Auctions

Despite Talk of a Boycott of the Russian-Owned Auction House, Phillips Cruises to a Solid $40 Million Evening Sale in London

The overall results were strong, especially considering challenges in the lead-up to the auction.

The overall results were strong, especially considering challenges in the lead-up to the auction.

Eileen Kinsella

Phillips pulled off what can only be described as an incredible feat in London today, March 3, landing a £30 million ($40 million) modern and contemporary art evening sale amid public talk of a possible boycott of the Russian-owned auction house.

Arguably the biggest story of the sale emerged before the auction even started, when Phillips announced it would donate the full net proceeds of its buyers’ and sellers’ premiums to the Ukrainian Red Cross Society.

The shrewd decision was made quickly and decisively after some in the industry, including former Bonhams head Matthew Girling, said it would be unwise to work with the rival company.

In the end, Phillips raised $7.7 million for the Red Cross.

“Before I turn to our sale results,” Phillips CEO Stephen Brooks said following the auction, “I think it’s important to recognize the unusual and frankly tragic events that have been happening this week. Witnessing the horrific scenes in Ukraine, I made a very clear statement earlier this week about our condemnation of the invasion of Ukraine. Tonight we have done something very practical.”

Notwithstanding the 11th hour withdrawal of five lots, including a Glenn Ligon pulled from the sale after it had already started, the auction was an clear success, with intense bidding for works by emerging artists, traditionally a strong niche for Phillips.

It also included solid, if less heated, bidding for works by established blue-chip masters such as John Chamberlain, David Hockney, Francis Bacon, and Claude Monet.

In total, 39, or 95 percent of the 41 lots on offer, sold. The sales total figured squarely within the sale’s revised lower estimate (taking into account the withdrawn lots) of £24.4 million to £35.3 million ($32 million to $47 million). By comparison, expectations were about £5 million higher (£29 million to £42 million) before the five works were pulled.

Eight artworks, or about 20 percent of the total lots, were backed by third-party guarantees, including two negotiated in the final day before the sale, indicating that buyers were looking to strike deals as the auction house looked for added insurance amid a backdrop of uncertainty.

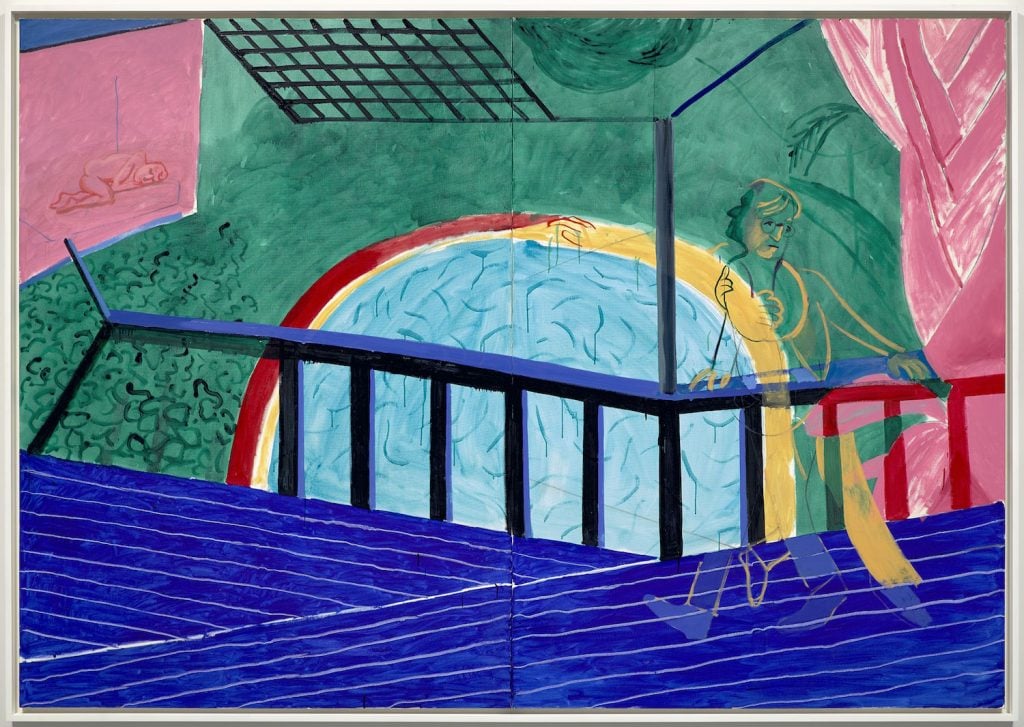

David Hockney, Self-Portrait on the Terrace (1984). Image courtesy Phillips.

