Market

How a New, ‘Deliberately Unsexy’ Blockchain Business Wants to Help Artists Benefit From Collectors Flipping Their Work

The founders hope that reallocating the spoils of success will create a more equitable art world.

The founders hope that reallocating the spoils of success will create a more equitable art world.

Annie Armstrong

Max Kendrick’s moment of clarity about the inequities of the art market came during college, when a friend of his was interning at a global bank and placed on the “lobby beautification committee.”

“He was like, ‘hey, look, we’re looking at bidding on one of your father’s pieces in auction!'” Kendrick relayed this to his dad, the sculptor Mel Kendrick. “Isn’t that cool!”

His father’s response? “There are so many reasons that’s not cool,” the elder Kendrick replied. “But most of all, I get literally no benefit from it. And by the way, that piece could be sold for less than it cost for me to make it. It’s literally lose-lose.”

That moment stuck with Max through eight years as a diplomat in the foreign service before he wound up in a business program at Stanford University in 2019. There, he met Charlie Jarvis, who was working on an undergraduate degree in computer science and studio art. The two bonded over a shared interest in how technology could disrupt some of the art market’s archaic models. In 2021, Fairchain was born.

Once upon a time, flipping an artwork—that is, buying low and selling high—was considered an art-world sin. Artist Robert Rauschenberg famously confronted collector Robert Scull after the record-smashing 1973 auction of the taxi magnate’s Pop art holdings at Sotheby Parke Bernet. The source of Rauschenberg’s indignation? That Thaw, which he’d sold to Scull for $900, had just changed hands for a whopping 94 times that amount—and the artist would see nary a penny.

Today, while still frowned upon, flipping is so common that the art world has almost grown desensitized to it. Yet unlike many European countries, the U.S. has no federal legislation mandating resale rights for artists, and this problem has been felt by emerging talents as acutely as it has been by grandees like Kerry James Marshall. But the advent of the blockchain era is altering the calculus, and Fairchain’s founders are seeking to shift power back to artists.

Artist Robert Rauschenberg, who fought for resale royalties for artists, photographed at the Museum of Modern Art in March 1977. Photo by Jack Mitchell/Getty Images.

“The boring, technical description is that it’s a title management authentication and transaction tool for fine art that helps support artists throughout their lifetimes,” Kendrick explained on a recent Friday over coffee near the company’s offices on the northern edge of Gramercy.

“While also protecting galleries and collectors from fraud in the space,” Jarvis added.

Like forerunners including Verisart, Fairchain uses blockchain technology to register the sale of an artwork with a digital contract that serves as a certificate of authenticity and follows the work in perpetuity. The contract guarantees a percentage royalty of up to 10 percent for the artist—sometimes split with the initial gallerist—to be paid every time the work changes hands. For every piece of art sold through Fairchain, the company gets $10, which is charged to the seller.

The duo describes the concept as “deliberately unsexy.” Over the past few months, however, Fairchain has ginned up a good deal of cachet: The company hosted star-studded dinners in Miami and Los Angeles, and their branding—by the revered design firm Pentagram—was ubiquitous (a poster bearing Rauschenberg’s indelible quote, “For Christ’s sake, you didn’t even send me flowers,” which he spat at Scull after the pivotal auction, hangs in my apartment as I write this). Advisors to Fairchain include big names in art, such as Hank Willis Thomas and Laurie Simmons, while investors include Carroll Dunham, Ludovic Nkoth, and Alteronce Gumby.

“People have made efforts to try to make something like this happen for years and years,” explained Simmons, who has known Max (through his father) since infancy. “It didn’t feel like a completely new idea. It feels like something being born again as a result of all this amazing new technology. I was excited out of the gate.”

Attempts have been made to remedy this problem before. Rauschenberg and others successfully lobbied to pass the California Resale Royalty Act in 1977, which mandated that artists receive a royalty payment upon resale if the transaction takes place in California or the seller is based in the state. However, it was struck down by a federal appeals court in 2018. There are also stories of artists adding an ad-hoc clause into their sales contracts that would entitle them to a royalty, though there is no infrastructure in place to enforce it.

