A year ago the auction market officially soared into the stratosphere during the major New York fall sales. Never before did just one part of a single-owner evening sale take an eye-watering $1.5 billion, as was the case with Christie’s auction of Paul Allen’s masterpiece-packed collection. It even outdid the seemingly un-toppable $922 million that the entire Macklowe collection had taken at Sotheby’s previously.

And yet, brace yourself! Judging from the stellar offerings being trotted out in the past few weeks, which will all come on the auction block at the three major houses in the next two weeks of November sales, the blue-chip auction market is still firmly in the troposphere, if you will, with an overall high estimate upwards of $2 billion for the major houses this fall.

“This season, when focusing on the Impressionist and modern, I see so many excellent works at all three houses that have been off the market for decades,” said veteran auction executive turned private dealer David Norman. “I think we are going to see some excellent results as well, which may start a virtuous cycle whereby discretionary selling returns.”

“What is the right word? Nuanced, very nuanced,” said Mary-Kate O’Hare, global co-head and senior art advisor at Citi Private Bank, Art Advisory & Finance. “2022 was intense; it was like a perfect storm, full of excitement with people coming back into the post-pandemic world with the art market functioning again… I think some of the air from that flurry is being let out. People have complicated, busy lives and art is just one component. Many other things now compete for their attention.“

Consider that the cumulative estimates for the evening sales alone at the three houses is in a range of $1.56 billion to $2.1 billion. That represents roughly a surprisingly slim 26 percent dip from the comparable range of $2.1 billion to $2.9 billion reported at this time last year.

Sotheby’s landed what is undoubtedly the premier single owner sale this time with the collection of Emily Fisher Landau, in which the part one or evening sale alone, is estimated at $344.5 million to $430.1 million. It has bumped the house into the top slot for overall expectations, along with three other evening sales, including modern, contemporary and ultra-contemporary under the nascent category, “The Now,” with an overall range of $789.4 million to $1.05 billion.

Coincidentally, Christie’s is selling the collections of two late entertainment titans—iconic Hollywood film director Ivan Reitman and recording executive and A&M co-founder Jerry Moss—that has added some serious firepower to its offerings and its potential bottom line. Evening sales are estimated to pull in between $630 million to $930 million. The house’s 20th-century sale alone is the highest estimated of the bunch, at $531 million to $757 million.

“This season was an interesting season for us,” said Christie’s chairman of 20th and 21st century art, Alex Rotter, during a recent walkthrough. It marked “a moment where we thought very carefully and all together about which paintings and sculptures to go after because we felt it needed a little bit of guidance and focus,” Rotter said.

“I would say that collectors are being more selective, more discerning in the last few months; thinking carefully about what they wish to add to their collections, whether this is the right artist, the right work, the right time to acquire,” said advisor Megan Fox Kelly. “And that is not a negative—I’m seeing a more thoughtful approach. Collectors are taking more time. There is less pressure for them to make quick decisions because the market in general is less frenzied.”

And Phillips’s evening haul is expected to take $142.7 million to $200 million, also exceeding last November’s expectation of $118.5 million to $165.3 million, which at the time was said to be one of its strongest seasons yet. This time around, the house’s offering is boosted by the Triton collection, a wide ranging group of works led by a Fernand Léger estimated at $15 million to $20 million. The collection was assembled by Dutch shipping and oil magnate Willem Cordia and his wife, Marijke van der Laan. The artworks that became the Triton collection were transferred into a foundation following Cordia’s death in 2011.

“In the lead up to our November sales in New York, which many see as a bellwether for the market at large, we are seeing nothing but confidence across the board,” said Jean-Paul Engelen, president, Americas, and worldwide co-head of Phillips 20th-century and contemporary art. “This season, our team has brought together one of the most ambitious offerings of 20th century and contemporary art ever presented at Phillips. In fact, this November marks the second highest estimate for any evening sale in Phillips’ history, a testament to the enduring strength of the market for truly exceptional works of art.”

In the auction world “there are spirals down and virtuous cycles and they can often overlap,” Norman said. “Art performance can often be in inverse proportion to interest rates but the laws of supply and demand can also work in the inverse. On the latter, I’ve found when the supply of high-quality material fresh to the market comes on, typically according to the famous three Ds, the demand rises to meet it. The supply in the last New York, London, and Hong Kong auctions were weaker and poor performance depressed the mood and that in turn reduces discretionary selling.”

Fox Kelly underscored the quality of the material on offer. “There are really exceptional examples at each house: the great Joan Mitchell and the Monet Nymphaes, the Cézannes and Gorky at Christie’s, and the extraordinary material from the Landau collection at Sotheby’s,” she said. “The fact that there are fewer estates being sold this season is more a matter of circumstance than a reflection of a retracting market.”

