Artnet News Pro

Who Actually Buys Fractional Art? We Spoke With 3 Investors: a Real-Estate Exec, a Podcaster, and a Corporate Lawyer

These everyday professionals are betting on bite-size pieces of cultural assets.

These everyday professionals are betting on bite-size pieces of cultural assets.

Annie Armstrong

A version of this article originally appeared in the Artnet News Pro spring 2022 Intelligence Report.

Who wants to buy a thousandth of a Picasso? As it turns out, plenty of people do—but they might not be the typical gallery or auction-house clientele. We checked in with three professionals—a real estate executive, a podcaster, and a corporate lawyer—who are placing bets on bite-size pieces of cultural assets.

Courtesy of Joey Quiros.

Age: 33

Location: New York City

Occupation: Real-estate agent at Compass

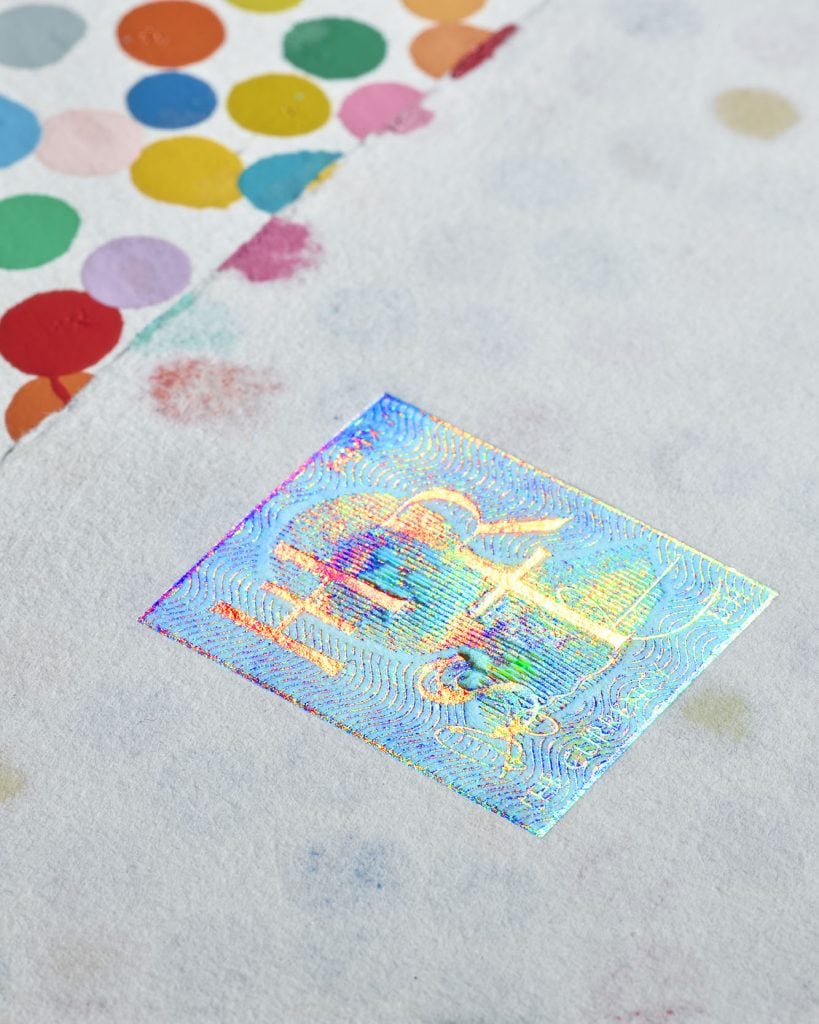

Investment: Owner of an NFT from Damien Hirst’s “The Currency” project

Image of Damien Hirst’s “The Currency” courtesy of the artist.

How did you first find out about “The Currency”?

Through Zima Red, one of the NFT-focused podcasts that I listen to.

What inspired you to invest?

NFTs and Web3 are going to fundamentally change the way we live. One of those changes will be the way art is collected and consumed, specifically a democratization of ownership, making art even more in demand than it is. I believe that “The Currency” represents one of the first, if not the first, crossovers of a major traditional artist into Web3. To own a small piece of that is an opportunity I feel lucky to be a part of.

What has been the most surprising part of owning an NFT?

How much I’ve become interested in the history of art. It’s particularly fascinating to see cycles where new forms are delegitimized by the establishment only to be celebrated by those same groups in the future.

Do you own any other art yourself?

Yes—all NFTs. I don’t know if I could see myself purchasing art that doesn’t have an NFT component at this point.

Courtesy of Katie Rothstein.

