Market

The Back Room: Punking the Market

This week in the Back Room: Crypto-friction at Christie’s, a record store’s lessons for dealers, Alice Neel (finally) gets her due, and much more.

This week in the Back Room: Crypto-friction at Christie’s, a record store’s lessons for dealers, Alice Neel (finally) gets her due, and much more.

Tim Schneider

Every Friday, Artnet News Pro members get exclusive access to the Back Room, our lively recap funneling only the week’s must-know intel into a nimble read you’ll actually enjoy. You’re now viewing the final free promo edition, so become a member (and click the “subscribe” box during checkout) to receive it next week and beyond.

This week in the Back Room: Crypto-friction at Christie’s, a record store’s lessons for dealers, Alice Neel (finally) gets her due, and much more—all in a 6-minute read (1,473 words).

_______________________________________________________________________

Nine CryptoPunks at Christie’s 21st-century evening sale on May 13, 2021. Courtesy of Christie’s.

If you bet anyone this past New Year’s Eve that Christie’s would trip into a beef with a crypto-whale named G Money over an NFT sale before Memorial Day, congratulations, Nate Freeman reports that it is time for you to collect.

So then why did G Money later launch a Twitter assault titled “How Christie’s Fucked Up the Punks Auction”?

Because Christie’s displayed the (digital-only) Punks as tiny physical reproductions scattered comically high up in the galleries—a pseudo-homage to street artist Invader.

G Money took the presentation as a symbol of either cluelessness or disrespect to crypto-collectors. He questioned why future Punks sellers wouldn’t either sell on NFT marketplaces for much lower commissions, or take their business to rival Sotheby’s.

Davis (under his admirably self-aware @PoseurNoah handle) took to the Punks Discord channel post-sale to apologize; G Money later did the same on Twitter.

Christie’s declined to comment further. G Money did not respond to a DM.

_______________________________________________________________________

The whole saga is a reminder that the art and crypto worlds still have a long way to go on their mission to integrate. Still, the Cryptopunks set sold on auction night for $17.1 million to another group of investors led by Haralabos Voulgaris. So if that counts as “fucking up” a sale, then Christie’s: please feel free to fuck me up anytime.

_______________________________________________________________________

_______________________________________________________________________

The record shop Rough Trade’s Brick Lane shop in London. The store’s Brooklyn location is now moving to 30 Rockefeller Center. Photo by David Corio/Redferns.

This Tuesday, the record mecca and countercultural hub Rough Trade will reopen its New York store in a new location few vinyl heads would have anticipated: 30 Rockefeller Plaza (30 Rock). The move demanded the store work through tensions between art, identity, and commerce that nearly every gallery faces in 2021.

So I talked to co-owner Stephen Godfroy about the thought process that led him and his colleagues to migrate from what the AV Club called “a special place” in Brooklyn to “every New Yorker’s worst nightmare”—and change much more than an address along the way. His answers hinged on three core themes that impact dealers, too:

Identity and Reputation

While critics have portrayed relocating to 30 Rock as selling out, Godfroy portrayed it as a trend-bucking return to form.

Nothing could be more punk (and on brand) to Godfroy than “shaking off the Williamsburg/Brooklyn record-store stereotype” for a spot where Rough Trade must win over an entirely new audience.

Real-Estate Optimization

Rough Trade NYC is downsizing from a 10,000 square-foot all-purpose warehouse to a 2,100 square-foot storefront, plus outsourcing online-order fulfillment and live-performance hosting to other facilities.

Godfroy argues decentralization is a better use of resources and does no damage to Rough Trade’s social fabric, which is woven from “great records and great people,” not whether each of its U.K. and U.S. stores has a stage and a cafe.

Championing Physical Objects in a Digital Culture

Rough Trade still believes tangible pieces of culture provide “multisensory stimulation, presence, and value that has no equal substitute.”

That belief becomes even more distinctive (and potentially attractive) in Midtown, a zone “crying out for disruptive, provocative change,” Godfroy said.

_______________________________________________________________________

Rough Trade’s thinking raises three parallel questions for galleries in a post-shutdown economy:

Can you thrive by doubling down on your core audience, or do you need to risk ridicule by reaching out to new constituencies?

Could you build a stronger community by thinking flexibly about space, geography, and tech?

Does a digital age demand selling digital art, or just designing better digital strategies for the analog works you believe in most?

