Auctions

Phillips’s Contemporary Sale Takes in a Respectable $132 Million, Despite Big-Ticket Stumbles From German Artists

The sale set world auction records for Robert Motherwell, Pat Steir, and Cory Arcangel.

The sale set world auction records for Robert Motherwell, Pat Steir, and Cory Arcangel.

Henri Neuendorf

After setting an all-time house record with its $135 million sale in London this past March, Phillips was poised to build on its upward trajectory in New York on Thursday. But despite a solid $131.6 million total—a 20 percent increase on the previous year—the result of the evening’s 20th Century and Contemporary Art auction ended up being more of a case of what could have been.

The atmosphere in the room was optimistic from the get-go. Just before the sale, Phillips’s deputy chairman for the Americas, Jean-Paul Engelen, compared the auction house to a specialty shop on Fifth Avenue and likened competitors Christie’s and Sotheby’s to Barney’s and Bloomingdale’s. “We’re a work in progress” he conceded, “but we’re feeling good and we’re optimistic.”

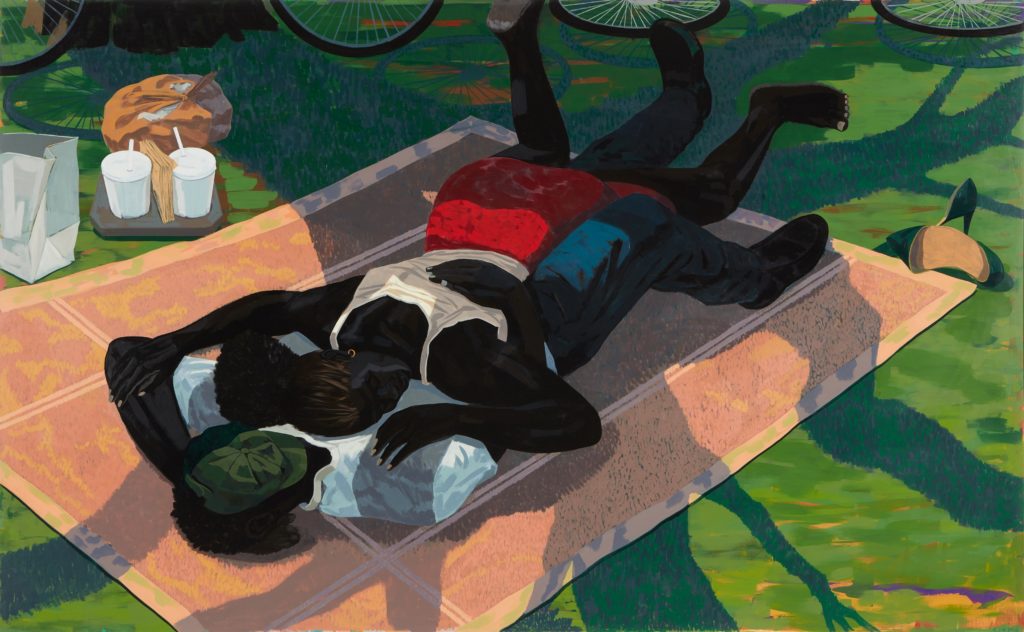

Robert Motherwell, At Five in the Afternoon (1971). Photo courtesy of Phillips.

That mood was quickly dampened when auctioneer Henry Highly announced a number of high-profile withdrawals, including Sigmar Polke’s Köchin (2005) (est. $4-6 million), David Hammons’s Untitled (Hidden from View) (2002) (est. $700,000-900,000), and Zeng Fanzhi’s Mask Series (1999) (est. $3.2-4.2 million). Adjusted for these withdrawals, the overall presale estimate was $110-162 million.

Nevertheless, things got off to a roaring start. On just the second lot, the house set a world auction record—the first of three—for Cory Arcangel, whose 2011 print of a Photoshop color gradient sold for $399,000, double its pre-sale high estimate. Another world record followed directly after for Pat Steir’s Elective Affinity Waterfall (1992), which sold for $2.3 million, well above its high pre-sale estimate of $800,000.

Gerhard Richter, Abstraktes Bild (811-2) (1994). Photo courtesy of Phillips.

