Analysis

Here’s Why Damien Hirst’s Art Market Is Not as Terrible as It Looks

A deep dive into the British artist's prices as he attempts a comeback.

A deep dive into the British artist's prices as he attempts a comeback.

Eileen Kinsella

After years of sluggish auction prices, is Damien Hirst poised for a comeback? In 2008, the British artist bypassed the gallery system to bring 167 newly created artworks straight to the auction block. The unprecedented sale upended every market convention and raked in $200 million. But the financial crisis hit Hirst’s market hard—in fact, Lehman Brothers collapsed the same day as the auction. And his prices have never quite recovered.

Now, Hirst’s dealers and collectors are betting that a much-hyped François Pinault-backed show in Venice—which cost an estimated £50 million to produce—can bring his market back to its former heights. The show presents Hirst’s first major new body of work in 10 years, and follows his return to powerhouse gallery Gagosian last year.

But new analysis shows that Hirst has a steeper climb back to market dominance ahead of him than many of his peers. artnet Analytics charted the average prices for Hirst at auction alongside his contemporaries over the past two decades.

Compared to other contemporary art stars who were market darlings at the forefront of the auction boom that peaked around 2007 to 2008—think Christopher Wool, Richard Prince, Jeff Koons, and Gerhard Richter—the correction to Hirst’s prices was more severe and prolonged in the years following the market bubble burst, our data show.

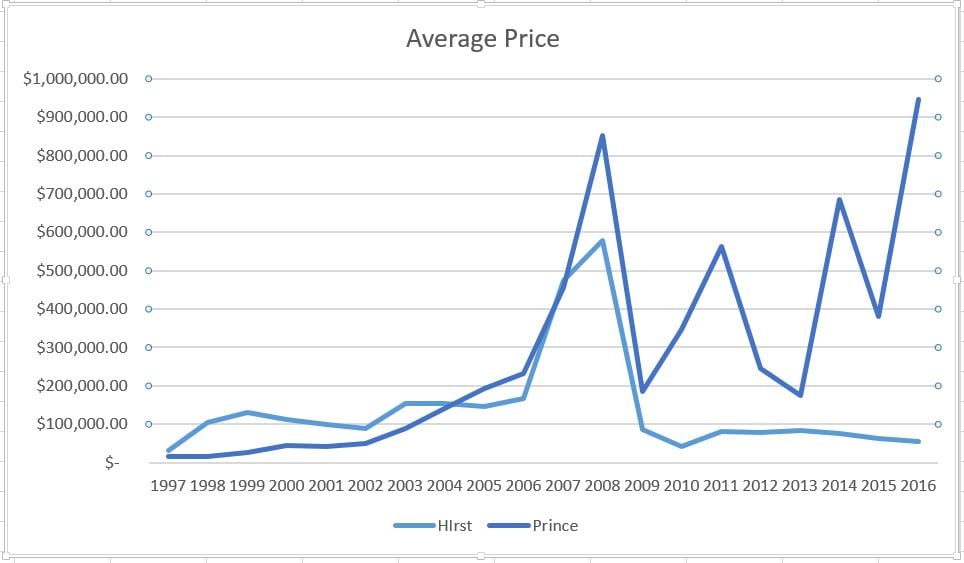

Average auction prices for Damien Hirst vs. Richard Prince from 1997–2016. Source: artnet Analytics

Experts offer various explanations for this trend, including speculative buying and a plain old branding problem. Some say that the drawn-out, decades-long production of “greatest hits” like the butterfly, spin, and spot paintings, medicine cabinets, and dead animals in formaldehyde-filled vitrines have weighed on Hirst’s market and reputation.

“For an inside art collector, it’s like a cliché to have a Damien Hirst spot painting,” says art advisor Lisa Schiff. “But for a nouveau riche person it’s like, ‘I have to have my Damien Hirst.'” Now that he has returned to Gagosian, some people who are “really into Gagosian’s brand” may be willing to spend a lot of money on a work by Hirst, Schiff says.

But gallery imprimatur is unlikely to cure all that ails Hirst’s market. Compare his auction history to that of Richard Prince, another maverick artist who has been in an on and off relationship with Gagosian. Prince’s auction results have been even more erratic than Hirst’s—but so far, they have a happier ending.

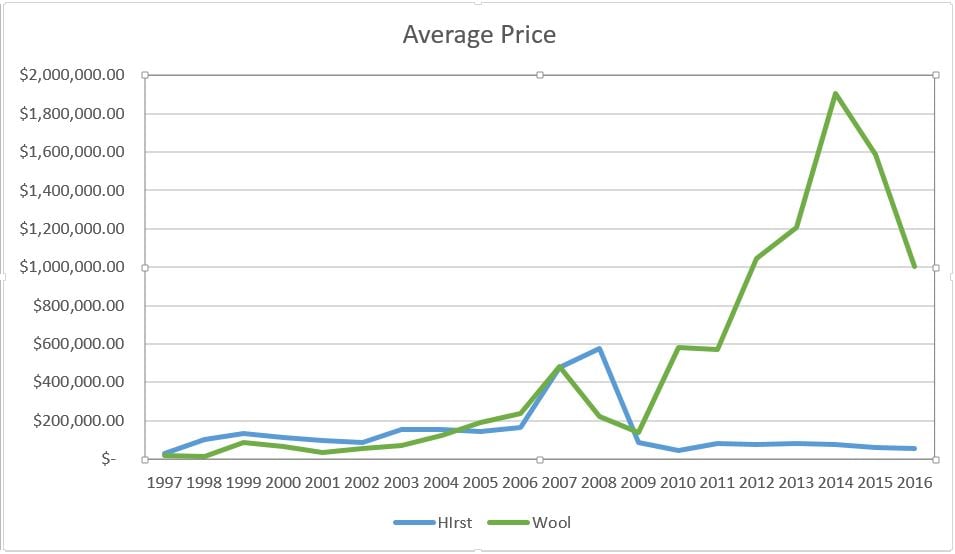

Average auction prices for Damien Hirst vs. Christopher Wool from 1997–2016.

