The world-altering shutdown of last spring is officially a distant memory at the summit of the auction market.

Last week, Christie’s and Sotheby’s carved up the art trade’s schedule to rake in close to $1.3 billion in sales across three nights in New York. Put that gaudy total next to fresh memories from the previous week’s in-person return of Frieze New York, and for many art professionals, it felt like old times.

Still, several factors pushed this auction cycle into the territory of the “new normal” instead of the plain old “normal.” Christie’s and Sotheby’s kept their salesrooms far south of their full capacity, leaving even some stalwart east coast bidders to the remote experience. And earlier this year, Phillips opted to reschedule its 20th-century and contemporary New York art sale for June, meaning one less evening auction to jockey for supply and demand in a crowded week.

And then there were the actual results. The bids certainly flew high and fast at times, but not always for the works observers expected. To help make sense of the ups, downs, and all-arounds, the Artnet News Pro team (Katya Kazakina, Eileen Kinsella, Nate Freeman, and Tim Schneider) has returned to hand out its bi-annual auction awards.

Biggest Winner: Christie’s

Christie’s at Rockefeller Center in New York City. Courtesy of Christie’s.

In the dollar-value duel between the premier houses, Christie’s came out ahead—again—with a total of $691.6 million for its sales of 21st-century art ($210.5 million) and 20th-century art ($481.1 million). Christie’s recently introduced the new sale categories in response to what it said were the demands of the market and shifting tastes, noting that the contemporary field had gotten quite large over time. It’s notable, however, that for the first time in a while, the larger sale total was for the classical works, as compared with the contemporary offerings.

Meanwhile Sotheby’s reported a total of $597 million, about $95 million lower than Christie’s, following a three-sale night on Wednesday that skewed more heavily to contemporary works if one looks at the total for the collection of the late Anne L. Marion, which realized $157.2 million and was heavy on Postwar art stars like Richard Diebenkorn, Clyfford Still, and Andy Warhol. Aside from this, the split on the sale categories was $218.3 million for the contemporary art evening sale and a slightly higher $221.3 million for the Impressionist evening sale.

Priciest Work: Pablo Picasso’s Femme assise près

d’une fenêtre (Marie-Thérèse) (1932)

Pablo Picasso, Femme assise près d’une fenêtre (Marie-Thérèse) (1932). Courtesy of Christie’s Images, Ltd.

One pandemic later, the king remains the same: No one has dethroned Pablo Picasso as the bellwether artist of the marquee evening sales.

While Basquiat made quite a splash this week, with two canvases each selling in the mid-to-upper eight figures, only one painting made it to the nine figures. That would be Picasso’s gigantic portrait of his great muse, Marie-Thérèse Walter, Femme assise près d’une fenêtre (Marie-Thérèse) (1932), which rose from a opening bid of $45 million and then steadily went up and up and up, with Christie’s specialists Vanessa Fusco and Max Carter battling it out on the phones, each besting one another until Fusco’s client offered $90 million, where it hammered. With fees, it was $103.4 million, easily the biggest lot of the week.

Biggest Flop: Christopher Wool’s Untitled (1990)

Installation view of Christopher Wool’s painting at Christie’s New York, ahead of the sale. Photo: Katya Kazakina.

The result for Wool’s chunky black-on-white text painting (spelling “OH OH”) was summed up best by writer and artist Greg Allen on Twitter: “UH-UH.”

Estimated at $8 million to $12 million, the work was one of 19 pieces consigned to Christie’s by financier Thompson Dean. The house guaranteed the group, and found third-party backers for many of the individual works… but not this one. Now, after the painting attracted zero bids on sales night, Christie’s is stuck with it while Wool’s market continues its downward trajectory.

Last year, auction sales of his paintings totaled $14.3 million, down nearly 87 percent from their peak in 2015, according to the Artnet Price Database. Zoom out to consider Wool’s auction lots in all media, and roughly 37 percent failed to sell in 2020—a striking reversal of fortune for an artist who used to ignite bidding wars and occupy pride of place on investors’ wish lists.

