Artnet News Pro

Who Won Auction Week? Here Are 16 Key Takeaways From New York’s $3.2 Billion Fall Sales

From the priciest work to the biggest flop (and more), here are our parting observations from New York's marquee auctions this November.

From the priciest work to the biggest flop (and more), here are our parting observations from New York's marquee auctions this November.

Artnet News

This season, a whopping $3.2 billion of art exchanged hands across the main day and evening sales at the Big Three auction houses in New York.

The buoyant total sales figures achieved present a rosy picture of the market’s health that may hope to inspire confidence in would-be buyers and consignors heading into 2023. And it would, too, if all they looked at was the self-congratulating post-sale press releases, and the immense market prop provided by the dissemination of an exceptional $1.6 billion trove of art left behind by a deceased billionaire.

Luckily for readers of Artnet News Pro, we’ve got a team of in-house sleuths with long memories and eyes still sharp enough to peer through the smoke trails left by any carefully choreographed fireworks to reveal a truer picture of the market, and what that might foretell for the seasons yet to come.

To make sense of the November madness, the team (Annie Armstrong, Vivienne Chow, Julia Halperin, Katya Kazakina, and Tim Schneider) huddled up to hand out its biannual auction awards.

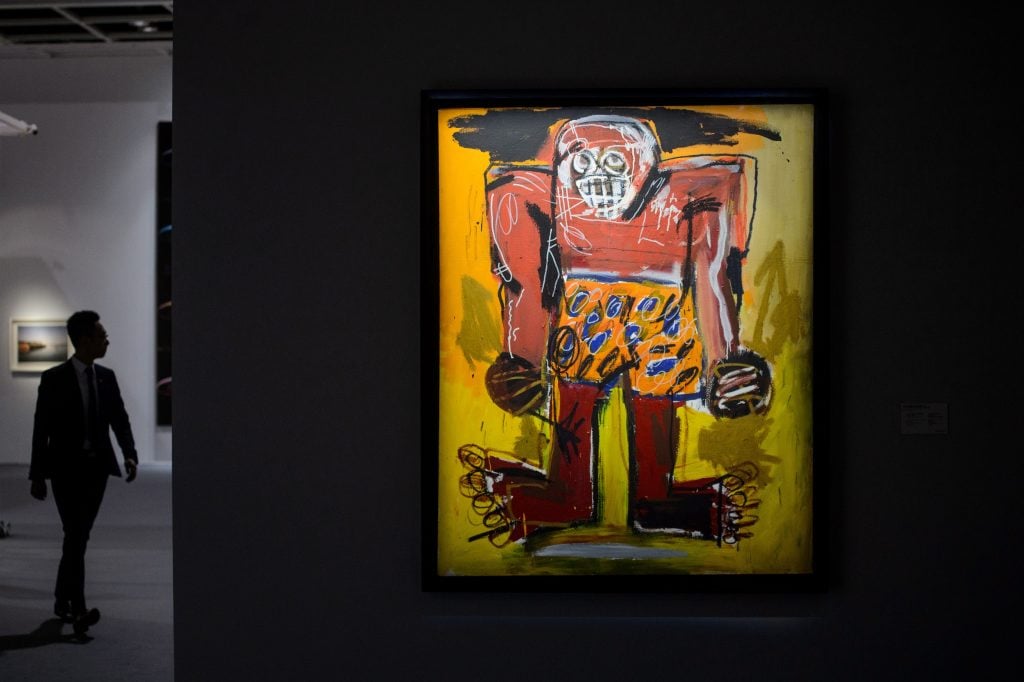

Jean-Michel Basquiat’s Sugar Ray Robinson at Christie’s (Photo: Anthony Wallace/AFP via Getty Images)

It wasn’t even close. The sale of Paul Allen’s collection buoyed Christie’s to an unprecedented total of $2.2 billion in art sales over less than two weeks, making it the undisputed winner of the 2022 fall sales season. A large chunk of that—$1.6 billion—was for the Microsoft cofounder’s star-studded collection, which saw five works sell for more than $100 million each. (Final prices include auction-house fees; presale estimates do not.)

