Auctions

Top Auction Houses Saw Total Sales Drop in 2020—But Sotheby’s Outpaced Rival Christie’s With $5 Billion in Revenue

Private sales, online sales, and demand from Asia are driving growth.

Private sales, online sales, and demand from Asia are driving growth.

Eileen Kinsella

There is almost no way that major auction houses would not see a significant drop in auction sales in 2020 given that traditional live auctions were suspended for a full nine months (not to mention the fact that the entire world was experiencing unprecedented upheaval).

Considering this backdrop, then, Sotheby’s and Christie’s final results for 2020 depict a fairly resilient sector—although perhaps not quite as resilient as they might like to project. Since both houses are now private companies, their true profit margins remain unknown.

For the first time in recent memory, Sotheby’s beat out Christie’s. The house announced total sales of over $5 billion (along with the caveat that it had several major auctions left before the end of the calendar year). The total represents a drop of $800 million, or 16 percent, from its combined $5.8 billion total in 2019.

Christie’s, meanwhile, reported total sales of $4.4 billion, which it said marked a 25 percent drop from the previous year, attributed chiefly to the decrease in live auctions and a shutdown-induced shock of supply.

Beyond the headline figures, however, the shifting totals reveal notable trends. Just as, for many companies, a hybrid work-from-home model is likely to stay in place long after a vaccine arrives, the auction market may retain its shift toward private and online sales well after 2020 recedes from view.

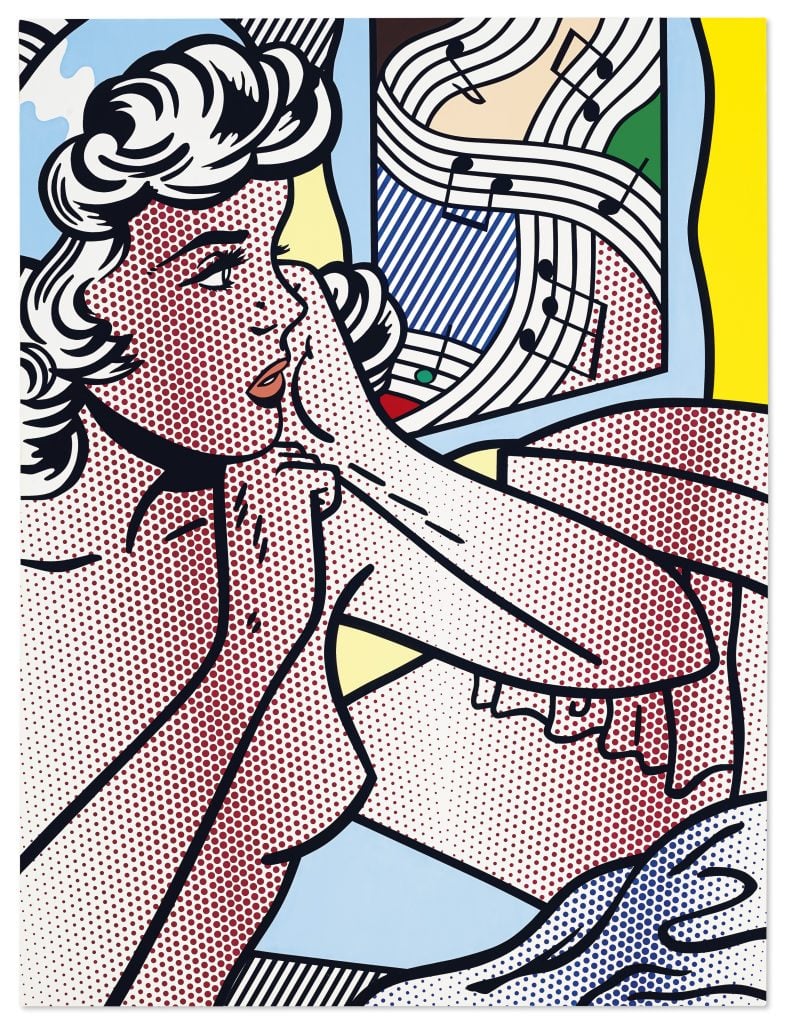

Roy Lichtenstein, Nude with Joyous Painting (1994). Courtesy of Christie’s Images, Ltd.

Both houses reported meaningful dips in auction revenue in 2020. Sotheby’s said live or online auctions accounted for $3.5 billion of its total revenue—a nearly 30 percent drop from $4.8 billion in 2019. Christie’s reported live auction sales of $2.8 billion, a more than 40 percent drop from last year’s $4.9 billion total.

Both houses’ shortfalls are likely largely due to a reduction in high-priced lots. Just two works sold for over $25 million at auction this year, compared to nine in 2019.

But a lot of action was happening behind closed doors. Christie’s said it sold more works over $25 million privately than publicly, and both houses reported record highs for private sales.