Strongest Gate-Crasher: NFTs

An algorithm-derived set of images made by Larva Labs. Photo courtesy Christie’s.

It’s staggering to many industry veterans that Christie’s even offered a set of digital works with non-fungible tokens in its glitziest evening sale since November 2019. When you add in that the lot in question—Larva Labs’ 9 Cryptopunks: 2, 532, 58, 30, 635, 602, 768, 603 and 757—attracted a presale-estimate-shattering bidding war that settled just shy of $17 million, it practically puts the result into the realm of science fiction. (Sources said the winner was a consortium of investors led by legendary NBA gambler and current Dallas Mavericks executive Haralabos “Bob” Voulgaris.)

Nonetheless, this episode is the strongest evidence yet that, love them or hate them, NFTs are gathering staying power at the stodgy old summit of the art market.

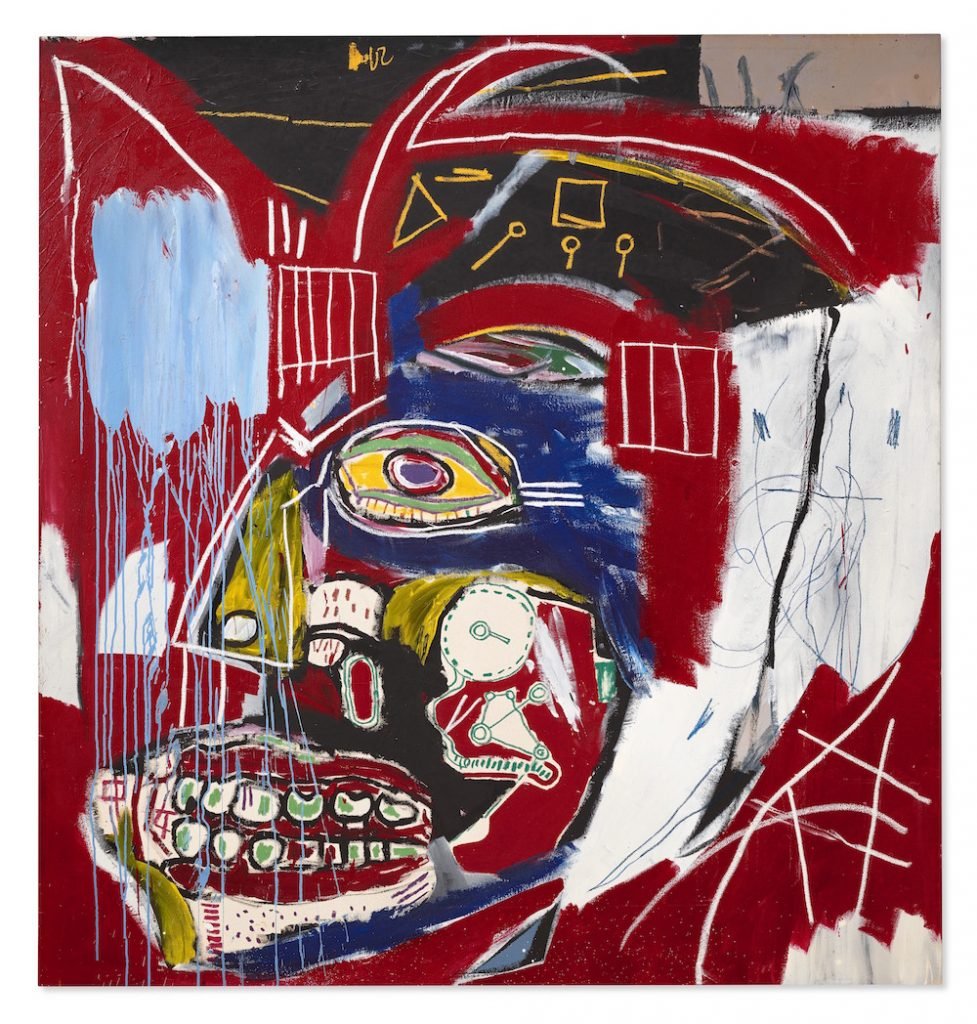

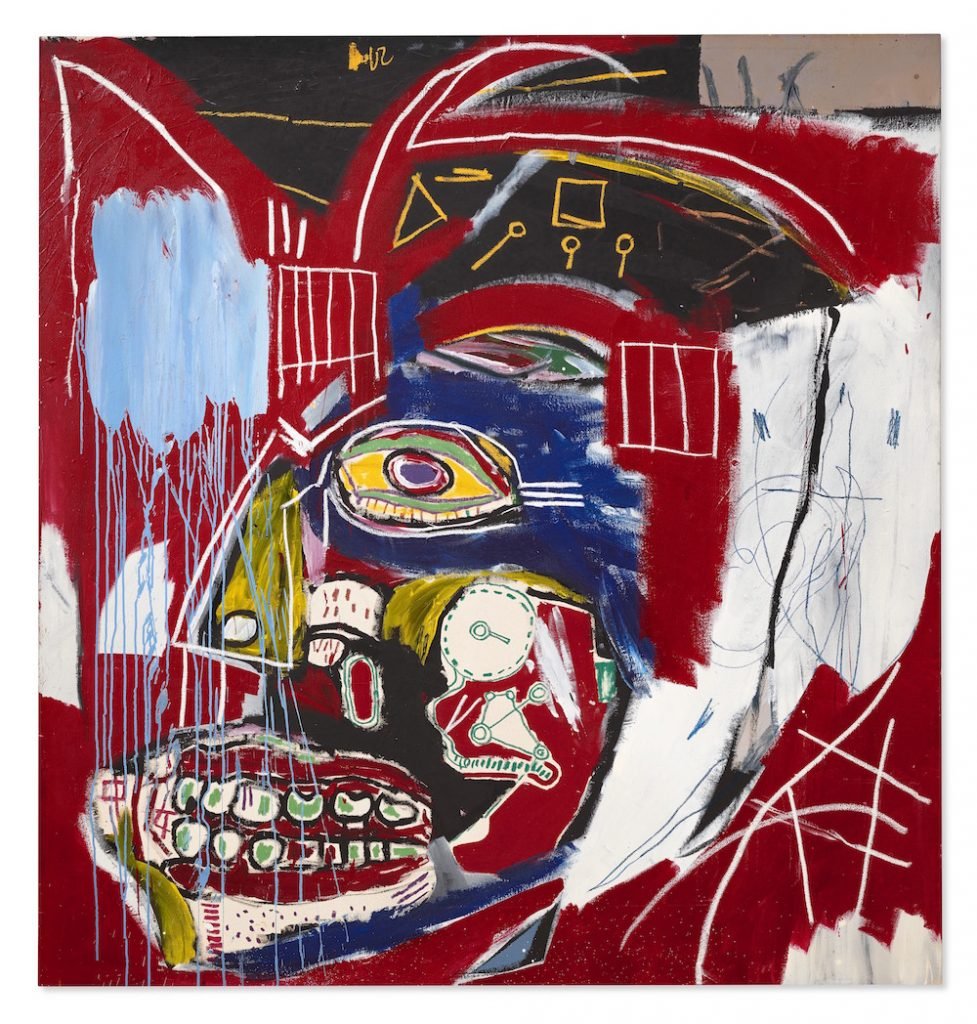

“Battle of the Basquiats” Winner: In This Case (1983)

Jean-Michel Basquiat, In This Case (1983). Image courtesy Christie’s Images Ltd.

Both Christie’s and Sotheby’s scored a trophy painting by Jean-Michel Basquiat for their marquee auctions, and both were estimated at around $50 million. In This Case (1983), which depicts a large skull on red background, soared to $93 million at Christie’s on May 11. The following evening, Versus Medici (1981), which portrays a male figure with exposed anatomy, went for $50.8 million at Sotheby’s.

