Art dealer Bennett Roberts has been saying no to collectors all week at Art Basel Miami Beach.

His Roberts Projects gallery booth at the largest contemporary art fair in the U.S. is filled with works by some of the hottest artists of the moment: Amoako Boafo, Otis Kwame Kye Quaicoe, and Jeffrey Gibson. All were sold by the time the event opened to the public on Thursday, and some were spoken for even before VIPs rushed in two days earlier for the event’s “First Choice” preview.

“Hundreds have asked,” Roberts said, looking exhausted and ebullient in equal measure.

Demand at the main fair, as well as at satellites such as NADA and Untitled, is off the charts, collectors, advisers, and dealers said. The question is: Who gets the privilege to take home that coveted painting by Boafo? Or the Genesis Tramaine being sold at Almine Rech? Or the Flora Yukhnovich work at Victoria Miro? It’s a dilemma for galleries that want to reward loyal clients, place works with museums, and grow new audiences at the same time, all while steering clear of speculators.

Otis Kwame Kye Quaicoe’s works at the Rubell Museum. Photo: Katya Kazakina.

Many conversations this week—whether in the fair aisles or at Champagne-drenched pool parties—included complaints that the best works had been sold in advance of the fair. Even stalwarts were scratching their heads at the amount of pre-sold material.

Part of that was due to the uncertainty over a new Covid-19 strain, with most Asian and many European clients unable to attend due to travel restrictions.

Then there’s the rampant speculative craze and the arrival of a new generation of wealthy collectors who want to find the next Basquiat. Those buyers have been snapping up young brand names often without seeing the works in person. It’s not uncommon to have 500 to 750 people on wait lists for leading emerging artists, dealers and advisors said.

Amoako Boafo, PINK CORSET PINK GLOVES (2021). Courtesy of the artist and Roberts Projects.

“Hong Kong, China, Russia—it’s totally international,” Roberts said. His only available painting by Boafo, whose auction record reached $3.4 million at Christie’s in Hong Kong this week, went to an American collector for $235,000. A handful of paintings by Quaicoe, an emerging artist prominently featured at the influential Rubell Museum in Miami this year, were gone in a nanosecond, with prices ranging from $40,000 to $85,000.

“They go to museums, private foundations, and collectors who are supporting the program and are willing to help another work go to a museum,” Roberts said.

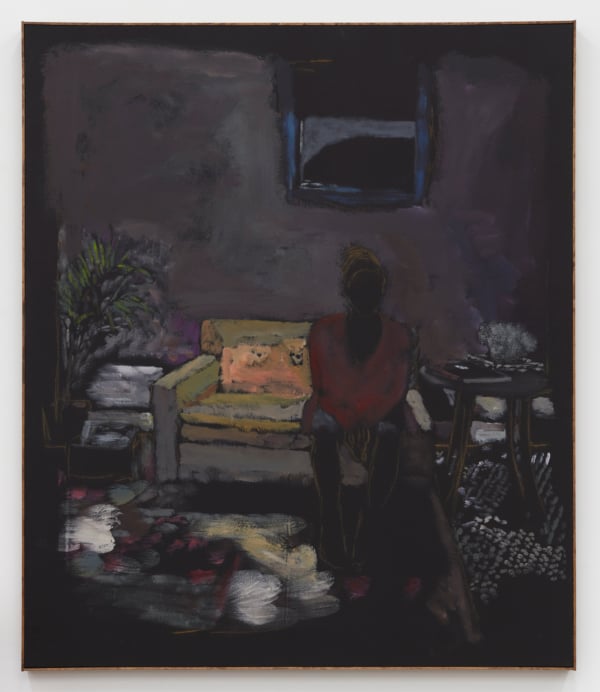

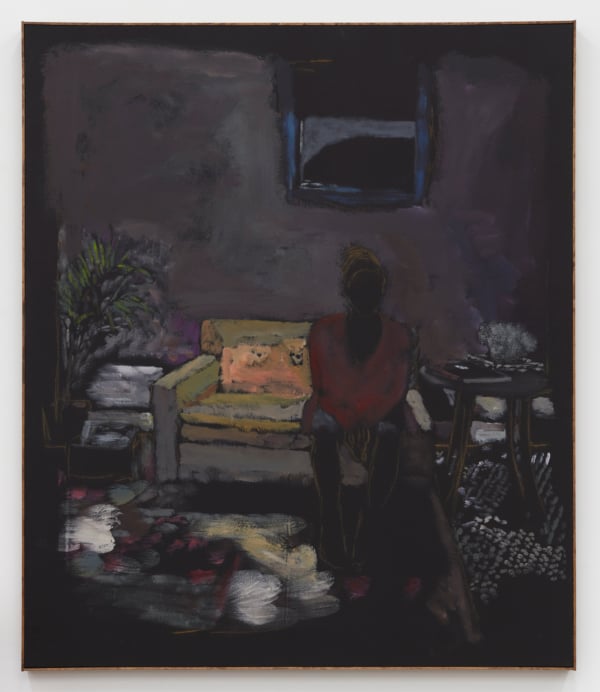

Reggie Burrows Hodges, Spinning Dub Records in Thun, (2021). Courtesy of the artist and karma.