Age: 24

Location: Los Angeles

Occupation: Web3 consultant and host of the Crypto Girls podcast

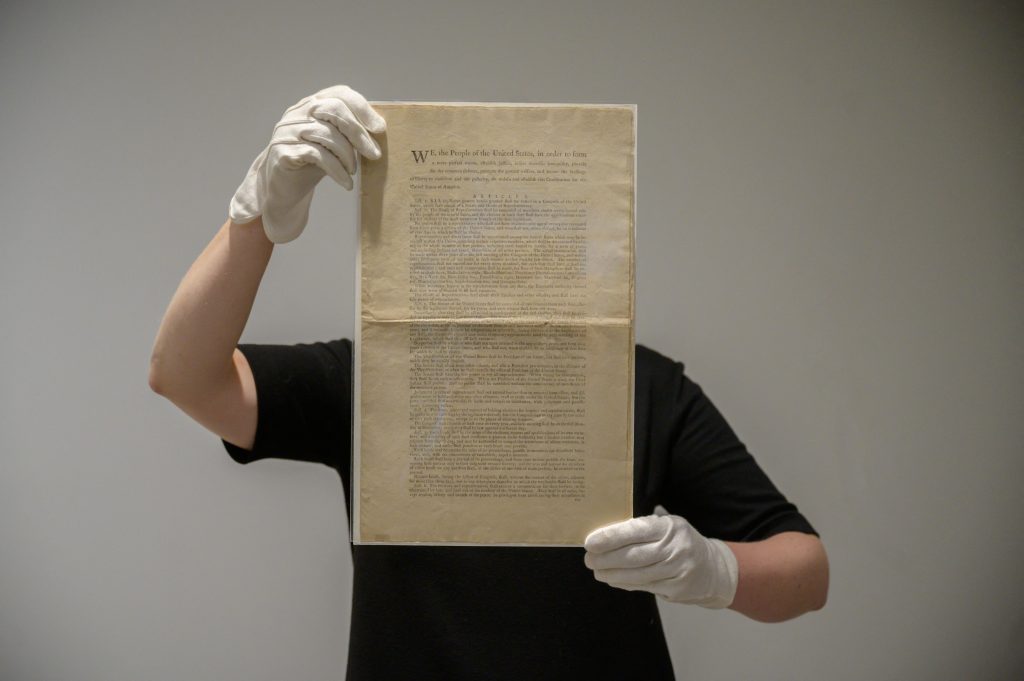

Investment: Member of ConstitutionDAO

The first printing of the United States Constitution, which sparked a bidding war between a DAO and a hedge-fund titan at Sotheby’s last fall. (Photo by ED JONES/AFP via Getty Images)

What interested you about being part of a DAO?

First, they give groups of people the ability to raise large amounts of money very quickly—shout out to the lagging government regulation that makes this possible for the time being. Second, the “decentralized” nature of the organizations. It’s so cool to be able to essentially invest in an idea from its genesis and then be guaranteed a seat at the table as it comes to life.

How did you get involved with ConstitutionDAO?

I had no idea what a DAO was. I saw a link on Twitter for a crowdfund that essentially was like, “We’re raising money to buy a copy of the Constitution at Sotheby’s and donate it to a museum.”

Once they had raised maybe $2 million or $3 million, I thought, “OK, this is probably legit.” I threw them a few hundred dollars and got some tokens in return. It wasn’t until after I put in my money that I actually understood this wasn’t a normal crowdfund.

What about it inspired you?

I was an art history major, and I’ve always loved libraries and rare documents. I just thought it would be funny to say that I was part of a group who came together on Twitter and bought the Constitution. I also liked the idea of sticking it to private collectors who view art only as an asset and spend millions of dollars on artwork only to lock it away in a safe.

How did you feel about the auction?

It was chaos! There was a lot of confusion around which Sotheby’s specialist was bidding on behalf of ConstitutionDAO. We thought we had won for about 10 minutes after the auction. At the end of the day, I was a little sad [to lose] but not surprised. The whole situation did a lot to raise awareness about the power of DAOs, crypto, and Twitter organizing, and this is only the beginning.

Courtesy of Kristopher Brown.

