‘For Our Own Trade’s Sake, We Should Sober Up’: An International Art Fund Says It’s Time For the Art World to Embrace Transparency

Artnet Gallery Network

Artemundi, an international art fund manager, has been in the business of managing art as an alternative asset since 1989 and has witnessed and weathered a world of change in the art market. Now, Artemundi’s Management Advisory Council shares insights into why the art world needs to retire handshake deals and embrace transparency.

Art is nearly as old as mankind itself. And while humanity has always openly admired, collected, and displayed it, its trade has, in equal measure, attracted myths, fostered opaque conduct, aggrandized biographies, and forged back-door alliances. Such a secret circus has an appeal not only in its attitude; it adds value and drives prices higher.

Yet once such tactics become systemic on an industrial scale—with practices ranging from the untrustworthy (price obfuscation, undisclosed intermediaries, and conflicts of interest) to the illegal (money laundering, smuggling, forgery, and theft)—the process starts to undermine itself. And it does so even more rapidly at a time when most industries are completely transparent and access to prices is universal. In some senses, the art market has become clownish, and for our own trade’s sake, we should sober up.

Take the example of Michael Steinhardt, who in 2006 bought a historic portrait of George Washington known as “Munro-Lenox” by the artist Gilbert Charles Stuart from the New York Public Library. When it was time to resell it in 2017, he turned to gallery Hirschl & Adler, who sold the artwork for $10 million. Now, two years later, Mr. Steinhardt has filed a lawsuit against the gallery based on fraud, breach of fiduciary duty, and unjust enrichment. He had by chance run into the portrait’s buyer, Leonard Stern, and found out about a $2 million difference in the agreed commission. As a clear example of lack of transparency in transactions on the secondary market, Mr. Steinhard is alleging that the gallery made a hidden commission of 17% by purposely undervaluing the portrait. For want of a famous example of such bad practice, remember the recent case of Dmitry Rybolovlev vs Yves Bouvier. Bouvier is alleged to have defrauded Rybolovlev for a profit of $1 billion over 38 deals, having solidly ignored any of our industry’s codes of best practice.

While buyers in most countries are largely protected by basic consumer rights, our private deals are still often virtually void of them. The same accounts for the supposedly more public auction world. Its intricate system of legal loopholes and psychological techniques in both the consignment and bidding processes have brought us the practices of “stiffing,” “puffing,” “chandelier bidding,” “shill bidding” (driving bid prices through drama or secrecy), or the famous activity of collusion. Like the recently highlighted yet very common practice of last-minute withdrawals of auction lots, which then neither enter indexes nor become available information, the behavior is not illegal, but it is unnecessarily detrimental and, yes, quite shady.

Jean-Marc Nattier, Allegory of Justice Punishing Injustice (1737). Courtesy of Wikimedia.

Seasoned market connoisseurs are in a stronger position while navigating our complex pond, but what happens when the ecosystem needs new participants? High-profile money laundering cases, theft, or smuggling have colored the public perception of our sector enough. They have discouraged new buyers from entering the art world and other industries from engaging with it adequately. If our industry itself keeps supporting practices such as not having easy access to the prices of comparable works, entertaining a system of undisclosed chains of commission-adding intermediaries in private deals, or inflating prices by instilling fear, it is preparing its own elephant graveyard. We ought to know that the time for behind-the-scenes activities is over. We know for a fact that transparency is becoming an industry demand, as where it is not found, there is no trust for newcomers – and hence no growth.

While many deliberately will not apply the given codes, part of the art world is taking measures to combat mistrust, eliminate trepidation, and provide prospective buyers with the certainty that they are receiving a fair, legal deal. The measures to accomplish this are clear: Self-regulation, open-book policies, track-record displays, and a collective commitment to price transparency. Perhaps here, the pandemic-induced shock of the online world temporarily becoming the sole promotion and sales channel for much of the industry has helped this cause. The insight that today’s buyers do not value opaque price policies is simmering.

