Auctions

Sotheby’s Shareholders Overwhelmingly Approve the Company’s $3.7 Billion Acquisition by French Media Mogul Patrick Drahi

CEO Tad Smith called it an historic moment for the 275-year-old auction house.

CEO Tad Smith called it an historic moment for the 275-year-old auction house.

Eileen Kinsella

It’s official: Sotheby’s is going private.

The auction house’s shareholders officially approved the proposed $3.7 billion acquisition by French-Israeli telecom magnate Patrick Drahi’s company BidFair at a special stockholder meeting in New York this morning.

News of the proposed deal was first announced in mid-June and is expected to close sometime in the fourth quarter. Today, 91 percent of the shares voted in favor of the merger, a representative said.

Patrick Drahi, president of French telecom group Altice, is Sotheby’s new owner. (Photo by Christophe Morin/IP3/Getty Images)

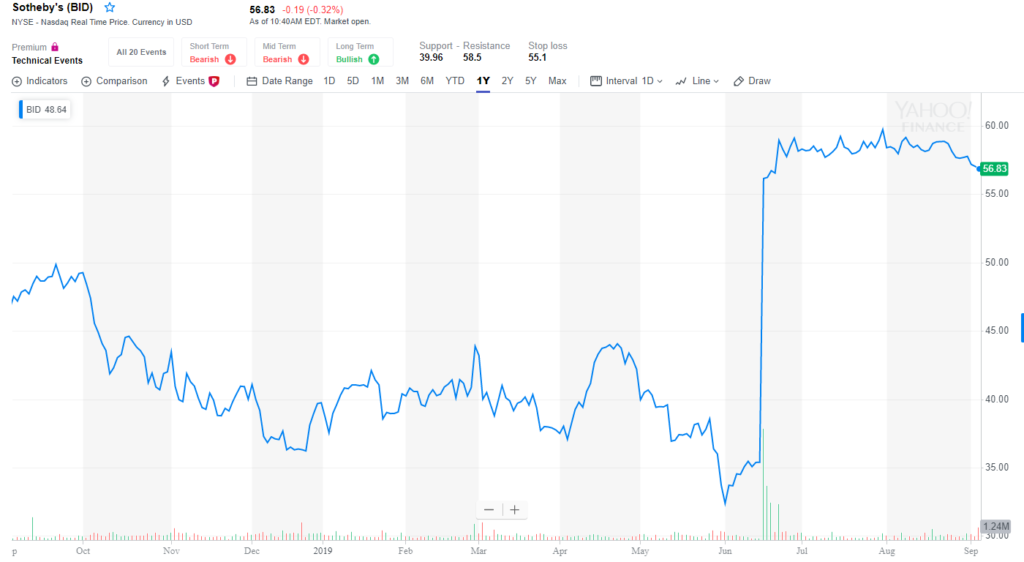

Under the terms of the agreement, shareholders, including employee shareholders, will receive $57 in cash per share of Sotheby’s common stock. That price was a steep 61 percent higher than where shares were trading at the time the deal was announced. Following news of the deal, the stock shot up to around $59, sparking some discussion that an even higher offer might be in the pipeline, though no competing offers appear to have emerged.

Shares of the stock, which trade under the symbol BID, and which will soon be delisted from the New York Stock Exchange once Drahi takes the company private, closed just under $57 a share yesterday. This morning, shares were trading at $56.88 down slightly from yesterday. (Sotheby’s went public in 1988.)

The auction house had been hit with four lawsuits brought by shareholders attempting to stop the deal. They argued that the information contained in a July 12 proxy statement included incomplete information about the lead-up to the Drahi deal. Sotheby’s has described the suits as “expected and routine” and said they were not expected to impact the deal.

Sotheby’s shares rose dramatically in mid-June after news of the merger was announced. Image via Yahoo Finance

Drahi’s offer “delivers a significant premium to market for our shareholders, including our employee shareholders, and positions Sotheby’s well for the future,” the auction house’s chairman Domenico De Sole said in a statement.

“This is an historic moment for Sotheby’s and we are very pleased to have the validation of the company’s shareholders,” CEO Tad Smith said. He added that Sotheby’s is “on track for another strong season with outstanding auctions set to be held in Hong Kong and contemporary art sales that will inaugurate our newly renovated space on Bond Street in London early next month.”