When Wendy Cromwell began advising people on buying art in 2002, she didn’t want to be called a consultant because that word had a bad connotation at the time. So, she called herself an art advisor.

Two decades on, Cromwell feels ambivalent about that title.

“Now, I don’t want to be called an art advisor because the name is so tarnished by bad actors,” she said this week.

We’ve all heard stories: When the market gets hot, a new cadre of advisors arrives with the hopes of getting outsized returns—and fast. Highly transactional and not very scrupulous, they leech onto the same hot emerging artists, helping to push their prices into millions of dollars. They get kickbacks from the galleries in exchange for bringing business from their clients, who also pay them. They are happy to flip works quietly without galleries finding out—because they know people who know people who own the works, and can make a cut, no matter how small, by selling them. (Unlike the runners of earlier decades, the folks operate through social media and their Gmail accounts.) Some call them “10-percenters,” others “Gmail art advisors.”

An influx of “Gmail art advisors” muddies the water when it comes to legitimate transactions. Photo: Edward Berthelot/Getty Images.

“A lot of people who printed out business cards that said ‘art advisor’ during the last couple of years, when things were frothier, will disappear back into the woodwork never to be heard from again,” said Todd Levin, a veteran advisor, whose clients have included former hedge-fund manager Adam Sender and actor Leonardo DiCaprio. “It’s almost like a parallel ecosystem that comes up when the market gets strong. They appear like a chimera and they disappear as one, once the bubble deflates.”

The bubble for some contemporary artists may be deflating in front of our eyes. January has been mostly quiet. People start talking about “a return to quality,” which to me always sounds like a code word for a market in transition. The industry will have to wait till the London auctions in March and the New York ones in May to really gauge the temperature of the secondary market. Sales of Old Masters in New York have done surprisingly well, as my colleague Eileen Kinsella reported last week.

The influx of new art advisors coincided with the influx of new art buyers since the pandemic. Many are young, recently out of college, and related to an art dealer or collector (i.e., nepo babies), which gives them the initial entry into the system. They are highly transactional and not necessarily interested in art. People often use some kind of hyphenated description like “an advisor-dealer.”

