For many years, analysts have considered Andy Warhol’s market to be a barometer for the art market as a whole. At a time when the latter is changing in dramatic ways, then, it’s only fair to wonder whether the notion of the so-called “one-man Dow Jones” might be shifting, too.

There is perhaps no one better to hold forth on the state of the Warhol trade than dealer Dominique Lévy. The co-founder of the gallery Lévy Gorvy, which now boasts spaces in New York, London, and Hong Kong, can consider Warhol one of the north stars in her nearly four-decade career. Lévy says that she sold her first Warhol work (a Marilyn (Reversal), if you were wondering) at 21 years old. A few years later, while still in her mid-20s, she went on to convince 10 separate donors to pledge $100,000 each to acquire Warhol’s 10 Portraits of Jews of the 20th Century for the entrance of Jerusalem’s Israel Museum.

Today, Lévy estimates that the 10 Portraits would be valued at a minimum of $25 million to $30 million—a leap that shows just how much the Warhol market, and the art market as a whole, has changed over the decades. It’s not surprising, then, that Lévy finds herself once again gravitating to Warhol.

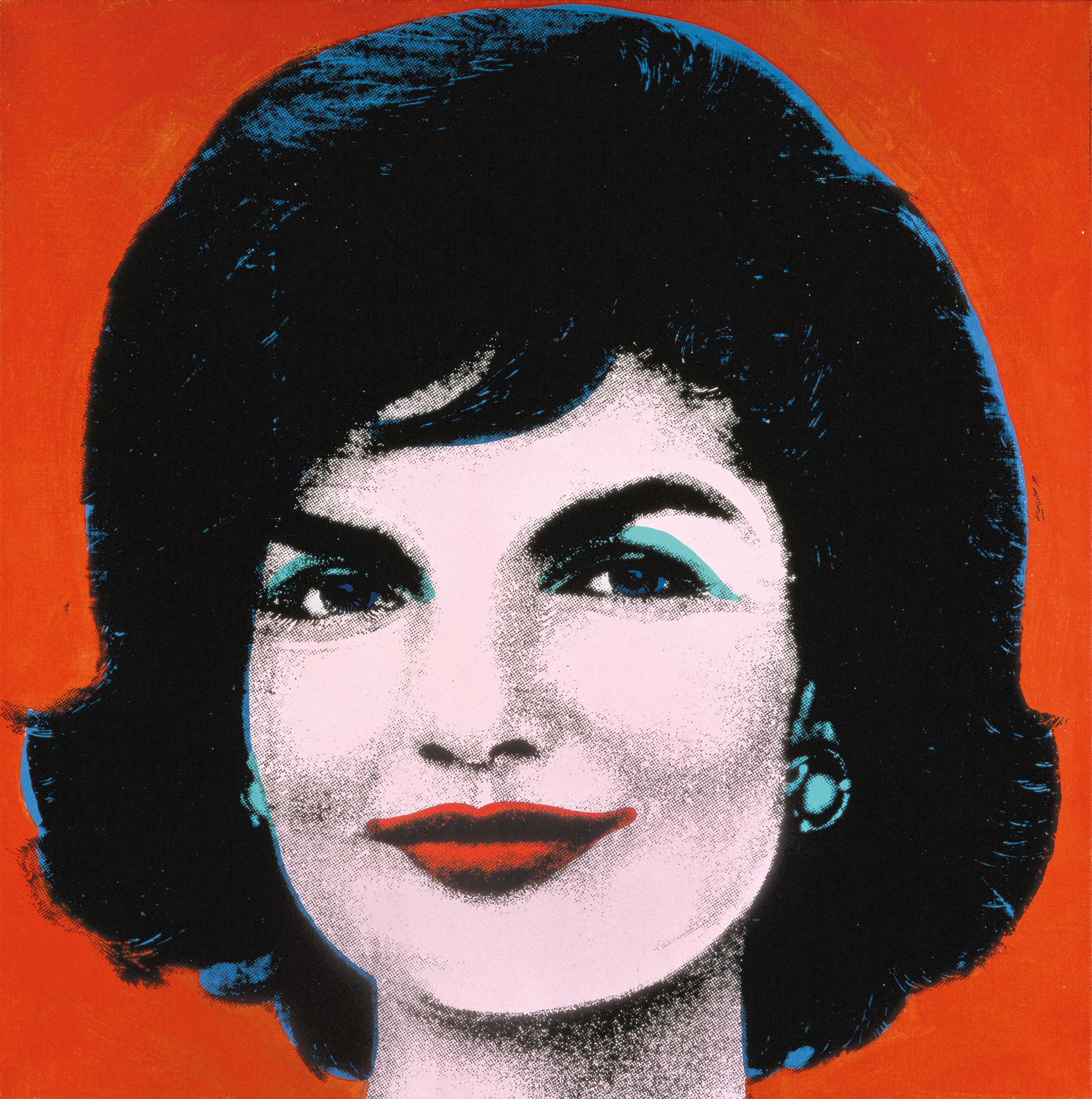

Lévy Gorvy is preparing to open “Warhol Women,” an exhibition focused exclusively on the artist’s portraits of women from the 1960s through 1980s, at its Madison Avenue headquarters this week. And although Lévy stresses that thinking of art as an investment “makes [her] whole body cringe sometimes,” she weathered the discomfort in her office prior to the show’s opening to discuss five surprising truths about Warhol’s market with artnet News.

Dominique Lévy, 2017. Photo by Zenith Richards. Courtesy of Lévy Gorvy.

1. WARHOL’S PUBLIC MARKET IS ‘SOFTER’ THAN HIS PRIVATE MARKET

Some art-market analysts have cast the Warhol trade as being in something of a multi-year lull since the artist generated a record $653.7 million in total sales at auction in 2014, according to the artnet Price Database. While Lévy acknowledges that Warhol’s auction market has been “not soft, but softer” in the years since, she also thinks it’s “completely irrelevant” to try to judge the market based on auction sales alone. “You can’t separate the market” into public and private, she stresses—unless, that is, you want to be woefully misinformed about what’s actually happening.