Tuesday, November 7

21st Century Evening Sale at Christie’s

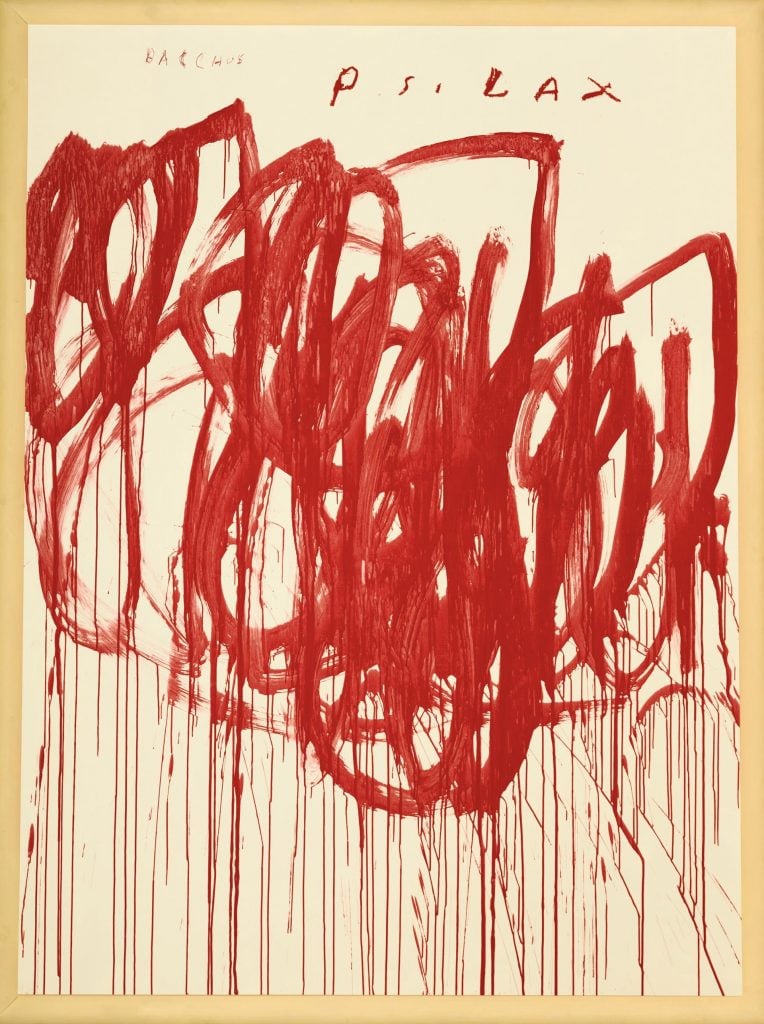

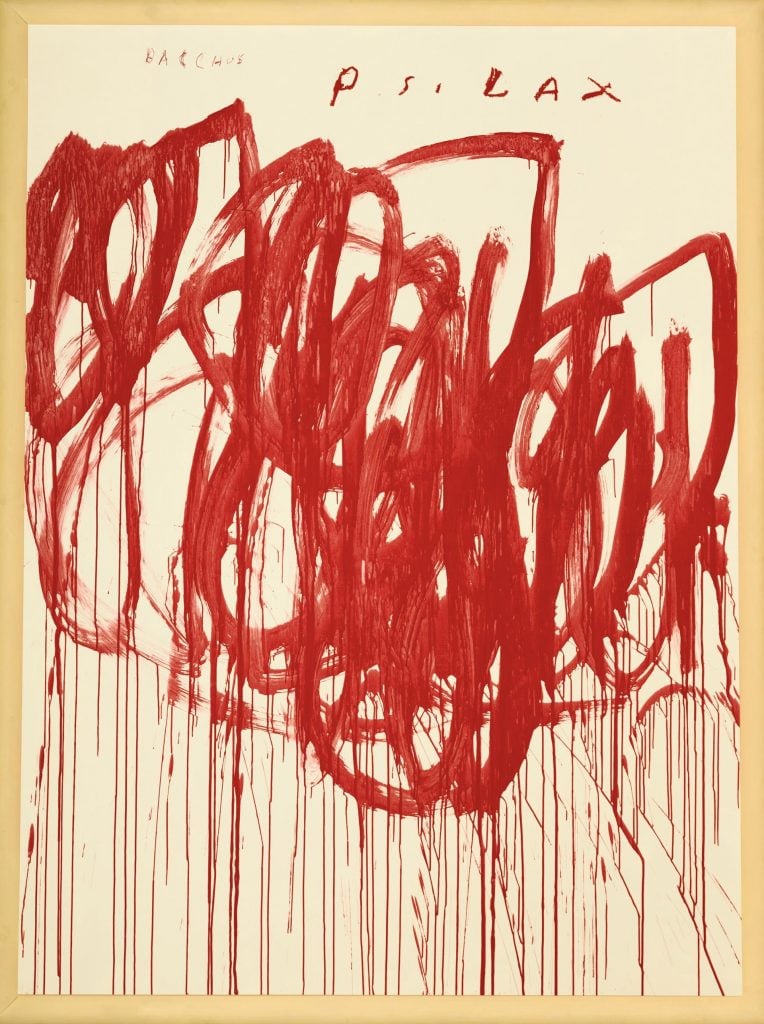

Cy Twombly, Untitled (Bacchus 1st Version II) (2004). Courtesy of Christie’s Images, Ltd.

When: 7 p.m. EST

Lots on offer: 43

Presale estimate: $99 million to $143 million

Presale estimate for equivalent sale in November 2022: $116 million to $174 million

Star lot: The painting hails from Twombly’s celebrated “Bacchus” series, created between 2003 and 2008, and is the crown jewel in the collection of consignors Ramiro and Gabriela Garza, who were identified as the sellers by Artnet News’s Katya Kazakina.