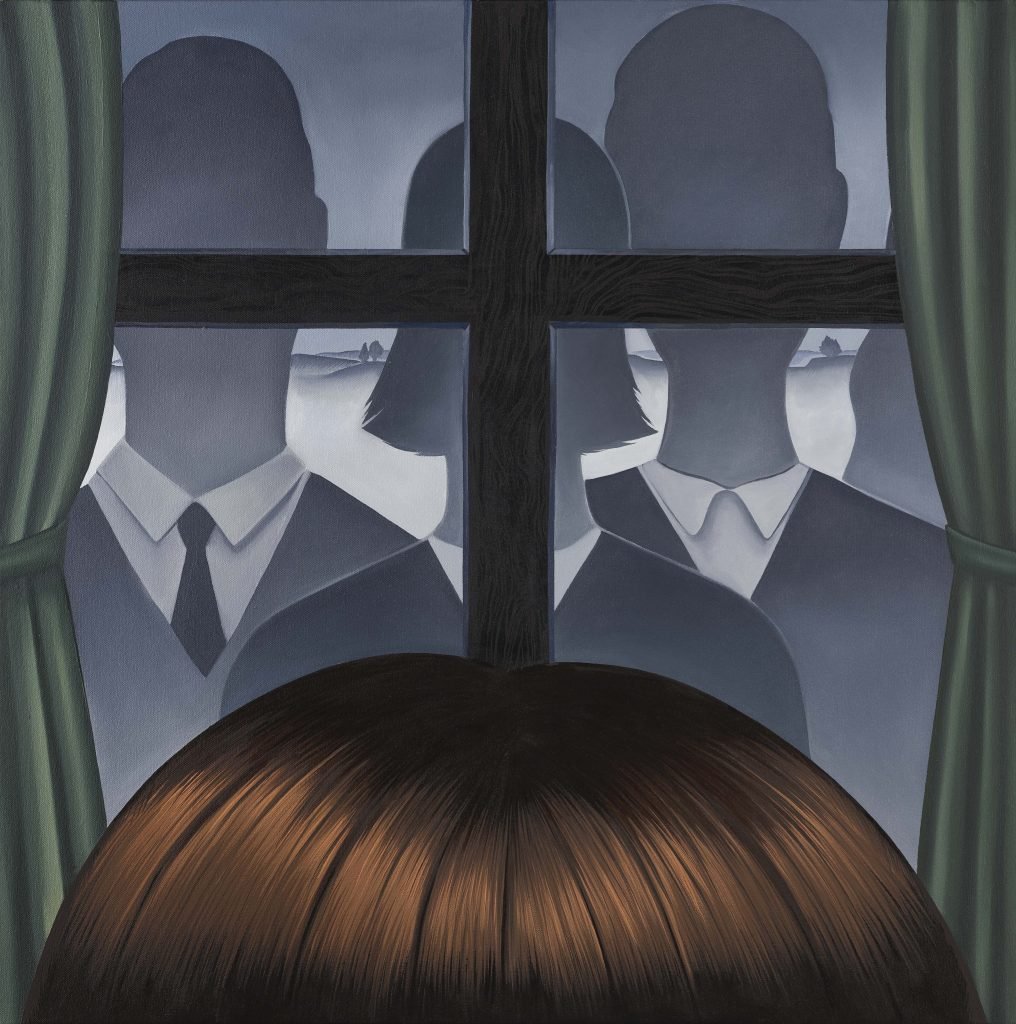

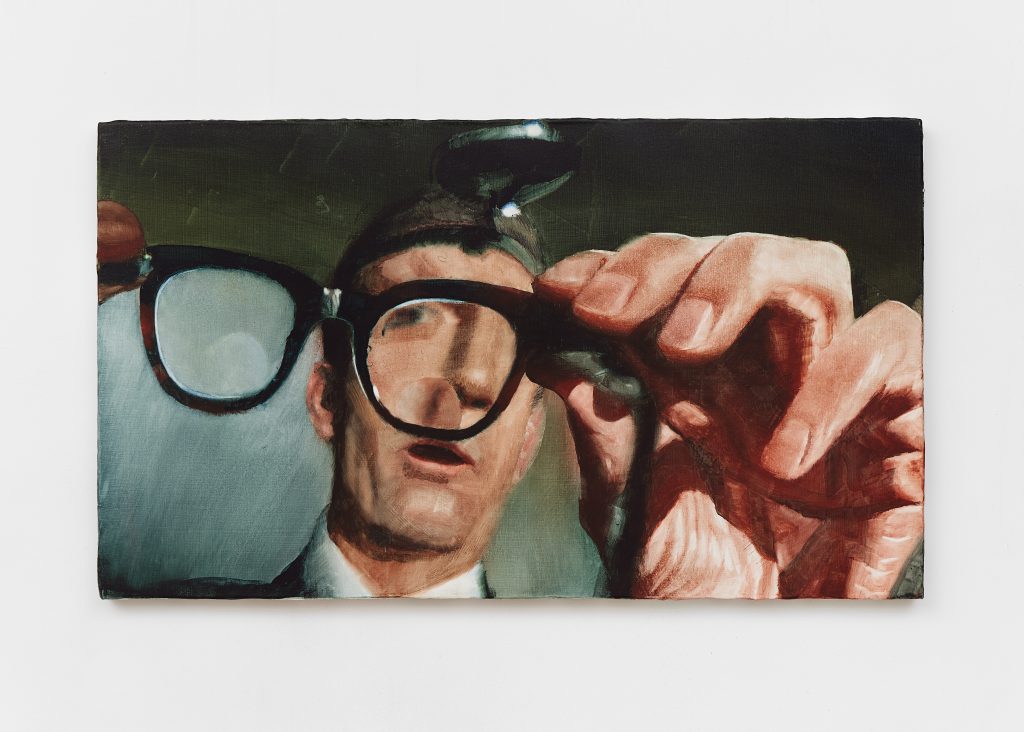

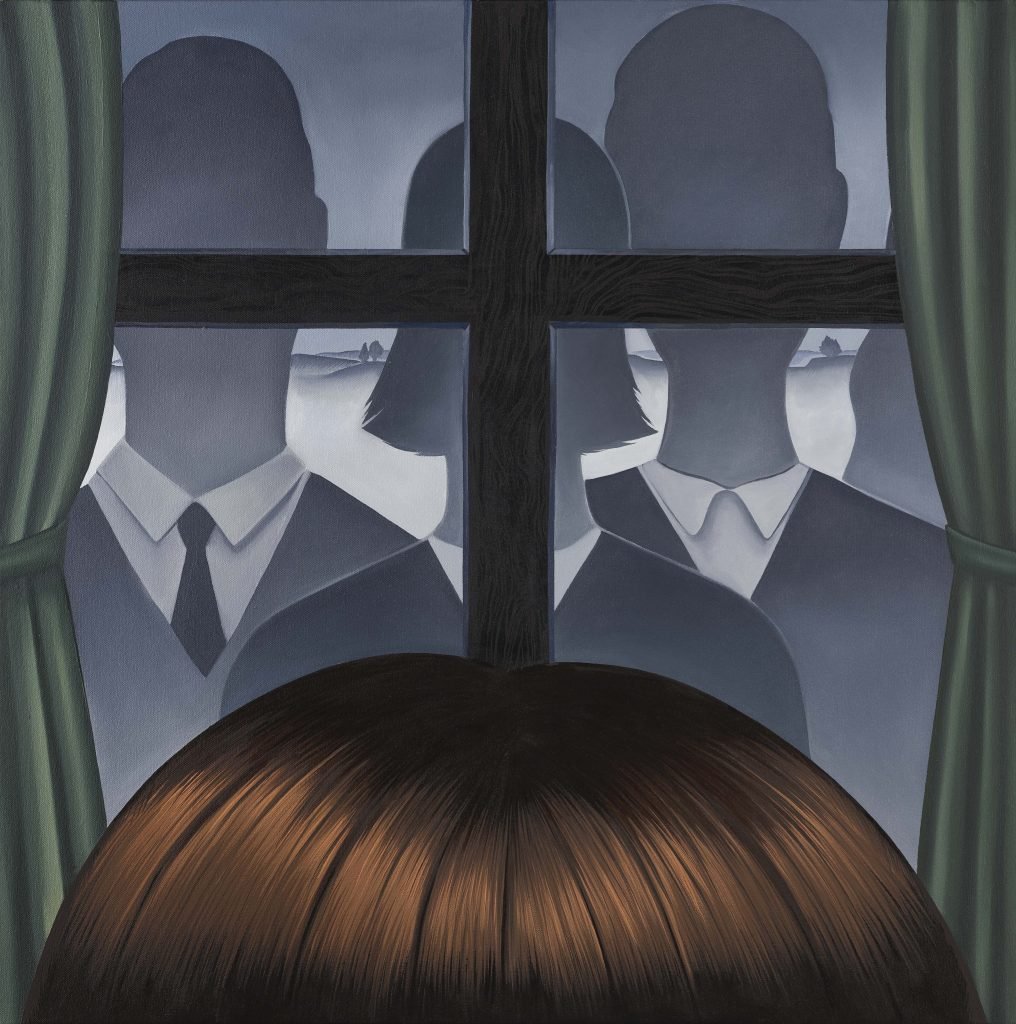

Julie Curtiss, The whispers (2020). © the artist. Photo © Prudence Cuming Associates Ltd. Courtesy of White Cube.

“They are like shapeshifters,” Levin said. “They’ll adopt any form that best suits their desire to transact.”

While the names of bad actors are circulated by galleries, Gmail art advisors are usually absent from the black lists—because they are not known entities.

“They appear out of the blue and often vanish into the mist,” said Allegra LaViola, a gallery owner who regularly receives emails seeking “available art” from art advisors she’s never heard of. “They often want your well known artists, which is obviously a no-go coming out of nowhere. Sometimes they do these blanket emails. They tend to be very mysterious about who their collectors are.”

An advisor of this kind is usually drawn to a collector of a similar speculative mindset, creating a symbiotic relationship that may be based on a shared transactional goal as much as sheer necessity.

“A really good collector wouldn’t be working with an advisor of this type,” Levin said. “And a collector of that type will be quickly ferreted out by an experienced advisor. You are not going to waste your time with them.”

Experienced advisors know that it could be as hard to get a $20,000 artwork as a $2 million one—and sometimes harder, given the access limitations for hot artists. They also know that indiscriminate buying leads to a collection whose value may go down 90 percent as soon as the works leave the gallery.