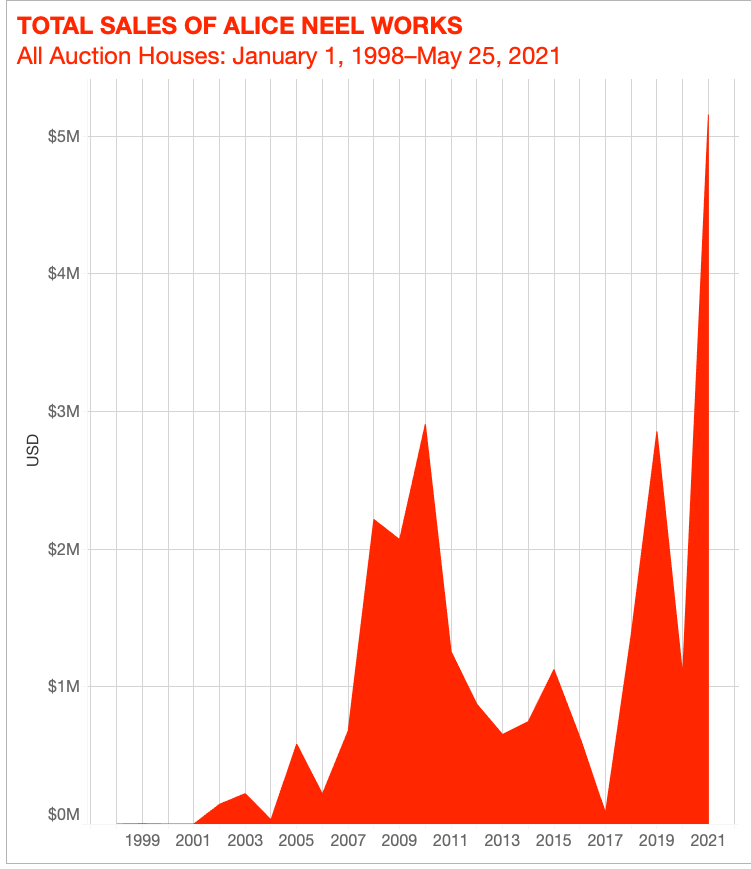

Data © Artnet Price Database.

As recently as 2001, Alice Neel racked up the same auction-sales total as I did: a cool zero dollars.

But in May 2021, the lines to get into her retrospective at the Met look like the lines to buy toilet paper and canned food last March, young stars like Jordan Casteel laud her as an essential influence, and bidders have already bought more than $5.1 million worth of her art—the most in any single year yet, with seven months of auctions still to go.

So what the hell happened in the two decades between? The short version is…

The art market started foraging for overlooked (and undervalued) artists in the early 2000s.

Neel’s estate jumped from the quiet Robert Miller Gallery to powerhouse David Zwirner in 2008.

Figurative painting moved from the art market’s fringes to its center starting around 2015 (when the Zombie Formalist fever broke).

For the more nuanced answer, check Katya Kazakina’s deep dive below.

_______________________________________________________________________

“It’s impossible that we have become so stupid today that there are no human beings alive capable of creating tomorrow’s masterpieces.”

—Mega-collector and Christie’s owner François Pinault recounting why he began buying contemporary art in the 1980s.

_______________________________________________________________________

John Baldessari’s estate will now be represented worldwide by Sprüth Magers. (Financial Times)

The gallery will debut his final series of works, titled “The Space Between,” in a show at its LA space from June 12 through September 11, with prices in the region of $400,000 each.

The estate, run by Baldessari’s two children, will continue working with longtime dealers Mai 36 (Zurich) and Greta Meert (Brussels)… but ended its relationship with Marian Goodman.

_______________________________________________________________________

David Zwirner wrestled the estate of Robert Ryman away from Pace; artist Merrill Wagner, Ryman’s wife of 50 years, joined the roster alongside her late husband. (Artnet News)

_______________________________________________________________________

At least 11 Korean cities, towns, and counties are vying to host the $2.2 billion collection of late Samsung chairman Lee Kun-hee. Their pitches range from “Lee was born here, so naturally…” to “Listen, we have the world’s fifth-largest airport!” (Wall Street Journal)

_______________________________________________________________________

The Fine Art Group, the London-headquartered advisory and art-finance firm, acquired U.S.-based Pall Mall Art Advisors for an undisclosed sum. (Artnet News Pro)

