Lessons From the Past: Collecting Art in a Crisis

Artnet Price Database Team

No one can predict exactly how the rest of 2020 will unfold. But in these uncertain times, the closest thing we have to a crystal ball maybe the past. By looking at other pivotal moments when the global economy has been destabilized, we can find clues as to how the world—and the art market— bounced back from the 2008 recession. We dove into the Artnet Price Database to see how the art world survived that hurdle and what the past may be able to teach us about our present moment.

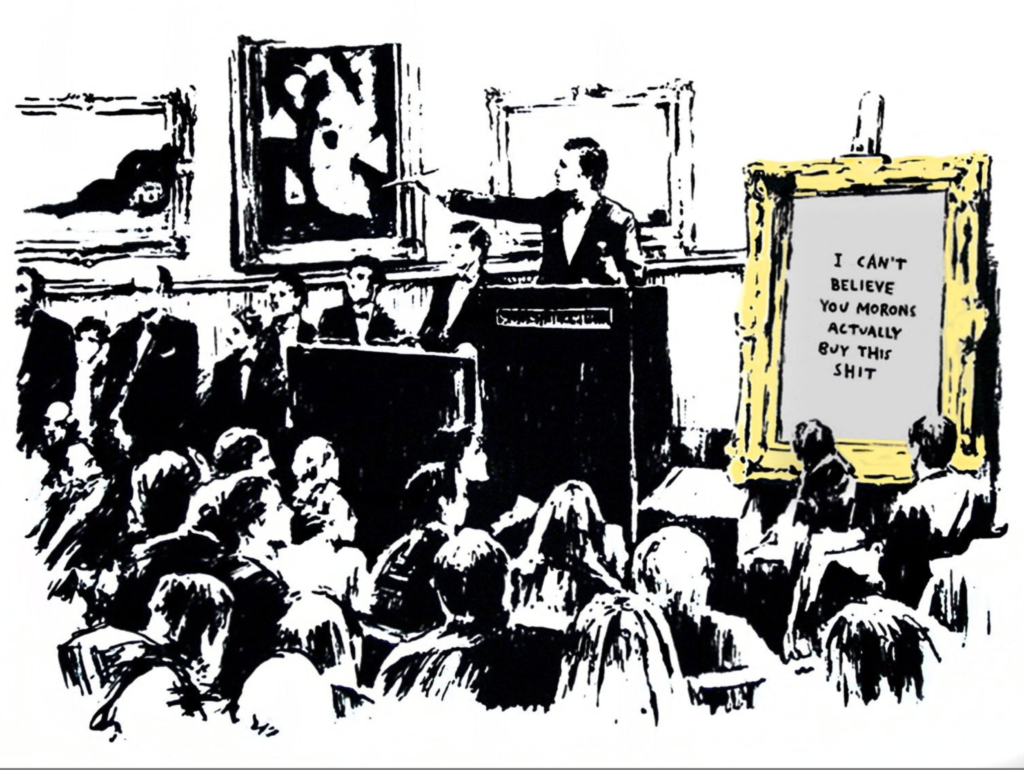

Banksy, Morons (Gold Frame) (2006). Photo: Courtesy Sotheby’s.

Nothing good lasts forever. Because the economy has been strong in recent years, experts were already examining the art market for clues of its next potential downturn for some time. Last year, Artnet News Art Business Editor Tim Schneider wrote an in-depth guide using the Artnet Price Database for how to be a “crash-proof collector,” and much of his advice still stands.

Among the most notable findings: a downturn in the market can still be a good time to sell a masterpiece. The very top of the market has proven to be remarkably resilient, and when an exceptional, once-in-a-lifetime work hits the auction block, it can still attract lively bidding, no matter the economic circumstances. Even in 2009, when global markets teetered into the very worst of the Great Recession, auction houses still produced some astounding results. Among the most memorable—and ironic—was when Andy Warhol’s 200 One Dollar Bills painting blew past its $12 million high estimate to sell for a jaw-dropping $43.8 million at Sotheby’s New York in November 2009.

During periods of great uncertainty, many people cut discretionary spending to save funds in case of emergency—and that means money for art purchases are among the first to dry up. But for those who are able, continuing to collect presents multiple potential upsides. The first and foremost is that buying art supports the art world. Whether it’s primary sales (which go in part directly to artists) or secondary market purchases, it’s a very real way of ensuring that the people and businesses who make up the art industry are able to survive.

There’s also the unavoidable truth that buying low is what investors often advise. A successful Lower East Side gallerist looked back at the 2008 financial crisis, and his advice for future recession-era collectors was blunt: “What the smart people do is buy lots of artwork,” he explained. “The people that really made money were the ones that bought at that first auction where works were selling at 35–45% under market.”

A visitor studies Dollar Signs (1981) by Andy Warhol for “The Art of Making Money” at Sotheby’s on June 8, 2015 in London. Photo courtesy Mary Turner/Getty Images.

With social distancing as our new normal, the art trade will be fully online for the foreseeable future. And that’s not necessarily a bad thing: digital platforms have come a long way since 2008, offering greater accessibility and transparency to collectors than ever before—if you haven’t explored Artnet Auctions yet, now’s the perfect time to start. Many of the industry’s biggest deals were already happening without in-person viewings, and signs suggest this will only continue.

On March 26, Sotheby’s closed its online-only sale dedicated to the work of famed anonymous street artist Banksy—and it was a runaway success. The auction brought in $1.4 million total, well exceeding the pre-sale estimate, and over 85% of lots exceeded their high estimates. Perhaps most significantly, almost half of the sale went to first-time buyers. Even now, new and young collectors are being drawn to making art-investment purchases, which offers the auction world a much-needed good sign.

To monitor any aspect of the auction market right now, be sure to contact us to order your own custom Analytics Report and get a closer look at any artist or collecting category. Stay safe and well—and we’ll continue bringing you the data you need, wherever you are.