The Back Room

The Back Room: Return to Form

This week: the eerie familiarity of the “new normal,” U.S. dealers regain their footing, the Rubells’ always-churning star machine, and more.

This week: the eerie familiarity of the “new normal,” U.S. dealers regain their footing, the Rubells’ always-churning star machine, and more.

Tim Schneider

Every Friday, Artnet News Pro members get exclusive access to the Back Room, our lively recap funneling only the week’s must-know intel into a nimble read you’ll actually enjoy.

This week in the Back Room: the eerie familiarity of the “new normal,” U.S. dealers regain their footing, the Rubells’ always-churning star machine, and much more—all in a 7-minute read (1,977 words).

__________________________________________________________________________________

A financier at his office on Fifth Avenue in New York. (Photo by TIMOTHY A. CLARY / AFP via Getty Images)

As the Delta variant rips through unvaccinated populations around the world, case counts, hospitalizations, and deaths are all rising. But with existing COVID-19 shots still proving highly effective, life and business in premier U.S. art cities are increasingly sliding right back into pre-pandemic trends.

Three possible societal shifts were taken practically for granted inside the depths of the crisis:

Yet 16 months since the first U.S. lockdowns, much of this triple threat looks empty. Let’s bullet through each element to see its impact on the stateside art market.

__________________________________________________________________________________

Air Travel Has Roared Back

The CEO of Delta Airlines announced in the company’s earnings call last week that “domestic leisure travel is fully recovered to 2019 levels.” The numbers back him up:

Airline execs also expect business and international travel to “improve meaningfully” in the autumn months, as they would in a normal year.

But art-market pros have been ahead of the pack for months. They started soaring to sell almost immediately after the initial panic settled, and scores of flights for fall’s must-see (and must-network) domestic events have already been booked.

__________________________________________________________________________________

Migration Patterns Have Stabilized

Forget the hope that long-overlooked cities might become exciting new hubs of art patronage. COVID largely left the map of wealth in America intact.

New York and San Francisco were the only major exceptions—and they deserve major asterisks.

Three months later, their forecast looks prophetic, because…

__________________________________________________________________________________

Major Industries Are Returning to the Office

Much of the New York finance sector is either already back at their old desks or arriving imminently.

The facts also show tech workers are flooding back into San Francisco and Silicon Valley, with an even greater influx coming soon.

Thanks to Wall Street and Big Tech, then, New York and San Francisco are rapidly regaining the young money that makes them so crucial and so promising (respectively) to the art market.

__________________________________________________________________________________

We’re not out of the woods. Concerns about the Delta variant seem to have been largely responsible for pushing the S&P 500 to its steepest one-day dive since May. Despite the arrival of “Freedom Day,” select U.K. institutions (including the British Museum, the National Gallery, and the full Tate lineup) are maintaining their prior attendance limits and mask mandates. France is now requiring all would-be visitors to museums and other cultural venues to show proof of vaccination or a recent negative COVID test.

But the most important long-term trends in U.S. business have already shown they will withstand the temporary upheaval of the pandemic. Within the art trade, the immunities also kicked in (metaphorically speaking) for domestic air travel long ago. In short, the future is here. It’s just easy to miss because, in so many ways, it’s the spitting image of the past.

__________________________________________________________________________________

Wet paint out. Photo by Nate Freeman.

Here’s what made a mark around the industry this week, powered by tips from outgoing gossip ace, soon-to-be Vanity Fair scribe, and lifelong Mayor of the Lower East Side Nate Freeman’s farewell edition of Wet Paint.

(The column will continue via a rotating cast of scene-trawling, source-rich guest writers, but readers, buy its originator a drink when you see him!)

Art Fairs

Rebecca Ann Siegel will step down as Frieze’s director of Americas and content in August, roughly nine months after ascending to the role.

While the fair searches for Siegel’s long-term replacement, Frieze New York will be captained by Kristell Chadé, and Frieze Los Angeles will be overseen by Romilly Stebbings, per an internal email.

303 Gallery has opted out of showing at Art Basel in Basel for the first time since 2010. (Curious about who opted in? Here’s the full list.)

ARCO Lisbon will be digital-only this fall. VIP access begins September 12, with the rest of the public able to e-visit from September 13–19.

Galleries

Hauser & Wirth’s brain trust teased further expansion in the New York Times, hinting that Paris and Asia could be next on the list.

In September, Blum & Poe‘s L.A. flagship will host a Mark Grotjahn solo show for the first time since 2016.