The surge of Gmail art advisors is in part a result of a low entry barrier into the field.

“Unlike being a stockbroker, which requires a rigorous process to get professionally certified, anyone could print up a business card that says ‘art advisor,’” said Alex Glauber, whose early professional experience was acquiring and then liquidating art of the Neuberger Berman and Lehman Brothers corporate collections.

“Any time that there’s a really buoyant and frothy market, especially one that’s filled with new collectors and a lot of heat around young artists, you get a number of people who participate as intermediaries and sort of masquerade as advisors,” he said, “because there is a surplus of people with money who want to spend it and are looking for direction.”

Access is essential, especially when you’re dealing with the primary market. Which is why newbie collectors may be drawn to those presenting themselves as having relationships with galleries.

Think of it as tourism, where art buyers are visitors and such advisors are guides. They’ll “take you to the bazaar, where they have the carpet dealer who’s a pal or a brother or whatever, and they’ll sell you all those carpets,” a young, savvy collector told me. “Every client has the same collection—basically the same five artists that the art advisor promotes.”

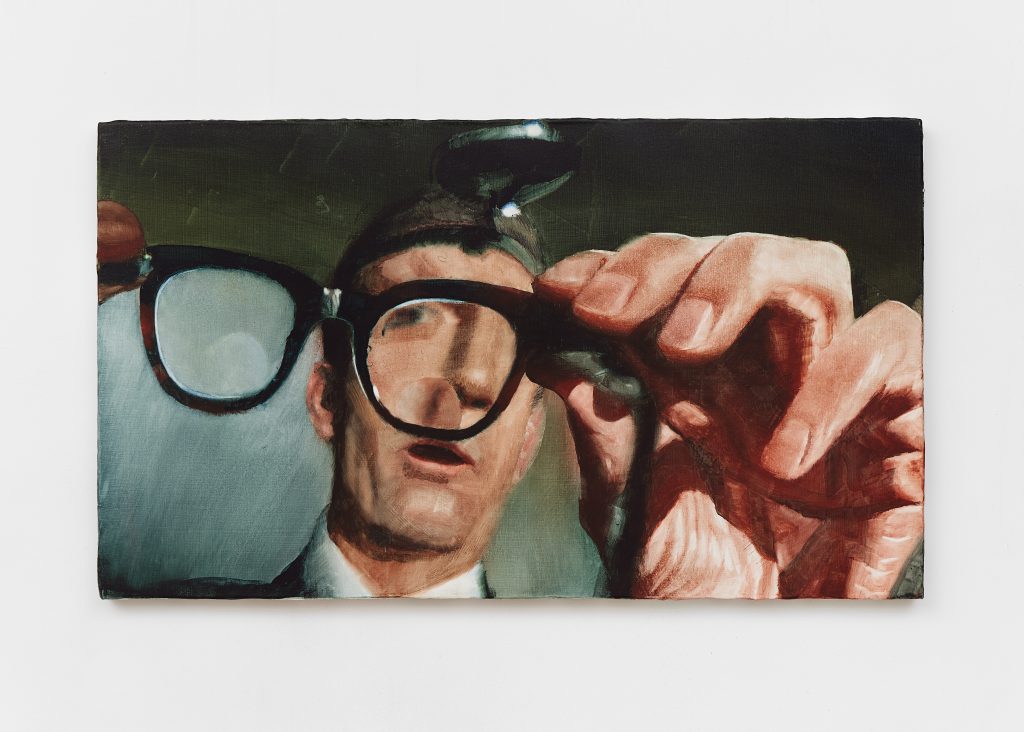

Joseph Yaeger, Sanctimony as a pastime! (2022). Courtesy of the artist and Project Native Informant, London.

There’s a way to ferret out bad actors and find good ones. The Association of Professional Art Advisors, for example, has 151 approved members internationally, up from 111 in 2013, with its ranks including curators as well as consultants. The gold standard of the field is Elizabeth Szancer, the longtime advisor to Ronald Lauder, who helped organize the show of some 500 objects that make up “The Ronald S. Lauder Collection” at the Neue Galerie through March 20. It’s a rare public look at the private collection of the museum’s billionaire co-founder and president, whose taste ranges from medieval armor to Modern art. Levin, Cromwell, and Glauber are all members too.