But the success of Allen obscured the more bracing reality facing the rest of the market. Of the seven evening sales, the hammer totals in five missed their aggregate low estimates. Sotheby’s sold $856.3 million across its evening and day sales, within the combined presale estimate of $733.2 million to $960 million. Phillips had the toughest week, with $165.6 million in total sales.

Alberto Giacometti, Trois hommes qui marchent (Grand plateau) (1952). Courtesy of Sotheby’s.

The art world’s equivalent to the multiple-minute standing ovation at Cannes may be the multiple-minute bidding war a piece of art can inspire in two competing collectors. This year, the figurative Golden Lion goes to Alberto Giacometti’s Trois hommes qui marchent (Grand plateau) (1952), for which the crowd at Sotheby’s auction of work from David M. Solinger’s collection sat for seven minutes, as two phone bidders one-upped each other, eventually culminating in a $30.2 million sale for the hand-painted bronze sculpture.

Egon Schiele, Standing Girl in White Petticoat (1911). Courtesy of Sotheby’s.

The question of whether two pieces by Egon Schiele were stolen from their Jewish owners during World War II was contentious for Sotheby’s, which adamantly asserted in a statement that neither “is registered as having been lost, displaced, or looted in any of the available databases and resources tracking art losses during that period,” and that “both have been cleared by the Art Loss Register.” However, the dark mark of Wolfgang Gurlitt’s name is on the provenance of Self Portrait (1910). (Gurlitt was a German art dealer during the Nazi era, and his collection included Nazi-looted art.) The piece passed without selling, and the other, Standing Girl in White Petticoat (1911), sold for half of its high estimate at $1.6 million.