The Matthew Wong Foundation, led by the artist’s mother, Monita Cheng, has “cut off” Karma and assumed exclusive management of his estate, per Kenny Schachter.

Pilar Corrias announced exclusive worldwide representation of painter Kat Lyons.

Institutions

The New Museum appointed curator and trustee Isolde Brielmaier as its next deputy director, effective September 1; she succeeds Karen Wong, who held the post from 2006 until 2015.

The Barcelona Museum of Contemporary Art (MACBA) has selected Elvira Dyangani Ose, director of London’s the Showroom, to be its next director, making her the first woman and first Black person to hold the post. She begins a five-year contract this year.

Meanwhile, the heads of MACBA’s Independent Studies Program, Yayo Herrero and Marina Garcèz, resigned to protest the removal of chief curator Tanya Barson and head of programming Pablo Martínez.

In what is widely seen as a political maneuver, state officials in Poland did not renew the contract of Hanna Wróblewska, the director of Warsaw’s Zachęta – National Gallery of Art.

The Virginia Museum of Fine Arts named Patrick Patrong its chief diversity officer and assistant deputy director for equity, diversity, and inclusion.

NFTs & Misc.

__________________________________________________________________________________

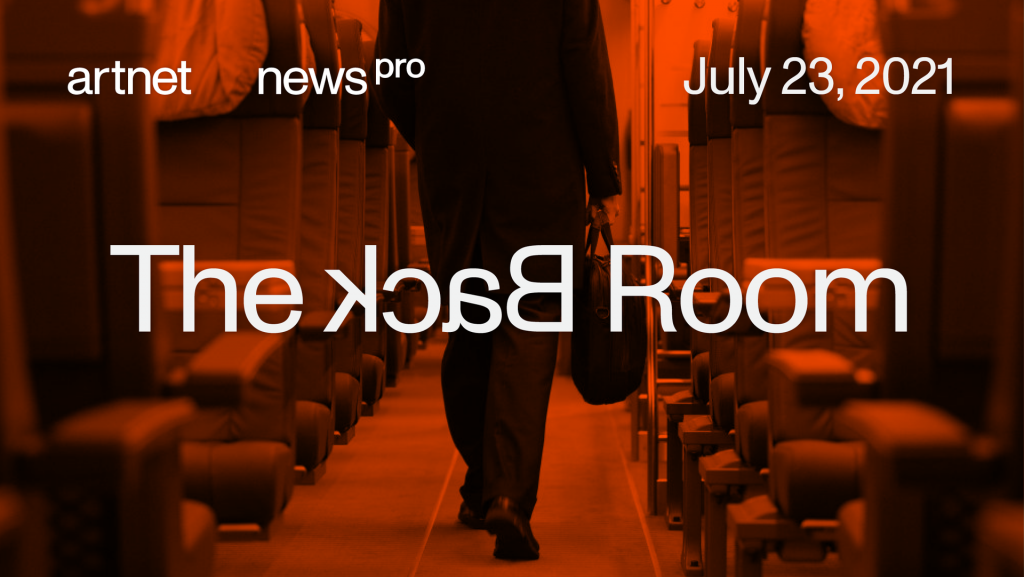

A graphic from the ADAA 2021 COVID-19 Impact Survey. Courtesy of the Art Dealers Association of America.

The 2021 COVID-19 Impact Survey, conducted in June and released this week by the Art Dealers Association of America (ADAA), found that roughly as many responding galleries topped their sales expectations as fell short in the first quarter of 2021. Last year as a whole, about three times more dealers landed in the red than in the black.

What changed aside from cost cutting? Nearly 90 percent of respondents applied for a Paycheck Protection Program loan from the Small Business Association, with all but seven percent of them receiving financial aid.

Dealers are adjusting their ambitions upward with revenue. Two-thirds of those surveyed said they plan to expand their artist roster this year, and three-fourths will return to in-person art fairs. If these trends continue, soon the trade may not even remember what number COVID we were on last year…

__________________________________________________________________________________

“It’s mandatory to be in Monaco in summer.”

—Antoine Lebouteiller, Christie’s director of Impressionist and Modern art in Paris, on the market’s growing seasonal focus on the sovereign city-state.

Katya Kazakina gave readers an inside look at the three latest artists to land a coveted (and often crown-granting) artist-in-residence spot at the Rubell Museum. (Artnet News Pro)

Each member of the triad will receive the usual solo-show treatment during Art Basel Miami Beach 2021, but their careers are already taking off in the meantime.