Age: 54

Location: New York City

Occupation: Attorney at Goodwin Procter

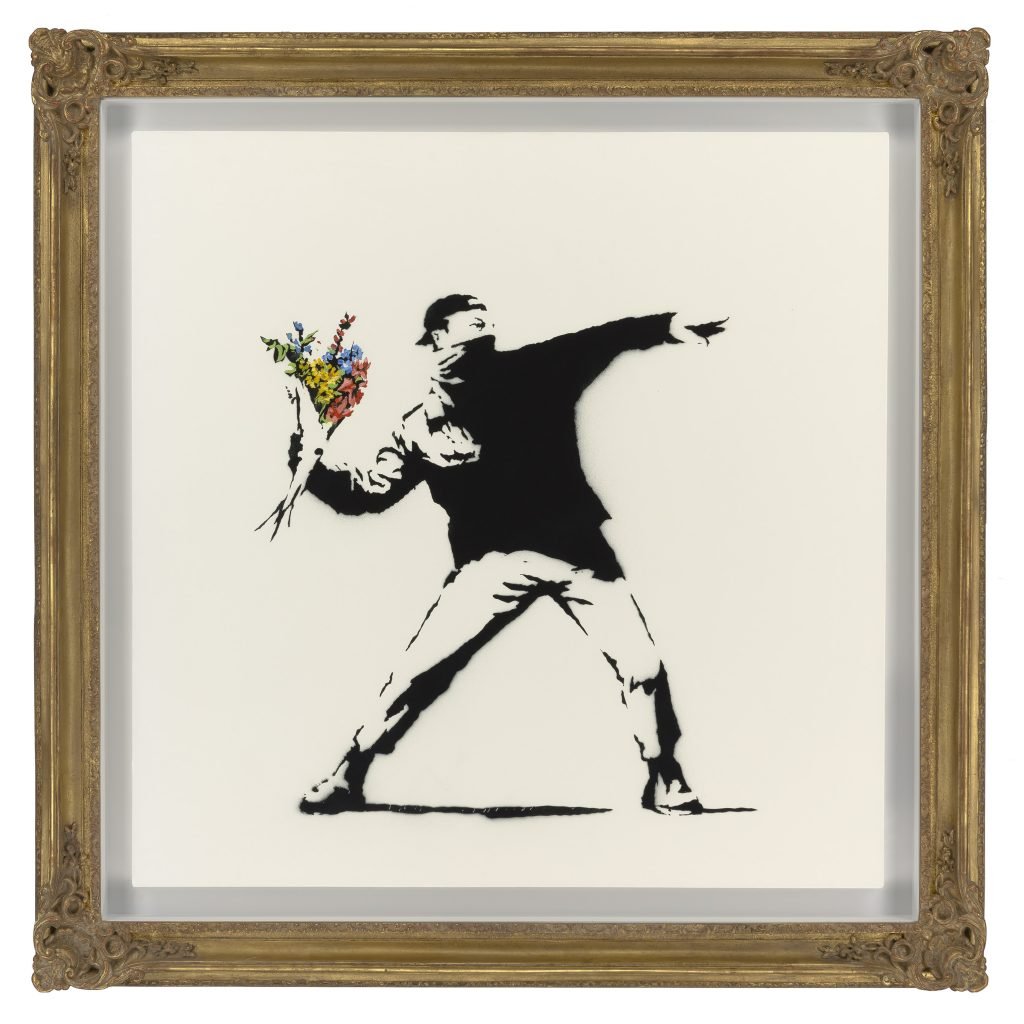

Investment: Fractional owner of Banksy’s Love is in the Air through the start-up Particle

Banksy, Love is in the Air (2005), purchased at Sotheby’s this year by Particle. Courtesy of Particle.

How did you first learn about fractional NFT ownership?

It really came together for me when I read the article on Particle in the New York Times. Adam Lavine [the company’s cofounder] shared it with me, as I am an alum of Brown University, where his son Shingo is in college, and have mentored Shingo on crypto and life sciences. He knew of my interest in doing innovative things with the blockchain, like being the first person to make a crypto donation to an Ivy League university.

Why did you feel it was right for you?

I am a huge fan of Banksy but also of disruptive technologies and novel means of using technology to spread opportunity. Applying the shared-ownership concept in the NFT/art setting seemed like an idea worth exploring.

Has fractional ownership gotten you interested in fine-art collecting?

Absolutely. In fact, I used some bitcoin to acquire one of Damien Hirst’s physical prints, called Politeness.

What are the perks of fractional ownership?

I like the feeling of owning a piece of something so interesting and important. It could also be fun to own a digital piece of an iconic song, movie, or even a digital house in the metaverse, entitling me to unique experiences others don’t get. For my alma mater, Brown University, it would be fun to, say, collectively donate $20,000 with 10 other people to buy a rare book and ensure that book is taken care of. In return, we all would get fractional-benefactor NFTs, which we could show to our friends and family but also to a third party who goes online to check out the digital version of the book. Just like in the past when someone got to put their name on a building, we could have our names associated with that book.

To download the full spring 2022 Artnet Intelligence Report, available exclusively to Artnet News Pro members, click here.