Galleries

The $450 Million Marron Collection Is the Art Market’s Ultimate Prize. Now, Three of the World’s Top Rival Galleries Are Joining Forces to Sell It

The heirs' decision to avoid the auction block comes as a surprise to the art world.

The heirs' decision to avoid the auction block comes as a surprise to the art world.

Eileen Kinsella

In an unprecedented move that is likely to send shock waves through the art industry, three top galleries are joining forces to sell the storied collection of late philanthropist Donald Marron. While it was widely assumed that Christie’s or Sotheby’s would handle the estate, particularly after news surfaced that the auction houses were scrambling to submit proposals last month, the collection will instead be sold jointly by Pace, Gagosian, and Acquavella. The arrangement is the strongest sign yet that the traditional lines between galleries and auction houses are blurring.

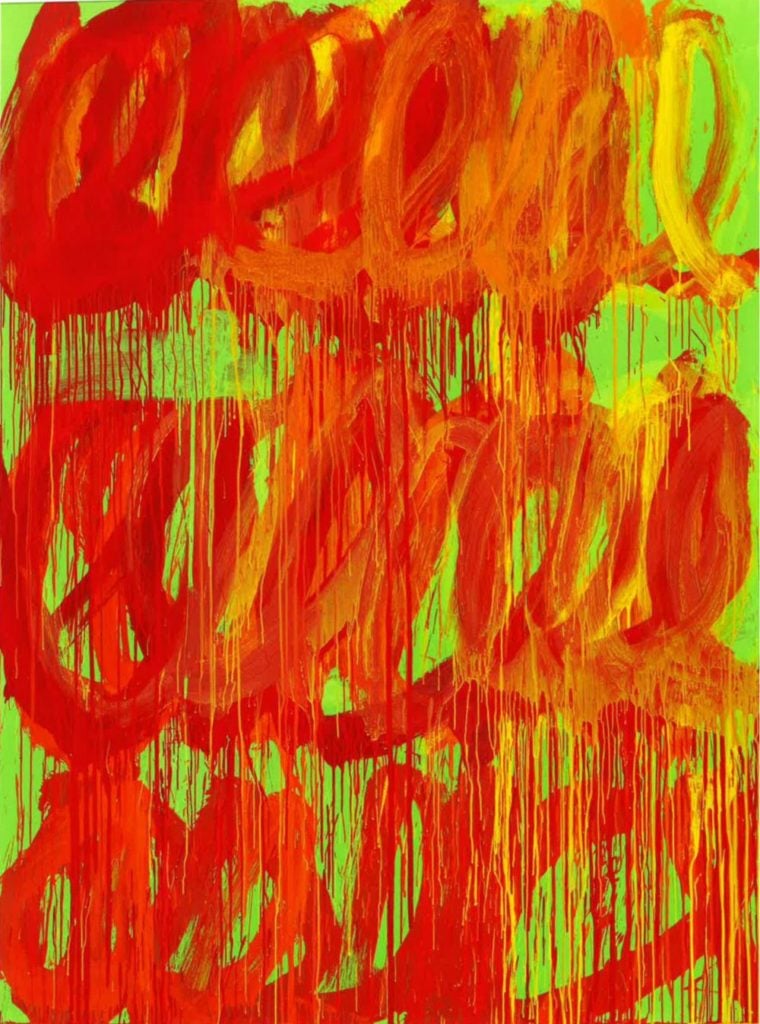

The group of some 300 works—reportedly worth upwards of $450 million—includes major paintings by such titans of Modern art as Pablo Picasso, Mark Rothko, and Cy Twombly. The collection, assembled over the course of six decades, will be shown at Gagosian and Pace’s Chelsea galleries in May.

“All three galleries were very close to Don, and all participated in building that collection with him,” Pace president Marc Glimcher told Artnet News. “I think we’re trying to give some new possibilities for what I think is a natural fit.”

Donald Marron and Catie Marron. ©Patrick McMullan

Marron died from a heart attack in December at age 85. He began building a sterling corporate collection back in the 1970s at the brokerage company PaineWebber, where he went on to become CEO. From 1985 to 1991, he served as president of the board at the Museum of Modern Art in New York, famously promising a trove of works from PaineWebber’s collection to MoMA in 2000. Glimcher said any further museum donations had already been finalized at the time of Marron’s death, leaving the rest of the collection available for sale.

The family’s decision to offer the collection privately could mark a turning point for the art business. With a few exceptions, auction houses have historically kept a firm grip on the sale of major estates and collections. They have been known to offer aggressive financial guarantees to secure coveted property, sometimes even giving the consignor a portion of their commission and foregoing profit in order to earn the prestige of handling such treasures. On the flip side, collections with sterling provenance have often benefited from the flashy marketing and drama of auctions, where a sense of excitement can see prices far exceed expectations.