Source: artnet Analytics

Prices for Prince’s “Nurse” series took off in the mid-2000s, rising from the low millions to a high of nearly $9 million. They plummeted in the depths of the economic crisis (one source says a seller would have been “lucky to get $750,000” for a Nurse painting post-2008). But now, those valleys are long behind. Christie’s set a new record for Prince this past May when Runaway Nurse (circa 2005-6) sold for $9.7 million. Meanwhile, Hirst’s prices have remained fairly flat.

Is the severity of the Hirst downturn linked to how bullish the market became in the first place? The timing of the 2008 “Beautiful Inside My Head Forever” sale unwittingly made him a symbol of the pre-crash excess. The sale also illustrated just how speculative Hirst’s market had become. As Colin Gleadell reported at the time, Sotheby’s Alina Davey, then a member of the private client group known to serve Russian collectors, bought nine works for a single client for a total of $23.2 million (the same paddle number was used for each). And Moscow gallery owner Gary Tatintsian acquired half a dozen works for $4.9 million.

Average auction prices for Damien Hirst vs. Gerhard Richter from 1997–2016. Source: artnet Analytics

Hirst’s prices “were very much at their strongest around 2007-2008,” says Cheyenne Westphal, the head of contemporary art at Sotheby’s during the 2008 Hirst auction and now global chairman at Phillips. “It was a general price correction after that but of course you know Damien was very much of that moment.”

Tellingly, of Hirst’s 100 highest auction prices, 40 were achieved at the “Beautiful Inside My Head Forever” sale and 42 were achieved before (2004-2008). Only 18 of the highest auction results were achieved in the years following (2009-2016), according to the artnet Price Database.

Some question whether Hirst’s auction prices have failed to bounce back because of overproduction. Four years after the Sotheby’s sale threatened to flood his market, the British artist filled every Gagosian Gallery worldwide with spot paintings for an exhibition titled “The Complete Spot Paintings.”

“There are times when high production seems to create confidence in the market. Other times it seems to be a turn-off…I think the jury is still out on that for Damien,” says the art advisor Todd Levin, the director of Levin Art Group.

Average auction prices for Damien Hirst vs. Jeff Koons from 1997–2016.

Source: artnet Analytics

But publicly available figures and graphs may not tell the whole story. Even though Hirst has not consistently set records in recent years, Westphal says: “It is amazing how much of his art has been selling all along…Buyers have been very serious about finding really important historic works both at auction and privately.”

One thing most experts can agree on: Hirst’s 1990s work is still considered the most important and valuable. Somewhere along the way, “it became uncool to have too much Damien Hirst. But it’s always okay to have early ones,” Lisa Schiff says. During this period, Hirst became associated with the YBA movement championed by the mega-collector Charles Saatchi.

As Levin points out, Hirst had “astonishing prescience early on in almost single-handedly packaging and pushing forward the YBA generation,” first with his exhibition “Freeze” (1988) on the docks in East Surrey, and then with the group show “Modern Medicine” (1990), which paired him with eight fellow students when he was still a sophomore at Goldsmiths.

“Whether or not the works are historic cannot be denied at this point,” Levin says. “He is important as an artist who catalyzed a generation of artists. He is owed a big debt for that.”

As Hirst’s market matures further, the distinction between the early 1990s work and later work will become even more pronounced, says advisor and dealer Nick Maclean. He predicts that prices for the earlier spot paintings, which were more likely to have been painted by Hirst himself, will soon eclipse the later ones, which were usually painted by Hirst’s army of assistants. “That’s the thing with conceptual work, you want to be in there early,” Maclean says. “It’s not like an artist developing his style, it’s an idea you’re buying.”

Will the Venice exhibition finally push Hirst’s market over the edge? “This is a different art market than the one we witnessed nine years ago,” says Alex Rotter, former Sotheby’s worldwide head of contemporary art who is now chairman of postwar and contemporary art at Christie’s. “I have witnessed the full cycle of Hirst’s career and I am very pleased to see the building strength of his market, as well as a newfound excitement around his work stemming from his show now up in Venice.”

Visitors look at the three Grecian Nude during the press presentation of the exhibition ‘Treasures from the Wreck of the Unbelievable’ by Damien Hirst at the Pinault Collection in Punta della Dogana and Palazzo Grassi in Venice on April 6, 2017. Miguel Medina/AFP/Getty Images.

After returning from Italy for the show’s opening weekend, Westphal is optimistic. “He clearly pulled out all the stops to produce art on a scale that’s rarely seen. Damien has spent the past decade inventing a new language for contemporary art and I think the new work will stand the test of time.”

Collectors will have the chance to render their own verdict next month, when Phillips offers a major Hirst medicine cabinet, The Void (2000), at its evening sale of 20th century and contemporary art on May 18. Medicine cabinets have fetched as much as $19 million at auction. This one is expected to sell for between $5 million and $7 million. But if Hirst has taught market-watchers anything, it is to expect the unexpected.