Why the difference? Brett Gorvy, who sold plenty of Basquiats during his time at Christie’s, said that the works appealed to two entirely different audiences. “One is the wow painting,” he said. “The other is more intellectual.”

In This Case was positioned as one of the three big skulls by Basquiat, one of which holds the $110.5 million auction record for the artist. It’s “all about the skull,” Mary Rozell, global head of the UBS art collection said on Instagram.

There’s also the appealing provenance. The work was consigned anonymously by Giancarlo Giammetti, a partner of fashion legend Valentino Garavani (who celebrated his 89th birthday the day of the auction). “Darling, GG plus Valentino Red = 93,” collector Inga Rubenstein, a friend of Giammetti’s and Garavani’s, said on Instagram.

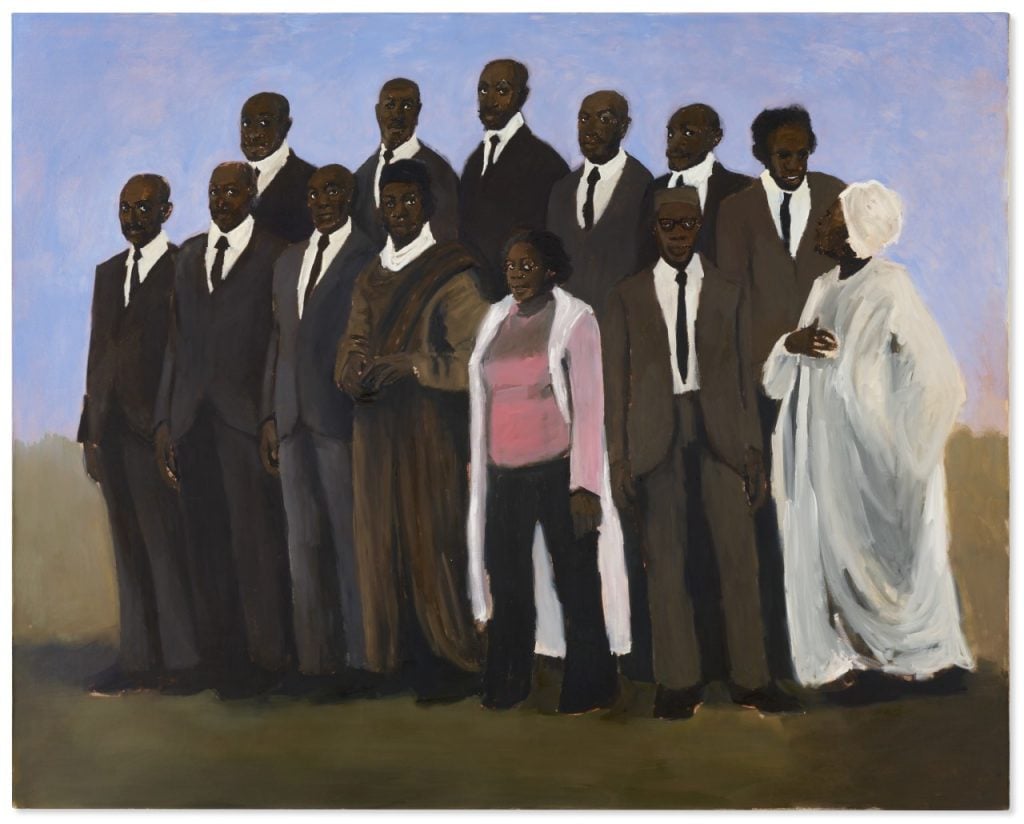

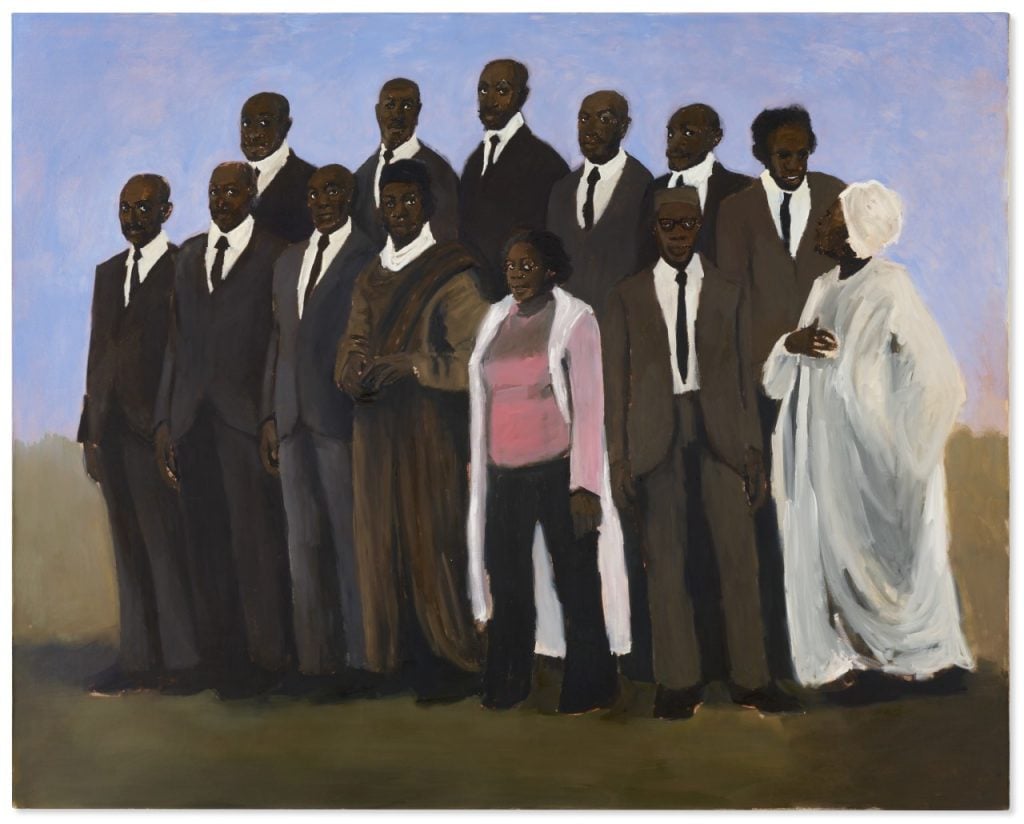

Most Sizzle: Young Artists

Lynette Yiadom-Boakye, Diplomacy III (2009). Courtesy of Christi’es Images, Ltd.

Sure, a few grade-A works by decades-dead standbys like Basquiat, Claude Monet, and Picasso triggered healthy bidding. But last week’s most manic buy-side frenzies fixated on works by creators still on the rise.

Five artists under age 45 set new auction records after heated competition in Christie’s and Sotheby’s evening sales: Lynette Yiadom-Boakye ($1.95 million), Nina Chanel Abney ($990,000), Salman Toor ($867,000), Jordan Casteel ($687,500), and Alex da Corte ($187,500). All of them also happen to be of color, continuing a demographic trend that has helped shape the market in recent years.

The number of records by fresh faces rises to six if you also throw in Matt Hall and John Watkinson, the cofounders of Larva Labs and co-creators of the CryptoPunks. Their inclusion would caveat the narrative above in at least two ways, given their status as crypto-developers rather than traditional artists, and their identity as two white dudes. Still, they only reinforce the fact that the hottest thing to be in the auction market this spring was young.

Charity Works: Millions for COVID Relief and Land Preservation

Dana Schutz, The Fisherman (2021). Courtesy of Christie’s Images, Ltd.

Amid this giddy orgy of unchecked spending—nine figures on Picassos, record prices on speculated-upon new artists, cryptocurrency on digital cartoon heads—a few lots actually did more than just make their sellers richer.

At Christie’s, three fabulous artists—Rashid Johnson, Urs Fisher, and Joel Mesler—all donated work to be auctioned off to benefit Sean Penn and Ann Lee’s disaster relief charity CORE, which is centering its COVID relief efforts on getting mobile vaccination trucks to marginalized neighborhoods. The three works raised $7.2 million in total, and Mesler’s and Johnson’s works set new auction records for the artists.