Untitled (Bacchus 1st Version II) (2004) comes from the first set of three distinct bodies in the series: it’s one of six portrait-format paintings Twombly completed in 2004, which were not exhibited until 2008, when they appeared at the Red October Chocolate Factory in Moscow. This set includes the only works with text. Four, including this work, are inscribed with “Psilax,” translating to “the Giver of Wings,” a surname attributed to Dionysus. Works from the Bacchus series account for some of Twombly’s top prices at auction. This work, estimated at $18 million to $25 million, is the priciest in the sale and carries a guarantee.

Other highlights include Jean-Michel Basquiat’s large Untitled painting from 1981 that was formerly in the collection of the late Diego Cortez. It carries an estimate of $10 million to $15 million and most recently appeared at auction at Sotheby’s London in 2007, when it sold for $5.7 million (£2.8 million) according to the Artnet Price Database. It’s followed by a very recently finished Brice Marden painting, Belle’s Turquoise (2020-2021), with an estimate of $8 million to $12 million.

Wednesday, November 8

Emily Fisher Landau Collection: An Era Defined

Evening Sale at Sotheby’s

Pabo Picasso, Femme à la montre (Woman With a Watch) (1932). Courtesy Sotheby’s

When: 6 p.m. EST

Lots on offer: 31

Presale estimate: $344.5 million to $430.1 million

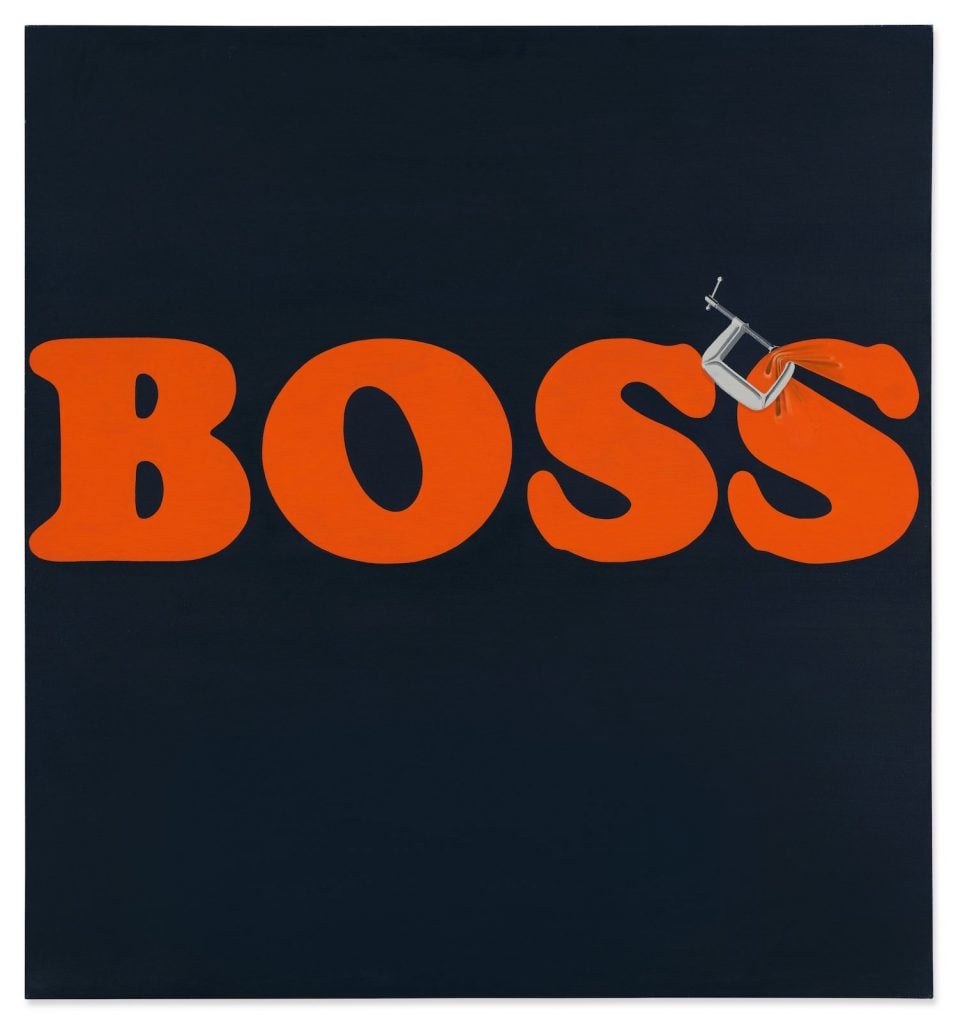

Star lot: The nine-figure asking price for this Picasso, estimated at “in excess of $120 million,” will land it among the most expensive Picassos ever sold when it hits its mark (it also accounts for more than a quarter of the hefty overall presale estimate). After all, the second-highest price for a Picasso at auction is $115 million for a Rose-period work sold in 2018 from the Rockefeller collection, so this is likely bump that down to third place. Observers and competing bidders can also expect fireworks for Jasper Johns’ classic double image Flags (1986) and Ed Ruscha’s eye-catching Securing the Last Letter (Boss), with the word “BOSS” spelled out in bold eye-catching orange. Each is estimated at $35 million to $45 million.

