Auctions

The Truth About the Murky Online Art Market

Who's buying what type of work online, and for how much?

Who's buying what type of work online, and for how much?

Paddy Johnson

Online art sales are on the rise. London-based art market research group ArtTactic and the Hiscox Group, a Bermuda-based insurance company, estimate that the online art and collectibles market will see an annual growth rate of 19 percent for each of the next four years, with profits increasing from approximately $1.57 billion in 2013 to $3.76 billion in 2018. This is based on the companies’ recent joint study of online art-buying platforms, which sought to determine what percentage of people are using sites like Auctionata, Paddle8, 1stdibs, Artspace, Artsy, Artuner, and Artfinder, what they are buying, and for how much.

The report, though extensive, is not exhaustive. Artnet Worldwide Corporation, the owner of artnet News, also owns and operates artnet Auctions, an online auction house and marketplace that sells fine art. Many of the sites included in the report are considered competitors, but since the report does not focus on artnet—the company is mentioned twice, both times in reference to its return policy—neither does this article. Coverage of the online art market tends to focus on newer, venture-capital driven companies; this likely explains why artnet Auctions, which was established in 2007, is not included in the ArtTactic-Hiscox report. Furthermore, many of the figures cited in the report cannot be independently verified because the companies they pertain to do not report their revenues and expenditures, and are not required to disclose their finances.

“artnet Auctions and Private Sales has set benchmarks since 2007 in online art sales,” says Roxanna Zarnegar, senior vice president of artnet Auctions & Private Sales. “Our objective now is to enhance the buying and selling experience. We’re focused on creating a seamless set of services that cater to our buying and selling client base.”

In many cases, the numbers in the ArtTactic-Hiscox report confirm conventional wisdom: People find buying art online less intimidating than walking into a gallery; buyers have a strong preference for original works; limited edition prints are a gateway drug for collecting more unique works at higher price points. But the study also turned up some surprising stats. Here are illuminating answers from the study to 10 questions we all have about online art sales:

How much money are online art sales sites actually making?

This is a tricky question, because very few of the sites surveyed actually shared this data. Christie’s auction house gets points for being among the most transparent: their 2013 online-only sales generated $20.8 million, a dramatic jump from just $4.7 million in 2012. However, in 2013 they ran 49 online-only sales compared to a mere 7 in 2012. That suggests Christie’s sees potential in online auctions, but if we break their numbers down per sale, the gain appears less significant. In 2012, Christies made an average of $671,429 per online auction, a figure that fell to $424,490 in 2013.

Paddle8, the online auction house, reported $9.8 million in sales in 2012 and surged past a whooping $50 million in 2013. The volume of active bidders quadrupled from 2012 to 2013. The total number of auctions increased 112 percent in that same period. That said, only 14 percent of their roughly 170 auctions in 2013 were non-philanthropic.

Artsper, a site offering artworks directly from galleries rather than via an auction platform, reports that, as of December 2013, revenues averaged €10,000 per month (about $13,700). Somehow, they expect 2016 will be a breakout year, with estimated revenue of €6 million ($8.2 million).

How much venture capital have art e-commerce start-ups received?

Is the online market all a house of cards? It’s hard to know without the sales reports, but based on how (in)frequently some of these sites get mentioned, we can assume there will be more than a few losers in this race. That’s not going to be fun, because what we do know now is that there are a whole lot of investors banking on big returns.

Here’s a breakdown:

— Paddle8 received $6 million in Series B funding. Total Funding:$17 million

— Artsy raised $5.6 million in new funding and introduced Sky Dayton (founder of Earthlink) to its board of directors. Total Funding:$25.9 million

— Artspace raised $8.5 million in Series B funding, and introduced art collector and investor Maria Baibakova as strategic director. Total Funding:$12.2 million

— Lofty.com has an initial investment of $3 million from the Founders Fund. Total Funding: $3 million

— 500px has received $8.8 million in Series A funding from Andreessen Horowitz and Harrison Metal. Total Funding:$9.3 million

— 1stdibs raised $42 million in investment from Index Ventures, Spark Capital, and Benchmark at the end of 2012. Total Funding:$57 million

— Expertissim raised €5 million ($6.8 million) in November 2013 Total Funding:N/A

— Artsper is currently raising €305,000 ($417,000): Total Funding:N/A

What price points do online platforms focus on?

A few surprises in this section. For one, Artsy, the site that claims to be like Pandora for art but functions without a discernible profit model, is reporting that 22 percent of their online sales are priced between £10,000–50,000 ($13,680–68,400) and that 8 percent of sales exceed £50,000. In sum, 30 percent of Artsy’s sales exceed £10,000. This is a higher total than 1stdibs, a well-known site selling furniture, fine art, and jewelry, where roughly 20 percent of sales are in the the over-£10,000 range. Coming in third in that market segment is Artspace, a limited edition site, with nine percent of sales tallied in the over-£10,000 range. The majority of their sales—51 percent, to be exact—are in the £1,000–£5,000 range ($1,400–6,800).

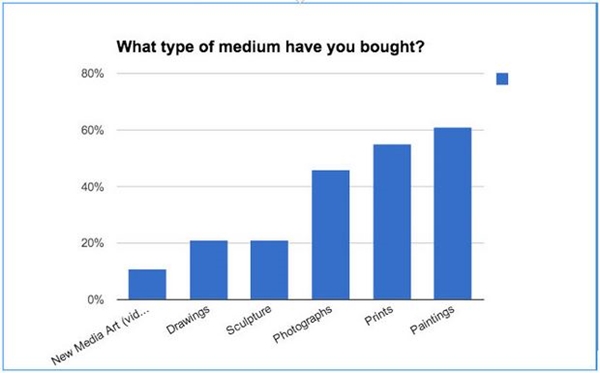

What type of work are people buying online?