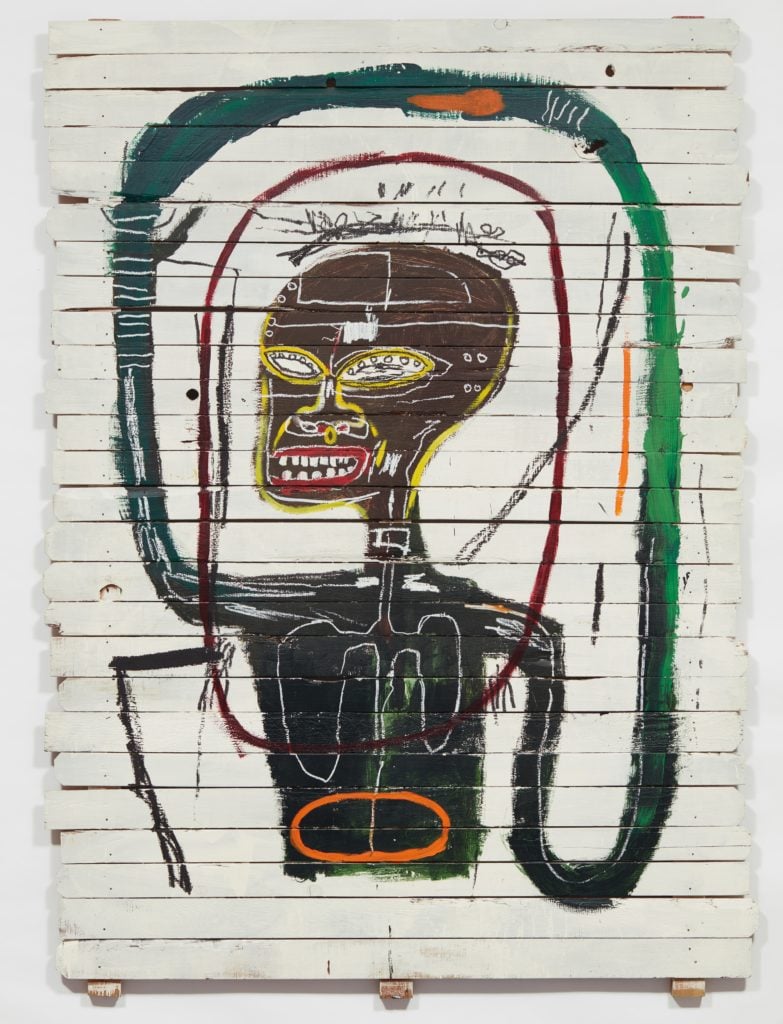

A sensational Basquiat work, consigned directly from the artist’s estate and described by Engelen before the auction as “probably the best painting the estate had left,” followed as the top lot of the night. Almost as soon as the auctioneer opened bidding at $15 million, a buyer in the room shouted “$30 million!”—easily surpassing the pre-sale estimate of $20 million. The painting eventually sold for $45.3 million to a phone buyer.

Robert Motherwell’s 1971 painting At Five in the Afternoon needed only to surpass its low pre-sale estimate of $12 million to set a new record for the artist (which previously stood at $3.6 million). The large-scale painting sold for $12.7 million. “Setting a new world record for Motherwell was very special,” Phillips chairman Cheyenne Westphal said at the post-sale press conference. “We really lifted him into a new price category that we firmly believe his work should be at.”

