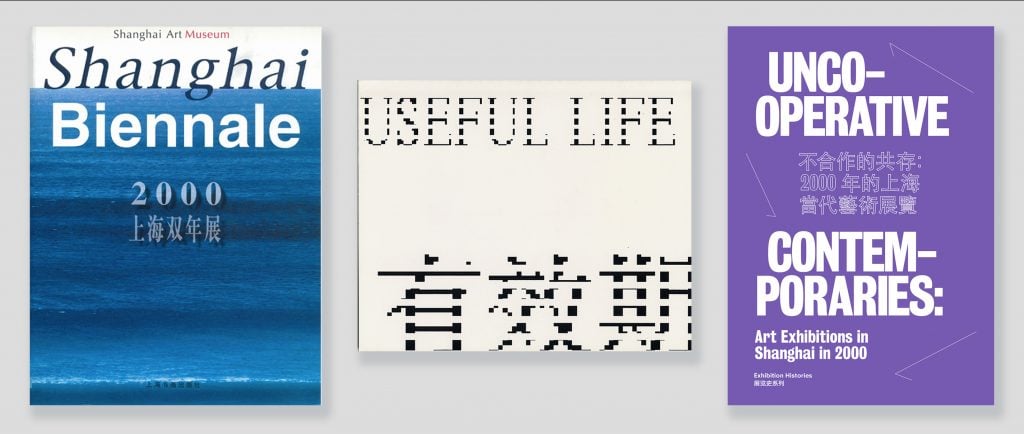

Shanghai Biennale 2000 exhibition catalog, Useful Life exhibition catalog, and Uncooperative Contemporaries: Art Exhibitions in Shanghai in 2000book cover. Courtesy of Asia Art Archive in America.

The exhibition was recognized as the first national large-scale exhibition of contemporary art held by a government art museum, a sign of legitimacy for contemporary art, according to Chinese art historian Lü Peng; the participation of international artists, including Anselm Kiefer and Lee Ufan, was at a record high of 40 percent out of the total number of 67, whereas the previous two editions in 1996 and 1998 had zero. Works by “internationalized” Chinese artists such as Ai Weiwei and Cai Guo-Qiang were also on show.

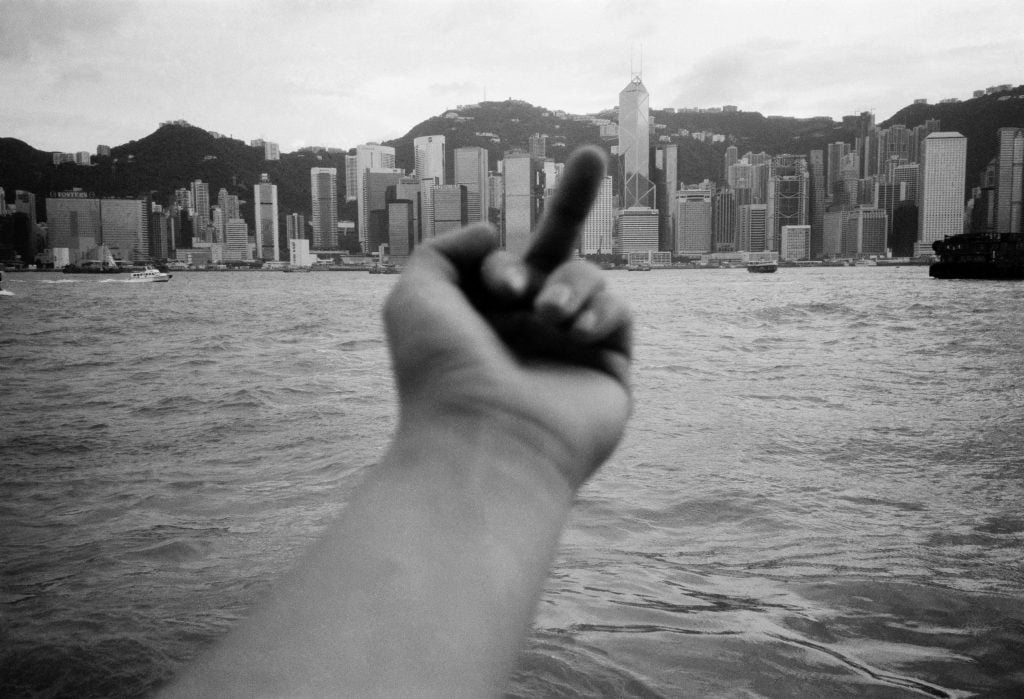

Homegrown exhibitions bloomed alongside the 2000 Shanghai Art Biennale. Independently organized “unapproved” exhibitions, including “Nothing to Do with Me” and “Usual and Unusual,” took place. Among them, the show “Fuck Off” revolved around the theme of uncooperative attitude towards the establishment. Curated by Feng Boyi and Ai Weiwei, it was critical of contemporary issues and the artistic environment. The show was shut down prematurely after a ten-day run. Openness and criticality could only go so far. As the decade turned over, in 2010, Ai Weiwei would be put under house arrest by the government.