Thursday, November 9

20th Century Evening Sale at Christie’s

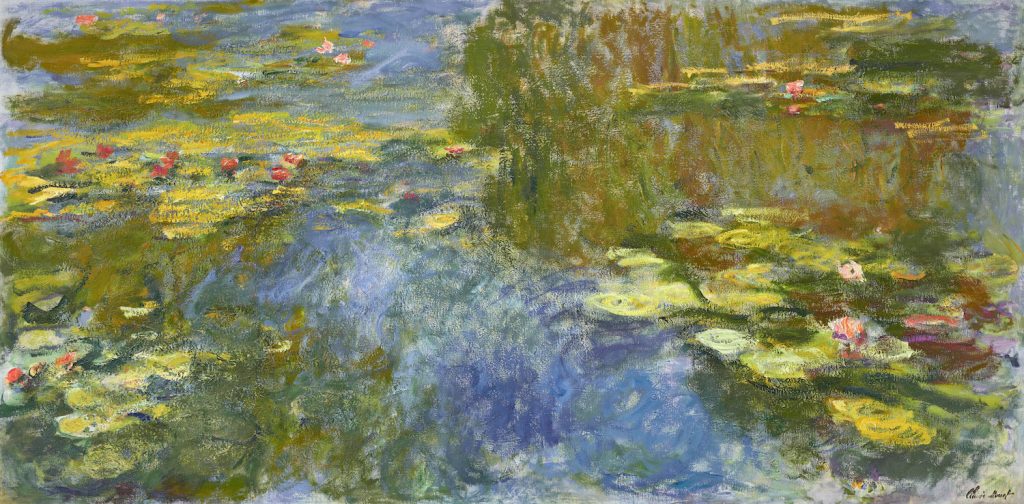

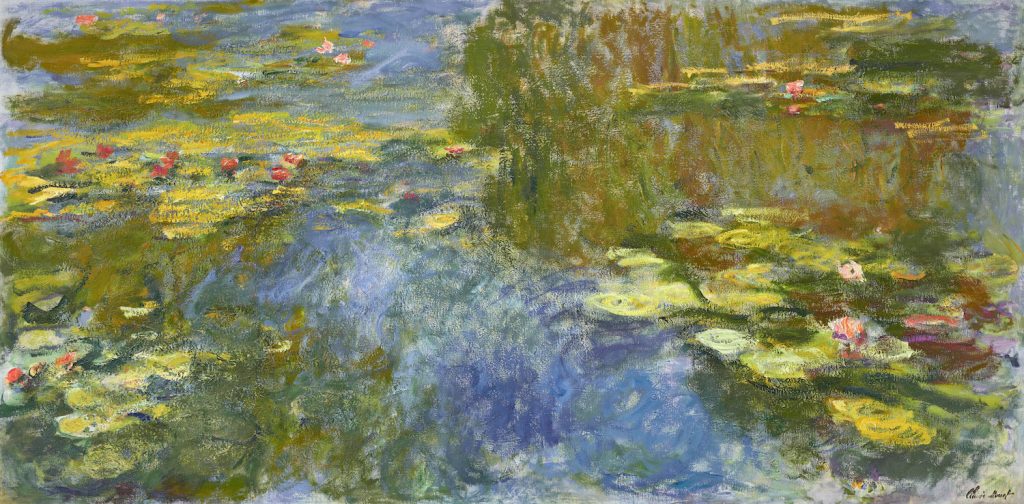

Claude Monet, Le bassin aux nymphéas (c. 1917–19). Image courtesy Christie’s.

When: 6:30 p.m. EST

Lots on offer: 65

Presale estimate: $531 million to $757 million

Presale estimate for equivalent sale in November 2022: $297 million to $445 million

Star lot: Claude Monet’s Le bassin aux nymphéas (c. 1917–19), with an estimate “in excess of $65 million,” is by far the most expensive of this masterpiece-packed sale. “What’s particularly special about this painting is the magnificent, panoramic size of it. It speaks to the grandeur of the period,” said Imogen Kerr, Christie’s co-head of the 20th Century evening sale, during a recent walkthrough. She noted that Monet moved with his family to Giverny in 1883 and went on to create a magnificent water garden there. From the end of the 1890s on, he went on to paint nymphéas (water lilies) numerous times through the end of his life, creating a 25-year legacy. They became “the most iconic images associated with Monet, and certainly one of the most iconic images of the 20th-century,” said Kerr. The painting has been in the same private collection since 1972, and between its rarity and the estimate, it could end up in the same trophy territory as the most expensive Nymphéas at auction, which sold for $84.7 million, at Christie’s in 2018, from the Rockefeller collection.

Christie’s 20th Century evening sale is the highest-estimated of this marathon two-week series. Roughly a dozen works in the sale are estimated above $20 million each.

Monday, November 13

Modern Evening Auction at Sotheby’s

Pablo Picasso, Compotier et guitare (1932). Image courtesy Sotheby’s.