Cy Twombly, Camino Real (2011)© Cy Twombly Foundation. Courtesy the Donald B. Marron Family Collection, Acquavella Galleries, Gagosian, and Pace Gallery.

The Marron family appears to have wanted a nontraditional approach. (Representatives for the family declined to comment on the sale.) Part of the appeal, it seems, was the discretion and speed the galleries could offer. If a work fails to immediately find a buyer in today’s tentative market, it will not do so publicly. Plus, the family may have seen a private sale as a way to avoid competing at auction with the storied collection of divorcing real estate titans Linda and Harry Macklowe, which is expected to hit the block as soon as this spring as part of a court order.

Glimcher said the galleries would not disclose publicly what is or is not available for sale, nor would they disclose an estimate for the collection. (“The joy of private sales,” he quipped.) The galleries expect the majority of the works to be placed before the May shows open.

Pablo Picasso, Femme au beret et la collerette (Woman with Beret and Collar) (1937). © Estate of Pablo Picasso / Artists Rights Society (ARS) NY. Courtesy the Donald B. Marron Family Collection, Acquavella Galleries, Gagosian, and Pace Gallery.

The unusual plan came together quickly. “I heard that [the Marron family] were considering going to auction and I just picked up the phone and called Larry [Gagosian] and said, ‘We should really present an alternative to the family. It’s tragic for this collection to go to auction,'” Glimcher recalled. After reaching out to Bill Acquavella, who also had a longstanding relationship with Marron, “we all came and presented an idea to the family of how we would do it” around a month ago.

Pressed on the details of the deal, Eleanor Acquavella told Artnet News that an NDA precluded her from divulging specifics, but the galleries confirmed they took a page from the auction houses in offering the family a financial guarantee. “When Marc called, I really liked the idea of competing with the auctions on a great estate. My father and brothers and I talked about it and thought it would be hard to pull off,” she said. “We certainly had to compete financially and otherwise” to win the business, she added.

According to the Wall Street Journal, Phillips, Sotheby’s, and Christie’s had offered guarantees of at least $300 million for the collection. “The key was to meet the fiduciary requirements of an estate, which is complicated,” said Andrew Fabricant, Gagosian’s COO. “We had to convince the family and the lawyers. The challenge was to be in line and competitive and still have some daylight for running with an exhibition and sales.”

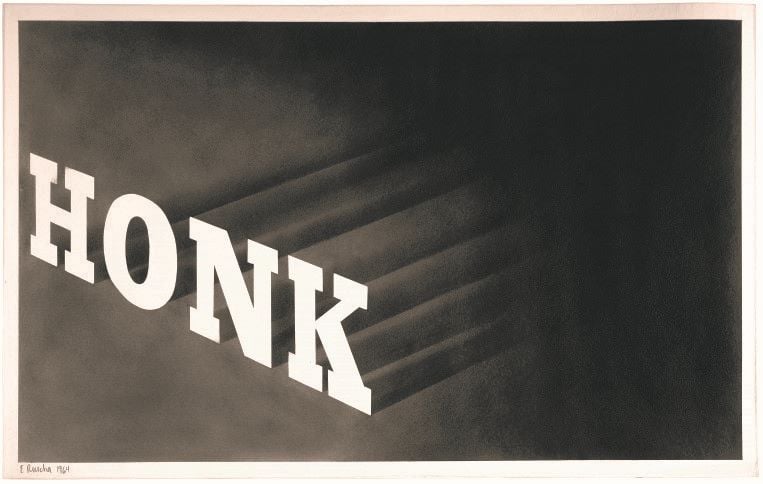

The storied collection is a who’s who of the Western canon, encompassing works by Henri Matisse, Pablo Picasso, Fernand Léger, Mark Rothko, Brice Marden, Willem de Kooning, Ellsworth Kelly, and Gerhard Richter. The collection is also particularly strong in works on paper, with highlights by Ed Ruscha and Mark Grotjahn. Other contemporary figures represented include Laura Owens and Jonas Wood.

Ed Ruscha, Honk (1964) ©Ed Ruscha. Courtesy the Donald B. Marron Family Collection, Acquavella Galleries, Gagosian, and Pace Gallery.

“The scope of this collection is incredible,” Glimcher gushed. “One of the responsibilities of our galleries—and we represent many or most of the artists that are in the collection—is to see that these works move from one great collection to another.”

In addition to the exhibition, the collection will be memorialized in a book (“not a catalogue,” Glimcher was careful to point out, alluding to auction catalogues that include price estimates) published by Phaidon. Further details about dates of the exhibitions are still being worked out.

“We’re really all excited and honored to be given the chance to do this,” Glimcher said. “We know we’re doing something that hasn’t really been done before. We have a system in place and were able to come together as a group to offer this.”