The Hammer

Simon de Pury Reveals the 14 Factors That Bestow Value on a Work of Art

The veteran auctioneer puts this priceless wisdom to paper for the first time ever.

The veteran auctioneer puts this priceless wisdom to paper for the first time ever.

Simon de Pury

Every month in The Hammer, art-industry veteran Simon de Pury lifts the curtain on his life as the ultimate art-world insider, his brushes with celebrity, and his invaluable insight into the inner workings of the art market.

When I started in the art world, what feels like a century ago, the market was dominated by a small constituency of passionate collectors. When I explained my profession to bankers, the reaction was invariably one of slight condescension.

Of course, things have changed over the years, and today most financial institutions consider art as an alternative asset class. The main reason for the skepticism of financial advisors was that the decision-making of collectors was seen as being highly subjective and purely emotional. They were right in that assessment since love, passion, and emotion are most certainly key factors in our fascination and yearning for art. They are why I chose this profession, and what motivate me every single day.

Even if you are the most passionate collector, if you spend a lot of money acquiring works of art, you will derive zero pleasure if the financial value of your acquisitions substantially diminishes over time. Prior to making a purchasing decision, you therefore need to do your due diligence.

I have put together a list of 14 criteria that convey financial value to a work of art. While the first point is emotional, all other points are actually rational. An investment-minded buyer or seller may therefore wish to see how a potential acquisition fares against each point. I have mentioned these in conferences over the years but I have never put them in writing before.

1. Emotion

Simon de Pury and Sarah Ferguson, Duchess of York Simon de Pury speak on stage during the amfAR Cannes Gala 30th edition presented by Chopard And Red Sea International Film Festivalat Hotel du Cap-Eden-Roc on May 23, 2024 in Cap d’Antibes, France. Photo by Andreas Rentz/Getty Images for amfAR.

Works of art like us humans exude their own energy. Every now and then we are madly attracted to a painting, sculpture or object and are in turmoil until our relentless pursuit is rewarded—provided the work of art does not belong to a museum. The appeal is of course entirely in the eye of the beholder and totally subjective.

2. Quality

A visitor looks at a painting included in “Pierre Auguste Renoir, the Promenade” at Magnani Rocca Foundation on September 13, 2024 in Parma, Italy. Photo by Roberto Serra – Iguana Press/Getty Images.

Even the greatest artists have good days and bad days. Therefore, there can be considerable differences in quality and hence value between various works in the oeuvre of the same artist. For instance, besides his enchanting best works that count among the masterworks of Impressionism, Pierre Auguste Renoir has produced many fairly mediocre works. During the 1980’s prices for his works were climbing irrespective of their relative quality. This brought about a rude awakening for some purchasers. Therefore, buy with your eyes and not with your ears!

3. Authenticity

The Museum of Fine Arts Boston has undertaken a year long process to restore two portraits by Rembrandt van Rijn, the “Portrait of a Woman with a Gold Chain” (1634) and the “Portrait of a Man Wearing a Black Hat” (1634) both of which were added to the museum’s collection in 1893. Rhona MacBeth, the Eijk and Rose-Marie van Otterloo Conservator of paintings and Head of Paintings Conservation at the MFA, works to restore both portraits, cleaning the surfaces to reveal the quality and detailed brushwork for the first time in a generation on March 9, 2018 in Boston, Massachusetts. Photo by Paul Marotta/Getty Images.

A work that turns out to be a fake has evidently zero financial value. Do your due diligence! Check the conditions of sale. You are protected by these when you buy from the top auction houses or galleries but only for a certain duration of time. Even the most reputable firms or individuals can make mistakes. Among the hundreds of thousands of works that are being sold by these leading firms only an infinitesimally small amount turn out to be forgeries. Watch Made You Look: A True Story About Fake Art, the 2020 Netflix documentary is a chilling story of how this can happen.

4. Rarity

American Pop artist Andy Warhol sits in front of several paintings in his ‘Endangered Species’ at his studio, the Factory, in Union Square, New York, New York, April 12, 1983. Photo by Brownie Harris/Corbis via Getty Images.

