Art Fairs

Art Basel in Basel 2014 Sales Report

It's a billion-dollar blast, from Georg Baselitz to Yayoi Kusama.

It's a billion-dollar blast, from Georg Baselitz to Yayoi Kusama.

Coline Milliard

Otobong Nkanga, Diaspore (2014). Presented at 14 Rooms in Basel by Fondation Beyeler, Art Basel, Theater Basel in 2014. Photo: Courtesy MCH Messe Schweiz (Basel) AG.

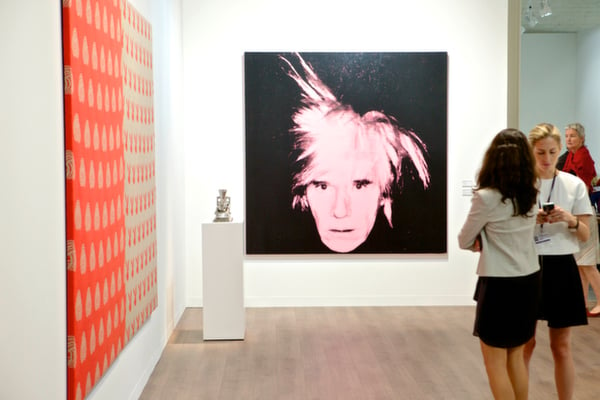

The historic results at New York’s auctions last month set the tone: Confidence is high and the global elite is in a buying mood. This bullish atmosphere has continued at Art Basel’s 2014 edition. Millions changed hands in the fair’s preview days. Unsurprisingly, it’s the brand names and safe investment pieces that attracted the top buyers. Secondary market gallery Skarstedt scored the biggest sale reported at time of writing, with a monumental Andy Warhol self-portrait from the iconic Fright Wig series, priced in the region of $35 million. One of Damien Hirst’s much sought-after early vitrines, Nothing is a problem for me (1992), sold for $6 million at White Cube, and at David Zwirner, and Jeff Koons’s eye-catching stainless steel Dolphin (2007–13) was bought on the first day for $5 million. At Thaddaeus Ropac, Joseph Beuys’s last sculpture was snapped up for $2 million.

Skarstedt Gallery, New York, at Art Basel in Basel 2014.

Photo: Courtesy Art Basel.

The cliché is as true as ever: Art Basel remains the industry’s mecca. Now in its 45th edition, the fair is the one to buy at, the one to be seen at—the one that museum curators all show up for. Art Basel doesn’t have a finger on the pulse; it is the pulse. And it is working hard to maintain its position at the very top of the industry. This year the fair is embracing performance—perhaps the most commercially challenging medium—and has staged a museum-size exhibition of live art, 14 Rooms, which comes courtesy of globe-trotting curators Hans Ulrich Obrist and Klaus Biesenbach. Garnering curatorial kudos is high on the agenda here, but this hasn’t deterred some of the most enthusiastic buyers, some of whom are rumored to have picked a few of these “experiences” for their personal collections. Unlimited, a section devoted to oversize solo presentations, has the air of a mini biennial.

The Art Basel Price Hike?

But for buyers, the Art Basel quality stamp comes at a price, even when compared to recent sky-high auction records. Call it the Art Basel premium. Julie Mehretu’s large abstract painting Mumbo Jumbo (2008) sold for a handsome $4.85 million at White Cube, beating the artist’s record at auction ($4,603,750), set at Christie’s last month. An uncanny Bruce Nauman sculpture, Andrew Head/Andrew Head, Stacked (1990), which appears to be the piece that fetched $2,251,750 at auction just a year ago, was bought at Zwirner’s booth for a staggering $3.2 million (as of press time, Zwirner representatives hadn’t confirmed whether or not it is indeed the same artwork).

The most desirable pieces command the largest markups. An influential New York–based art adviser told artnet News that she had noticed a $150,000 difference between a small Gerhard Richter she was hoping to acquire for a client, and the average auction price for an equivalent work.