__________________________________________________________________________________

Frieze CEO Simon Fox still believes in the physical art (and sales) experience. (FT)

__________________________________________________________________________________

If you thought coordinating and paying for art shipping sucked pre-pandemic, it’s gotten even more maddening since. (Artnet News Pro)

__________________________________________________________________________________

Kenny Schachter unspooled the growing crises of predatory appropriation and price fixing in the crypto world. (Artnet News Pro)

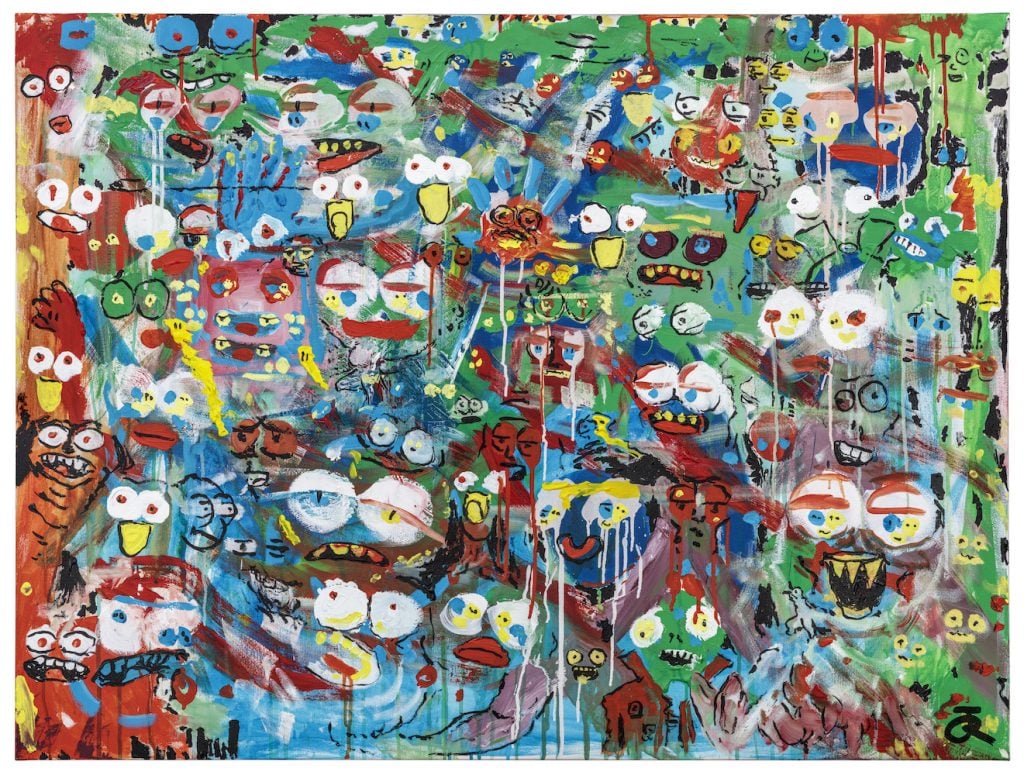

Justin Roiland, mypeoplefriend (2021). Courtesy of Sotheby’s.

__________________________________________________________________________________

Date: 2021

Seller: The Artist

Estimate: $15,000 to $20,000

Sale Price: $56,700

Sold at: Sotheby’s Contemporary Art Online (New York)

Sale Date: Bidding closed July 21

If you don’t know Justin Roiland’s name, you probably don’t watch many cartoons for grownups. In 2012, Roiland co-created Adult Swim’s Rick & Morty, which follows the interdimensional adventures of a kooky scientist and his grandson (both voiced by Roiland himself) and has since inspired a cult following that is now paying off inside the art establishment. His first painting to reach auction, mypeoplefriend nearly tripled its presale high estimate after a week of bidding at Sotheby’s contemporary art online sale in New York.

The outcome isn’t exactly a bolt of lightning from a cloudless sky. Harrison Tenzer, who headed up the best-ever $6.7 million auction, credited “the emergence of a new generation of buyers, who are increasingly merging the worlds of fine art and popular culture.” More than 25 percent of buyers in the sale were new to the house. While this demo’s influence has been felt in the “meteoric rise of street art and NFT’s, to name a few examples,” Tenzer continued, “we think that Roiland, and mypeoplefriend in particular, are contributing to a new chapter in this story.” If nothing else, it’s proof positive that the new normal won’t be a complete rerun, at least.

__________________________________________________________________________________