We’ve seen the art market stumble, slump, and tumble—but what happens when it stops cold?

The answer, according to an analysis by the Artnet Price Database examining worldwide auction results from March 2020, the first full month of the lockdown era, is bracing: sales volume collapses, average prices shrink, and collectors hoard their goods.

To get a sense of what may be in store as the global lockdown continues, we broke down the results to see what segments of the market have been hit hardest—and to see which ones may continue to prosper.

“Deals will get done,” said one dealmaker, who, like others we spoke to for this story, asked to remain anonymous to avoid being blamed for spooking the market. “But they will get done at a different level.”

Takeaway 1: Total sales are down—way down.

Auctioneer Jussi Pylkkanen at Christie’s postwar and contemporary sale in London in February 2020. Courtesy of Christie’s.

Fine-art auction sales plummeted 75.8 percent in March 2020 compared to the same month in 2019, according to the startling analysis. Last month, auction houses around the world sold a total of $227.6 million worth of fine art, down from $939.3 million in March 2019. The slump is even more dramatic considering that sales totaled $1.2 billion in March 2018.

On the one hand, that shouldn’t come as a huge surprise—many lucrative March sales, like the Asia Week series in New York, were cancelled or rescheduled for later this year. But the amount of money generated at auction last month still fell considerably faster than the total number of sales held, suggesting that sellers may have opted to hold onto their more valuable objects amid the global upheaval, even as the sales themselves continued. Buyers also appear not to have been keen to shell out for pricey works while the stock market was yo-yoing erratically for much of the month. All told, the number of sales held in March 2020 dropped only 26 percent from March 2019; the number of lots offered also fell by about a quarter.

The true test of the market’s health will come at the end of June, when most of the marquee auctions have been rescheduled. Many market players are already bracing for impact.

“By the end of 2020, we’ll be lucky if sales were half of what they were last year,” said one analyst.

Takeaway 2: For the works that are coming to auction, demand is steady.

Sotheby’s auctioneer Oliver Barker sold David Hockney’s The Splash (1966) to a Sotheby’s Los Angeles specialist for £23.1 million ($30 million) in February 2020. Photo by Michael Bowles/Getty Images for Sotheby’s.

Here is one comforting sign for the market: the sell-through rate for artworks sold at auction actually rose slightly in March 2020, to 66.8 percent, compared with March 2019, when 64.7 percent of works that hit the block found buyers. Some insiders see the sell-through rate as the only reliable way to gauge the health of the demand side of the market, since other stats—like total sales or lots offered—are more a reflection of fluctuations in supply. The sell-through rate has remained relatively consistent annually (between 64 percent and 68 percent) since 2013.

But the average price of an artwork sold at auction last month tumbled 68 percent compared to March 2019, from $34,856 to $11,191. So the demand reflected is for smaller-fry material, which is unlikely to sustain the market over the long term.

The good news, however, is that while collectors may not be in the mood to spend much, auction houses are astutely meeting buyers where they are. And in a market as sentiment-driven as the one for art, that could stave off a catastrophic implosion—at least for the time being.

Takeaway 3: Lower-priced work is where the action is.