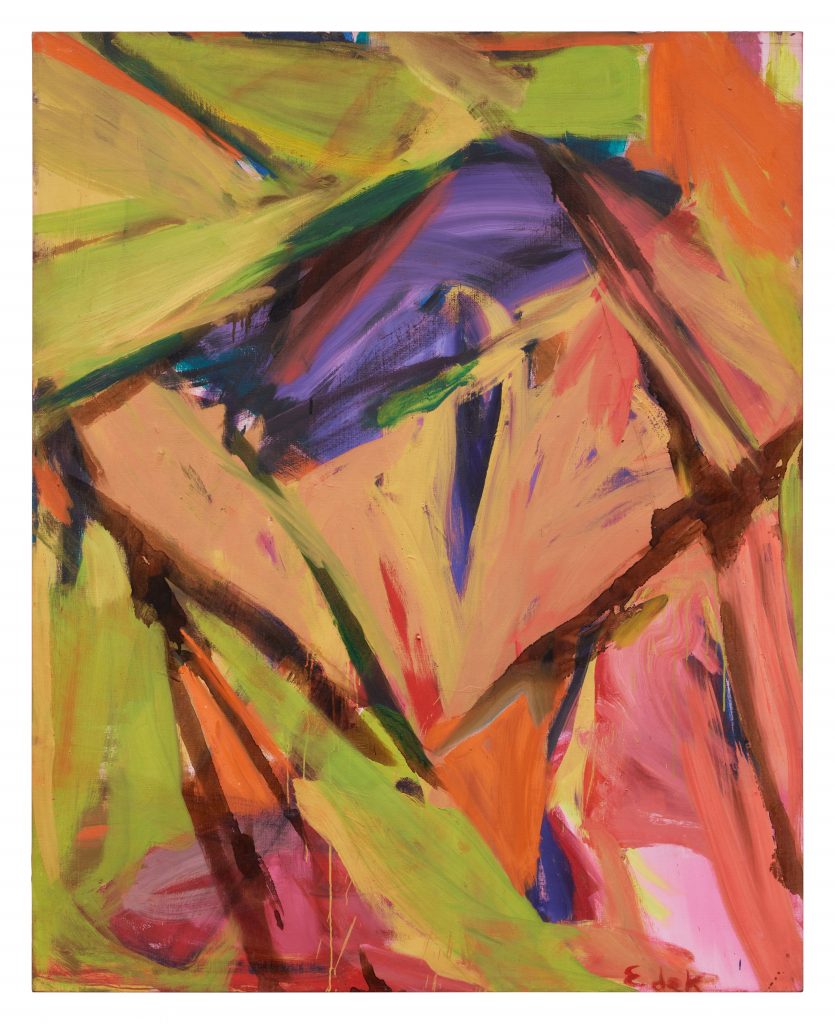

Elaine de Kooning, Charge (1960). Courtesy of Sotheby’s.

Leading off Sotheby’s Modern evening sale, Elaine de Kooning’s previous auction record of $562,000 was pummeled with the sale of Charge (1960) for $1.1 million. Until this season, the abstract expressionist artist has been a mainstay at the day auctions across auction houses, with prices typically coming in at five figures, scarcely six. So if the sale of Charge is any indication, interest in the artist, who is one of the five “Ninth Street Women” of Mary Gabriel’s famous book, is gaining traction. This seven-figure sale doubled her previous market high.

Large Interior, W11 (after Watteau) by Lucian Freud from the Paul G. Allen Collection on October 14, 2022. Photo by Wiktor Szymanowicz/Anadolu Agency via Getty Images.

The collection of Microsoft cofounder Paul G. Allen became the priciest trove ever sold at auction, fetching $1.6 billion over two days and smashing the $1.4 billion high estimate. (We’ll do the math: the average work in the 155-lot collection cost a whopping $10.5 million.) The evening sale alone grossed $1.5 billion, which makes it the richest in Modern auction history.

The previous record-holder, the Linda and Harry Macklowe collection, only managed to keep the title for six months. That collection was sold across two sales that hauled in a combined $922.2 million after fees. (Adjust for inflation, and the premium-inclusive grand total for Macklowe would still “only” hit $971.9 million in today’s dollars.) The landmark sale of the Peggy and David Rockefeller collection—whose evening sales brought in $753 million, or $888.4 million in fall 2022 dollars—also trails behind Allen.