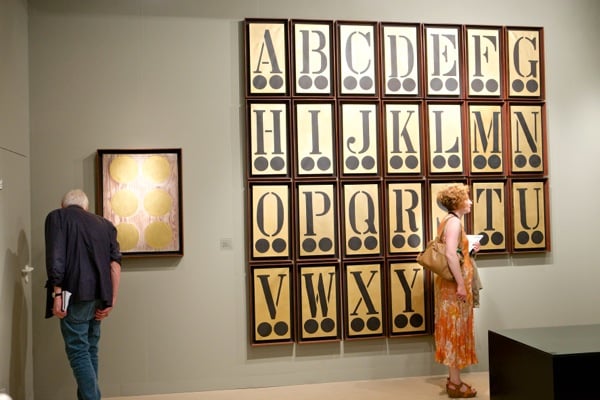

Galerie Gmurzynska, Zurich, Zug and St. Moritz, at Art Basel in Basel 2014.

Photo: Courtesy Art Basel, MCH Messe Schweiz (Basel) AG.

Perhaps due to the absence of the Venice Biennale this year, the overall impression was that fewer Americans made the trip, although usual suspects like Don and Mera Rubell and the Mugrabis were in attendance. Asian collectors were also spotted in large numbers, attracted to Basel by the fair’s sister operation in Hong Kong.

“They want to find out the difference between what is being shown there and what is being shown in Switzerland,” comments Galerie Gmurzynska’s co-CEO Mathias Rastorfer. And is it that different? “Oh yes, this is very European-American,” he answers, gesturing towards the booth’s remarkable display of modern abstractions, inspired by Peggy Guggenheim’s iconic gallery Art of this Century.

Galerie Thaddaeus Ropac, Salzburg, Paris, at Art Basel in Basel 2014.

Photo: Courtesy Art Basel.

What’s Selling?

Georg Baselitz was much in demand this year. His wooden colossus overlooking Thaddaeus Ropac’s entire stand, Volk Ding Zero (Folk Thing Zero) (2009), went for $2.3 million. At Skarstedt, his oil on canvas Edvard vor dem Spiegel (Munch) / (Edvard in front of the Mirror (Munch), priced at $3 million, found a new home almost immediately. Other notable sales included a Joan Mitchell painting, snagged for $1.5 million by a collector so eager to get it in the local free port that it was gone by the time artnet News reached the Cheim & Read booth. The gallery also reported healthy sales across its inventory, including pieces by the likes of Lynda Benglis, Jenny Holzer, and Jack Pierson.

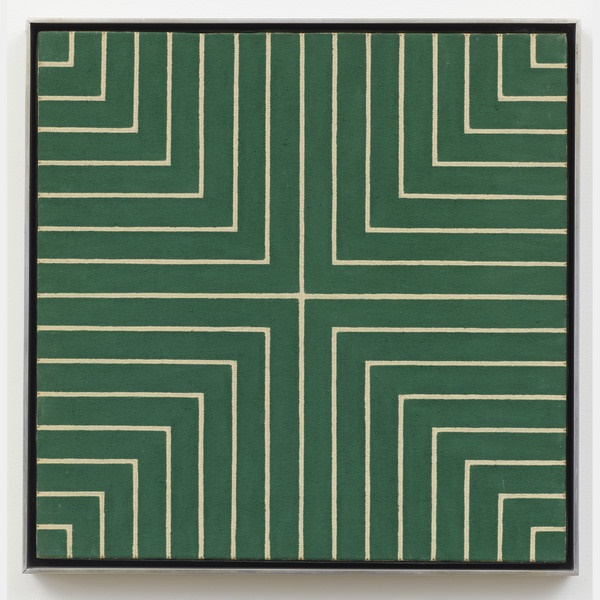

Frank Stella, Delaware Crossing (1961). Photo: Courtesy Art Basel.

As the global art fair circuit accelerates, collectors have professionalized. Meandering around the booths hoping to fall in love with this or that piece is a tactic from a bygone era. Buyers—or their advisers—do their homework scrupulously. “It’s much less spontaneous, more prepared,” says Art Basel veteran Dominique Lévy, who told artnet News she had been contacted by 50 art advisers, dealers, and collectors ahead of the fair itself. At her booth, a rare installation of eight pictures by Günther Uecker went to a European institution for €5 million ($6.8 million), while Frank Stella’s Delaware Crossing from 1969 topped $1 million.

