The Art Detective

Bear Alert! Auction Prices for Many Artists Are in Free Fall, But Some Emerging Works Climb Higher

At sales this week, estimates were notably lower, and some consignors took haircuts.

At sales this week, estimates were notably lower, and some consignors took haircuts.

Katya Kazakina

There was a bear high up in the tree outside of my window!

I spotted it while interviewing a dealer about the state of the art market. First, I noticed an odd, black mass near the top of the tree—a beautiful hickory, with leaves just starting to turn—but it was raining, and I didn’t give it much thought. Then the shape started moving up and down the trunk. I looked on with a mix of alarm and astonishment.

Sure, bears are not entirely unusual sights in my neck of the woods. They’ve been known to open windows and doors, helping themselves to cereal and steak, traumatizing humans and house pets. They’ve taken down bird feeders, rummaged through garbage cans in broad daylight, and even defecated in vehicles.

But scaling such precarious heights—where a single misstep could lead to a fatal fall? What was the bear thinking? And what’s the creature going to do, I wonder, holding my breath?

A bear high up in a tree outside of my window. Photo: Katya Kazakina

While the bear contemplated its next move, I noticed the parallels between the situation unfolding in front of my eyes and the one I was discussing with my source. Was life imitating . . . the art market?

The global art trade finds itself in a bear market, following two vertiginous years unleashed by the pandemic, when prices soared and investors feasted. Key indicators have turned red. Consider some half-year metrics, 2024 vs. 2023: Total sales generated by Sotheby’s, Christie’s, and Phillips were down 29 percent, the average price of an artwork sold at auction fell 26 percent (to $27,301), auction sales in the ultra-contemporary segment declined 39 percent, and sales of art for $10 million or more were down 30 percent. (You can find more data and analysis in Artnet’s latest Intelligence Report and on our Art Angle podcast).

“Financial markets are at an all-time high, but people are super anxious and desperate to get out” of all the art they bought, a collector told me this week.

We were discussing season-opening auctions in New York: “New Now” at Phillips on Wednesday, “Contemporary Curated” at Sotheby’s today, and “Postwar to Present” at Christie’s this coming Tuesday, October 1.

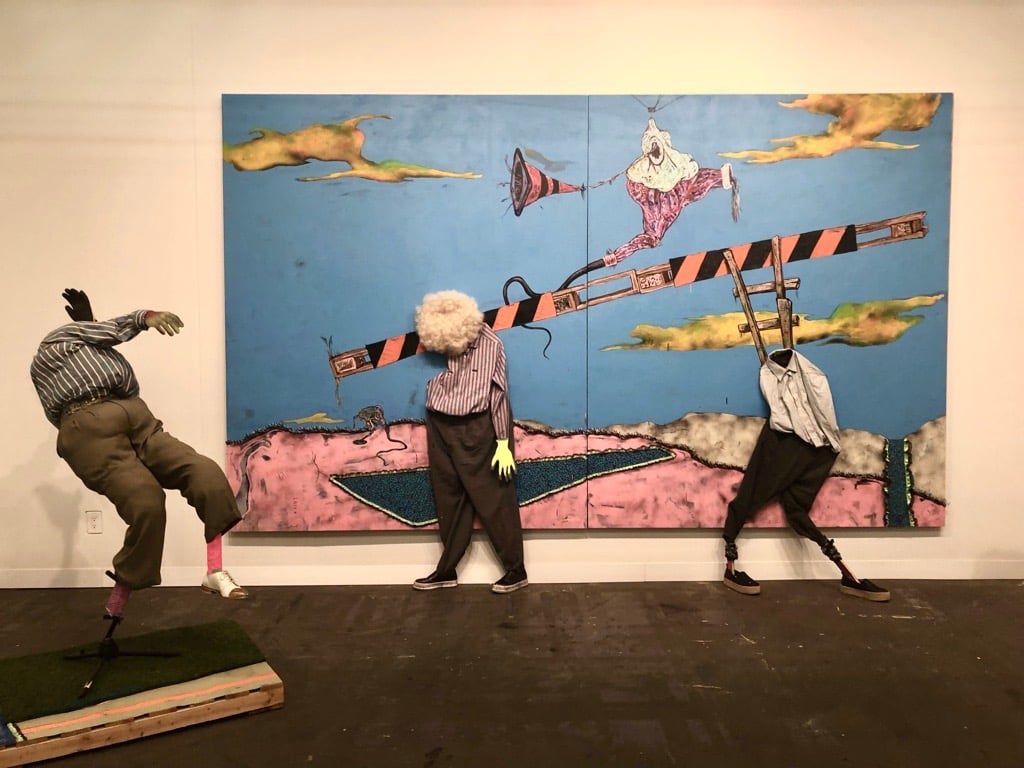

Josh Smith’s fish painting, left, and reaper painting, right, at Phillips. Photo: Katya Kazakina

Estimates seem very conservative across the board. Works are priced to sell, with “no reserve” lots appearing more frequently. At Phillips, anonymous sellers include the disgraced producer Scott Rudin, as my colleague Annie Armstrong reported last week, and the heirs of Phillip G. Schrager, a collector from Omaha, Neb. Christie’s will resume its sales of Rosa de la Cruz’s art next week.