Who buys what?

It’s no big surprise that painting outsells new media art (defined here as video and digital art), but the fact that 11 percent of online buyers have bought digital artworks is impressive. Just last year, Pierogi director Joe Amrhein told me that video art doesn’t sell. And with the second iteration of Paddles ON! (the digital art auction launched by Phillips and Tumblr) now live, those figures are set to increase.

Still, every other other medium accounted for a larger percentage of sales. Of the buyers surveyed, 46 percent said they purchased photography online, 55 percent had bought prints, and 61 percent had bought paintings. Sculpture had a much lower purchase rate, 21 percent, but often represented larger price points. Of the sculpture collectors surveyed, 40 percent had paid between £1,000 ($1,400) and £10,000 ($13,680), and 15 percent had bought one or more sculptures for more than £50,000 ($68,400) online.

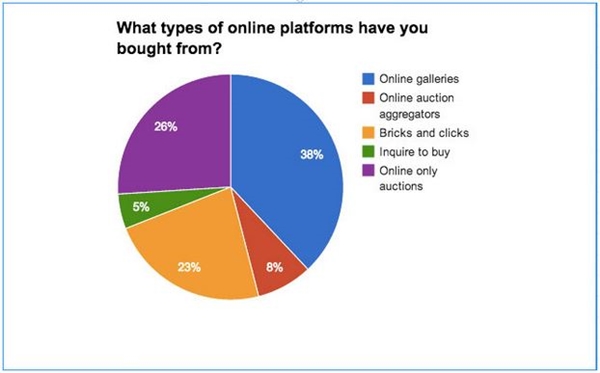

Types of sites study respondents have used to buy art.

Where do they buy art?

According to the ArtTactic-Hiscox study, online galleries command the largest share of online art sales, accounting for 38 percent of all transactions, whereas “inquire to buy” features account for only 5 percent. Online-only auctions account for 26 percent of online art sales.

Why do people buy art online?

The big surprise here is that 75 percent of those surveyed said that the main advantage of the online art marketplace was that it enabled them to find artworks and collectibles they might not otherwise find in a physical space. And 74 percent of respondents said that website search functions provided a big advantage on this front.

This may not mean, however, that these collectors are finding out about new artists through these sites. No data was offered as to whether those collectors were looking for work by artists they already knew or making new discoveries.

Does browsing translate into sales?

According to the study, 55 percent of high-frequency visitors are also online art buyers. In other words, users who spend a lot of time on an art e-commerce site will be more likely to end up buying. Unfortunately, the report doesn’t offer any data about whether or not sites with internal magazines and blogs have greater success at converting readers into buyers.

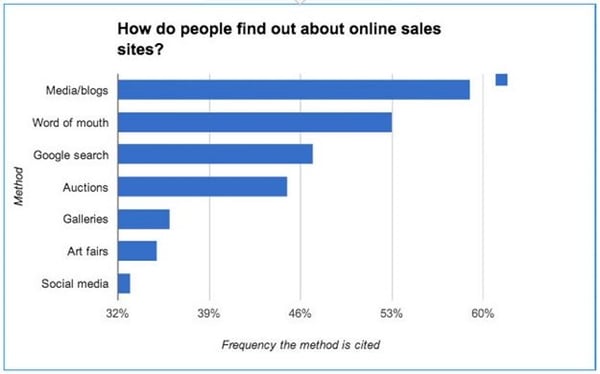

How buyers are finding out about online art sales platforms.

How do people discover online art sales platforms?

In short: Through blogs. An overwhelming 59 percent of all respondents said they came to online art sales sites through articles, though 53 percent also cited word of mouth as an influence. Some 47 percent said Google search results were a factor, but only 33 percent had found art sales sites through social media. That said, it seems possible that there is some conflation between the social media and word of mouth categories.

What kind of authentication do online sellers have to provide?

Remember the days when a physical signature on an actual object was essential? It was only four years ago that a specialist from Swann told me that certificates of authenticity from online edition companies were essentially worthless and that every collector wanted to see evidence of the artist’s hand on the actual work. Well, no more. According to this study, 83 percent of buyers said they would require a certificate of authenticity before buying a piece of art online.

Are return policies a factor?

There are many details in the report about how companies are dealing with this issue. Long story short: there’s no standard. Artspace currently maintains a 30-day return policy; Artfinder gives dissatisfied buyers 14 days; and artnet offers seven days, unless the work is defective. In the EU, a 14-day return minimum is required, an increase from 7 that was implemented in June. Of those surveyed, 66 percent said the extra 7 days would make them more inclined to buy online.

Conclusions

The ArtTactic-Hiscox study makes a couple of things abundantly clear. First, there’s a lot of venture capital pouring into these online art marketplaces right now, and very little public data available to evaluate the stability of these investments. And second, the online art market is growing and there’s sufficient evidence of its success that brick-and-mortar galleries need to be paying attention. If they’re not careful, they may find themselves competing with companies like Paddle8.

All numbers and figures in this article, including those represented in the charts and graphs, are drawn from the ArtTactic-Hiscox report.