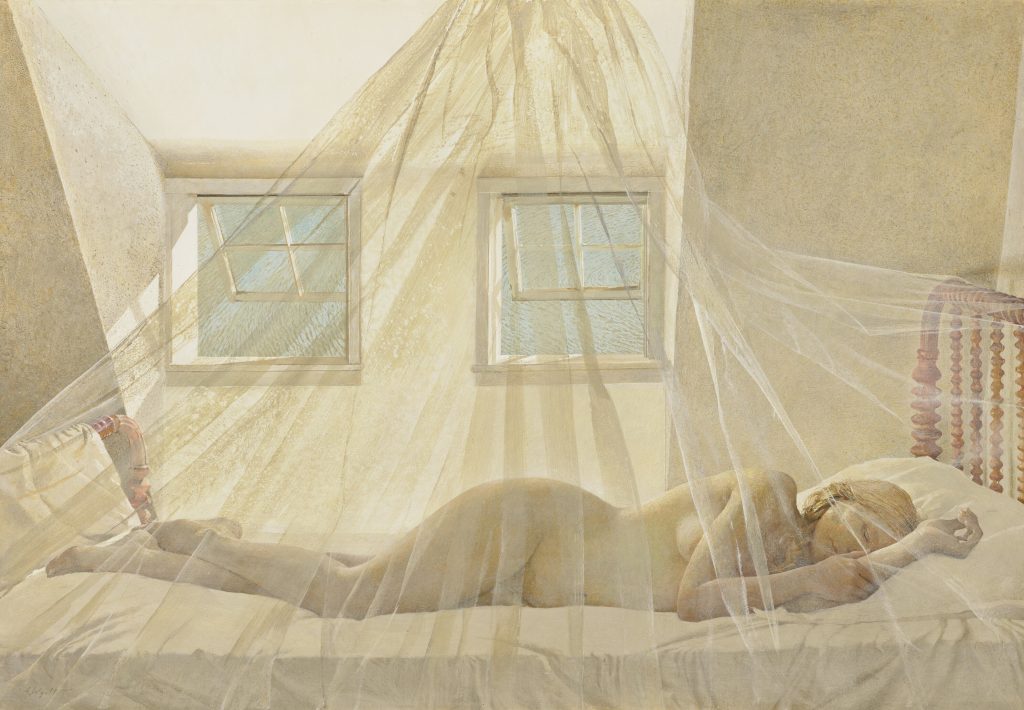

Andrew Wyeth, Day Dream (1980). Photo courtesy of Christie’s Images Ltd.

Andrew Wyeth’s windswept Maine landscapes and solitary figures facing the vastness of nature (like his best-known work Christina’s World) aren’t often found at the glamorous high-stakes auctions. That changed thanks to Paul Allen, whose diaphanous Wyeth Day Dream (1980) was part of the $1.5 billion sale at Christie’s. And boy did it do well! Estimated at $2 million to $3 million, the work drew a flurry of bids, soaring to $23.3 million, more than twice the late artist’s previous auction record of $10.3 million. The winner was a telephone client of Christie’s chairman of West Coast, Ellanor Notides.

Willem de Kooning. Untitled III (1978). Photo: Christie’s Images Ltd.

“And the room?” Auctioneer Jussi Pylkkänen faced the sea of dealers, advisors and collectors at Christie’s Rockefeller Center headquarters on November 17, seeking to elicit a $27-million bid for the star lot of the 20th-century evening sale. The room was silent and motionless. The phone banks were quiet. And so Pylkkänen had to buy in De Kooning’s Unititled III for Christie’s, estimated at more than $35 million and guaranteed by the auction house.

“It wasn’t an A+ painting,” said veteran art dealer Nicolas Maclean. “It was too blurry. Top buyers want top quality.” It was one of 15 works by the AbEx master on offer in New York this week at Christie’s, Sotheby’s, and Phillips. The De Kooning family consigned three works to Sotheby’s and they barely scraped the low estimates. “There were a couple of De Kooning buyers maybe taken out in the past couple of days,” Alex Rotter, Christie’s chairman, said about the flop. “We are very happy to have it. We already received calls for it and we are going to think about it.”