When: 7 p.m. EST

Lots on offer: 41

Presale estimate: $199.2 million to $275.4 million

Presale estimate for equivalent sale in November 2022: $237.2 million to $295.3 million

Star lot: The eclectic mix of offerings in Sotheby’s modern evening sale is led by Picasso’s Compotier et guitare (1932), which has an unpublished estimate/estimate on request in the region of $25 million. As always, past auction results give some indicator of where the market for particular works or artists was in the past. In this case, the same work sold for $9.9 million at a Sotheby’s auction in 2000. The still life contains “coded references to the artist’s famed ‘Golden Muse’ Marie-Thérèse Walter, at a time when their clandestine affair,” by then going on in secret for years, according to Sotheby’s.

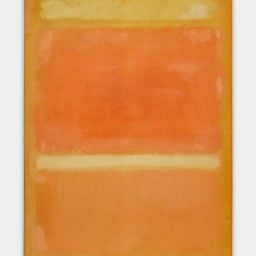

Other highlights include Monet’s Peupliers au bord de l’Epte, temps couvert (1891) which is estimated at $30 million to $40 million, and Balthus’s Patience (c. 1943) which is estimated at $12 million to $18 million. Billed as highlighting the innovations of the avant-garde, the sale has works ranging from Monet and Picasso through Mark Rothko and Philip Guston.