For a real market to develop, the output of an artist must neither be too scarce nor must the market be flooded by it. It is interesting to note that Picasso and Warhol have now been amongst the very best selling artists of the international art market for several decades. If you told me that you would like to acquire a work by either of these artists not now but in a year’s time, I could safely tell you that such works will be available on the open market then. While there is a sufficient supply of works by these towering figures, there is enough variety in their artistic journey that you can collect them in depth. If the totality of a painter’s work during their career is nearly identical with no variety and little trace of evolution, it is not a positive factor.

5. Conservation

Giovanni Antonio Canal, called Canaletto, Venice, a pair of views: The Churches of the Redentore and San Giacomo; The Prisons and the Bridge of Sighs, (Estimate: 2,500,000 – 3,500,000 GBP) at Sotheby’s on June 28, 2024 in London, England. Photo by Tristan Fewings/Getty Images for Sotheby’s.

Art, when truly great, is timeless. But even works of art are not immune to aging and physical alteration. Whether we are curators, dealers or collectors it is our responsibility to take proper care of the works that are entrusted to us so that they can outlive us in the best possible conditions.

A work in pristine condition will generally be more valuable than one that deteriorates over time. Often the true physical condition of an artwork can not be judged by the naked eye. It is therefore essential to ask for a condition report done by a professional conservator to be provided by the auction house or gallery selling an artwork.

6. Size

Gallery assistants look at a painting titled And willingly imprinting the memory of my mistakes (2023) by Jade Fadojutimi during a photocall for the new exhibition “To Bend the Ear of the Outer World: Conversations on contemporary abstract painting” at Gagosian in London, United Kingdom on June 01, 2023. Photo: Wiktor Szymanowicz/Future Publishing via Getty Images.

The art market is one of the few areas where a bigger size is not better. Many artists have this urge to make ever larger works. Unless you own a palace or a chateau with very high ceilings, you will not be able to live with your acquisition if the height exceeds 3 meters. Length is also problematic unless the work consists of several panels. If you can’t install your purchase in your home, you will incur substantial storage and shipping costs.

7. Provenance

American art collector Peggy Guggenheim (1898 – 1979) standing in front of a Picasso painting ‘On The Beach’ at the Peggy Guggenheim museum, Venice, Italy. Photo by Tony Vaccaro/Hulton Archive/Getty Images.

Each work of art has a life of its own and a story to tell. Its history is a bit like a curriculum vitae for us humans. While it doesn’t change anything in the physical appearance of a painting, sculpture or object, the identity of the previous owners can have a non negligible impact on it’s financial value.

The less the intrinsic monetary value is of an artwork, the bigger the multiplying factor due to a prestigious provenance. The astronomical prices achieved for Andy Warhol’s cookie jars or the Duke of Windsor’s cufflinks are a demonstration of this phenomenon.

8. Taste

Louis Vuitton Debuts Charlotte Perriand’s ‘La Maison Au Bord De L’Eau’ at The Raleigh on December 3, 2013 in Miami, Florida. Photo by Rodrigo Varela/Getty Images for Louis Vuitton.

Taste is constantly evolving. What we find to be most desirable today is completely different from what it was 50 years ago and definitely not what it will be fifty years from now. When I started in the business most high-net-worth individuals were buying 18th century French ormolu mounted furniture to go with their Impressionist and post-Impressionist works. Today’s super wealthy hang their post-war paintings above French 1950’s furniture by people like Royère, Prouvé or Perriand. In contemporary art there is an acceleration of change of taste. From an investment perspective you ignore the evolution of taste at your own peril.

9. Tastemakers

Visionary musician, dancer and artist FKA Twigs unveils a major new work of art, ‘The Eleven’ at Sotheby’s on September 13, 2024 in London, England. Photo by Tristan Fewings/Getty Images for Sotheby’s.

Top gallery owners are unquestionably tastemakers. The creators of more than half of all contemporary artworks being sold at Sotheby’s, Christie’s and Phillips are represented by Gagosian. This makes Larry Gagosian the pope of taste in the art world.

Often key influencers of taste are not directly in the art market. Charles Saatchi, Pharrell Williams, Benedikt Taschen or K-pop star Choi Seung-hyun better known as T.O.P are all tastemakers. Bernard Arnault, Founder, Chairman, and CEO of LVMH heads a marketing machine that dwarfs anything that art market professionals can do. That makes him the god of taste in the world.

10. Market Makers

Adrian Cheng and Her Excellency Sheikha Al-Mayassa bint Hamad bin Khalifa Al Thani attend the opening night of City as Studio at K11 MUSEA on March 19, 2023 in Hong Kong, China. Photo by Keith Tsuji/Getty Images for K11.