Warhol is a case in point. “The highest prices paid for Warhol, which are for a large Disaster painting and the Orange Marilyn, are for $150 million to $200 million [each]. And at that level, just in the last five years, there have been at least four [private] transactions, if not five, that I know of,” says Lévy. “And then if I go to the level of $50 million to $100 million, there’s another 20 [private] transactions.”

Add just those lucrative private sales on top of the public auction results—to say nothing of the $1 million to $10 million transactions for Warhol works that she describes as “constant”—and suddenly, the old saw about the Warhol market peaking in 2014 disintegrates.

2. WARHOL’S GROWTH IS ONE OF PEAKS AND VALLEYS

According to Lévy, part of the misconception about Warhol’s market comes from its uniqueness. “Contrary to the Calder market, which has a very steady, slow-rise curve,” she explains, the Warhol trade moves something like a seesaw being pulled uphill: it rises and falls, but each new high and low is above the last one. (She describes the trend as approximating “these fabulous waves, but always going up.”)

What’s responsible for this distinctive trait? Lévy attributes it to the regular influx of new collectors fascinated by the artist. “At different moments, you’ve had different groups of collectors entering the Warhol market, and that resulted in peaks in demand, then satisfaction and a slow down,” before the process repeats with the next generation or the next demographic. “I don’t think I’ve ever met a collector today who is in between, let’s say, 25 to 65 [years old] who will tell me, ‘I won’t collect Warhol,’ and I don’t know that about any other artist,” says Lévy.

From an overall standpoint, then, each fresh group of buyers stands atop the shoulders of the last, and lifts the Warhol market to new heights.

Andy Warhol, Dolly Parton, 1985. Courtesy of Lévy Gorvy.

