During the throes of Art Basel, Gagosian made a big announcement: It was adding the septuagenarian abstract painter Stanley Whitney to its roster. Whitney parted ways with Lisson, which had represented the artist since 2015. He will be the subject of a solo exhibition at Gagosian’s Grosvenor Hill space in London next year.

Based in New York and Parma, Italy, Whitney is best known for his colorful grids of rectangles. The abstractions—which always show the hand of the painter, with gently undulating rather than straight lines—draw on minimalism, Color Field painting, and process-based abstraction. Whitney has also cited ancient Roman and Renaissance architecture, Old Masters, and improvisational jazz music as influences.

The mega-est of galleries has added Whitney to its stable at a time when his market has been on the up, and off the back of the opening of an important exhibition of his work in Venice coinciding with the Biennale. We took the news as a prompt to delve into artnet’s price database to see what we could find out about why Whitney’s market is enjoying a late-career spike.

The Context

Auction Record: $2.3 million, achieved at Sotheby’s New York in November 2021

Whitney’s Performance in 2021

Lots sold: 31

Bought in: 4

Sell-through rate: 88.6 percent

Average sale price: $235,036

Mean estimate: $70,248

Total sales: $7.3 million

Top painting price: $2.3 million

Lowest painting price: $60,480

Lowest overall price: $2,000 for a 1985 signed and dated lithograph on paper, part of an edition of 15.

© 2022 Artnet Worldwide Corporation.

