Analysis

Artspace Sale Augurs Inevitable Shake-Out in Online Art Sales

It's time for some honest talk about online art sellers.

It's time for some honest talk about online art sellers.

Benjamin Genocchio

News that Leon Black’s art publishing business Phaidon has absorbed online art seller Artspace (see “Leon Black’s Phaidon Confirms Purchase of Artspace“) marks the beginning of an inevitable shake-out in the online art sales business. It has been coming for a while, in spite of the endless, often breathless, and, for the most part, poorly-researched media reporting about new online art sellers.

Artspace was always a bad bet, lacking sufficient capital and the right management and innovative thinking to build a long-term marketplace for art. Nobody in the New York art world believed they could make it work—sorry, and I don’t mean to be snarky or unfair, but that’s the truth. The current sale does little to deflect or mitigate that judgment. Phaidon, another failing business, relies on the good graces of Black, its bored, aging billionaire owner who happens to have a personal passion for art and the means to indulge it. I don’t know about high finance or investment but I don’t get how two bad businesses make a good one.

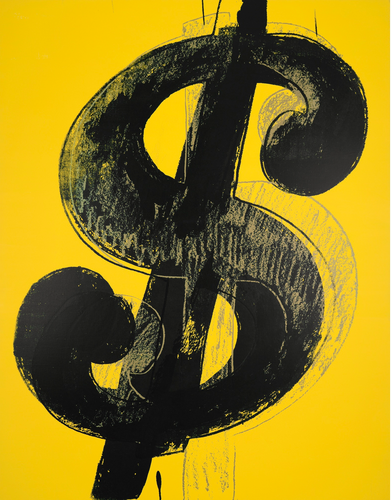

How much did Phaidon pay? Not much, I would think. Phaidon declined to disclose terms of the deal. What we do know is that the Berlin-based online auction house Auctionata was also in talks to acquire Artspace, and the deal fell apart when Auctionata, which valued Artspace at around $5 million, only offered them stock. That was smart because Artspace effectively has no revenue, and paradoxically the enthusiastic reporting about the sale (read: Leon Black as an art world white knight and/or shrewd investor) actually reveals Artspace to be a total failure: As of February 2013 Artspace had raised $12.2 million in investment money, and yet after five years it has little to show for it beyond a mailing list of 150,000 people, half of which Artspace bought from the defunct online VIP Art Fair. (To put this in perspective, merely as a point of comparison, artnet News has a daily mailing list of over 280,000 people.) It doesn’t sound like investors will get much of a return on their investment.

The Artspace logo. The art auction website has recently been acquired by Leon Black.

Photo: Art Agenda.

The irony of the situation is that the same precarious financial model goes for Paddle 8 and Artsy, neither of which has demonstrated an ability to make money or develop a consistent revenue stream online. In this regard Artspace was doing no better or worse than its competitors. The difference is that Paddle 8 and Artsy simply do a better job of fundraising for their ventures. That’s basically the rub here.

Increasing Sales and Speculative Investment

There is no denying online sales are increasing as the art market expands. The question is whether sales are increasing at a rate that justifies the much-hyped and speculative investment in online sale platforms like Artspace, Paddle 8, and Artsy.

I was reminded of this issue two weeks ago when artnet News published a story questioning figures Paddle 8 had provided to a survey about online art sales. The company was touting “$50 million in bidding activity,” which sounds good, but exactly what does that mean? When I contacted Paddle 8 to provide real revenue figures, they refused and became defensive, even belligerent.

I believe the Artspace acquisition marks the beginning of an inevitable shake-out in online art sales platforms. But it should also serve as a wake-up call to reporters and to the media to take a closer look at the finances of online art marketplaces; in effect, to do a bit more due diligence when writing about them. Millions of dollars are being wasted on businesses that are, well, not real businesses—I mean, does anyone in the art world believe, really, that Artsy is selling art on that site?

Artsy’s Shifting Identity

Like most people, I can’t even work out what Artsy is anymore, as it changes and evolves at a rate of what seems like every five minutes in search of a business model. Its latest scheme to make money is to copy a successful 25-year-old business model pioneered by artnet: creating landing pages for galleries to load and promote their inventory.

Here’s a prediction: The future of art sales will, shockingly, look a lot like the present, with a healthy mix of offline (high-end) and online (the rest) transactions. The art world isn’t going completely online, for reasons I will elaborate another time, but first and foremost of which is privacy. Rich people don’t want their friends and colleagues to know what and when they are selling. Hence the ballooning business at the high end of the market in offline private treaty sale transactions, which, frankly, dwarf the online art market a hundredfold. And art fairs have also emerged as good for offline business along with branded mega-gallery franchises like Pace, Hauser & Wirth, and Gagosian. But if you don’t believe me, that’s fine, invest in Paddle 8 and Artsy. If you’ve got billions of dollars, like Leon Black, maybe you’d even like to buy one of them.