Tuesday, November 14

Living the Avant-Garde, The Triton Collection Foundation at Phillips

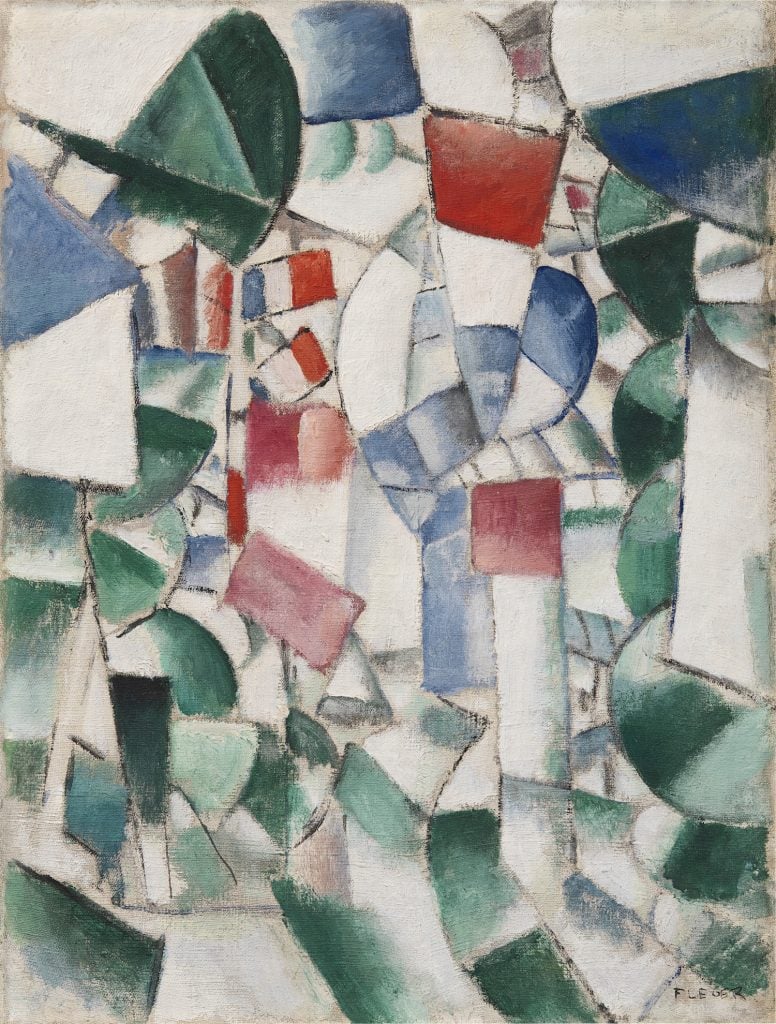

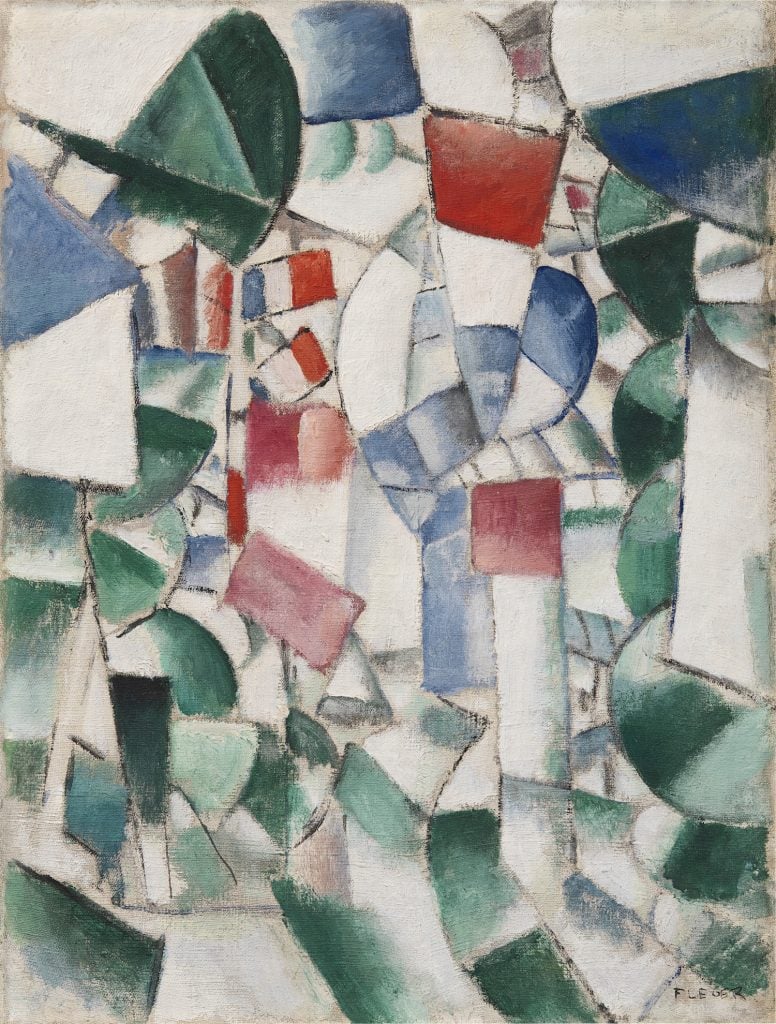

Fernand Léger, Le 14 juillet (1912–13). Image courtesy Phillips.

When: 6 p.m. EST

Lots on offer: 30

Presale estimate: $70 million to $100 million

Star lot: The star lot of the Triton Foundation collection is Fernand Léger’s Le 14 juillet, with an estimate of $15 million to $20 million. Phillips describes it is as a “joyous Cubist depiction of Bastille Day” and this marks the first time it is being offered at auction. “What makes the work even more remarkable is that it includes a second painting on the verso, long believed to have been lost,” according to a statement from Phillips.

The painting was acquired by the foundation in 1999, and thanks to the meticulous work of conservators, it was able to save the painting on the verso. The work was exhibited for the first time ever last year at the Kröller-Müller Museum in the Netherlands. It belongs to Léger’s “Fumées sur les toits” series, derived from the view out the artist’s studio window across the rooftops of Paris.

The same pre-sale estimate of $15 million to $20 million also applies to Picasso’s Femme en corset lisant un livre (c. 1914–18), also from the Triton collection.