Nevertheless, the events spurred a series of follow-ups at the state-funded level: the first Guangzhou Triennial of Contemporary Art organized by Guangdong Art Museum, one of the most important government-run art museums, took place in 2002; the China Millennium Art Museum and the National Art Museum of China staged the first China Beijing International Art Biennale in 2003. Meanwhile, the buzzing art scene in China’s capital Beijing was featured in Time magazine and Newsweek in 2003. By 2005, China participated in the Venice Biennale for the first time with its own national pavilion.

Study of Perspective, 1995. Photo courtesy Ai Weiwei Studio.

The Primary Market Underwriters

Today, the world is dazzled by the rise of South Korea and its cultural products, with the art market, the art, and a lot of its institutional exhibitions being orchestrated by state-driven initiatives. But back in the 2000s, Chinese contemporary held that spotlight. But it was different in a key way: the western world—and money—was driving the hype, as Kejia Wu, researcher and author of A Modern History of China’s Art Market.

“The western world was fascinated by this very strong China story. They wanted to understand better and get to know more about it, and were willing to provide more opportunities,” said Wu on a phone call. She was co-founder of the East Modern Art Center (EMAC), the first nonprofit contemporary art center in Beijing.

“The major underwriters for China-related exhibitions in Europe and the U.S. were foreign banks like Morgan Stanley and HSBC, or the Henry Moore Foundation, the Warhol Foundation, and international collectors,” she said.

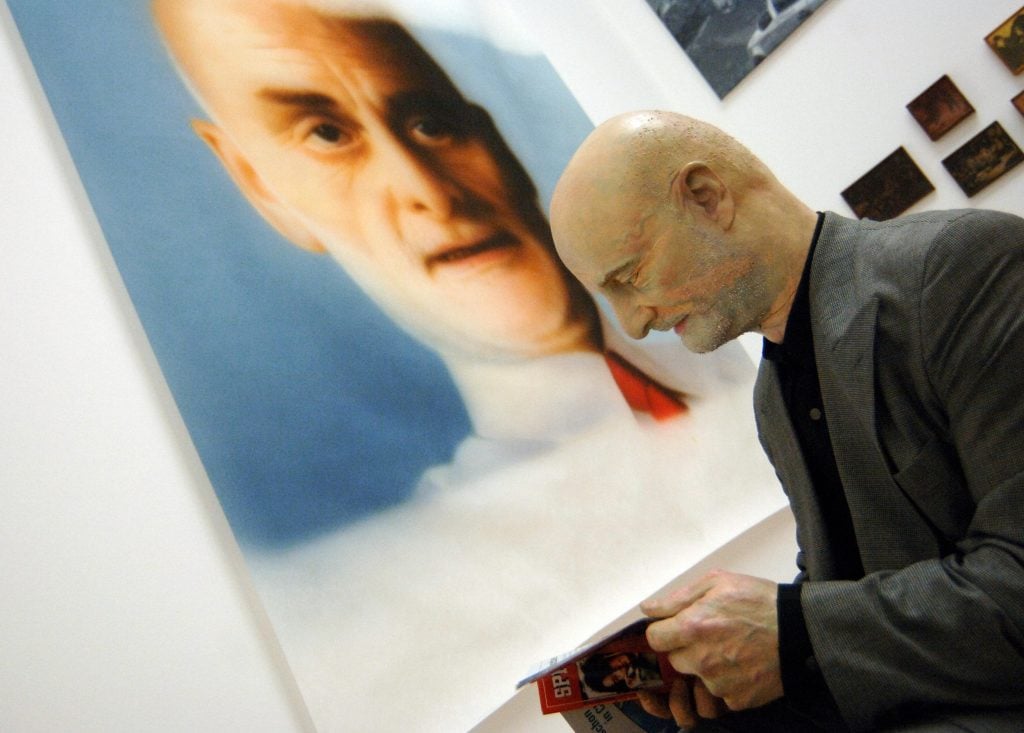

Uli Sigg standing by his portrait painted by Chinese artist Zhou Tiehai, part of a new exhibition of contemporary Chinese art at the Museum of Fine Art in Bern. Photo by JEAN-PIERRE CLATOT/AFP via Getty Images

Wu cited the importance of China’s entry to the World Trade Organization in 2001 and the subsequent economic growth, driven by the surge in Foreign Direct Investment (FDI), as a catalyst. “All the foreign companies had incentive to expand their businesses in China at the time,” she noted.

