Dealer’s Diary

The UK’s divorce from Europe has yet to make much impact other than creating cheaper Brexit pounds. By getting payment terms on a sculpture I purchased in London before summer, I benefitted from an additional 10 percent discount without having to ask for a change.

But I wasn’t going to wait around for the fallout, so I got on a plane to New York last week to look for brighter opportunities (though with a view of nothing but buildings from my hotel room, my NY was always night). I wheezed so much in the taxi from the airport, the driver asked me if I’d like a Marlboro—it was good to be back. I wondered if the coughing comedian, Dennis Leary, is still alive.

So what’s been happening since summer you may (or may not) care to ask? Richard Prince of Thieves has been popping out Insta-paintings faster than his lawyers can defend them—I bet he misses his frequent co-defendant Larry G. who maintains his own formidable team of attorneys adjacent to his inimitable sales staff. Prince’s legal legacy will be as studied in art school as in law school. Cool.

George Condo’s latest work includes yet another celebrity collaboration, this time in the form of dating Ashley of the Olsen twins, one-upping her sister Mary-Kate who used to go out with Nate Lowman. Guess they follow the art market too.

Then there is Choi Seung Hyun aka T.O.P., a Korean pop star with 5.7 million Instagram followers who is curating a Sotheby’s sale next month in Hong Kong, which includes works by Rudolf Stingel, Christopher Wool, Jeff Elrod (which I may own), combined with locals such as Nam June Paik, Lee Ufan and younger artists like Japanese highflier Kohei Nawa.

The catalogue for the T.O.P. sale features more pictures of the performer than the art, with enough outfit changes to make Anna Wintour blush. His frequent social media posts contain an array of great artworks yet nary a mention of the makers, which is rather self-serving, to say the least (especially in light of his vast audience).

So I Made a “Kenye”

Kanye continues to trespass into the fields of art and fashion without fear (of having much to say). His latest foray was a had-it-made wax sculpture aping a Vincent Desiderio composition but comprised of yet more celebrities, featuring himself, and Kim, of course. The act of gallery Blum & Poe in hosting and sanctioning such a circus confounds the mind as much as the eye(s), not to mention the credibility strain by showcasing the ubiquitous jack-of-all-trades, master of two (music and sneakers). Kanye accomplished with a phone call (to the fabricator) what took Desiderio six years to paint: if Kanye could rip Vincent, why can’t I jack Kanye? So I made a Kenye—with a bunch of critics, a writer, and curator.

Swizz Beatz launched the second iteration of his art fair, No Commission, in the Bronx (the first was in Miami), a more promising effort than the last show in the space, Lucien Smith’s debacle featuring a shot-out car, exhibiting a particular sensitivity to the neighborhood. It didn’t seem to bother the models and actors that showed up in droves. Art and hip-hop, I can only tremble at the thought of what’s next.

The Business of Selling Art

In the actual business of selling actual art, there was no shortage of activity in the summer of 2016, despite roiled markets worldwide. Traditional art seasons of the past—January to June and September to December—no longer apply, and thankfully so, as I managed to stay well occupied throughout.

Working on transactions involving Yayoi Kusama, new works selling from $450,000 – 800,000, which look like simulacra of older pieces, and Rudolf Stingel, subject of a still unannounced Fondation Beyeler show (out of bag now), which, at $2.5 to $4 million, remain crowd pleasers.

Mark Grotjahn, whose prices on both paper and canvas beggar belief reaching upwards of $10 million and beyond for a secondary market seventy-odd inch cardboard-on-canvas work—they all are made that way—are probably the most sought after of all (at the moment, anyway).

Wade Guyton works are still moving briskly between $2 to $3 million, on the heels of his show at Le Consortium in Dijon, while market stalwarts Andy Warhol, Gerhard Richter, and Mike Kelley soldier on trading at a steady clip.

This was a first: an Andy Warhol viewing was arranged and then unannounced to the consignor marketed as: “A meet and greet with author Anthony Haden Guest in attendance. Buyers only please. Almost everything is already sold.” What the hay?

Image courtesy of Kenny Schachter.

High Season at the Car Auctions

Summer is high season for car sales, the biggest of the year, where over $300 million worth of vehicles trade during a frenzied week of auctions, in California alone. The results were robust and only slightly off the mark from last year (and like art, well off 2014 tallies), boding well for art as the markets closely track each other.

The differences are still marked though. For starters, the sales proceed at a snail’s pace (despite the inherent speed of the underlying assets) moving along at frustratingly small increments and lasting about forever. Also, you get drink tickets with your catalogue upon entry prior to the onset of sales—at least in the UK—and a dangerous cocktail at that—more on that later.

September 7 saw the auction at RM Sotheby’s London, which I attended with Sage, my 14-year-old. To give the kid a taste of the auction process, à la Nahmad family, who famously let their children bid in diapers (and gamble), I encouraged Sage to throw up a paddle for a 1996 Ford RS200 at £170,000 – £210,000 at a price well below the estimate.

