Artnet News Pro

The Co-Founders of SuperRare Tell Us How and Why Their Incredibly Successful NFT Platform Became a DAO

We spoke to the brains behind the company about its genesis four years ago and its massive growth.

We spoke to the brains behind the company about its genesis four years ago and its massive growth.

Eileen Kinsella

No one could have predicted the speed and intensity with which NFTs would storm the art world over the past year—not even some of the earliest and most ardent fans and proponents. However, amid the flood of supply and proliferation of NFT platforms offering their services, it seems like—as in many areas of cutting-edge technology—those willing and able to engage their audience as stakeholders may be pulling ahead of the pack.

Enter the team behind the now-thriving SuperRare platform, whose co-founders launched it nearly four years ago, in spring 2018. As sales skyrocketed in 2021, they took additional steps to democratize both the business model and the curation process to make it stand out amid a sea of competitors. To wit: last summer, the company became a DAO (Decentralized Autonomous Organization) and launched its own governance token ($RARE) to allow fans to buy into the company and gain voting rights over aspects of its operations as well as to make decisions about handling and sharing profits.

“A new DAO comprised of $RARE token holders will help define the future of art and culture for a digitally native generation. Membership in the SuperRare DAO allows you to curate the platform, control marketplace parameters, and add your voice to one of the most ambitious art projects in the world today,” according to the SuperRare website.

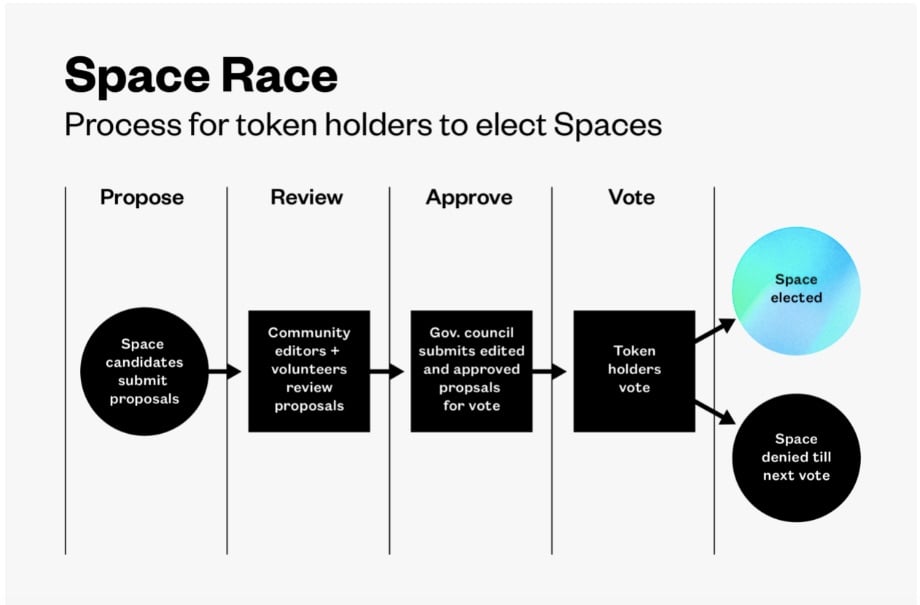

This Monday, March 21, token-holders will be able to vote for the second edition of SuperRare’s Space Race winners, where 10 “curators” will be selected from competing candidates to operate a virtual showroom (Spaces, in SuperRare parlance). Described by SuperRare as a “community curation game designed to surface emerging talent in the NFT ecosystem,” it enables curators to bring on whatever artists they want and then claim a percentage of sales proceeds, just as a traditional dealer would. SuperRare takes an 18 percent fee.

The first Spaces curators were announced last year, with Museum of Crypto Art founder Colborn Bell getting one, and the artist Carlos Marcial Torres gaining another. Torres dedicated his to spotlighting fellow Latin American artists. Artist collectives have also begun competing for Spaces.

SuperRare co-founder and CEO John Crain. Image courtesy SuperRare

This decentralized way of operating SuperRare, and the enormous success of the platform, with over $240 million in sales recorded to date, are the fruit of blue-sky thinking.

“We had a dream and a hope that NFTs and digital art would go somewhere,” John Crain, one of SuperRare’s co-founders, said in a phone interview with Artnet News. “Personally, I was always into generative art and following digital artists. I thought it would be so cool if you could collect somebody’s Processing work and wondered what that would look like.” (In addition to JavaScript, Processing is one of the most popular tools to code generative artworks.)

So when Crain, his brother Charles (who now serves as SuperRare’s CTO), and Jonathan Perkins first started hearing about and seeing NFTs (non-fungible tokens), they immediately thought they could have the “game-changing tool” to help create a market for digital art.

They launched the platform with no investment and no backers, working mostly nights and weekends with the aim of creating a place where buyers could find NFTs with a degree of confidence about authenticity.

“It was slow and steady growth for the first two years,” Perkins said. “The fall of 2020 was when you started to see numbers ticking up and new collectors entering the space who we didn’t personally know.”

The biggest turning point, of course, was last March, when an NFT by Beeple sold for a jaw-dropping $69 million at Christie’s. “Things have gone much more crazy than we could have ever imagined,” Perkins said.

Like many crypto-art platforms, SuperRare experienced incredible growth last year. The highest priced primary sales to date include the Ross Ulbricht Genesis Collection sold for 1446 ETH in December ($6.3 million). It was bought by a DAO. The second highest primary sale work was Dimitri Cherniak’s A slight lack of symmetry can cause so much pain, sold for 800 ETH ($2,404,764) in October 2021. Today the company has 55 employees.

XCOPY, This is clearly money laundering, Mar-01-2021,. Image courtesy of XCOPY and SuperRare. The work sold for $434,052 on April 17, 2021 in through SuperRare.

As for the DAO structure, Crain said that, as a result of working in the crypto field prior to building SuperRare, there was always some element of a “decentralization ethos built into the platform.”

In the process of building the company, Crain said, the three helped “pioneer something that is now taking root across the NFT ecosystem with respect to artist royalties.” Anytime an NFT is sold on the secondary market, the artist gets 10 percent of that sale, which becomes “a perpetual second line of income for artists, especially where the amounts on a tertiary or secondary sale vastly surpasses initial sale of the work,” Crain said.

As for the current fee structure: on primary sales, 18 percent of fees go to the DAO ((15 percent commission and 3 percent network fees); on secondary sales three percent goes to the DAO: and for sales transacted via Spaces, eight percent goes to the DAO (five percent commission and three percent network fees) in addition to the variable commission that the Spaces take.

Carlos Marcial Torres, The Old Morales (2021). Image courtesy the artist and SuperRare

With the launch of the DAO, some ETH from commissions and marketplace fees will now go into a “community treasury” that has roughly $15 million in it so far. “The idea is that the community can allocate that money as it sees fit through artist grants or other distributions,” Crain said.

The option to sell independently on the platform or as part of a Spaces sale allows for different business styles. Where some artists have no problem taking to Twitter to blast out the current bid and remaining time on an NFT sale, others are more comfortable letting a dealer (or a Spaces curator) handle the business side of things.

Image via SuperRare.com

Even before the latest initiatives, Crain said, using the web as an additional income stream has been an extremely powerful tool for artists, whether they are early pioneers like the husband-and-wife duo in Italy known as Hackatao, or later adopters like street art star Shepard Fairy, who dropped a piece on SuperRare last spring.

“We have heard countless times that being able to make rent by using SuperRare has been a lifeline for a lot of creators,” he said. “I think we’ve done a good job of teaching people this is culturally relevant. It’s more than just kids trading pictures of frogs.”