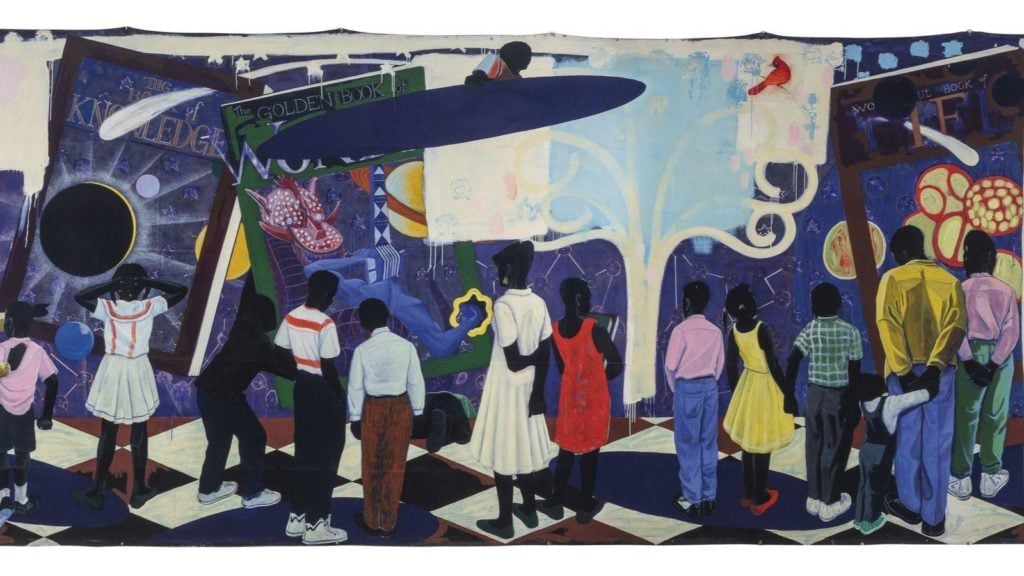

Kerry James Marshall, Knowledge and Wonder (1995). The artist pushed back at the Chicago Public Library, which had planned to auction its mural at Christie’s in 2018, saying the library was “exploiting the work of artists in the city for short-term gain.” Photo courtesy of Christie’s.

Fairchain had its soft launch during Art Basel Miami Beach last year, allowing dealers to elect to use the platform to close a sale. It’s also been used during several benefit auctions, including those hosted by the Leslie-Lohman Museum of Art, Art For Black Lives, and the Church, Eric Fischl and April Gornik’s art center in Sag Harbor.

Fairchain’s technology could discourage flipping for profit in the charity arena, too. “Artists donate their works to these auctions,” Jarvis noted. “Now are they basically able to protect themselves when their act of goodwill is taken advantage of.”

“There’s a freedom of movement in the art world that I’ve always appreciated, that you can [make a deal] on a handshake,” Simmons told me. “However, as more and more money comes into the art world—more and more international money, and I’ll throw in the word oligarchic money, why not—a lot of people don’t know if their artworks are real.” (In the week I interviewed her, Simmons saw a forged piece purportedly made by her husband, Carroll Dunham, go up for auction in Florida.)

As is often the case in the art world, a big selling point comes down to privacy. According to Kendrick, when the duo were first meeting with galleries to discuss the concept of Fairchain, one dealer insisted to him, “’Whatever you design, I’m always going to have a collector coming in here who wants to pay me in a suitcase full of cash. So make sure that can still happen.’”

Fairchain’s use of blockchain differs from that of NFTs. Whereas NFT wallets allow for complete transparency, when Fairchain records a transaction publicly, it allows collectors to keep what’s in their collection totally private—the collector is the only person who can control whether their collection is visible, and which pieces are visible on the blockchain. “We’re removing frustration, but not mystery,” explained Kendrick.

The team at Fairchain. Courtesy of Fairchain.

For artists, the advantages seem clear. Securing buy-in from the other parties, however, takes some prodding. One incentive, mainly for collectors, is expediency and dependability: A Fairchain contract can be drafted and sent over to a collector in a matter of minutes, whereas the current standard operating procedure is to wait around to see if an invoice shows up in your email to find out whether you secured a work or not.

“It feels a little bit like when my parents want to go to the airport and they order a cab for the next morning,” explained Jarvis. “And you’re never sure it’s going to show up. You wake up in the morning and you’re waiting for the taxicab.” The advantage of Fairchain, says Jarvis, is more akin to a ride-hailing app: “When I want to go to the airport, I wake up, I call an Uber. I know exactly how much Uber’s going to cost. I know exactly when it’s going to arrive and when I’ll get there.”

Since the launch, several hundred pieces of art have been sold through Fairchain. New York dealers Charles Moffett and Hannah Traore (who is also an investor in the company) both have upcoming shows that will sell all works through the service.

“For an artist, it’s much more feasible to be able to build a career if there’s greater economic security,” said Jarvis, who grew up watching her own father create art out of a woodshop in their house, but with no concept that he himself could sustain himself as a working artist. “The idea that you could have a career in the arts is not what anyone in my community even had as a concept… What we’ve built is this really cool thing that actually extends access.”