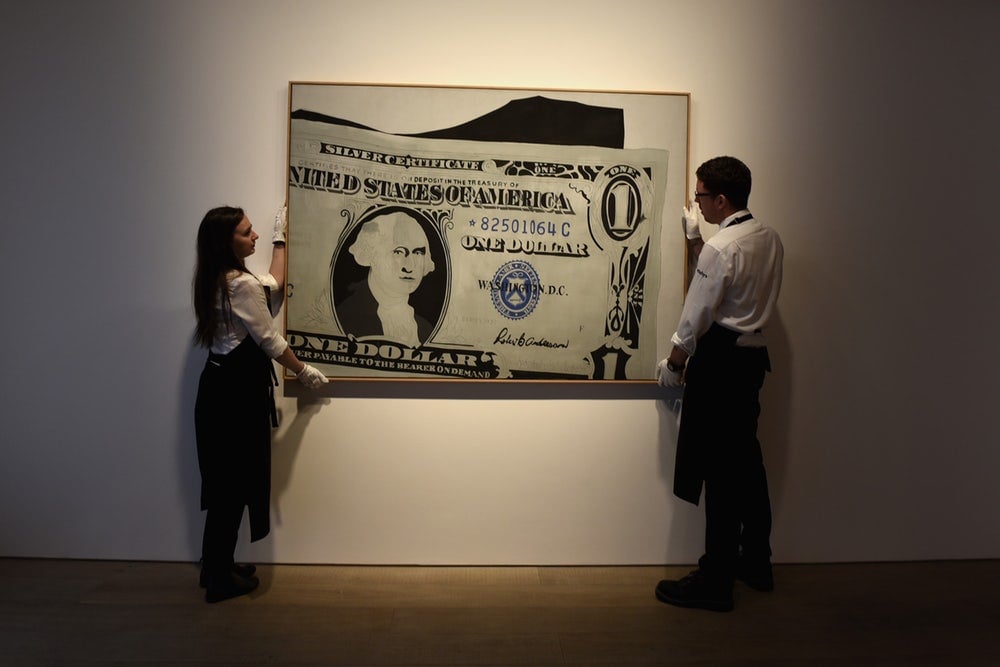

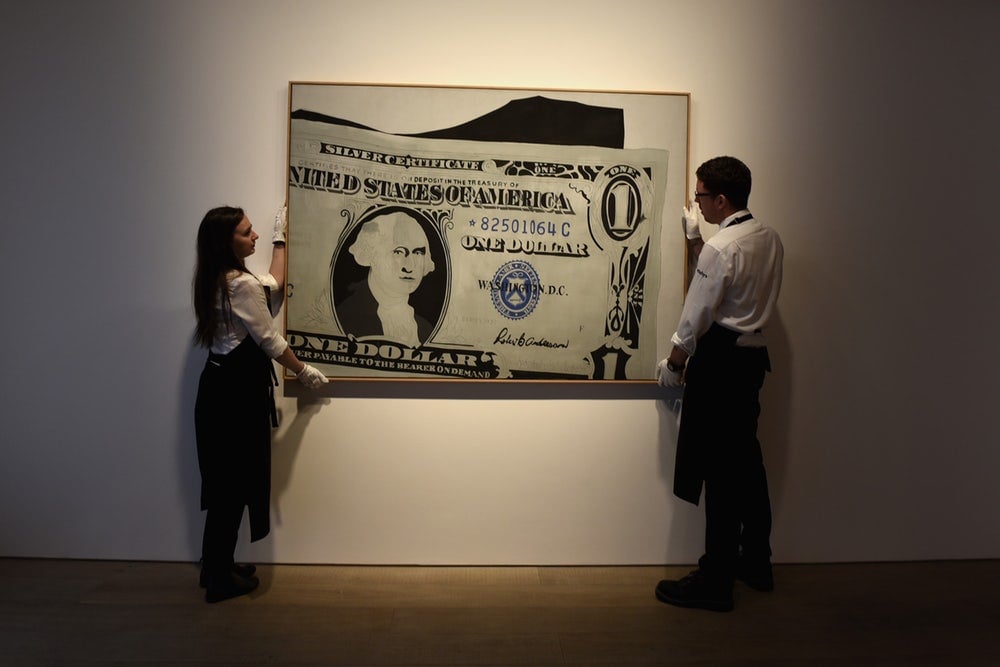

Andy Warhol’s signed dollar bill ahead of auction at Sotheby’s. Courtesy of Sotheby’s.

Data from recessions past shows that the top end of the market tends to dry up first and most dramatically, while the lower end stays afloat for longer.

In 2009, when the Great Recession’s impact was most deeply felt in the art market, the number of pieces consigned worldwide with a low estimate between $1 million and $10 million dropped almost 60 percent from 2008, to just 443. And the number of works consigned with a low estimate of $10 million or higher dropped nearly 75 percent, to just 12. (Broadly similar but less severe declines occurred in the 2016 downturn.)

Although the June sales will be the next test of this theory, similar trend lines are already starting to appear. Total sales were down in every price bracket last month, but the high end was most deeply affected. Fine-art sales in the range of $1 million to $10 million were down a whopping 90.8 percent compared to March 2019, while the $100,000-to-$1 million segment of the market declined 70.9 percent. Brackets that showed the smallest declines in the same period were under $10,000 (down 26.5 percent) and $10,000 to $100,000 (down 53 percent).

Of course, this dynamic has as much, if not more, to do with supply than demand, since higher-value sales were cancelled last month and others were pushed online, where lower-priced work is easier to sell and more attractive to buy. The lower echelons of the market are also the friendliest for new buyers who might be dabbling in auctions for the first time while bored at home. (Sotheby’s and Christie’s have both reported that almost 40 percent of the winners in their March and early April online sales were new customers; Artnet’s own April prints and multiples auction drew 50 percent first-time buyers.)

“You’re not going to see a ton of new buyers for Hirst ‘Spot’ paintings, but you will in that up-to-$20,000 bracket among folks who are decorative buyers,” one art advisor said.

Asked to predict how the market will shift in the next few months, another dealmaker was frank: “I just think total value is going to drop significantly.” He noted that a client who owns a painting worth north of $10 million had been holding out for a big price—until the pandemic hit. “As of last week, that client was willing to sell for a correction price.”