What’s more, the last lot in the Christie’s 21st-century evening sale was Dana Schutz’s The Fishermen, which was sold to benefit the land conversation organization Art for Acres. The masterful artwork sold for nearly $3 million, and with partnering organizations pledging to match the funds, the total amount donated was $9.8 million.

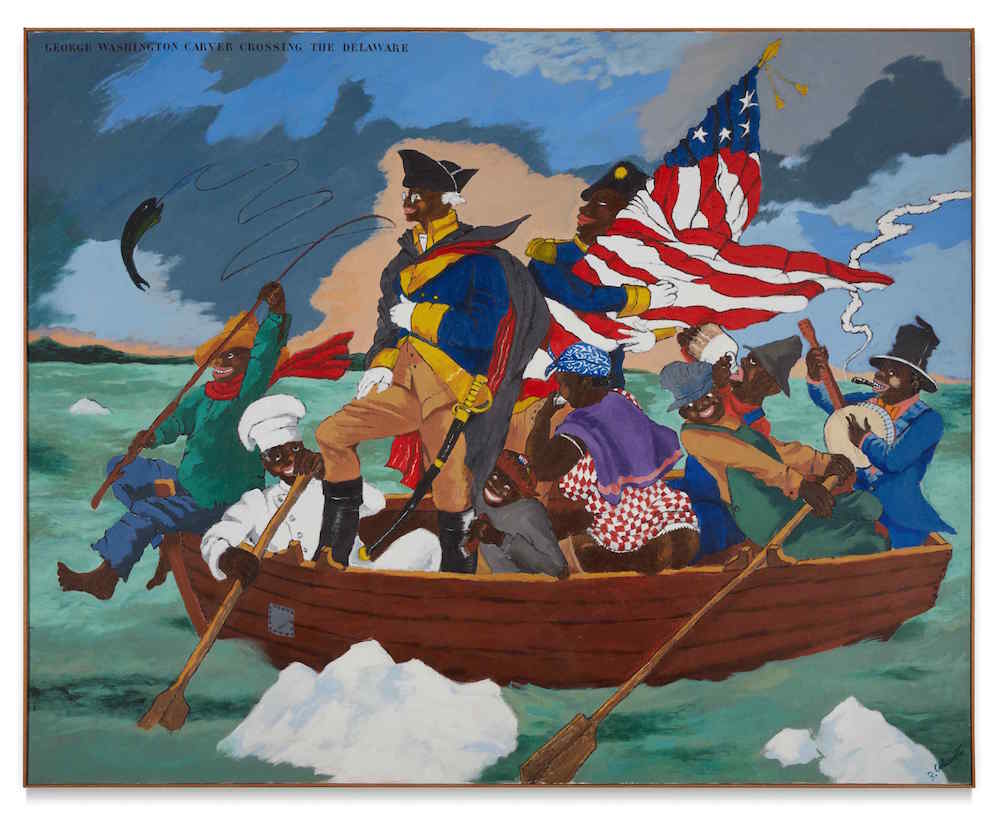

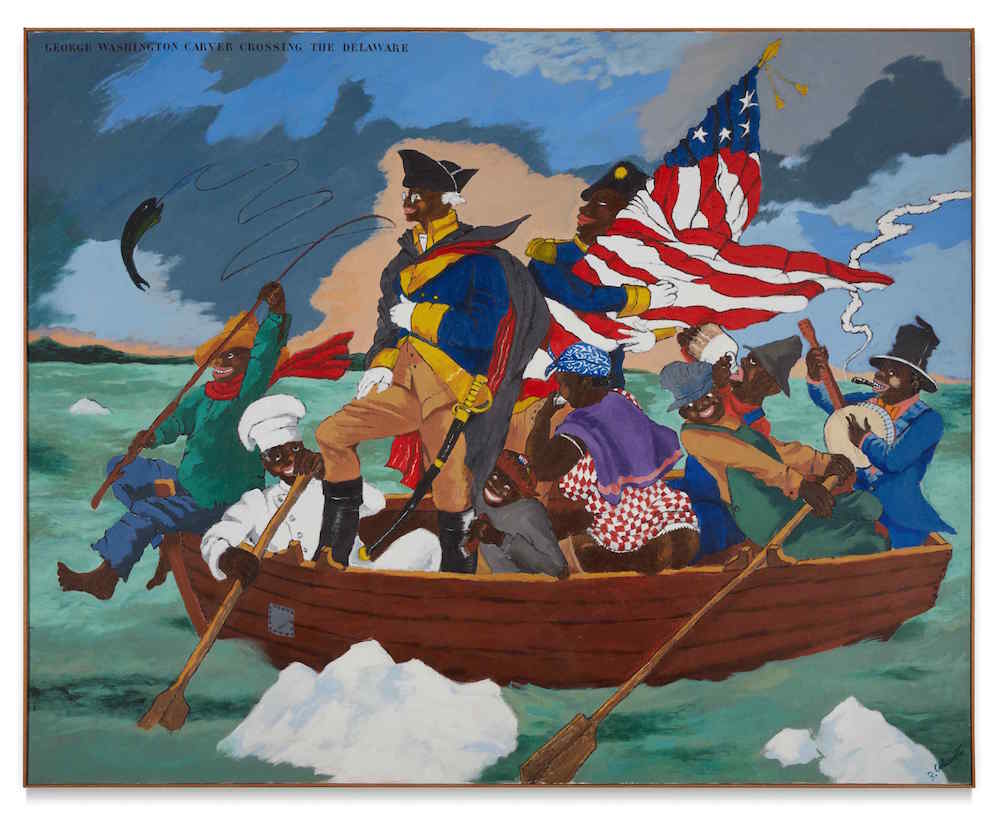

Biggest Resurgence: Robert Colescott

Robert Colescott, George Washington Carver Crossing the Delaware: Page from an American History Textbook (1975). Image courtesy Sotheby’s

It’s no secret that many formerly overlooked and under-appreciated Black artists are finally getting their due, but the run-up in the auction market for the late Robert Colescott last week is still staggering.

When the massive 1975 painting George Washington Carver Crossing the Delaware: Page from an American History Textbook came on the auction block Wednesday evening, it soared to $15.3 million, compared with an estimate of $9 million to $12 million. It smashed the previous (and not even three-years-old) Colescott auction record of $912,500.

After bidding opened around $7.8 million it was chased by two Sotheby’s specialists on the phone with clients, until it reached $10.8 million and a third specialist jumped into the action, eventually winning it on a hammer price of $13.1 million. Following the sale, the Lucas Museum of Narrative Art, founded by Star Wars film director George Lucas, confirmed that it was the proud new owner of the record-breaking painting.

Best New Auctioneer in Town: Gemma Sudlow

Auctioneer Gemma Sudlow fields bids during Christie’s 21st Century evening sale in New York in May 2021. Photo: Christie’s Images Ltd. 2021.

When the gavel rapped at the podium to mark the start of Christie’s 21st-century evening sale, the presiding auctioneer wasn’t Christie’s global president Jussi Pylkkanen, who usually jumps into the cockpit for the big sales. It was Gemma Sudlow, head of private collections and decorative arts, who’s been with Christie’s since 2004, but was a new face to many contemporary art folk.

The house didn’t explain the switch up, though the Art Newspaper hinted at some issues with the Brits getting work visas to enter the states—notably, Pylkkanen was not in New York, though he appeared via satellite from London on Thursday to buy Warhol’s Nine Multicolored Marilyns for a client.

Regardless, Sudlow was a hit, moving things along as a steady, if not brisk, pace. And she pulled through when it mattered: for six minutes, Sudlow ably egged on bids from her colleagues on Jean-Michel Basquiat’s In This Case (“Keep going! Take a look! One more bid!”) until it hammered at $81 million, miles ahead of its $50 million estimate.