The Appraisal

Are Rumors About the Softening Andy Warhol Market True? We Analyzed the Auction Data to Find Out

We took to the Artnet Price Database to investigate.

We took to the Artnet Price Database to investigate.

Naomi Rea

The enduring appeal of Andy Warhol is undeniable, and the Pop artist’s silkscreen Marilyns and dollar signs have long felt synonymous with the contemporary art market.

Last week, I reviewed a play in London about Warhol’s relationship with another art history (and art market) legend: Jean-Michel Basquiat. The play delved into a tension that felt as relevant in 2022 as it did in the 1980s, when Warhol’s star was fading and Basquiat’s was on the rise. Warhol was for the longest time the top performing U.S. artist at auction, and the volume of work circulating in the market at different price points has meant that his sales have often been looked at as a barometer for health of the wider art market.

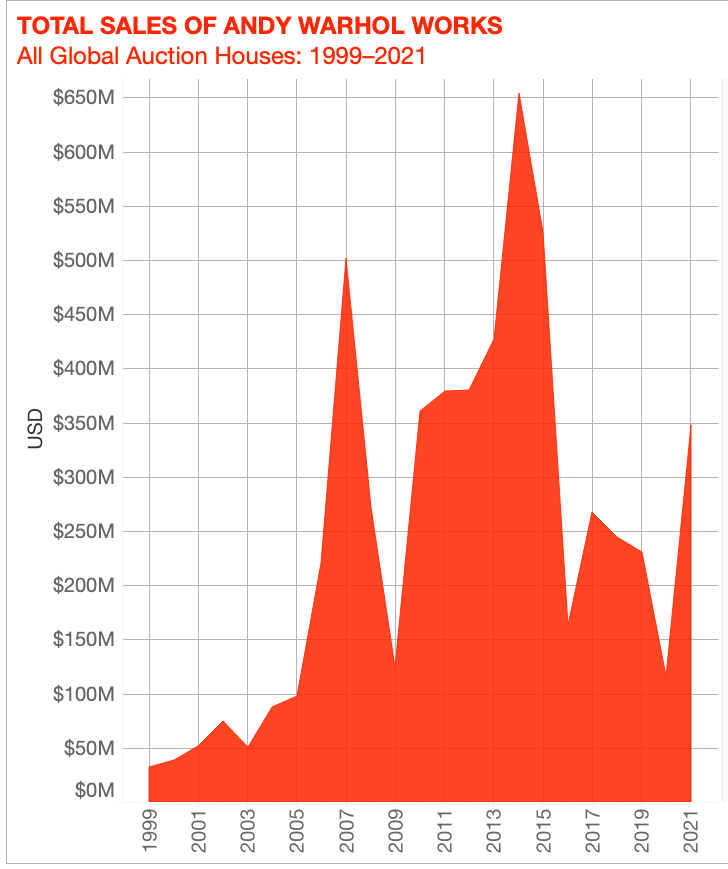

In 2018, he was unseated by his younger protégé, and since then Warhol has continued to be a fixture of the main evening sales, but there has been more and more talk of a market softening for the icon.

We took it as a prompt to ask whether Warhol is still the bellwether of the art market, and took to Artnet’s Price Database to see what we could find.

Auction record: $105.4 million, achieved at Sotheby’s New York in November 2013

Andy Warhol’s Performance in 2021

Lots sold: 1219

Bought in: 260

Sell-through rate: 82.4 percent

Average sale price: $285,121

Mean estimate: $190,194

Total sales: $347.6 million

Top painting price: $47.4 million

Lowest painting price: $2,500

Lowest overall price: $153, for a silkscreen of flowers with some hand coloring, dated 1974

© 2022 Artnet Worldwide Corporation.

Andy Warhol’s market is driven by volume—he is said to have produced more than 10,000 works throughout his career—as well as diversity in medium, price, and subject matter, which means audiences of all stripes can have access to the market.

While there is clearly genuine demand across all levels, a handful of key players are invested in keeping prices high at the top, and consistently use the auction rooms as marketing platforms—which has a ripple effect on the rest of the market, including prints released in large edition sizes.

There is no denying sales have been lower since the Warhol zenith in 2014, but the consistency of his performance, which is reliably supported by the stats across a large volume of sales, means there is a positive feedback loop to the market that will most likely continue to impress.