Phillips totaled $7.5 million, with 78 percent of 248 lots selling. Sure, C+ is not the grade you want to get, but at least it’s not an F. Sotheby’s, for its part, withdrew 10 lots to improve the optics, ending up with a $20.5 million total and sell-through rate of 84 percent.

One work that looked familiar at Sotheby’s was Mark Bradford’s Tina (2006), estimated at $800,000 to $1.2 million—68 percent below its estimate last November, when it got withdrawn. That time, the house guaranteed the work for entertainment legend Michael Ovitz (as part of a larger group) and was now in control of it. On Friday, it hammered at just $415,000 ($498,000 with fees).

Artist Josh Smith, who’s gone from strength to strength since emerging in the mid-aughts, took to Instagram to comment on three of his paintings that Phillips was offering: “Not the best feeling seeing your work in an auction like this, but at least it’s 3 good ones here. It’s fun making them. It’s hard to see them go. Then you have to watch them go again sometimes. That’s life.”

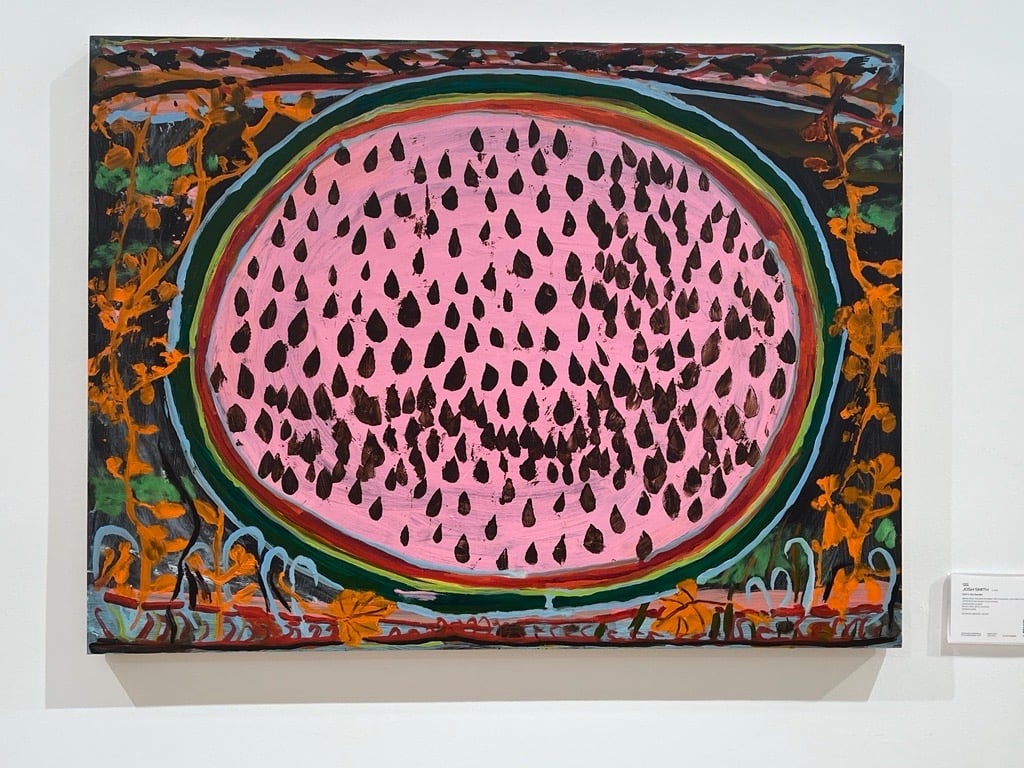

Josh Smith, Still in the Garden (2018) at Phillips. Photo: Katya Kazakina

There were no takers for his cheerful watermelon painting, Still in the Garden (2018), estimated at $20,000 to $30,000; bidding stalled at $19,0000. Those paintings were priced at around $50,000 when they were shown at Eva Presenhuber’s (now-shuttered) New York gallery in 2018.

An early Smith painting of the Grim Reaper, from 2011, hammered at $12,000, below its $15,000 low estimate. That’s the entry level price for an emerging artist price these days.

Compare that to the $350,000 that Smith’s gallery, David Zwirner, was asking just a couple of years ago for new large-scale reaper paintings, according to a person involved in the artist’s market. Since 2017, Artnet has consistently reported sales of new Smith works at art fairs at prices ranging from $100,000 to $250,000, with one painting even going for $1.25 million.