Evening Sale of 20th Century & Contemporary Art at Phillips

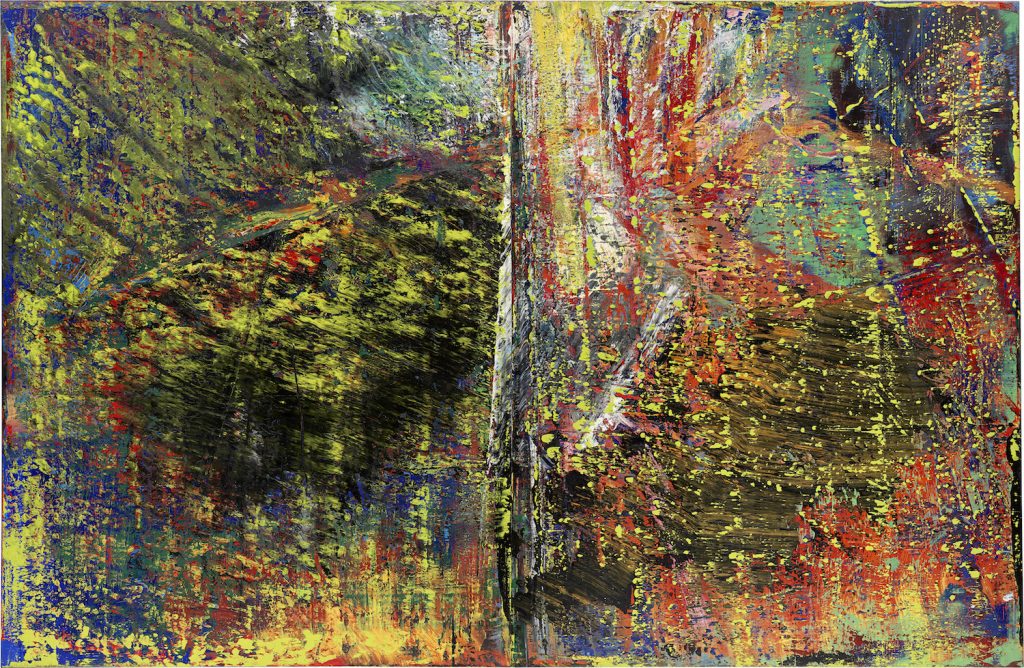

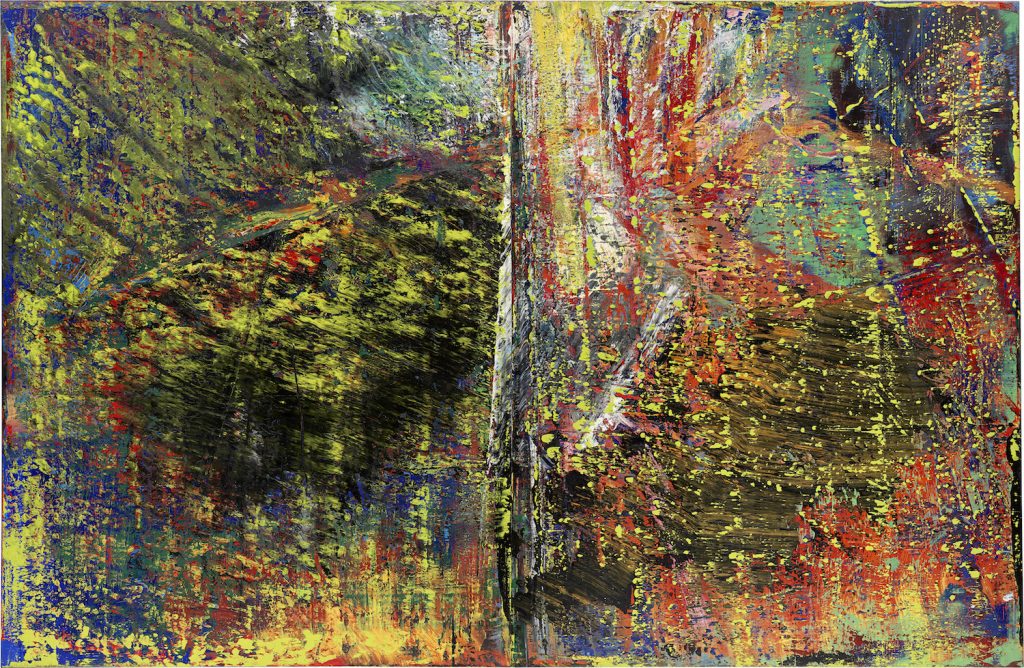

Gerhard Richter, Abstraktes Bild (1987). Image courtesy Phillips.

When: Immediately following the dedicated Triton sale

Lots on offer: 30

Presale estimate: $72.7 million to $100 million

Presale estimate for equivalent sale in November 2022: $118.5 million to$165.3 million

Star lot: The classic Richter abstract is comprised of two canvases, spans over eight feet in height and 13 feet in width, and carries an estimate on request “in the region of $30 million.” Phillips calls it “ a consummate example of Richter’s skill with the squeegee, a tool he integrated into his abstract paintings only one year prior, which has become a hallmark and visual signature of his richly varied practice.” With the squeegee, the artist pulls paint across the composition, working on both canvases at once, scraping layers out from under one another in a seemingly infinite field of color.

Also on offer is a vibrant 1962 Joan Mitchell abstract painting, titled Blueberry, created after she moved to Paris in 1959. It is expected to sell for between $9 million and $12 million.

Wednesday, November 15

The Now Evening Auction at Sotheby’s

Kerry James Marshall, Plunge (1992). Image courtesy Sotheby’s.

When: 6 p.m. EST

Lots on offer: 19

Presale estimate: $43.7 million to $60.6 million

Presale estimate for equivalent sale in November 2022: $32.4 million to $47.2 million

Star lot: This small-but-mighty sale category that was introduced by Sotheby’s just a few years ago has become the ultimate barometer of the ultra-contemporary art market, and that includes both the good and the bad—skyrocketing demand or market speculation fallout.

In the lead spots are work being sold by the China-based Long Museum, each estimated at $9 million to $12 million. One is Plunge (1992) by sought-after artist Kerry James Marshall. It has already been requested for inclusion in the forthcoming retrospective of the artist’s work at the Royal Academy of Arts in London, opening in the fall of 2025. It last sold in May 2016 at Christie’s for $2.2 million.

Meanwhile, a fleshy painting of several side-by-side nudes by Jenny Saville, titled Shift (1996–97), is also offer from the Long Museum with an identical $9 million to $12 million estimate. Both are backed by third-party guarantees.