But perhaps the most era-defining exhibition was “Mahjong,” held 2005. The expansive show featuring works by more than 120 artists at Kunstmuseum Bern in Switzerland was the first public showcase of the collection of Chinese contemporary art (more than 1,200 works by around 180 artists at the time) that had been amassed by none other than Uli Sigg, Switzerland’s former ambassador in Beijing, and his wife Rita since the early 1990s. It was a time well before the entrance of the Ullens, when “no one was collecting [Chinese] contemporary art even remotely systematically,” the collector said in an interview in the exhibition catalog published at the time.

Many of the works featured in the exhibition are now in the collection of M+ in Hong Kong today as a result of Sigg’s part-donation, part-sale deal of his collection agreed with the museum in 2012: it includes Zhang Peili’s painting X? No. 4 (1987), Wang Guangyi’s iconic Mao Zedong: Red Grid No. 2 (1989), and Liu Wei’s Landscape (2004).

But even Sigg was critical of the way the market was shaping up. “Monopoly on exhibitions and the right of interpretation of what contemporary Chinese art is showing abroad should be wrested from foreigners and Chinese living abroad and finally shifted to China,” Sigg noted in the catalog interview. “But foreigners nonetheless do have the merit of having pressed an interest and a preliminary assessment of its contemporary art on official China.”

The Second Market Explosion

When Western art world heavyweights, including Sigg and the Ullens, began actively championing contemporary art from mainland China on a global scale, the secondary market followed. Global art auction sales of Chinese contemporary art grew nearly 200 percent from 2003 to 2007. The market potential of Chinese contemporary art drew the attention of international auction houses early on. Christie’s had the foresight to hold a sale in London titled “Asian Avant Garde” in October 1998, featuring a range of Japanese, Korean, and Chinese contemporary art. But it was still too soon; out of the 50 lots of Chinese contemporary art, 47 went unsold.