Whoever spends the most in any given field becomes a market maker. The biggest cultural projects of the 21st century are all taking place in the Middle East. Sheikha Al-Mayassa bint Hamad Al Thani heads Quatar’s phenomenal drive in that area. Her influence is comparable to that of historical figures like Catherine the Great of Russia.

The rulers of Abu Dhabi and Saudi Arabia have the vision, means and determination to at least equal or top these collections. As a result, the region will become a must destination for art lovers for hundreds of years to come.

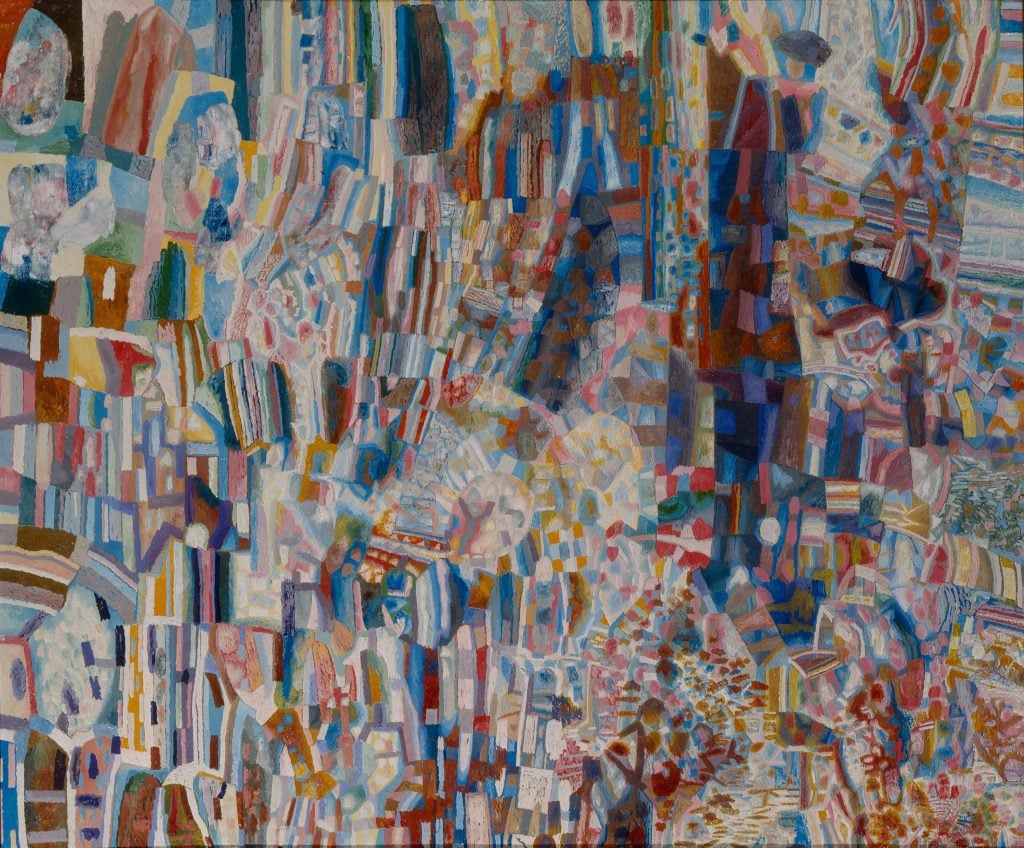

11. Local, National, Continental or Global Market

Composition (1928-1929), From the collection of the State Russian Museum, St. Petersburg. Photo by Fine Art Images/Heritage Images/Getty Images.

Early on, galleries determine the size and geographical span of the future markets for the emerging artists they represent. The temptation can be great to sell all works to a local clientele. Right from the start however, strategic selling to buyers from different parts of the globe is essential.

Consider these Swiss and Russian examples: Alberto Giacometti’s work is represented in top institutional and private collections all over the world. His very best works sell in excess of $100 million per piece. The vast majority of works by Ferdinand Hodler, a Swiss contemporary of Gustav Klimt or Egon Schiele are located in Switzerland. His very best works sell around $10 million. His price level and notoriety will never compete with an artist whose works have a wide global spread. The Russia-born Marc Chagall is a household name in the art world, whereas the equally brilliant Pavel Filonov is only known to a small group of connoisseurs, since most of his works are located in the Russian Museum of St. Petersburg and at the Tretyakov Gallery in Moscow.