Such a pedigree can be valuable, because being an art advisor involves much more than just getting an artwork or walking someone around an art fair.

“If you’re a collector in New York you’re probably acquiring from galleries and fairs, and you’re probably dealing with a lot of international shipments and administrative challenges that you probably don’t want to deal with,” Glauber said. “And that’s another key responsibility of a good art advisor.”

Educating clients, shaping their vision, researching provenance, and inspecting the condition of art are among other responsibilities. Historically, the role of an advisor has been played by curators and dealers. William Rubin, former chief curator of painting and sculpture at the MoMA, advised the collector Leon Black. Art dealer David Nash found many irreplaceable treasures for Paul Allen.

The ranks of art advisors began to expand as more people began investing in art. These days, in addition to organizations like the APAA, there are global consortiums like AIG, co-founded by auction dynamo Amy Cappellazzo, and Schwartzman &, founded by her once-partner Allan Schwartzman, who advises artists and their foundations as well as collectors. The Fine Art Group and its rival the Winston Art Group offer advice on acquisitions, financing, and deaccessioning among other services.

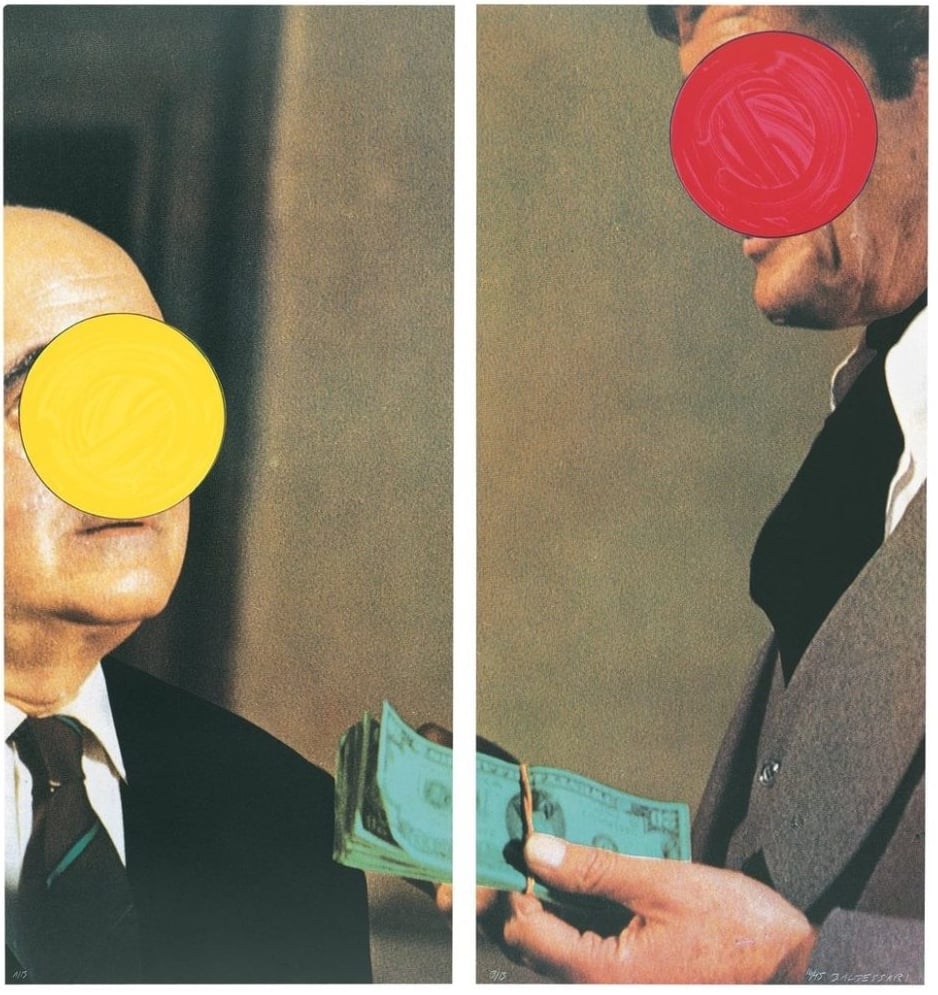

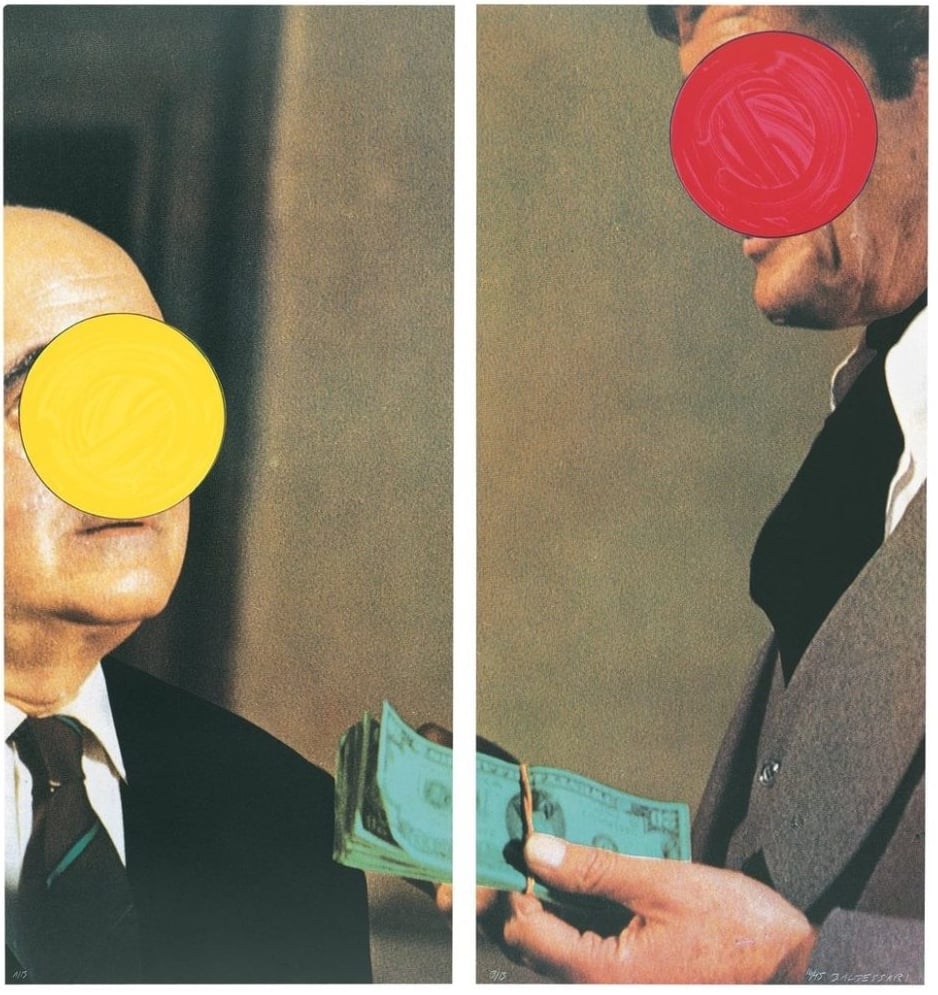

John Baldessari, Money (with Space Between) (1991) courtesy Gemini G.E.L.© John Baldessari.

Payments vary. Retainers used to be common, but a recent internal survey by APAA members revealed that being paid by commission based on a purchase price has gained traction in recent years. The standard is 10 percent, but that could go up to 20 percent on lower-value works, or fall far below at the trophy level, advisors said.

Undisclosed commissions from a gallery are a big no-no for an APAA member, as is holding inventory, according to Megan Fox Kelly, the organization’s president. The key is to always act in the best interest of a client, and uphold the greatest transparency, she said.

One cautionary tale is the epic legal battle waged by Russian billionaire Dmitry Rybolovlev, who claims to have overpaid $1 billion in fees to Yves Bouvier, the Swiss shipping and freeport magnate, who procured 38 artworks for him over a decade in the capacity of an advisor.

The murkiness of the field is precisely why new people pour into it during frothy times but exit quickly in sober periods.

“It’s really hard to make money,” a collector, who deals on the side, said. “With these young people, they don’t realize that. It’s easy to set up, easy to get going, to show up at Art Basel or a White Cube dinner. Then they meet the wrong person. The wrong person flips the painting. And boom. Where do they go? I guess real estate. The next thing they’ll do is try selling condos.”