The Back Room

The Back Room: Plot Twists and Fate Reversals

This week: an alternative view of Asia’s ascent, a potential Rothko resurrection, a few surprises at FIAC, and much more.

This week: an alternative view of Asia’s ascent, a potential Rothko resurrection, a few surprises at FIAC, and much more.

Tim Schneider

Every Friday, Artnet News Pro members get exclusive access to the Back Room, our lively recap funneling only the week’s must-know intel into a nimble read you’ll actually enjoy.

This week in the Back Room: an alternative view of Asia’s ascent, a potential Rothko resurrection, a few surprises at FIAC, and much more—all in a 7-minute read (1,914 words).

__________________________________________________________________________________

A scene from KIAF Seoul 2021. Photo by Kiaf SEOUL Operating committee. Courtesy of Kiaf SEOUL.

A simple narrative has often been used to explain the Western contemporary art market’s growing focus on Asia: it’s the region where the most wealth is cascading into the youngest hands, making it a no-brainer for international auction houses, dealers, and advisors to pivot East and try to capitalize on Asian buyers’ increasingly global taste for new and recent art.

But what do we do with this narrative when actual global wealth trends don’t support it?

That’s the question I wrestled with this week while trying to reconcile some surprising economic data with the Asia-focused strategies of Art Intelligence Global (AIG)—the 360-degree advisory firm formed by Sotheby’s vets Amy Cappellazzo, Yuki Terase, and Adam Chinn last week—and LGDR—the forthcoming consortium of dealers Dominique Lévy, Brett Gorvy, Amalia Dayan, and Jeanne Greenberg Rohatyn announced in August.

Although both AIG and LGDR aim to do it all in the global marketplace, they are prioritizing Asia in different ways. Terase will oversee an AIG headquarters with ample exhibition space in Hong Kong while Cappellazzo and Chinn man a New York counterpart. LGDR will make Asian business Gorvy’s primary mandate, and the firm has pledged to exhibit at art fairs only in Asia, where expos “remain an important gateway to a wider array of young collectors,” in the words of the New York Times’s Robin Pogrebin.

However, their respective Asia-first approaches only make sense if the firms are looking beyond sheer net worth—because Asia is still running a distant second to North America when it comes to producing new plutocrats.

What Does the Data Say?

Credit Suisse’s latest Global Wealth Report, published this June, estimated that in 2020…

Credit Suisse’s outlook for the future tilted in Asia’s favor to some extent, though not decisively. The bank’s quants projected that between 2021 and 2025…

What’s the Explanation?

Some art-market heavy-hitters think budding Asian millionaires and UHNWIs are simply more valuable on average than their North American counterparts—precisely because there are fewer of them.

A conversation I had with Brett Gorvy of LGDR helped clarify four main reasons this makes more sense than it seems at first glance…

All of the above are true to varying degrees across the region, from Hong Kong and mainland China, to nearby wealth centers like Korea, Singapore, and Taiwan. Since a base in one of these destinations provides easy access to the rest, Eastern expansion makes even more sense for Western art players with big ambitions but not necessarily big footprints.

__________________________________________________________________________________

Asian nations are still minting many fewer millionaires and UHNWIs than the U.S. However, less really is more in the high-end art market in this case. Western firms are pivoting to Asia largely to focus on acquiring new clients of the highest quality, not the highest quantity—and the wisdom of that approach means even more international sellers, advisors, and entrepreneurs will follow the leaders soon.

__________________________________________________________________________________

A display of (real! not fake!) wave paintings at Raymond Pettibon’s retrospective at the New Museum in 2017. Photo by Johannes Schmitt-Tegge/picture alliance via Getty Images

In the latest Wet Paint, one of the Raymond Pettibon works fraudulently completed and flipped by fallen art star Christian Rosa allegedly wound its way through Pettibon’s own gallerist, Sadie Coles, as well as dealer Marc Jancou, prior to finally tripping the alarms at Sotheby’s.

Oh, and megawatt Zoomer pop star Billie Eilish has begun collecting art, with an Anna Park piece being one of her earliest known acquisitions.

