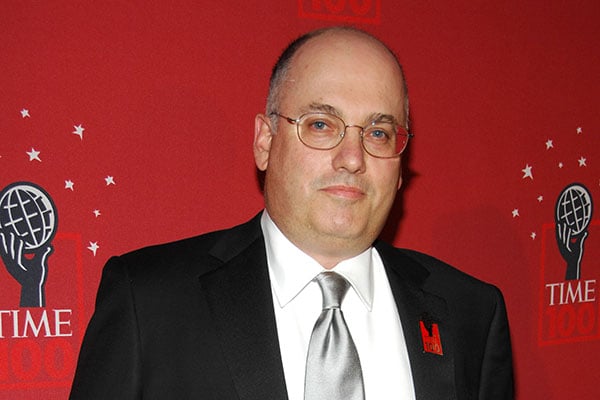

Point72 Asset Management, Steven Cohen’s investment firm, has dropped two thirds of its Sotheby’s stock, Art Market Monitor reports, based on a July 31 13F filing by the company with the Securities and Exchange Commission.

While the company held 3.2 million shares as of a May 16 filing, its holdings now number just one million, says the latest document, also known as an Information Required of Institutional Investment Managers Form. Cohen’s firm was previously the house’s fifth-largest shareholder.

This revelation comes just weeks after the news that Chinese insurer Taikang had assumed a 13.5 percent stake in Sotheby’s—the largest of any shareholder. Taikang’s CEO and chairman is Chen Dongsheng, founder and president of China Guardian, the country’s second-largest auction house (after Poly International). He also happens to be the grandson-in-law of Mao Zedong.

The one-year performance of Sotheby’s stock (BID).

While Sotheby’s stock (BID) hit a one-year low of $19.13 a share on February 11, it has climbed to $40.27 as of yesterday, just over its price of $38.43 a year ago.

“One of the key questions around Taikang’s purchase of a 13.5% stake in Sotheby’s on the open market was how the life insurer was able to acquire so much of the stock without drastically moving the price,” Art Market Monitor’s Marion Maneker writes. “The logical place to look for a seller was Cohen’s Point72, an active trader of stocks that would have been keen to realize the nearly 50% rise in value over a six month span.”

The billionaire also made headlines this week in connection to a 2013 investigation into allegations of insider trading at his company. In a settlement with the S.E.C., Cohen has agreed to a ban from federal commodity trading through at least December 31, 2017, according to the New York Times.

Cohen is also one of the artnet News Index’s top 100 collectors.