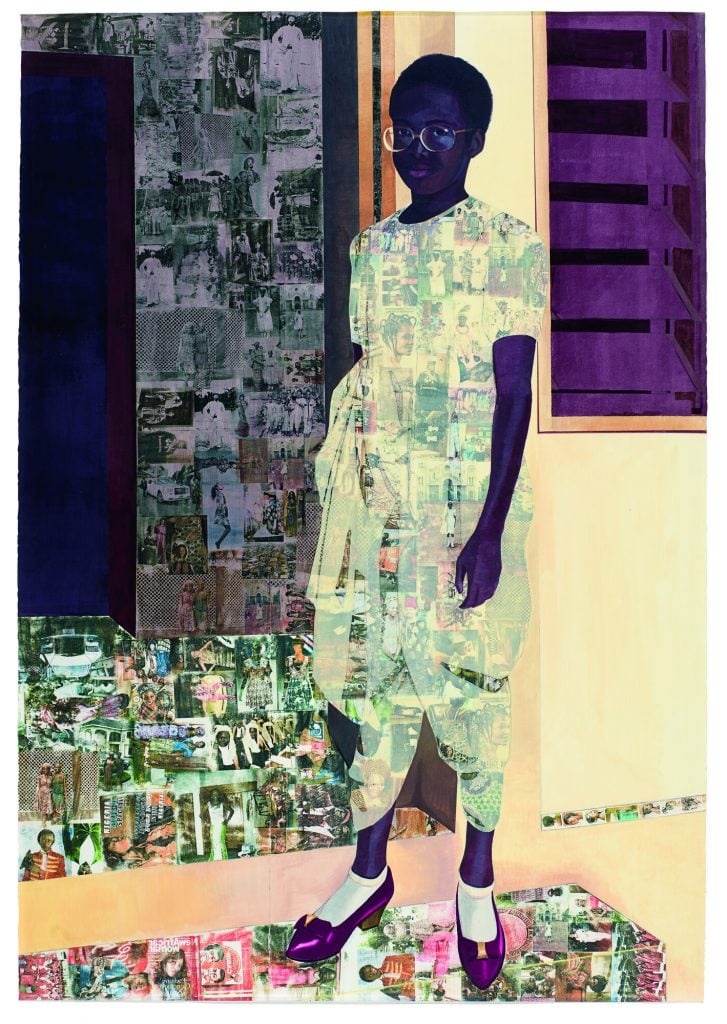

Njideka Akunyili Crosby, The Beautyful Ones (2012). Courtesy of Christie’s.

What kind of investment can bring you a 50 percent return in just five years? Perhaps a work by Njideka Akunyili Crosby. The Nigerian-born Los Angeles-based artist has been a fast-rising star at auctions in recent years. And five years after having her auction record set with her 2012 work The Beautyful Ones, the very same painting set yet another auction record again for the 1983-born artist.

The mixed media painting depicting her sister at the age of 10 was first exhibited in 2013 at Luxembourg’s Zidoun and Bossuyt Gallery, and was sold in 2017 at Christie’s post war and contemporary art evening auction in London just above $3 million. It was back on the market at last week’s Christie’s 21st century evening sale, where the bids began at $3.7 million and after two bids sold for over $4.7 million including fees (closer to the lower end expectation at $4 million, excluding fees but more than a 50 percent increase on the previous high water mark).

Other works sold during the New York sales week with relatively short hold were seen at Sotheby’s contemporary evening sales. They included Georg Baselitz’s Malermund (Painter’s Mouth) (1966), which sold for nearly $1.9 million, and Christopher Wool’s 2000 untitled work, which was on guarantee and fetched nearly $2.3 million. Both were back on the market since 2015.

Alexander Calder, Uprooted Whip (1940). Courtesy Christie’s.

Alexander Calder’s sculpture Uprooted Whip was created in 1940. It was exhibited in 1942 at the Guggenheim Museum in New York when it was still known as the Museum of Non-Objective Painting. Nearly three decades later in 1970 when it was shown at the Perls Galleries in New York, and subsequently sold and has been kept in the collection of Annabelle and David Prager since then.

It has taken 52 years for this work, which is registered with the archives of the Calder Foundation in New York, to come back on the market. The work, under a third-party guarantee, was expected to sell between $3 million and $5 million (excluding fees). The bidding race began at $1.8 million, and it went under the hammer at $2.8 million around two minutes later after around six bids, rounding up a final price of $3.4 million including fees.