Here’s what else made a mark around the industry since last Friday morning…

Art Fairs

Auction Houses

Galleries

Institutions

NFTs and More

__________________________________________________________________________________

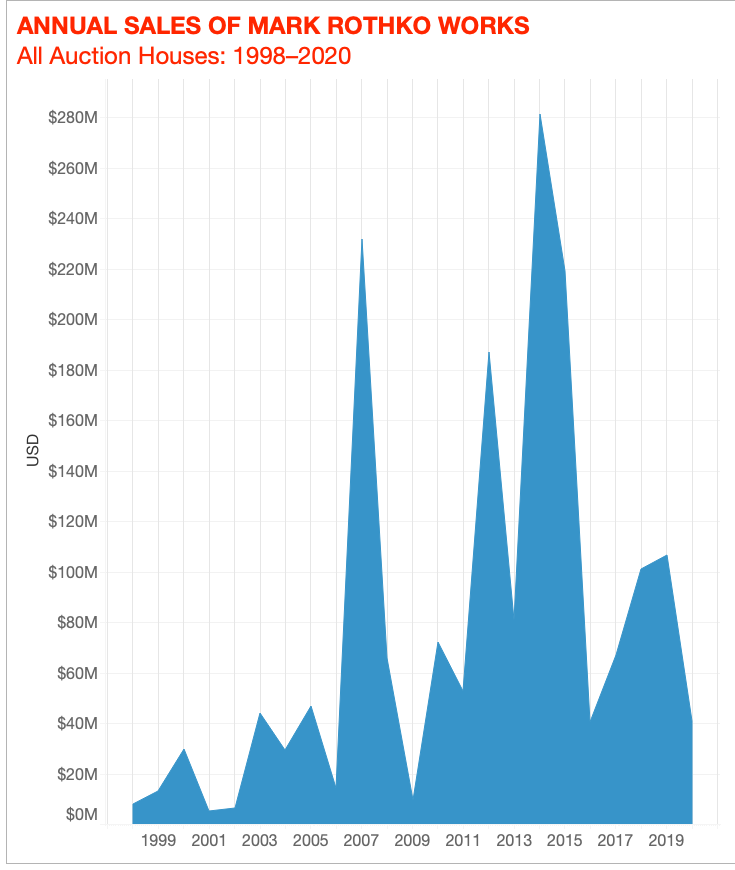

© 2021 Artnet Price Database and Artnet Analytics.

“The Rothko market could use some love,” Katya Kazakina wrote last Friday. Back in 2014, the AbEx giant’s works brought an all-time-high $281 million at auction thanks to bidding wars between “Qatari royals, Russian oligarchs, and billionaire hedge-fund managers.”

But demand has gotten much softer in the years since, as figuration by a diverse array of young living artists has largely replaced abstraction by canonical Caucasian corpses as the molten core of the auction volcano. Case in point, Rothko lots made only $40 million under the hammer in 2020—one-seventh as much as his annual auction apex six years earlier, according to Artnet Analytics.

We’ll find out soon whether two trophy paintings can help reverse the swoon. Next month, Sotheby’s will offer Rothko’s No. 7 (1951), estimated between $70 million and $90 million, and Untitled (1960), estimated between $35 million and $50 million, as part of its sale of works from the trove of divorcing couple Linda and Harry Macklowe. If No. 7 lands at the high end of its estimate range, it could overtake Orange, Red, Yellow, made in 1961 and sold for $86.9 million in 2012, as the artist’s priciest lot ever.

So gear up for a showdown. Just don’t expect an utter flame-out. Katya hears that Sotheby’s has already finalized an irrevocable bid for No. 7.

__________________________________________________________________________________

“The people that we see here in FIAC are not the ones we saw at Frieze, they’re not the ones we saw in Basel, and they’re not the ones we saw at Art Paris earlier in the season.”

—Galerie Templon’s general director, Anne-Claudie Coric, on whether the industry really, truly, honestly needed a third significant European fair in five weeks.

