Analysis

Auction Data Shows the US Market Expanded in 2015 Amid Global Contraction

Auction data paints a mixed picture of the market.

Auction data paints a mixed picture of the market.

Eileen Kinsella

Amedeo Modigliani, Nu couché (1917–18).

Courtesy Christie’s New York.

After several consecutive years of robust growth, and numerous headline-grabbing prices of masterworks at auction, the global auction market is contracting. But in contrast to recent reports, it appears the market experienced significant dip between 2014 and 2015, according to data compiled by artnet.

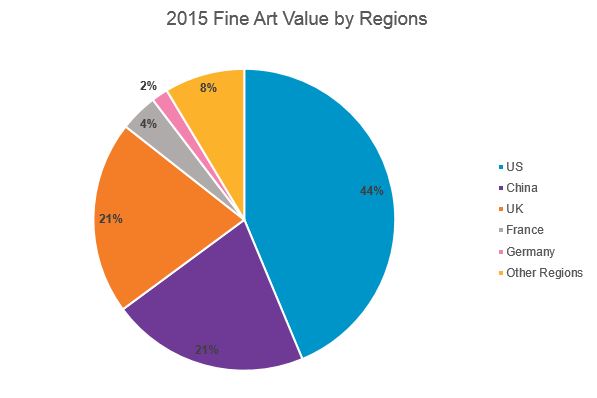

Source: artnet Analytics

The data reveals a nine percent drop, to $14.8 billion in 2015, from $16.3 billion. The decrease—call it a dip, downturn, slowdown, or much-needed correction—certainly shows a degree of anxiety or hesitation, perhaps most recently reflected in the February London auctions. Still it is only one part of the broader art market.

Pablo Picasso Les Femmes d’Alger (Version ‘O’) (1955)

Photo: Christie’s

However, the US market during this time was seemingly unstoppable, showing 10 percent year-over-year growth, to reach $6.5 billion worth of fine art auction sales, and garnering a 40 percent share of the total fine art auctions market.

Meanwhile, other top markets went in the other direction. China, for instance, the second-largest market, lagged billions behind in total auction sales value: $3.1 billion—a 30 percent decline. This was just above the third-largest market, the UK, which totaled $3.06 billion, down 11 percent.

Major international auction houses such as Christie’s and Sotheby’s appeared to see similar pressure, judging from their 2015 annual reports. Christie’s reported a five percent decline in total sales for 2015, to £4.8 billion, or $7.4 billion (the reported percentage drop is based on British pounds). Sotheby’s, which pre-announced its fourth-quarter and full year 2015 results due to its acquisition of Art Agency Partners, posted an estimated range of net auction sales around $5 billion, down from $5.1 billion, in 2014.

Picasso La Gommeuse (1901).

Image: Courtesy of Sotheby’s

Sotheby’s had an unusual fourth-quarter given that it also clocked a cost of $500 million—the amount it guaranteed to secure the collection of former chairman A. Alfred Taubman. That resulted in a loss of $12 million for the house. And while Sotheby’s described the situation as a one-time deal, it nonetheless reflects the cut-throat competition between it and its rival Christie’s, as well as how expensive the business of marketing and selling multi-million dollar masterpieces is.

On a positive note, Sotheby’s did see an increase in private sales in 2015 according to its report, to $673 million from $625 million. Which brings us to another point raised by several art experts and dealers when told that the global auction market contracted. Many say private sales are booming, which makes us wonder if some of the decrease in auction activity is not due to a marked move to the realm of private sales.

“Everyone listen up, auctions are a barometer of the market, not the only one,” artnet News columnist Kenny Schachter points out in his recent recap of the February sales in London. “There is no chart for all the masterpieces that are stored or, in the rare instances, hung. Art’s doing fine thank you very much.”

He also said that he had seen “more deals flow this December and January than I have at any time before.”

We also checked in with Phillips, which, like Christie’s is privately held. Spokesperson Michael Sherman told us that overall auction sales, heavily weighted by contemporary art but also including design and other categories, were up 34 percent year on year for 2015.

Phillips also points out its recent London sale was up 40 percent when compared with last February’s sale. “We took a cautious approach in the fall when we were building the February sales,” Jean-Paul Engelen, Phillips global head of contemporary art, told artnet News. “We decided we shouldn’t take too much risk.”

“Although we are up, we have to remain cautious,” he said. “For us, the market is fine. If you don’t have to do a billion dollar sale, the market is fine.”