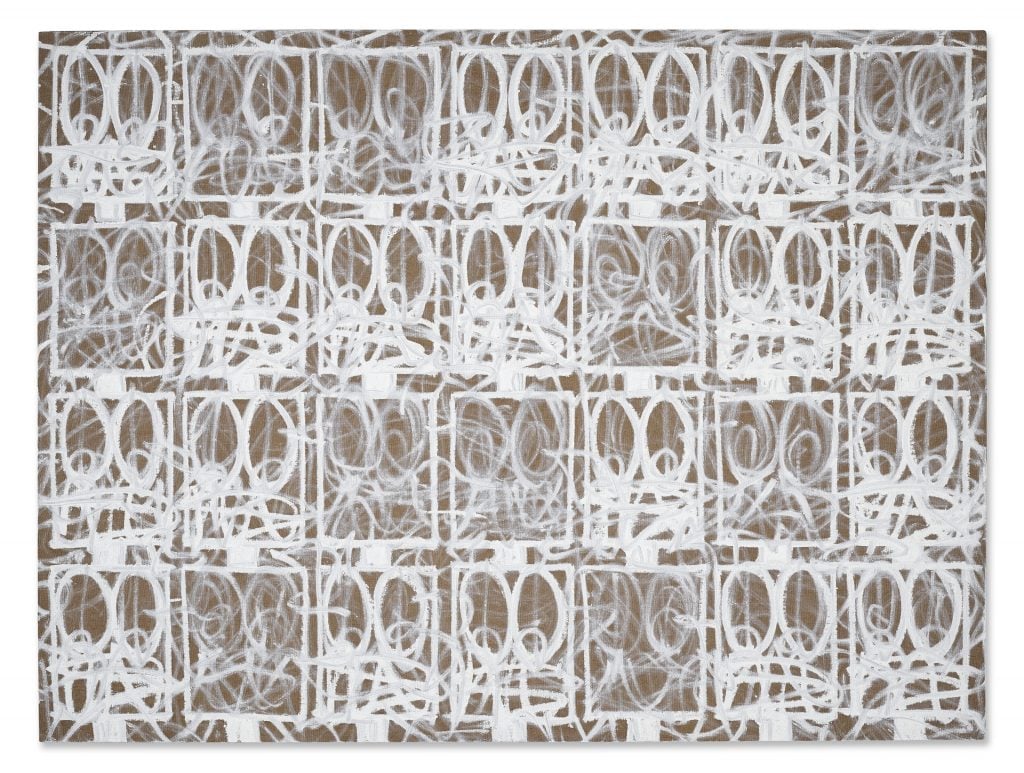

Rashid Johnson, Surrender Painting “Sunshine” (2022). Sold for $3 million. Photo courtesy of Christie’s Images Ltd.

Artist Rashid Johnson consigned a painting from his new series to raise money for The Right of Return Fellowship, cofounded in 2017 to support and mentor formerly incarcerated creatives. Estimated at $600,000 to $800,000, it hammered at $2.5 million (or $3 million after fees were added) to set a new auction record for the star artists. The price was tax-deductible.

“Makes anyone buying one of these works primary market for $975,000 feel quite good,” collector Andrew Reed said in an Instagram post. The artist is represented by Hauser & Wirth.

The “Surrender” paintings are the latest body of work by Johnson, and its loopy iconography comes out of his popular “Anxious Men” series. Here, the artist uses titanium white oil paint (as opposed to red) on raw linen. A cross between Cy Twombly and Richard Pousette-Dart, the paintings conjure “a feeling of redemption and recognition,” according to Johnson. “There’s a simplicity and quiet nature in how these new series relate to collective experiences of the last months.”