Dealers often vet potential buyers, but that can only go so far. When prices get into the stratosphere, selling a painting may be tempting—and even financially prudent. (Just think: You might have $1 million hanging on your wall.) Even seasoned collectors aren’t immune to flipping.

“It’s a trial by fire,” said Brendan Dugan, the owner of Karma gallery in New York, which represents many popular artists. This week, it has only one painting by the in-demand artist Reggie Burrows Hodges in its booth. A collector who already owns work by Hodges purchased Spinning Dub Records in Thun (2021) for the Carnegie Museum of Art in Pittsburgh as an immediate gift, according to Dugan. He declined to reveal the price, but works by the artist have sold for more than $600,000 at auction.

“You really want to build a community around the artists,” Dugan said. “Hopefully, it includes institutions, curators, and people who create the right context for the works.”

With hundreds of people clamoring for artworks, making a decision is often hard, but “you get clarity when the right thing happens,” Dugan said. “The focus is the artist and that guides my decisions.”

An untitled 2021 painting by Rick Lowe at Gagosian’s Art Basel Miami Beach booth. (Photo by Sean Zanni/Patrick McMullan via Getty Images).

Miami-based collector and art patron Jorge Pérez, who opened a private foundation in town two years ago, said he ended up buying 30 works at various fairs this week.

“I pre-bought a lot of these works,” he said at a wine tasting organized by art dealer Kavi Gupta at Red Rooster on Thursday.

But many others ended up feeling disappointed.

Max Dolgicer, a New York-based collector who owns works by KAWS, Boafo, Rashid Johnson, and Tracey Emin, found many pieces he coveted pre-sold on opening day. So he was excited to find a new painting by Rick Lowe, a Houston-based artist who recently joined Gagosian gallery, still available. But before pulling the trigger, Dolgicer wanted to check out another painting stored in Gagosian’s back room at the fair. By the time he returned to the floor 10 minutes later, the Lowe was sold.

“I should have known better,” Dolgicer said.

Anyone who understands Economics 101 knows that markets are about supply and demand. But the art market is different because galleries often attempt to artificially control demand, especially for sought-after artists, by deciding who gets the work and who doesn’t.

“That access is a very complicated formula that’s hard to determine,” said art advisor Todd Levin. “I am sure everyone would appreciate it if there was an algorithm.”

Levin was discussing this very issue with several art-industry friends over dinner at Joe’s Stone Crab on Wednesday. “If I were a normal person walking into your gallery for the first time, would you sell me a Dana Schutz?” he asked the group hypothetically. “Of course not,” said a dealer from a major gallery. “We have to go through this whole process.”

It’s not just about who spends the most money.

“It’s all based on relationships,” Levin said. “Institutions would be prioritized. Good galleries know it’s also important to place works with collectors who are known quantities and are seen as tastemakers.”

A work by Genesis Tramaine at Almine Rech booth. Photo: Katya Kazakina.

Which means that dealers say no all the time. After seeing Tramaine’s large portraits at the Rubell Museum this week, the hordes rushed to the booth of Almine Rech gallery, which represents the artist and had one work on offer, priced at $70,000.

“They probably had to say, ‘No, it sold’ 772 times in the first three hours,” Levin said.

“We place the works of our artists into stable collections and with collectors who have been supporting our program,” said dealer Almine Rech, whose booth sold out. “It does not matter whether the artist is in high demand or less in demand.”

Many galleries frequently ask collectors to donate one work to an institution in order to get another (some refer to this as BOGO—buy one, give one). Some dealers sell a hot artist’s work if collectors also buy pieces by other less popular artists from their program.

“People do get upset,” said Janis Gardner Cecil, a private dealer. Unable to gain access to primary market works, buyers turn to auction. “This is why you have crazy auction prices.”

While all of this is done, presumably, to build up and nurture an artist’s career, the galleries get it right as many times as they get it wrong, Levin said.

“I suggested to one gallery—as crazy as it sounds—why don’t you do a lottery?” said Dolgicer, the New York-based collector. “Then it’s a level playing field.”