Analysis

Art Market Analysis: What Is the Work of The YBAs Really Worth?

artnet News combs through two decades of auction results to assess the YBAs' market.

artnet News combs through two decades of auction results to assess the YBAs' market.

Coline Milliard

Long gone are the days when London gasped at Damien Hirst, Tracey Emin, and the Chapman Brothers’ irreverence. The once-scandalous Young British Artists have been Britain’s artistic aristocracy for almost two decades, and the British press has never ceased to give many of them the attention usually reserved for A-list celebrities.

The media circus surrounding the YBAs—and the success of Hirst’s 2008 Sotheby’s sale Beautiful Inside My Head Forever, which generated £111,576,800 (US$ 185,407,582)—has often blurred the picture as far as the secondary market for their work is concerned. Using artnet Analytics, artnet News looks at the bare facts.

1. Damien Hirst – Green Shoots after the Crash

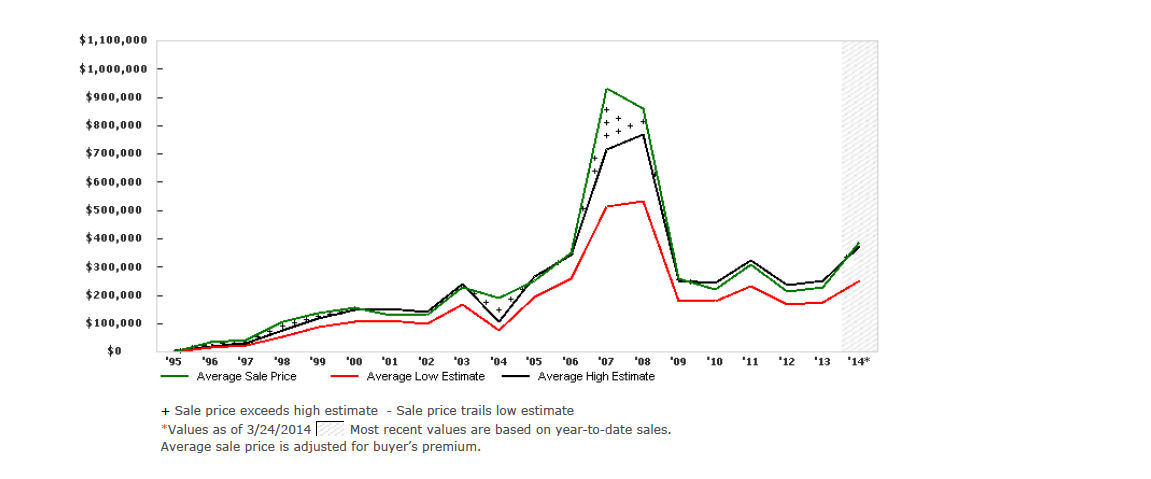

It’s not by chance that Hirst’s work has come to epitomize the concept of the art market bubble. Results at auction peaked in 2008 (the year of the Beautiful sale), reaching an average selling price of $858,647—the artist’s highest ever—and followed suit with the general collapse of the economy post-2008. In 2010, his average price at auction was $220,152. Things have been fluctuating ever since, but results for 2014 suggest green shoots. This year, the average price at auction is $386,962, the highest since 2008, partly boosted by the sale of the early vitrine Where Will it End (1993). It brought $1,601,497 at Christie’s London last month (against a presale estimate of $1,331,114–1,996,672).

Although his record is for the 2002 medicine cabinet Lullaby Spring, which sold for $19,230,922 at Sotheby’s in 2007, the second and third top results for Hirst are his Golden Calf, and The Kingdom, a tiger shark in formaldehyde. Both pieces were part of the Beautiful auction; they sold for $18,603,218 and $17,193,400, respectively. It is also worth noting that except for four years between 2000 and 2003, Hirst’s work has always mainly sold above the higher estimate. And for all the market’s turmoil, Hirst has been a fantastic investment for those who bought the artist’s work early on. The 2014 return on a 1995 investment is a staggering 1,238 percent.

Damien Hirst – Average Sale Price vs Estimates (artnet Analytics).

2. Tracey Emin – Slowly but Steadily

Emin’s secondary market is a much more modest affair, both in price and in volume. During her busiest year, 2013, 29 lots were offered, of which 22 sold. By comparison, even Hirst’s second-highest volume year, 2012, saw 171 lots hit the block (370 Hirsts were offered at auction in 2008). Emin’s market is much less liquid. But it is worth noting that although the recession didn’t leave her market unscathed, sales quickly rebounded and are now on an upward trend.

The relative scarcity of her work on the secondary market has been an asset for Emin. This, combined with the image of an artist who has reached maturity, promoted by major institutional shows such as Love is What you Want at London’s Hayward Gallery in 2011 and the just-closed Angel Without You at MOCA North Miami, means that Emin’s work has never been so desirable on the secondary market. The top 3 prices for her work were achieved over the last two years. Her four-poster bed sculpture To Meet My Past (2002), the appliqué blankets Super Drunk Bitch (2005), and Terminal One (2000) sold for $778,976, $603,161, and $323,627, respectively.