Sotheby’s posted $1.5 billion in private sales, an increase of 50 percent from last year’s billion-dollar total. Christie’s tallied $1.3 billion in the segment for 2020, a 57 percent increase from 2019.

Auction-house specialists handling private sales told Artnet News they were busier than ever—one executive estimated an average of one deal per day—and also that fears of fire-sale prices never came to pass.

The auction business also benefitted from the absence of top art fairs, which often pose competition for top material. Meanwhile, a desire for discretion helped to move the action away from live auctions. (Although billionaires largely consolidated their wealth in 2020, few people want to be seen dropping eight figures during a recession.)

In October, Sotheby’s conducted an unusual “sealed bid” process to sell a Giacometti sculpture, reportedly from the collection of Ron Perelman, with a minimum asking price of $90 million. (The Revlon executive’s widespread art-offloading was a godsend for the houses this year.)

And Sotheby’s and Christie’s continued to chase the money literally, by following wealthy buyers to the places they fled during lockdown: the Eastern End of Long Island and ritzy Palm Beach.

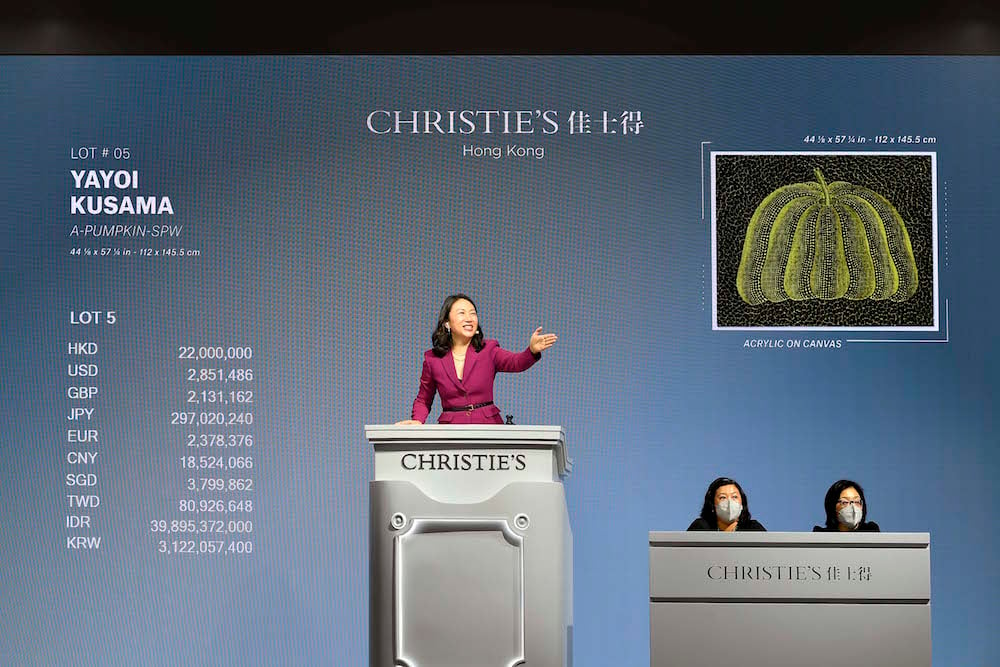

Elain Kwok on the rostrum during the Hong Kong portion of Christie’s December 2 relay sale. Image courtesy Christie’s.

Both houses—along with much of the rest of the industry—also raced to transition sales online after lockdown set in.

Sotheby’s, the traditional house that arguably did the most work in recent years to shore up its online infrastructure, said over 70 percent of its auctions were held online in 2020, up from 30 percent last year. Thanks to new web and mobile products, 80 percent of all bids were placed online. What’s more, over 40 percent of bidders in online auctions were new to Sotheby’s.

Not surprisingly, Christie’s also posted a record total for digital sales: $311 million, up 262 percent from 2019.

Ren Renfa, Five Drunken Princes Returning on Horseback (late 13th/early 14th century). Image courtesy Sotheby’s.

Meanwhile, after a few years seeing its spending drop, Asia also re-emerged as a major force in the market in 2020, having returned to relative normalcy ahead of the West. Even on an anecdotal level, it was hard not to notice the intense demand from Asia at livestreamed Impressionist, Modern, and contemporary art sales.

Sotheby’s described Asian collectors as “especially resilient.” The house said $982 million—or 20 percent of its total sales—hailed from the continent. Of the top 20 lots auctioned by Sotheby’s, the house said, Asian clients bid on 10 and acquired nine.

Christie’s attributed 34 percent of its sales to Asian buyers, compared with 33 percent in America and 33 percent in Europe, the Middle East and Africa. Of the top 10 prices achieved for living artists under 45, nine sold in the Hong Kong salesroom.

Christie’s CEO Guillaume Cerutti said the auction house is optimistic about the outlook for 2021 based on strong global demand and “an influx of new clients, especially millennials.”