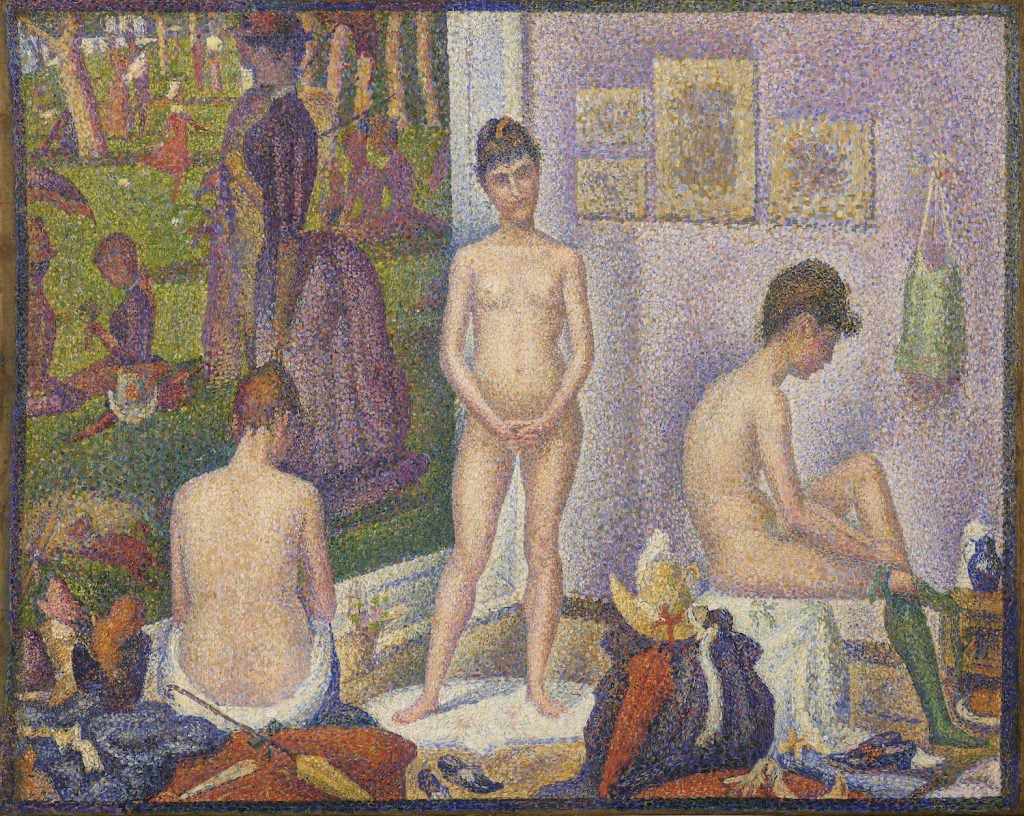

Georges Seurat, Les Poseuses, Ensemble (Petite version) (1888). Image courtesy Christie’s.

There was never any doubt that this work would be one of the top sellers of the fall auction cycle, but its status as numero uno was (unlike the Allen collection as a whole) not guaranteed. Paul Cézanne’s La montagne Sainte-Victoire (1888–90), also in the star-studded sale, had an unpublished estimate in excess of $120 million, one-fifth higher than the $100 million expected of what art-world consensus held to be the greatest Seurat painting still in private hands.

Yet the winning bid for Les Poseuses, Ensemble (Petite version) was $130 million, or $10 million more than the hammer price for the Cézanne. Fees lifted the Pointillist masterwork to $149.2 million, giving Seurat the cash crown in a minor upset. The winner was a client of Xin Li-Cohen, deputy chair of Christie’s Asia—and so far, that’s all we know about the diminutive yet dominant painting’s next home.

Andy Warhol, White Disaster (White Car Crash 19 Times) (1963). Courtesy of Sotheby’s.

Outside of the Allen sale, most of the pieces with November’s loftiest expectations did just enough to avoid embarrassing anyone—but not much more, no matter which auction house or era they came from. Of the five works estimated to sell for at least $35 million, only one hammered above expectations: the untitled Cy Twombly anchoring Phillips’s evening sale. The painting sold on a bid of $36 million, barely over its $35 million presale projection.

Elsewhere, the winning bid came south of expectations for would-be star lots in Sotheby’s contemporary and Modern evening sales, as well as Christie’s 21st century evening auction. In order: Andy Warhol’s White Disaster [White Car Crash 19 Times] (1963), hammered at $74 million, below its estimate “in excess of” $80 million; Piet Mondrian’s Composition No. 2 (1920) hammered at $48 million, a few million less than its expectation of more than $50 million; and Jean-Michel Basquiat’s Sugar Ray Robinson (1982) hammered at $28.2 million, roughly 20 percent below its estimate “in the region of $35 million.”