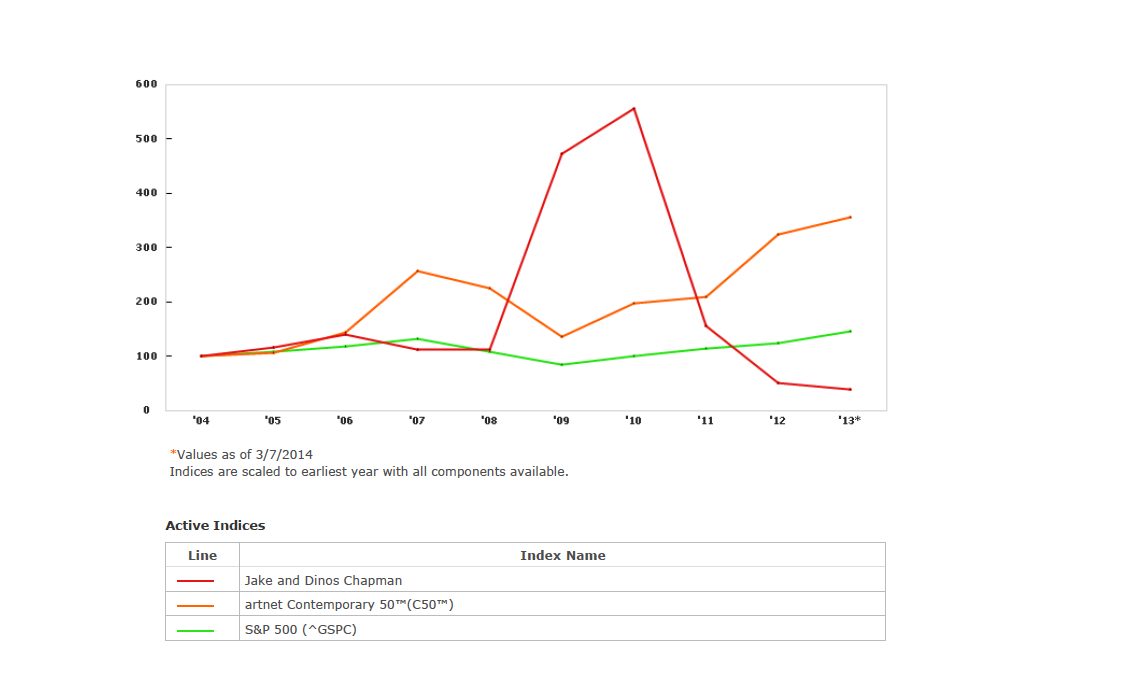

3. Jake and Dinos Chapman—An All Time Low

According to artnet Analytics, Jake and Dinos Chapman’s work is unusual among the YBAs in its very poor return: the projected 2013 return on a 2004 investment is a galling -63%. And, at $33,454, the average sale price is now lower than it ever was—with the exception of 2012, when it dipped even further, to $26,242. In the last few years, the Chapman brothers’ work has seen a fairly poor sell-through rate, as low as 33 percent in 2011 and 40 percent thus far in 2014. One must take into consideration the fact that the Chapman brothers’ market is particularly illiquid. In each of their busiest years (2011 and 2007) only 15 lots hit the auction block, a scarcity that tends to exaggerate the statistical results. But these markers, combined with a record of only $390,561 (for a portfolio of 83 works, Disaster of Wars III from 2000)—achieved at the peak of the 2007 boom—offer no immediate hopes of recovery for the Chapman brothers market.

Jake and Dinos Chapman – Report Index Graph (artnet Analytics).

4. Sarah Lucas, Promising Consistency

Sarah Lucas might be the most discreet artist of the group, one who has long nurtured her career away from the limelight. So much so that, in 2012, Lucas’s dealer Sadie Coles gave her a year-long project space, SITUATION, to showcase a practice that had been fairly little shown in Britain over the preceding years. Things have now changed dramatically, in part due to Lucas’s acclaimed retrospective at the Whitechapel Gallery in 2013. The artist is also about to receive an unprecedented level of exposure in 2015, when she’ll represent Britain at the Venice Biennale.

artnet data on Lucas shows consistency and a solid, if not stratospheric, return on investment (her work is up 187 percent from 1999). As with Emin and the Chapman brothers, the supply is very limited (25 lots in 2007, Lucas’ busiest year at auction), but auctions of her work have had a good sell-through rate in the last few years, including a rate of 87 percent in 2013. Lucas’ average sale price reached its highest ever mark in 2013, at $61,520. Last year also saw the artist’s auction record: $470,141 for Fighting Fire with Fire (1997), a six-part photographic piece sold at Christie’s London. With the forthcoming interest generated by the Venice Biennale, more growth in the coming years wouldn’t be surprising.