__________________________________________________________________________________

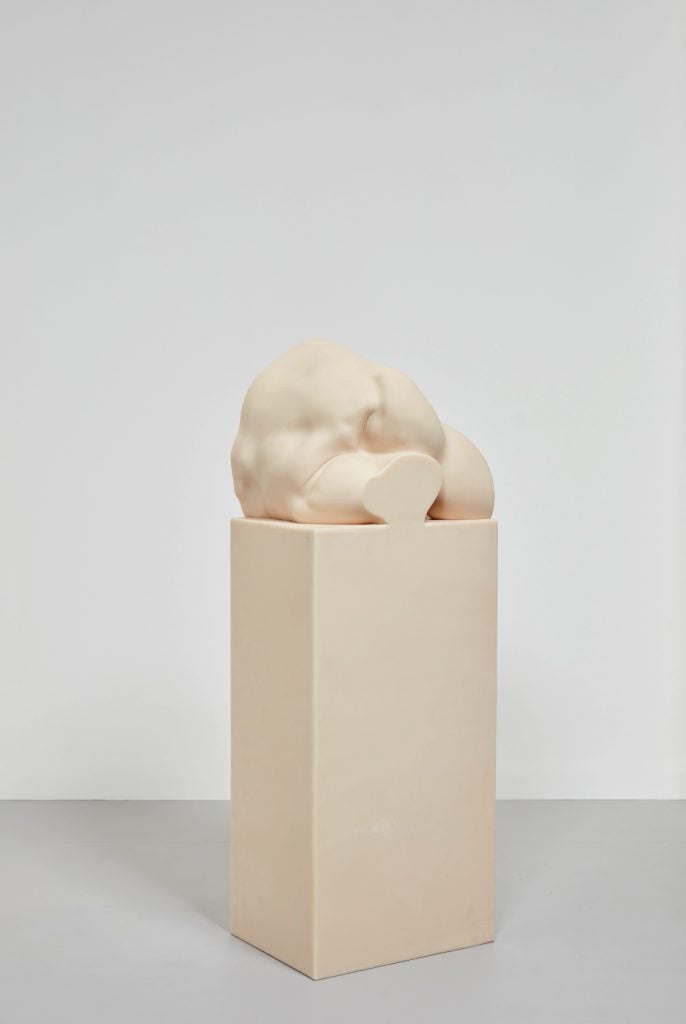

Martin Margiela, Torso III (pale) (2018–21). Photography by Studio Shapiro. Courtesy of Zeno X Gallery, Antwerp.

__________________________________________________________________________________

Sale Price: €50,000 ($58,000)

Sold at: FIAC

Now even art institutions can join rappers and pop stars in bragging about their Margiela collections. In 2009, the elusive Martin Margiela stepped away from the influential fashion house he founded in 1989 to devote himself to making artwork. This week, the Parisian foundation Lafayette Anticipations presented Margiela’s first solo exhibition, encompassing some 40 works spanning collage, film, installation, painting, and sculpture—and the interest in his next creative chapter transformed into cold hard cash at FIAC.

There, the booth of Belgium’s Zeno X Gallery included a group of Margiela sculptures that remix segments of the human body into three quasi-surreal, quasi-absurdist forms: one cast in plaster, the other two cast in differing shades of silicone. Each “torso” work was available in an edition of three (plus one A.P.), and buyers pounced on most of them during the fair’s VIP day.

My colleague Naomi Rea reported that Zeno X placed all three editions of the “pale” silicone Torso III for €50,000 ($58,000) each, one cast of the “medium”-toned silicone Torso II for €40,000 ($46,500), and two editions of the white plaster Torso I for €45,000 ($52,000) each—and “at least one museum bought all three versions.”

Asked about the magnetic quality of Margiela’s works on collectors, Nina Hendrickx of Zeno X said, “There is just a beautiful tension between the classical appearance of the white plaster sculpture and the tactility of the silicone sculptures, which feel very contemporary.”

No word yet on the identity of the acquiring museum(s). Nevertheless, Lafayette Anticipations may not be the only institution exhibiting the long-gestating fruits of Margiela’s studio practice soon.

__________________________________________________________________________________

Additional reporting and writing by Naomi Rea.