But hey, at least those works all actually sold. That’s more than we can say for Willem de Kooning’s Untitled III, which passed at $27 million against a $35 million expectation (as detailed above). And as the trophy lots go, so go the auctions as a whole.

Deborah Schmidt Robinson. Courtesy of Art Market Advisors.

During the Paul Allen evening sale, a blonde woman wielding Paddle 282 struck again and again, winning five bidding wars totaling $130 million. She picked up a floral Georgia O’Keeffe, White Rose with Larkspur No. I (1927) for $26.7 million, more than three times its high estimate of $8 million, as well as works by Alexander Calder, David Hockney, Louise Bourgeois, and Jasper Johns.

Robinson is an auction house veteran and a member of Art Market Advisors, a firm formed in 2016 by former-Sotheby’s executives Mitch Zuckerman and Warren Weitman. Robinson joined in 2019. She began her career at Sotheby’s in 1989. Her focus would eventual shift to trusts and estates, rising to become executive director of the group. She has been instrumental in the sale of property from numerous the estates, including those of Alfred H. Barr, Jr. and Brooke Astor. She is a trustee of the Smithsonian’s Archives of American Art, the Greenwich Historical Society, and the Professional Advisory Council of the Metropolitan Museum of Art.

Salman Toor, Four Friends (2019). Courtesy of Sotheby’s.

During the May sales cycle in New York, eight artists aged 40 or younger cracked $1 million on a single lot, including multimillion-dollar results for Christina Quarles ($4.5 million) and Avery Singer ($5.3 million). This fall, however, only one new artist born in 1975 or later (our definition of “ultra-contemporary”) joined the seven-figure club, when Salman Toor’s Four Friends (2019) went for nearly $1.6 million after fees at Sotheby’s Now sale.

That stat nods toward the suddenly uneven landscape of demand for young talent at auction. Yes, two works by María Berrío, one by Anna Weyant, and another by Quarles vaulted comfortably over their high estimates to reach $1.2 million or more after fees. But two other Weyant lots landed within her rumored primary price range of $350,000 to $600,000, and a second Quarles at Christie’s hammered at $480,000, on the lower side of its estimate range.

Other sought-after names fared even worse. One painting each by recent surefire bidding-war starters Amoako Boafo, Nicolas Party, Amy Sherald, and Singer were all won on bids beneath their low expectations. A second Sherald canvas at Phillips failed to sell at all. So while it would be too extreme to say the sky is falling in the category, its high-flyers definitely lost altitude.

Ernest Trova, Manscape (1967). Image courtesy of Sotheby’s.

Did you know you could buy a work at Sotheby’s for less than it costs to take someone out to dinner at a nice restaurant these days? It turns out, you can, if that work is American Surrealist Ernest Trova’s Manscape (1967), a four-inch silver coin of a head in profile. The work—number 17 of an edition of 50—came from the estate of David Solinger, the entertainment attorney and former Whitney Museum president who died in 1996. Solinger had many, many hits in his collection, like works by De Kooning, Giacometti, and Paul Klee that shattered their estimates in the evening sale. But not everything he owned was a market-maker. The Troya—one of several works by the artist on offer—hammered at $300, well under its $1,000 low estimate.

© Christie’s Images Limited 2022.

It was an odd switcheroo. About half way through the Allen sale, Adrien Meyer, who had just hammered down masterpieces by Seurat, Cézanne, and Gauguin for record prices, put down his gavel, stepped off the rostrum, and joined the telephone banks of Christie’s specialists. A wave of surprise rippled through the room. In short order, Meyer was replaced by Jussi Pylkkänen, the top auctioneer, who had taken the sales of Rockefeller and Da Vinci, among many others. Pylkkänen arrived just in time: within a couple of lots the auction house passed the $1 billion mark and went on to hand another $500,000 to wrap up the historic sale. Apparently, this kind of a switch has been happening at Christie’s other long sales (with 50 lots or more), including, most recently, the Getty sale. But the big evening auctions so far have been immune. Not any more.