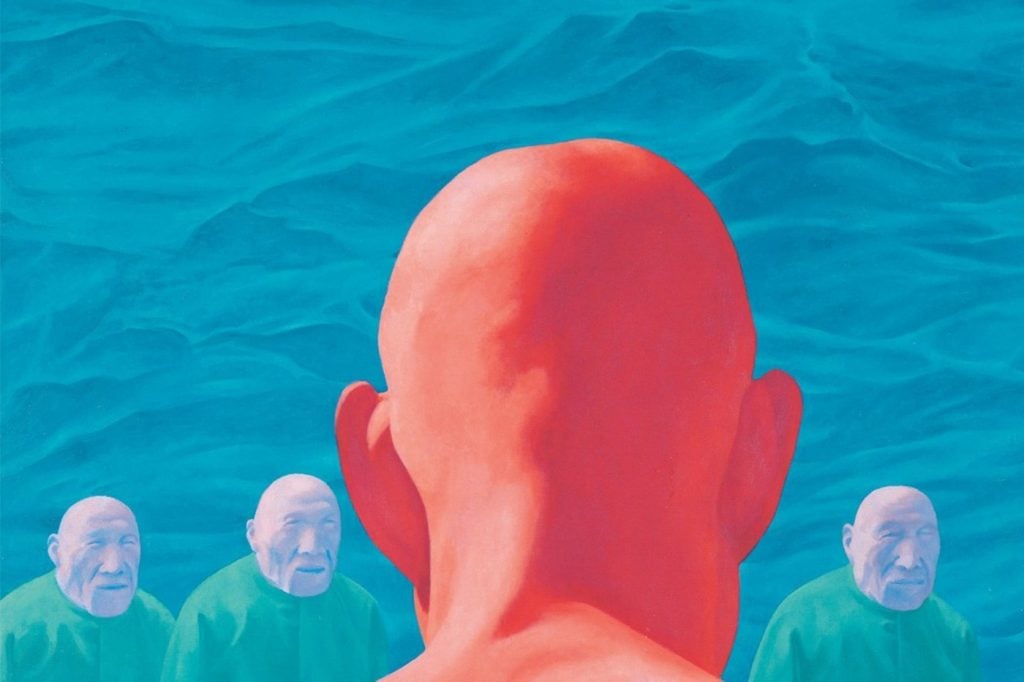

The moment finally struck in October 2004 when Chinese contemporary art became a standalone category at a Sotheby’s Hong Kong sale. The interest spread like wildfire to New York and London in the following years. Most notable was the 2007 record-breaking sale of Yue Minjun’s Tiananmen crackdown-inspired painting Execution (1995), which sold for £2.9 million ($5.97 million) at a Sotheby’s auction in London. This record was broken the following year with the sale of Yue’s Gweong-gweong (1993) at a Christie’s sale in Hong Kong, sold for HK$54 million ($6.9 million).

Between 2003 to 2007, the average prices spiraled upwards by more than 325 percent, according to the 2007 TEFAF report. Data of Chinese contemporary art sales from Artnet Price Database indicated that sales exploded from 2003’s $970,097 to $4 million in 2004, and by 2007, it reached more than $480 million.

Recalling the boom, Evelyn Lin, co-head of 20th/21st century art department, Christie’s Asia Pacific, credits a new class of affluent Chinese individuals who had been abroad. “The [economic] boom was also accompanied with the influx of a new breed of mainland Chinese collectors who had been educated in the west and were returning home. Having been exposed to global art trends and practices, they brought back with them a new appreciation and understanding of contemporary art,” Lin noted.

Lin was the specialist who helped to organize the 2004 Sotheby’s Hong Kong’s first Chinese contemporary art sale, which achieved a 94 percent sell-through rate, totalling $2.8 million, more than 80 percent of the fees-free pre-sale low estimate. Chinese artists’ increasing exposure to global influences also enabled them to create a distinct aesthetic “that resonated with both domestic and international collectors,” she noted.

The 2006 auction of Liu Xiaodong’s 2004 painting New Immigrants at the Three Gorges, sold for 22 million yuan ($2.7 million), doubling the fees-free presale estimate, conducted by the then newly established Poly Auction in Beijing was a landmark sale. It set a record for Chinese contemporary art sold in China to entrepreneur Zhang Lan. But the artist was left unsettled by the surreal growth of the price of his work, and was disheartened when he found out that an Indonesian collector flipped his work at auction, “I am disappointed and perplexed. I have mixed feelings about this,” the artist said, cited in Wu’s book.

Liu Xiaodong attends exhibition opening for LIU XIADONG at Mary Boone Gallery on September 10, 2010 in New York City. Photo by SHAUN MADER/Patrick McMullan via Getty Images

Will History Repeat?

Riding on the exponential growth in the 2000s, new doors were opened to a generation of Chinese artists who emerged in this era. Qiu Anxiong, for example, a Shanghai-based Chinese artist who first appeared at the Shanghai Art Biennale in 2006, was within a few years on view at Art Basel in 2008. Represented by Beijing’s Boers-Li Gallery, Qiu’s installation Staring Into Amnesia, which consisted a 1960s railway car with videos of the country’s troubled past projected inside the carriage, was an instant hit the fair and a darling of international media. “That kind of speed for the kind of international opportunities available for [Chinese] artists is kind of unthinkable nowadays. [Qiu] was only an example of the decade,” said Kejia Wu on the phone.

But the party shut down in the 2008 financial crisis, and the market frenzy cooled. Sales in 2008 dropped to $379 million from that $480 million high just the year before, according to Artnet Price Database. It hit a five-year low in 2009 at $157 million. Sales picked up again in 2010, totaling $425 million, and the upward trend continued in the first half of the following decade until 2015, which saw the Shanghai stock market crash and nearly 300,000 officials being punished under President Xi Jinping’s anti-corruption campaign.

Despite the economic downturn and the prolonged lockdowns more recently, which resulted in the cancelation of many art events and exchange with the international art world, Chinese contemporary art is still there, and the artists are still actively making art. There’s also a new generation of overseas educated artists who are being picked up by western galleries. But the market today is very different from the 2000s golden era. Even some of the biggest collectors, such as Hui Ka Yan (or Xu Jiaxin), chairman of Evergrande Group, the world’s most indebted property developer, as well as Liu Yiqian and Wang Wei, founders of Long Museum, have been selling off their art collections. The China story today is no longer one straight forward story about the rapid rise of a great nation.

“With everything becoming so complex from the early 2010s until now, there isn’t a straightforward trend story,” Wu noted. “Certain artists will stay. It doesn’t mean there’s no growth. I just don’t think it will grow at the same kind of speed.”