Surprisingly, the least attractive of the three at Phillips—a muddy fish painting from 2008—generated the most excitement, with online bids coming in from New Jersey and Portugal. It hammered at $20,000, above its $15,000 high estimate. But that’s also a fraction of what similar fish paintings have sold for on the secondary market. The person involved in the Smith market sold one brown fish for about $60,000 in 2022, and said that “beautiful blue fishes” traded between $120,000 and $200,000.

“The art market is bottoming out right now,” the collector I spoke with said.

There was Nate Lowman’s signature bullet hole silkscreen, estimated at $20,000 to $30,000. Back in 2013, when it was made, these works sold for as much as $545,000 at auction, according to the Artnet Price Database. In fact, this week’s consignor paid $197,000 for the work that year at Sotheby’s. This week, they took an 86-percent loss, after it hammered at $28,000. (Let’s hope they were harvesting losses to offset investment gains elsewhere.)

Katya Kazakina testing out Mary Heilmann’s table set at Phillips. Courtesy: Katya Kazakina

I was also struck by a table set designed by Mary Heilmann, a doyenne of bright geometric abstraction. I had to look twice to make sure I read the sign correctly: Four painted wooden chairs and a table were estimated at $5,000 to $7,000. Made around 20 years ago, they seemed to be in good-enough condition. Why so low?

The set was sold by the estate of Schrager (designated as “Property from the Private Midwestern Collection”), who donated tons of his art to museums. The auction included a dozen of his artworks.

“The owners paid $15,000 for each chair,” a Phillips staffer manning the floor told me. (I did some quick math in my head and started texting my friends and family.) Sadly, not much interest materialized during the sale, and the set ended up hammering for $5,500, a tiny portion of the original purchase price. (Alas, I was not the buyer.)

A large-scale assemblage, Tangled, Untangle (2017), by Simphiwe Ndzube hammered for $5,000, below its low estimate of $10,000. I remember first seeing similar works by the South African artist at the Armory Show in 2018, where they were exhibited by Nicodim Gallery with prices ranging from $20,000 to $40,000.

A solo booth by Simphiwe Ndzube at the Armory Show’s Nicodim gallery booth in 2018. Photo: Katya Kazakina

“What hasn’t collapsed?!” an art advisor exclaimed when I pointed out these disappointing results.

But there were some bright spots. At Phillips, works by Richard Prince, Theaster Gates, and Alfred Leslie exceeded their high estimates, and auction records were set for six artists, including (with fees): Richard Nonas ($44,450), Deana Lawson ($40,640), and Moira Dryer ($39,370).

The biggest surprise was the frenzy over a monumental painting (comprising three canvases) by a 30-year-old British painter, Daisy Parris, whose fortunes are rising. The exuberant abstract picture, I’d Rather Get No Sleep Next To You Than Sleep Along (2022), was estimated at $20,000 to $30,000. It hammered for $200,000 (or $254,000 with fees), the fourth-highest result of the “New Now” sale.

The work was part of the batch consigned by Rudin, who bought it for £50,000 ($61,000) two years ago from a show at the James Fuentes Gallery in New York.

This year, Parris, who uses they/them, has been on a roll, appearing in a group show at Hauser and Wirth in Somerset, England, and having a solo presentation at the Green Family Art Foundation in Dallas.

Daisy Parris, I’d Rather Get No Sleep Next To You Than Sleep Along (2022) at the James Fuentes Gallery in New York. Courtesy James Fuentes Gallery

Fuentes, who discovered Parris through Sim Smith, a small, trendy gallery in London, said that he appreciated the way the artist has merged the history of Abstract Expressionism with a punk rock sensibility. The raw text that appears in many of their canvases reminded Fuentes of early Oscar Murillo.

“I saw a direct line between Oscar and Daisy in terms of energy,” Fuentes said. “I was struck by Daisy’s incorporation of the text, so subtle, deep, and emotional. You had to get very close to the painting to read it. But then it’s, ‘Oh, my god, so powerful.’”

Sim Smith, who’s been working with Parris since 2019, featured the artist’s three paintings at the Armory Show in New York earlier this month, with two priced at £45,000 ($60,200) and one at £140,000 ($187,000). Smith is opening another solo show with Parris on October 8, during Frieze London.

Doubling prices every two years is risky for a young artist, as recent auction results have shown. Auction houses and flippers move through careers with breakneck speed, leaving piles of casualties behind.

A black bear climbing a tree. Photo: Katya Kazakina

Back in my home office, or rather just outside, the bear began making its way down the tree trunk, with surprising deftness and agility. I was scared it would plummet, but it seemed to know what it was doing. There was power and familiarity to its moves.

There is hope for the art market, I remembered. We’ve been here before, and we’ll be here again. We’ve seen a huge move down. Perhaps, like the bear, we reached the bottom. Let’s hope we’ll also have a soft landing.