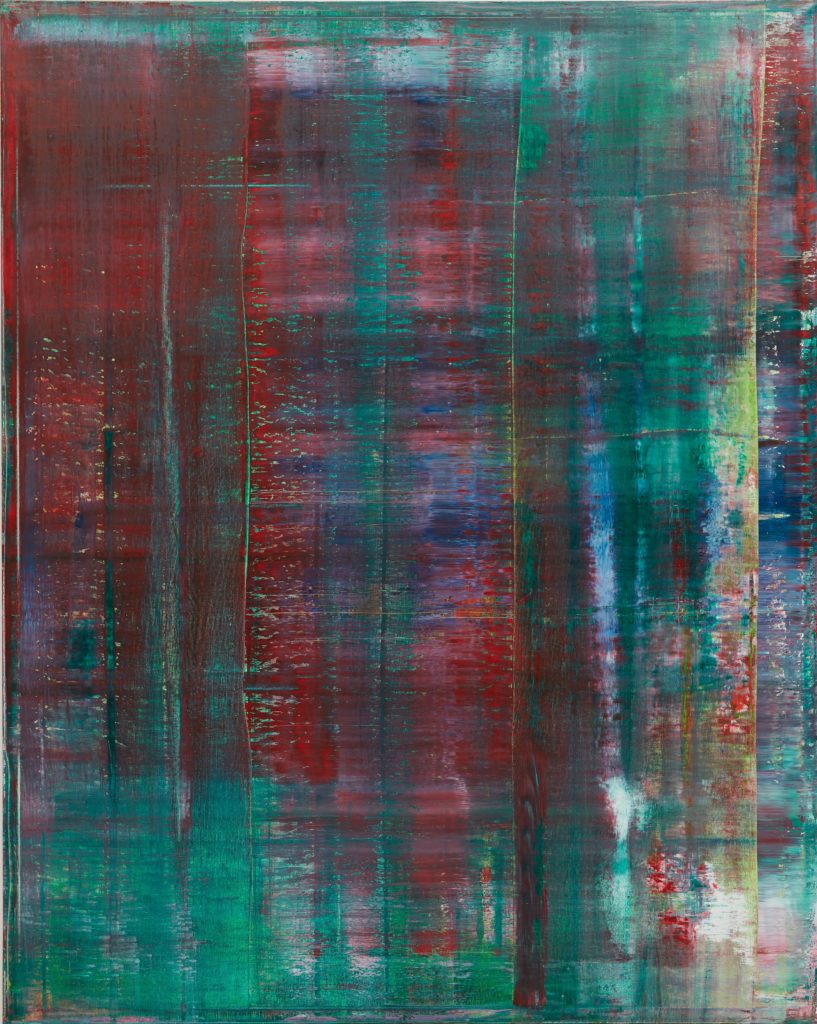

Buoyed by a $21.1 million record set earlier this week at Sotheby’s, Kerry James Marshall’s Untitled (Blanket Couple) (2014) sold for $4.3 million, the seventh-highest selling lot of the night.

Kerry James Marshall, Untitled (Blanket Couple (2014). Photo courtesy of Phillips.

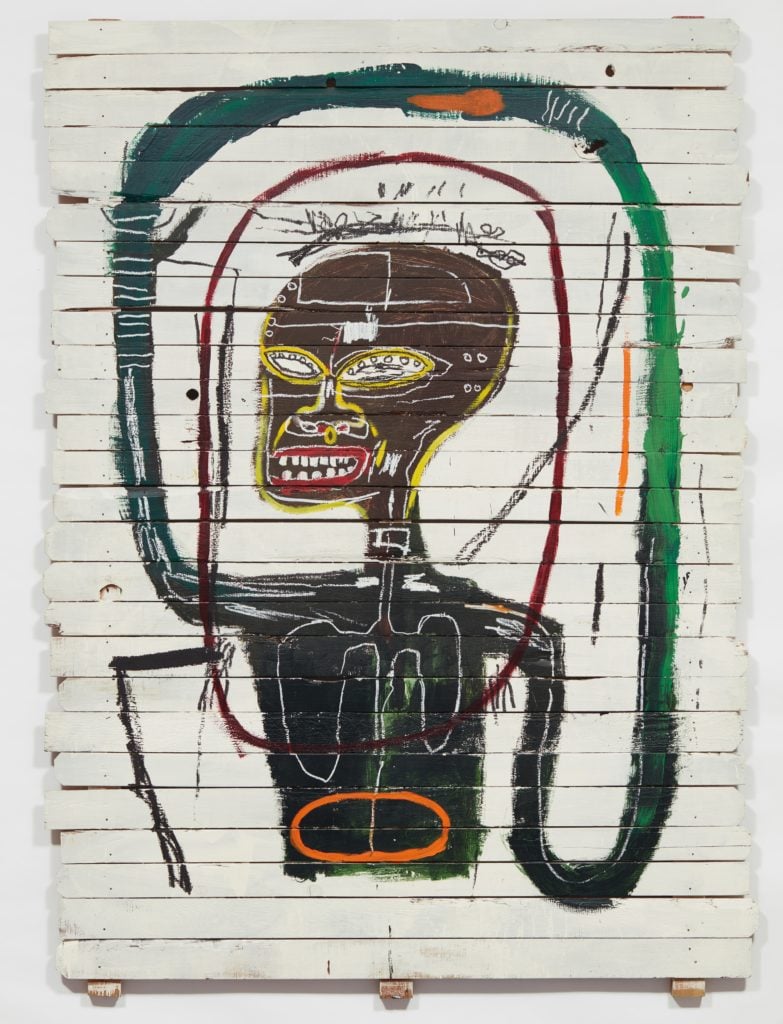

Phillips faltered, however, when it came to typically high-priced German artists. Two lots which shared the second-highest estimates ahead of the sale, Gerhard Richter’s Abstraktes Bild (811-2) and Sigmar Polke’s Stadtbild II (1968), failed to sell. (So did Luc Tuymans’s Model (2012) at an estimated $400,000-600,000.)

“It was not the best night for German art,” Westphal said. “We were sad not to see the Polkes sell [the other was withdrawn]. It’s an extraordinary painting, but maybe it wasn’t the right moment or price point. For Richter we saw a great price for the early painting, but the late abstract work didn’t find a buyer tonight.”

Sigmar Polke, Stadtbild II (1968). Photo courtesy of Phillips.

“I was surprised to see that the [abstract] Richter did not sell—the estimate certainly seemed reasonable, but the Polke seemed aggressively over-estimated for the scale and subject matter,” said art advisor Todd Levin in an email to artnet News.

“I think the market has followed the classic auction rule,” said Ed Dolman, who has been making strides at Phillips since becoming CEO in 2014, in his closing remarks. “Well-priced, fresh material is going to do well and there’s been no shortage of that. So I don’t think there’s anything wrong with the market at all. It’s just that we had a couple of Germans above $10 million that didn’t do so well.”