The Appraisal

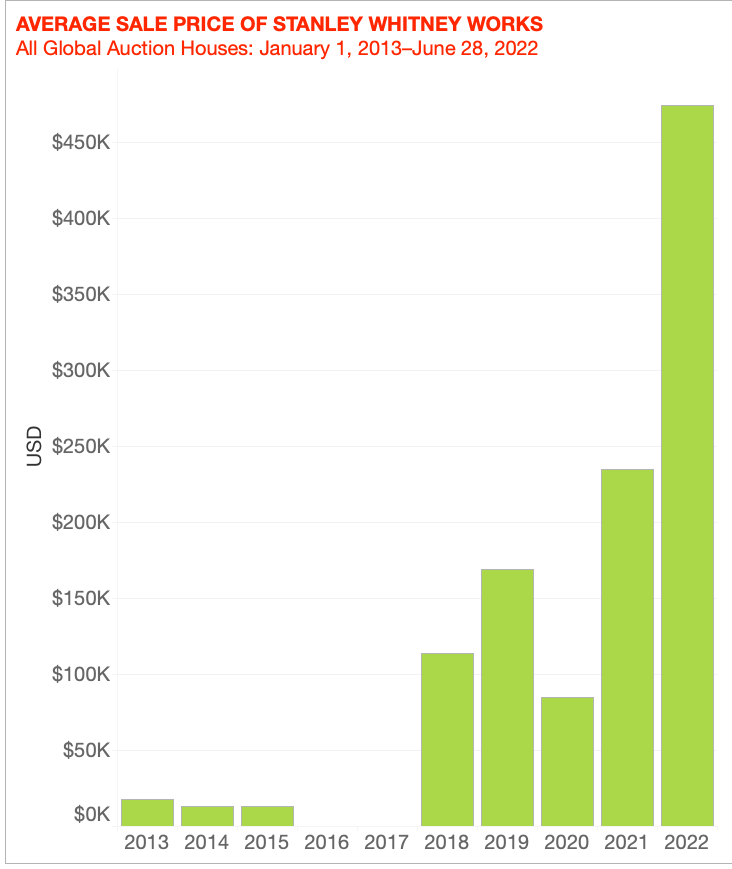

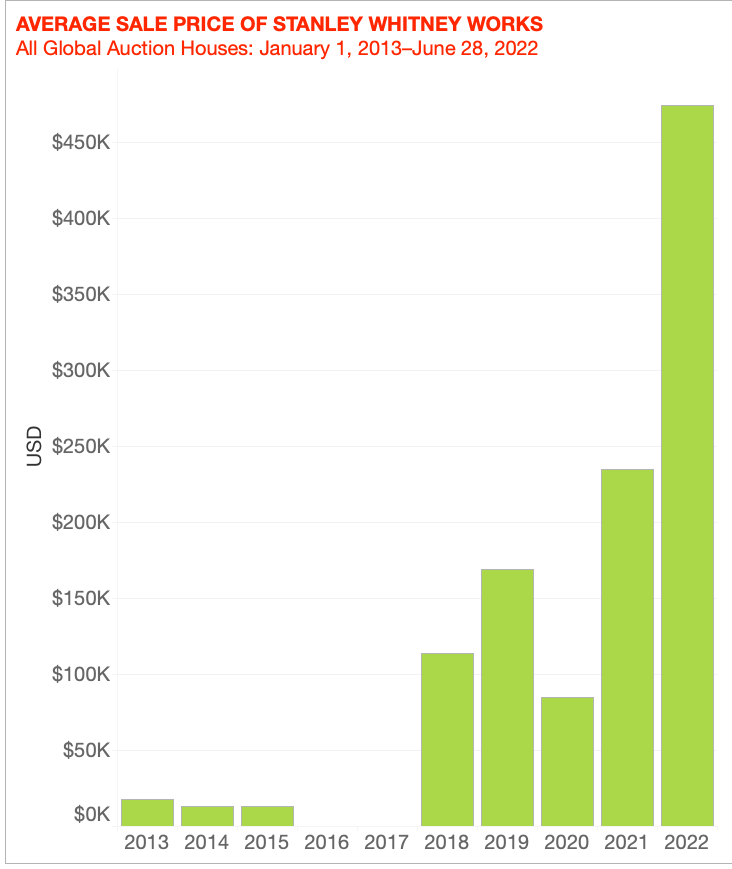

- Slow start. Though he has been working since the 1970s, Whitney’s career entered a new phase in 2015, when a survey at the Studio Museum in Harlem brought him broader recognition. He was picked up by Lisson Gallery that same year. Before then, Whitney was a rare presence at auction, with just three works hitting the block between 2013 and 2015, selling for a paltry average of $14,827. After 2015, supply tightened even further, with nary a work coming up for public sale in 2016 and 2017.

- Market ascent. Lisson worked hard to garner the artist international exposure through more than half a dozen exhibitions and numerous art-fair presentations. By 2018, with several gallery shows behind him and primary market prices climbing into the six figures, enthusiasm began to ripple onto the secondary market. Whitney’s auction high more than quadrupled when Phillips sold a painting for $121,291 in its London spring sales, and eight more works appeared at auction that year, boosting his average price by 88.2 percent.

- Auction flood. In 2020, Gagosian—which was clearly already eyeing him for its roster—presented a show of new work by Whitney in Rome, and later offered a painting priced at $350,000 as part of its Artist Spotlight series during lockdown. By 2021, primary market access tightened as Whitney continued to gain institutional recognition, including a commission from the Baltimore Museum of Art to create stained-glass windows for its Center for Matisse Studies. In tandem, his auction market flourished—total sales more than quadrupled, to $7.3 million, between 2020 and 2021, and his record was reset three times.

- Beyond the grid. Unsurprisingly, Whitney’s signature large-scale, colorful grid paintings are his most sought-after. Though he has been explicit about his commitment to abstraction, he has at times ventured into more overtly political work, such as in his “No to Prison Life” series, which was shown at Lisson in 2020 to benefit Agnes Gund’s Art for Justice Fund. In these works on paper (priced at around $15,000 each), the grids become claustrophobic, recalling prison bars, and are marked with slogans addressing racism and the criminal justice system in the U.S. There remain opportunities to buy his smaller sketches and works on paper at affordable prices on the secondary market.

- Boom time. In 2022, work Whitney made in Rome in the 1990s, where he developed his signature style, were the focus of a collateral exhibition in Venice at the Palazzo Tiepolo Passi presented by the Buffalo AKG Art Museum, which also announced plans for a larger retrospective at the museum in 2024. Less than halfway through the year, Whitney’s auction total—$14.7 million—has already more than doubled his full-year high in 2021, bumping his average price up to $474,404. Over the past 12 months, 2,670 users have searched artnet’s price database for information on Whitney.

Installation view of “Stanley Whitney: Drawings” at Lisson Gallery, New York. © Stanley Whitney, courtesy of Lisson Gallery.

Bottom Line

Since the 1970s, Whitney has remained steadfast in his commitment to and development of a visual language all his own—despite the fact that it took a while for him to garner the respect he deserved among institutions and the art market. He pursued abstraction at a time when Black artists were largely celebrated for representational work, and created in relative obscurity for decades.

Now, the rest of the art world has finally caught up. One might wonder whether a looming recession is poised to undo the long-awaited recognition. In 2021, auction prices spiked across the board in response to market injections from those who made a lot of money during the pandemic or through the booming stock and crypto markets. As these markets crash and inflation soars, we are beginning to see a bit of a correction. Nonetheless, the ingredients are there for Whitney to survive a wider recalibration: existing market buzz will be confirmed by further institutional recognition, which will no doubt be further encouraged with the help of mega-gallery representation.

Shifting galleries is also a surefire way for an artist to raise prices, so expect to see a readjustment on the primary market soon. And with more critical eyes and resources on his existing inventory, it is very possible that underexposed historical bodies of work will materialize, and offer enough supply to fuel further market growth.