12. Legislation

Gallery assistants Pablo Picasso’s Femme au beret et a la robe quadrillee (Marie-Therese Walter) estimated to fetch $50 at Sotheby’s London. Photo by DANIEL LEAL/AFP via Getty Images.

Some countries such as Italy, Spain, or France have restrictive legislation. If a work is declared as a national treasure that cannot be exported, it instantly loses a massive percentage of its value. It comes awfully close to nationalization or confiscation of private property.

13. Marketing

Simon de Pury and Marina Abramovic attend the Moco Museum London Inaugural Gala in London, England. Photo by Dave Benett/Getty Images for Moco Museum.

When I started out in the art market, I naively assumed that an outstanding masterpiece didn’t need any marketing at all and that its quality would ensure it reached a record price. The more buying power a person or institution has, the more they are being solicited from left, right and center. It is therefore only marketing, both personalized and general, which will ensure that a top potential buyer is, if not in the auction room, at least at a computer terminal or the end of a telephone line.

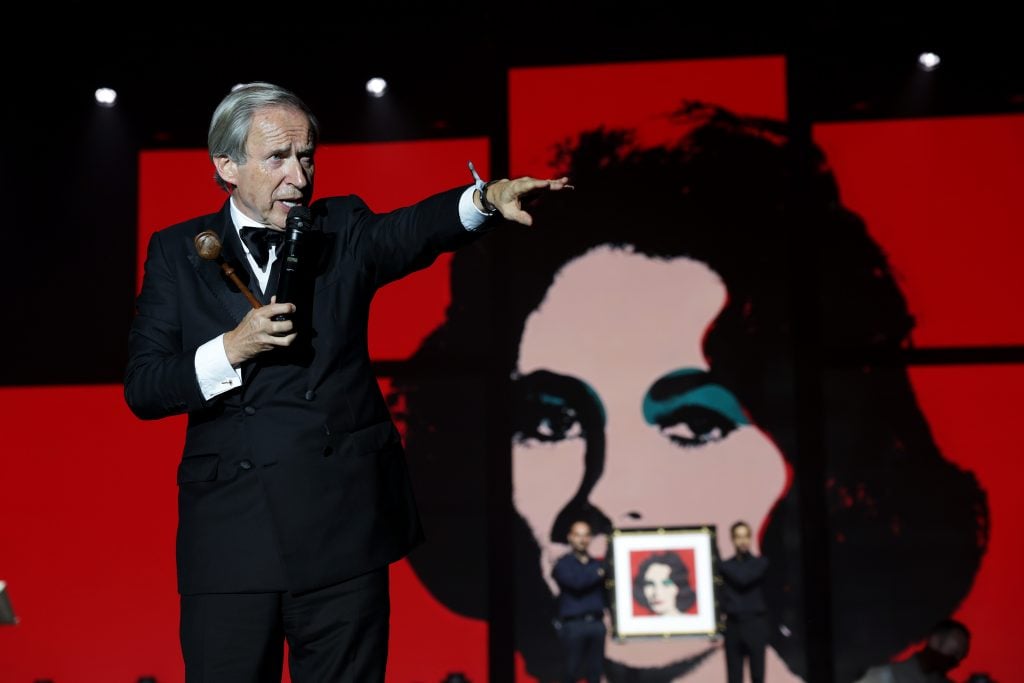

14. Auctioneer

Simon de Pury onstage at the amfAR Cannes Gala in front of an artwork by Andy Warhol. Photo by Kennedy Pollard/amfAR/Getty Images for amfAR.

While this can not be proven I am convinced that if the same work was sold by three different auctioneers, i.e., not different auction companies but three different individuals wielding the hammer you would obtain three different prices. Auctioneers like artists have good days and bad days. On a good day a good auctioneer will be able to extract at least one extra bid beyond the mental ceiling that each bidder had fixed for themselves.

Simon de Pury is the founder of de PURY, former chairman and chief auctioneer of Phillips de Pury & Company, former Europe chairman and chief auctioneer of Sotheby’s, and former curator of the Thyssen-Bornemisza Collection. He is an auctioneer, curator, private dealer, art advisor, photographer, and DJ. Instagram: @simondepury.