3. EACH NEW GROUP OF WARHOL BUYERS TARGETS DIFFERENT SERIES

To hear Lévy tell it, the unique contours of the Warhol market don’t just stem from the sheer number of collectors steadily entering the fray. They also owe to the passage of time and the increasing diversity of the neophytes. Each successive wave of collectors tends to connect with aspects of Warhol’s oeuvre that the preceding one didn’t necessarily find relevant at the time.

When the masters of Wall Street caught the bug, their status as children of the 1960s pulled them toward Warhol’s Elvises, Jackies, and other icons of that era. But as time defused the initial political charge of the Mao and hammer-and-sickle paintings, Chinese and Russian buyers came to see those as premier works. And now is the time, Lévy believes, for “Warhol Women,” because today’s high-level collectors and connoisseurs relate to, say, a portrait of Gertrude Stein or the drag culture depicted in the Ladies and Gentlemen series completely differently than their equivalents in earlier decades, strictly because of the natural movements of the zeitgeist.

4. THERE IS LESS WARHOL ON THE MARKET THAN YOU THINK

Lévy claims there was a point at which there were more Warhol pieces trading on the market than Picasso pieces, which certainly fits with the default understanding of Warhol’s prolific, series-based career. But the supply has significantly tightened up in recent years, particularly in marquee auctions. If you compare auction catalogues from 15 years ago to today, she contends, “You go from 15 or 20 or sometimes even 25 Warhols in a sale to two or three.”

This has been broadly true in the auction market as a whole, too. The number of Warhol consignments peaked in 2013 at exactly 2,300 total across all media, according to the artnet Price Database. Last year, that number dropped to about 1,400 consignments, and 2019 is currently on pace to offer around 1,050 Warhols, which would be the lowest total since 2006.

Lévy holds that the Warhol catalogue raisonné has played a crucial role in this process. Out of the five volumes produced to date, the three most recent (which cover his paintings and sculpture from 1970-1978) were published in 2010, 2014, and 2018, dramatically reframing scholars’ and traders’ understanding of both quantity and relative quality. It is not a coincidence, then, that no more than 10 of the 42 paintings on view in “Warhol Women” are available for sale.

Nevertheless…

Andy Warhol, Ladies and Gentlemen, circa 1974–1975. © 2019 The Andy Warhol Foundation for the Visual Arts, Inc. /

Licensed by Artists Rights Society (ARS), New York.

Photo: Tim Nighswander. Courtesy of Lévy Gorvy.

5. THERE ARE STILL UNDERVALUED OPPORTUNITIES TO BE HAD

Lévy identifies Warhol’s 1980s works as among his most undervalued at present, though even these are beginning to pop at prices in the $5 million to $7 million range. This is one trend line where Warhol does not deviate from his blue-chip predecessors. “You can look at late Picasso, late de Kooning, late Matisse” and see the same phenomenon, Levy says. “Late works take more time,” even though the artist’s “energy and genius is often at its best.”

But there are opportunities earlier in Warhol’s canon, as well. Lévy tabs the “Shadow” paintings—a growing favorite among Minimalist collectors—as well as any of his works featuring nudity or sexual imagery “because of course they’re difficult to live with.” But the best value of all can be found by looking beyond the paintings. “His photographs, like the “Stitch” photographs, are an extraordinary body of work, and you can buy [them] for less than $20,000. It’s absurd!”

To be clear, Lévy is not necessarily suggesting that the “Stitch” photographs will one day overtake the Orange Marilyn in the price championships. “There will always be more expensive and less expensive,” she says, “but I think the dichotomy will shrink” as scholars, dealers, and collectors move beyond what she still calls “the tip of the iceberg” of Warhol’s practice.

“I believe our great-grandchildren will still be collecting Warhol more than many of the artists that are more pricy today. If you were coming to me as an investor and asking, ‘Who is the artist I should buy for my grandchildren and put away?’ one of my top five would be Warhol, without a doubt.”

“Warhol Women” is on view at Lévy Gorvy from April 26 through June 15.