The highest price of the sale was the £4.9 million ($6.5 million) achieved for David Hockney’s 1984 diptych Self-Portrait on the Terrace, which sold for just under its low £4 million ($5.3 million) estimate, with a hammer price of £3.9 million on a few bids. (Final prices include fees; pre-sale estimates do not.)

Bidding was significantly more muted for a 1992 abstract painting by Hockney’s contemporary, Gerhard Richter, which failed to sell after getting nowhere near its low £1.6 million ($2 million) estimate.

But the real excitement—as ever at Phillips—was for works by highly sought-after young art stars and their emerging counterparts.

British painter Cecily Brown’s When Time Ran Out (2016) hit the second-highest price point of the night, landing at £3.2 million ($4.3 million) after energetic bidding. The same collector who won the lot through Phillips deputy chair Svetlana Marich also snapped up Shara Hughes’s Crooked (2017) at £627,500 just before. That work shattered its high £250,000 estimate.

A few lots earlier, the very same client of Marich’s won Issy Wood’s painting Chalet (2019), which set a new auction record for the artist when it sold for £441,000 ($588,000) compared with a high estimate of £150,000 ($200,000).

Cecily Brown, When Time Ran Out (2016). Image courtesy Phillips.

One of the most rousing battles of the night was over Jadé Fadojutimi’s painting My Blanket has a possessive nature (2018).

Its winner fought off competition from at least three bidders, including online collectors vying for the work from Hong Kong and Germany. The winner eventually captured the picture for £529,200 ($705,000), nearly triple the high £180,000 estimate ($240,000).

Later in the sale, the same paddle number won John Chamberlain’s 2000 sculpture Snatching Bookie Bob, which sold for £346,500 ($462,000) against a high estimate of £200,000 ($267,000).

Shara Hughes, Crooked (2017). Image courtesy Phillips.

Both Brown and Fadojoutimi had two works apiece in the sale, each of which sparked intense competition to push the lots well above the highest published expectations.

“Online and phone bidding from Asia was particularly strong throughout the sale,” said Olivia Thornton, head of 20th-century and contemporary art at Phillips. “And we had a host of young women artists” for whom prices were solid, she said. The “boom for figurative artists,” she added, was reflected in high prices for pictures by Cinga Samson (£304,416), Kwesi Botchway (£138,600), and Tschabalala Self (£138,600).

Yet there are limits. The estimate on a 2015 painting by highly sought-after Swiss figurative artist Nicolas Party, Houses, felt a bit aggressive at £1.1 million to £1.5 million, and the work carried a third-party guarantee. It was quickly hammered down to a Phillips specialist bidding for a client for £1.2 million ($1.6 million).

Nicolas Party, Houses (2015). Image courtesy Phillips.

At the post-sale press conference, Phillips global chairman Cheyenne Westphal said the main story of the night was “a British one,” noting the results for Brown, Hockney, and Hurvin Anderson, whose Untitled (Handsworth Park) (1998) sold to one of her clients over the phone for £1.3 million ($1.7 million).

Asked about the withdrawn lots, Westphal chalked it up to diminished interest.

“There were certain works we felt we just couldn’t get the market to focus on in a way that would lead to a successful sale,” she said. “In those cases, we advised [clients] to withdraw the works.”

Brooks also fielded a question from a reporter as to whether Phillips was keeping its eye on lists of Russians whose assets might be frozen.

“We don’t transact with any individuals who are subject to sanctions,” he said, adding that the auction house had an “extensive compliance process” in place.

The reporter also asked if the auction house got any requests from consignors that their works not sell to Russian buyers out of fears they wouldn’t be able to pay.

“No,” Brooks answered. “I didn’t receive any of those.”