White Cube, London, Hong Kong, São Paulo, at Art Basel in Basel 2014.

Photo: © artnet News.

So intense has the pre-fair activity become that almost half of the pieces in the booths are now expected to be have been sold—or “presold,” to use the art dealers’ code—well before the First Choice VIP card-holders hit the floor. But Skarstedt’s director Bona Montagu is adamant that most of the deals still take place at the fair. “The best dealers will have conversations but the agreements are done here, when the client has seen the artworks,” she says.

The Primary Market vs. the Secondary Market

Art Basel’s traditional distinction between the first floor (or ground floor, for Europeans), dedicated to modern art and secondary market works, and the second floor (or, for Europeans, the first floor), which is more focused on cutting-edge primary market galleries, seems increasingly irrelevant. “I’ve got the impression that the fair has a tendency to push aside the secondary market dealers,” says Lévy. “It generates a feeling of repetition, an homogeneity.”

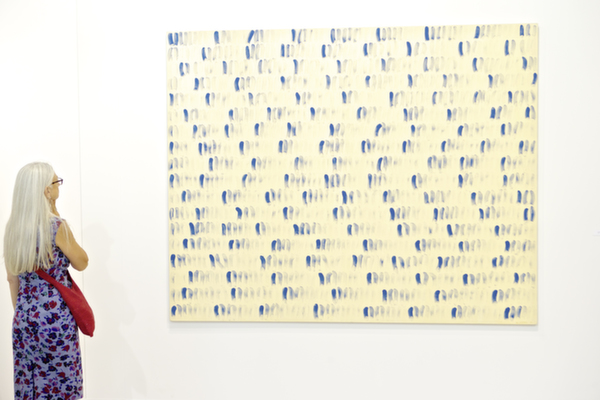

Mitchell-Innes & Nash, New York, at Art Basel in Basel 2014.

Photo: Courtesy Art Basel.

Mitchell-Innes & Nash‘s David Nash chimes in, telling artnet News: “The emphasis is getting more and more on the fashionable contemporary art.” Still, the New York dealer had no trouble finding buyers for his bijou Anthony Caro sculpture Display (2011–12), which sold in the region of $100,000, and for his two André Kertész photographs taken in Piet Mondrian’s studio, which went for up to $100,000. Several dealers made similar remarks, both on the modern and on the contemporary side. And the shift in focus echoes the direction of the global market as a whole, which—according to TEFAF’s much-perused annual market report—has tended toward the contemporary in the last few years. It might also be a case of Art Basel honing its identity, purposefully accentuating the differences with its most direct competitor, TEFAF, to remain, unchallenged, at the top.

Lehmann Maupin, New York, Hong Kong, at Art Basel in Basel 2014.

Photo: Courtesy Art Basel.

Although the prices are less impressive than in the modern section, the contemporary art galleries fared very well. At Lehmann Maupin, three circular paintings by the Brazilian artist-of-the-moment Adriana Varejão sold for $250,000, while works by Liu Wei, Ashley Bickerton, and Teresita Fernández, priced in the region of $150,000, all found buyers. São Paulo’s great Galeria Luisa Strina sold two of Pedro Reyes’s intriguing (and topical) Navaja Suiza (Swiss Army Knife) IX (2014) sculptures, priced at $40,000, one of them to a European trust.

Pace, New York, Beijing, London, at Art Basel in Basel 2014.

Photo: Courtesy Art Basel.

Pace devoted half of its stand to Lee Ufan, capitalizing on the Korean artist’s high-profile exhibition at Versailles. The trick paid off as paintings and works on paper priced at up to $375,000 flew off the wall. Over at Victoria Miro, works by the ever-popular Yayoi Kusama sold for up to $800,000, while healthy sales were reported for works by Idris Khan, who designed the set for a new dance piece, currently on show at Zurich’s Opernhaus. Art Basel might be expensive and in flux, but it has lost none of its punch.

Art Basel in Basel 2014 continues through June 22.