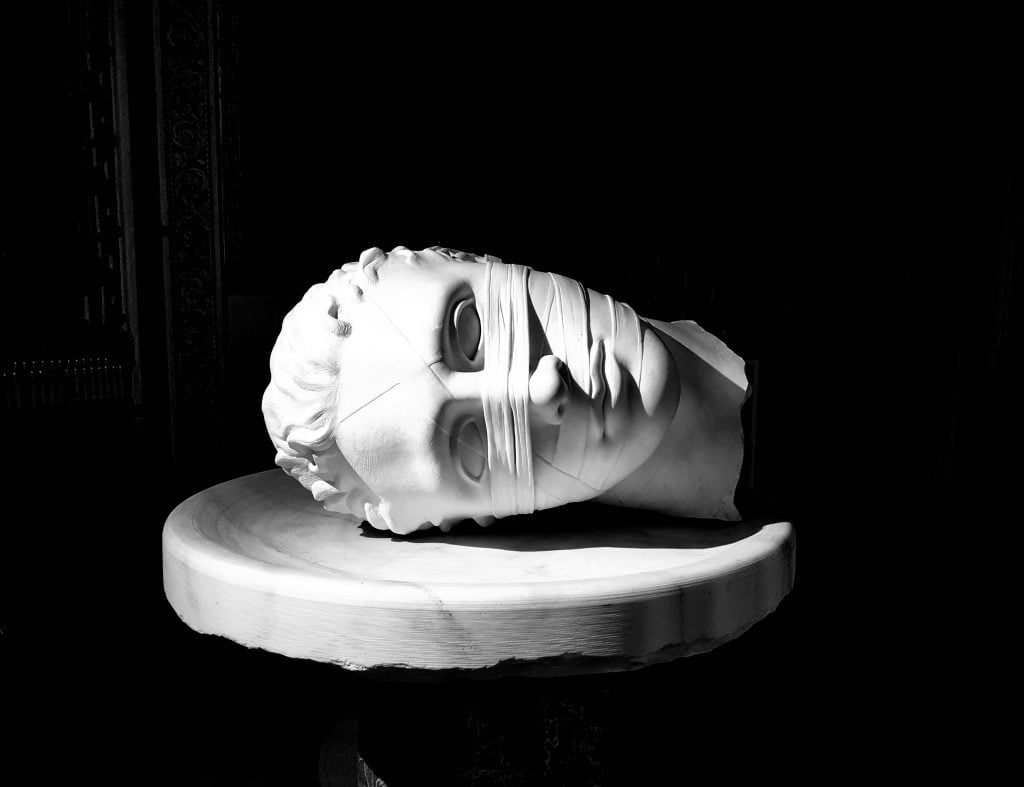

Sculpture of the bandaged, severed head of St. John the Baptist in the Santa Maria degli Angeli e dei Martiri, Baths of Diocletian, Rome. Photograph by Peter Chiykowski.

Personally, we know it is possible to change historic malpractices and repair our sector’s reputation because it is something we have been doing for the past decade. For over ten years, we have continuously operated under Anti-Money Laundering (AML) procedures and with strict Know Your Client (KYC) compliance. We have also promoted disciplined measures to avoid counterfeit art advisors. This has granted our clients and us peace of mind and shown the art world a new working methodology.

Government institutions have also increased their watch. In the United States, the Financial Crimes Enforcement Network (FinCEN) introduced Customer Due Diligence Requirements for financial institutions requiring these institutions to comply with KYC requirements. The U.S. House of Representatives also passed HR 2514, a law requiring AML programs for all persons “trading or acting as an intermediary in the trade of art,” forcing all parties to act in the open or risk legal repercussions.

The European Union introduced the Fifth Anti-Money Laundering Directive in 2018, changing the rules to require KYC practices for all transactions of 10,000 euros or more regardless of payment method. And in the United Kingdom, the government updated the country’s AML laws to go beyond the past KYC norms, requiring transparency in terms of the involved dealers, agents, advisers, and intermediaries, as well as the source of the funds themselves. Most regulations were set to go into effect in January 2020, but according to Deloitte’s Trust-Transparency-Responsibility report from October 2020, market participants have received a grace period due to COVID-19. This has been extended up until June 2021 in some places.

Giovanni Batista Tiepolo, Time Unveiling the Truth (circa 1745–1750). Courtesy of Museum of Fine Arts of Boston.

We obviously stand in firm support of these advances. Yet, as an industry, we cannot appear to require government oversight and fear of legal reprisal to act openly and transparently. We must move ahead of legislation to show that the art world is credible, trustworthy, and honest. We simply must begin to self-regulate. We ought to set positive standards, ensuring new collectors can enter the art world with confidence.

Some markets have taken steps toward this already. The United States, for instance, has an appraiser’s association to ensure the proper valuation of works of art. Many countries have similar associations for auction houses or galleries working to ensure proper self-regulation within their borders. Exercising careful due diligence in art transactions and committing to written agreements goes a long way toward aiding these efforts. Simply adhering to the usual rules applied to the acquisition of high-value assets – like checking ownership or the right to transfer ownership – does help.

2021 will be a missed opportunity if the art market as a whole does not rethink its priorities and its image. We must no longer be seen as an opaque market reserved for an elite audience. Innovation and transparency laws will arrive, and they will stay. We can establish a secondary market where all dealers, agents, advisors, and intermediaries acting on the transaction disclose the initial seller and final buyer, as well as the source of funds. We can even create a utopia where collectors and sellers feel comfortable enough with the intrinsic artistic merit of their pieces to publish their inventories and collections online in reputable outlets such as Artnet. This idyllic practice will end scavenger dealers, bring down auction house oligarchies, attract newcomers and money from other industries, and help avoid nasty legal disputes, escrow and delivery complications – even taxing dilemmas. Yes, it is still a utopia. But the mythical “elephant graveyards,” where generations go to die, do not really exist, either. They hold funerals where one has died and move on to where pastures and foliage grow.