Contemporary Evening Auction at Sotheby’s

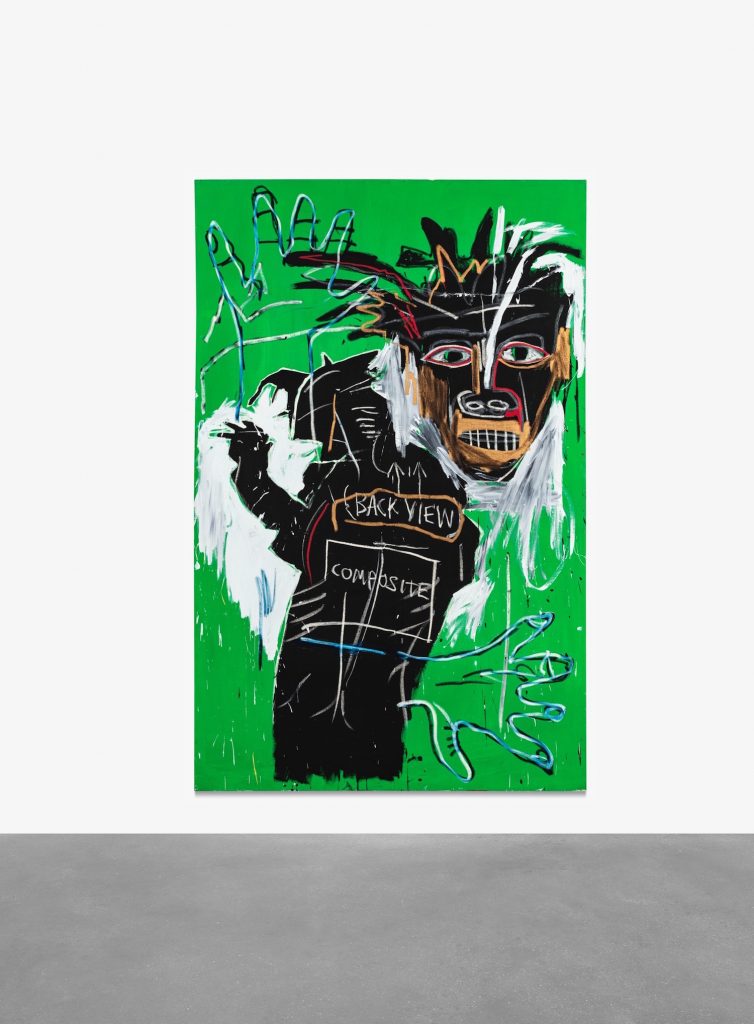

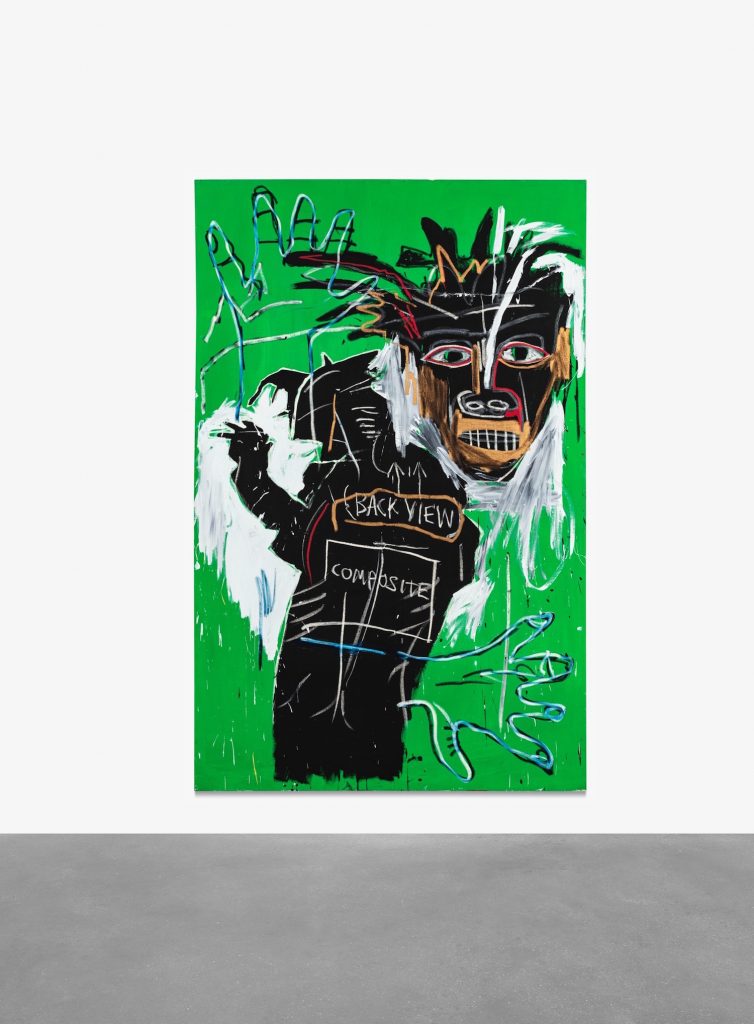

Jean-Michel Basquiat, Self-Portrait as a Heel (Part Two) (1982). Image courtesy Sotheby’s.

When: 7 p.m. EST

Lots on offer: 46

Presale estimate: $202 million to $289.2 million

Presale estimate for equivalent sale in November 2022: $249.2 million to $316.6 million

Star lot: Jean-Michel Basquiat Self-Portrait as a Heel (Part Two) (1982) is estimated at $40 million to $60 million and the sale is a sure thing, since it’s backed by an irrevocable bid or third-party guarantee. It also has an extensive market track record that mirrors the soaring trajectory of the Basquiat market over the last two decades.

Among various prestigious former owners, it came up for auction at Christie’s New York in May 1999, when it sold for $772,500 on a high estimate of $600,000.

More Trending Stories:

A Secret Room in a 16th-Century Italian Chapel, Where Michelangelo Hid—and Drew—for Months, Opens to the Public

Stuart Semple Unleashes His Final Superblack Paint in His Long-Running Art Supply Battle With Anish Kapoor

This 15th-Century Painting Might Actually Depict a Prehistoric Tool, New Research Suggests

The World’s Most Popular Painter Sent His Followers After Me Because He Didn’t Like a Review of His Work. Here’s What I Learned

A Young Collector Is Launching a New Art Fair in Seoul, Testing a Model He Hopes Will Make a Difference in Asia

A Delayed and Expanded David Hockney Show Opens at London’s National Portrait Gallery, Harry Styles and All

A Nautical Chart Sold at Auction for $239,000 Is Revealed as the 4th Oldest of Its Kind and Is Now Tagged at $7.5 Million