By the time he complied, the lot hit the reserve and he (we) turned as white as the paint on the Group B rally legend—as impossible to get into as it is to drive. Incidentally, car auctions are unsurprisingly mostly male and white, for now anyway. Thankfully, Sage ended as the under bidder, always a propitious position.

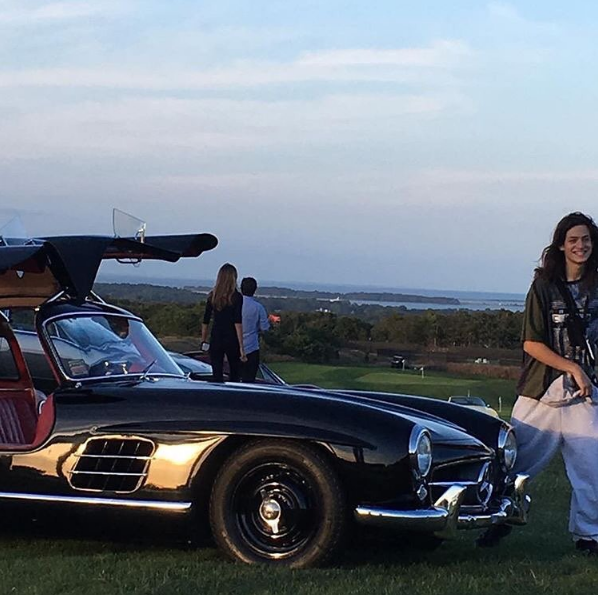

The car from a recent RM auction that Adam Lindemann ridiculed, in Kenny Schachter’s office. Image courtesy of Kenny Schachter.

For as long as anyone would listen, I’ve been preaching Porsche, how radically undervalued they are (the record stands at $10 million) in relation to Ferrari (the top auction price is $38 million, and over $50 million privately). Yes Ferrari owns the 1960s, and Jaguar the 50s, but no other manufacturer has won as many competitions from the 70s to the present. Lo and behold, a 1995 Porsche 911 GT2 at RM Sotheby’s London fetched $2.4 million, well over $1 million above the previous record for the model.

The 1961 Alfa Romeo Giulietta Spider was a slightly different story, an attractive small sports car geared as an affordable entry-level vehicle produced from 1955 to 1962, designed by acclaimed coachbuilder Pininfarina. Adding to its single-family ownership status (prized in cars as much as in art), the Giulietta was featured in the Italian film The Best of Youth in 2003 (another value adder for both).

Taking full advantage of the drink tickets, I splurged on the unrestored, time warp Alfa above the high estimate (still well below $100,000), which brings me to the next straddler of the car and art markets: gallerist and trader Adam Lindemann.

Adam Lindemann. Image courtesy of Adam Lindemann.

How Adam Lindemann Is Changing the Car Market

Adam is a squat, surly throwback to a 1950s guy’s guy in his late 40s who, against my better judgment, I like and respect (with a fistful of salt). He also races and collects cars of that era (and earlier), having recently driven stints at the vintage races Le Mans Classic and Watkins Glen, which are neither easy nor particularly safe. In another art tie-in, it was painter Richard Phillips that launched Adam’s sportive driving. I’m not sure what’s more hazardous, trading cars (and art) or driving them—quickly.

Lindemann reflects a significant change and potential growth factor in the car market: the introduction of third-party guarantees. Guarantees recast the art market’s penchant to roll the dice by speculatively pledging to buy a work prior to a given sale, with a view to some upside (with no money down) should it surpass the guarantee.

Adam is the first and only player jumpstarting the market in this vein, adding fuel to the mix, pardon the puns. He previously did it last year on a Jaguar C Type, which performed exceptionally and most recently (as whispered throughout the market) on a D Type Jag for just under $20 million, which made over $21 million (with the house commission) at RM in Monterey this summer, achieving a modest gain for the investor. He certainly knows his Jags cold.

Lindemann wasn’t too impressed by my auction acquisition, calling the Alfa “a cute, delicate, girly car,” and “a bit femme” for him. Actually, he’s kind of right. It was previously owned by a woman, but so what? And he may have called me a pussy (seems Trumpian), too, for turning down his invite to compete against him in an event.

I can’t deny he’s correct about that too—the thought terrifies me. I prefer my cars inside…of my office. Let him run his. I will exhibit mine and take them on short jaunts to town for lunch and on the school run, the only times I have to drive. To each her own, no?

I think the worlds of art and cars have the capacity to collide like art and celebs (granted not to the same extent). In that regard, I’m working on an upcoming display of classic cars and art in the context of industrial design. Stay tuned.

Coming up: Kenny Schachter’s Dealer Diary: Of Art & Cars, Part II