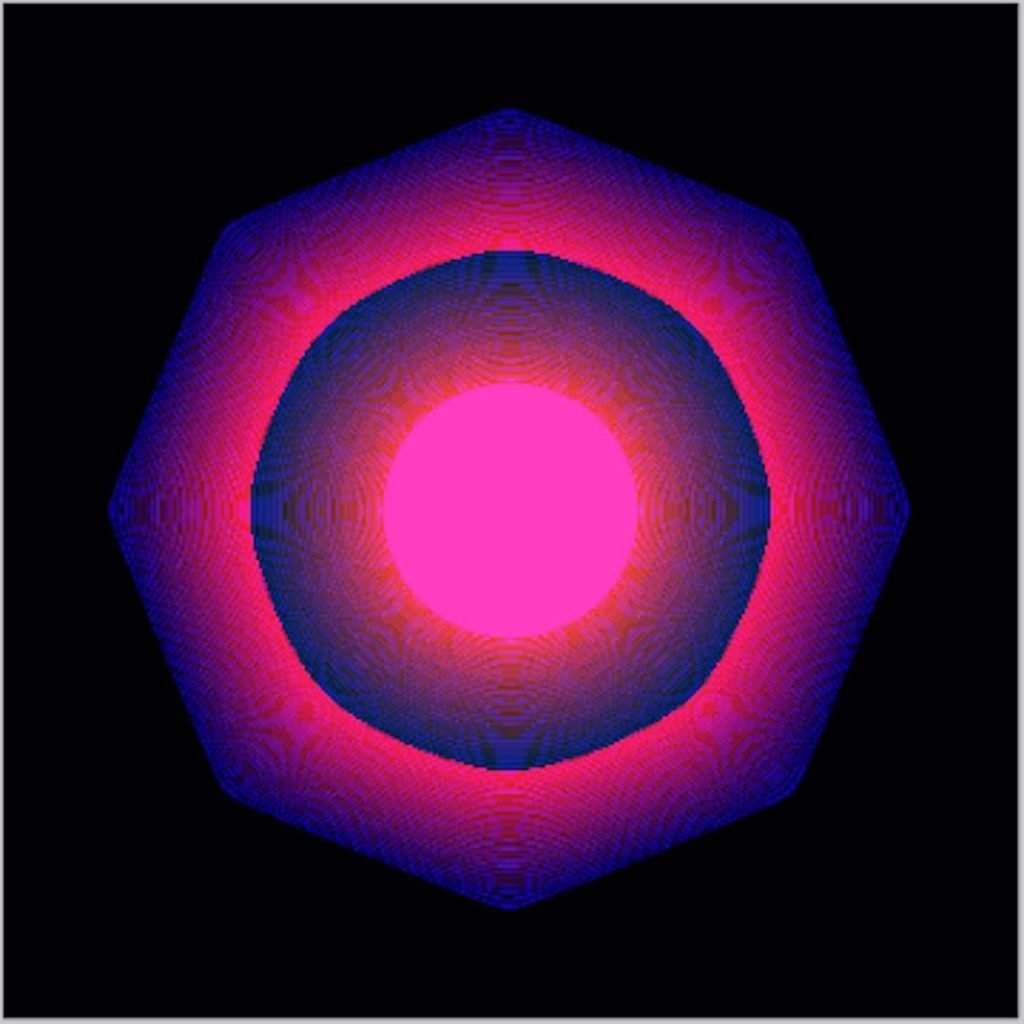

Kevin McCoy, Quantum (2014). Courtesy of Sotheby’s.

Date: 2014

Seller: The Artist

Price: Bids start at $100

Selling At: Sotheby’s “Natively Digital” auction

Sale Date: Thursday, June 3–Thursday, June 10

Starting next week, Sotheby’s will host “Natively Digital” a weeklong online auction foregrounding 28 influential new media artists whose works surface the historical roots and future prospects of NFTs as a medium. Anchoring the sale is Quantum, a generative digital animation backed by the first non-fungible token ever minted.

The work’s origin is the 2014 edition of Rhizome’s “Seven on Seven” conference, where Kevin McCoy and collaborator Anil Dash premiered what they then (semi-ironically) called the monetized graphic (or “monegraph”)—a digital image time-stamped and registered to its creator on the blockchain, allowing the artist to retain ownership (and be paid appropriately for authorized use) of a file that is otherwise by its nature infinitely replicable.

Seven years later, Quantum isn’t just the cornerstone of a Sotheby’s auction making every effort to thoughtfully engage with early adopters and true believers in crypto. It has also become the unexpected cornerstone of a speculative-trading phenomenon rampaging outside the art-tech nexus. Let’s see if bidders reward a well-intentioned NFT pioneer to the same degree they’ve rewarded some recent arrivals making transparent cash grabs with, frankly, boring art.

_______________________________________________________________________