Market

Bananas for Bitcoin? What the Recent Crypto Rally Means for the Art Market

Sotheby's is enabling crypto payments for "select" lots at its New York evening sale.

Sotheby's is enabling crypto payments for "select" lots at its New York evening sale.

Margaret Carrigan

A version of this article originally appeared in The Back Room, our lively recap funneling only the week’s must-know art industry intel into a nimble read you’ll actually enjoy. Artnet News Pro members get exclusive access—subscribe now to receive the newsletter in your inbox every Friday.

Crypto is having a renaissance. Let’s recap some of the rapid developments of the last few days:

– The price of Bitcoin surged to an all-time high this week, exceeding $90,000, and rising by more than a third since Donald Trump’s re-election last week. (Yes, that was only a week ago.)

– The global crypto market topped $3 trillion for the first time by Thursday. (Yes, that’s a pandemic-era high.)

– Dogecoin, Elon Musk’s favorite meme coin, rose 150 percent in value since election day and further still after Trump tapped him and biotech entrepreneur Vivek Ramaswamy to lead a new advisory group called the Department of Government Efficiency, or Doge for short. (Yes, seriously.)

Elon Musk on stage before Republican presidential nominee former President Donald Trump speaks at a rally at Madison Square Garden in New York, NY on Sunday, October 27, 2024. Photo: Jabin Botsford/The Washington Post via Getty Images.

This turn of events is the latest in a boom-and-bust cycle that saw Bitcoin below $20,000 last year, in the depths of a so-called “crypto winter” that cast a stultifying chill over the art world’s growing NFT market. A report published in August by NFTevening said that since the dramatic downturn in 2023, the average NFT owner has experienced a 44.5 percent loss on their investment and 95 percent of NFT works are considered “dead.” Could there be a crypto rebirth in the art trade on the horizon?

Digital art-focused dealers, like London’s Gazelli Art House, said that while the recent surge hasn’t translated to more sales yet, “we are anticipating an increase in collectors purchasing new media works with cryptocurrencies like Bitcoin and Ethereum,” according to a spokesperson.

So are auction houses, especially Sotheby’s, which is enabling clients to pay with crypto on select lots next week during its marquee New York sales. “With cryptocurrencies in price discovery mode and making new all-time highs, we expect to see those heavily invested looking to redistribute some of their profits into blue chip assets just as we did in the 2021 boom cycle,” said Sebastian Fahey, the house’s head of Global Fine Art.

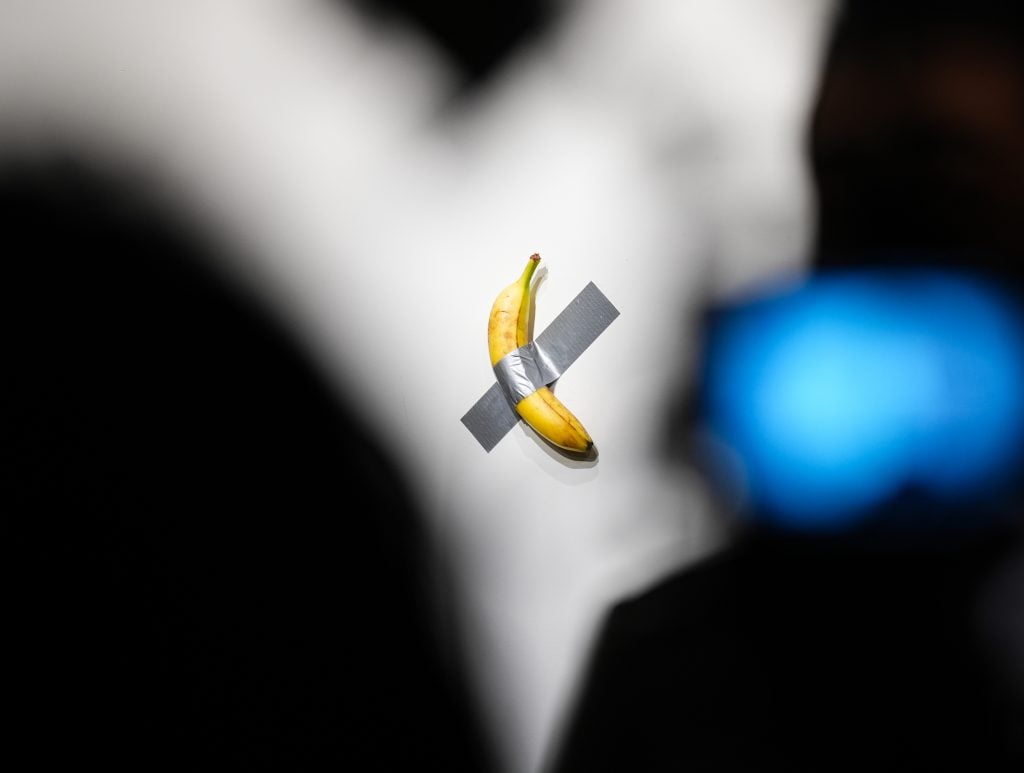

Artist Maurizio Cattelan’s Comedian is seen during a press preview for Sotheby’s Evening Auction on October 25, 2024 in New York City. Photo: John Nacion/Getty Images.

Which lots are selected? Just one: Maurizio Cattelan’s The Comedian, the viral duct-taped banana sold for $120,000 at 2019’s Art Basel Miami Beach. It’s being offered in Sotheby’s “The Now” and contemporary evening sale on November 20 with a $1 million–$1.5 million estimate.

Coincidentally, last month, Michael Bouhanna, head of digital art and NFTs at Sotheby’s, created a meme coin inspired by Cattelan’s fruit called Comedian ($BAN), as Artnet’s Katya Kazakina revealed. Launched on Pump.Fun, it quickly became “the latest sensation” of the unregulated meme coin market, according to a post on Medium. Bouhanna claims he didn’t promote $BAN or encourage anyone to buy it. Nevertheless, it seems the crypto sphere can’t get enough potassium these days: a lucky trader turned an initial investment of $1,795 into $873,000 in two days.

With Bitcoin over $80K, it’s a good time to spend some on a Peter Schiff Ordinal, each one inscribed on the Bitcoin blockchain. There’s 21 million Bitcoin but only 50 Golden Triumph ordinals. It’s clear which one is more valuable. You can’t argue with math.https://t.co/SPJSbv1ut5

— Peter Schiff (@PeterSchiff) November 10, 2024

Even some crypto cynics seem to be reconsidering their position. Stockbroker, financial commentator, and well-known Bitcoin skeptic Peter Schiff is now selling his digital art collection on Magic Eden, an NFT platform. Schiff has been a big proponent of investing in gold, historically, so this sale was met with some snide remarks on social media. His 50 “Golden Triumph” ordinals still sold out, though.

Cryptocurrencies remain volatile, but president-elect Trump’s appointment of many pro-crypto lawmakers, who intend to introduce legislation that could offer some regulatory clarity, may inspire more confidence in them. This could help digital art markets mature further and spur more crypto-based revenue streams for traditional art businesses. In perhaps an indicator of what’s to come, banking institutions have already reportedly piled into Bitcoin futures contracts in the weeks before the presidential election–just around the time Bouhanna was launching $BAN.